Housekeeping: Every word of this is worth reading

Timeline/ Contents:

- 2008: The US Great Financial Crisis Begins

- China Sends an Emissary to Hank Paulson

- The GFC Re-sensitizes China to Gold’s Value

- Gold Promoted Domestically

- 2009: The Long Term Gold Strategy Begins

- Gold The Logical Choice in a Return to Sensibilities

- 2008-2022: The Dedollarization Battle

- 2013: The Xi Jinping Era begins

- 2016: Qualifying for the IMF Status

- Xi Wants a Multipolar Legacy

- 2022: China Restarts its Gold Strategy

- 2023: Yuan Internationalization Begins

- Gold Hits the Main Stage

- 2024: The Process Accelerates

- What Needs to Happen to the Yuan Next

Previously:

Foreword

These are quotes from a Chinese national outlining the history of US/China relations over the past 15 years through a golden lens. All additions are [bolded in brackets].Titles, Subtitles, and a few pictures were added. Only the tense of a few verbs were changed from the translation, and our own notes were re-organized in a chronological order where possible, for coherent flow of China’s evolving policies and practices.

2008: The US Great Financial Crisis Begins

Authored by Bai Xiaojun, Contributions and Editing by VBL

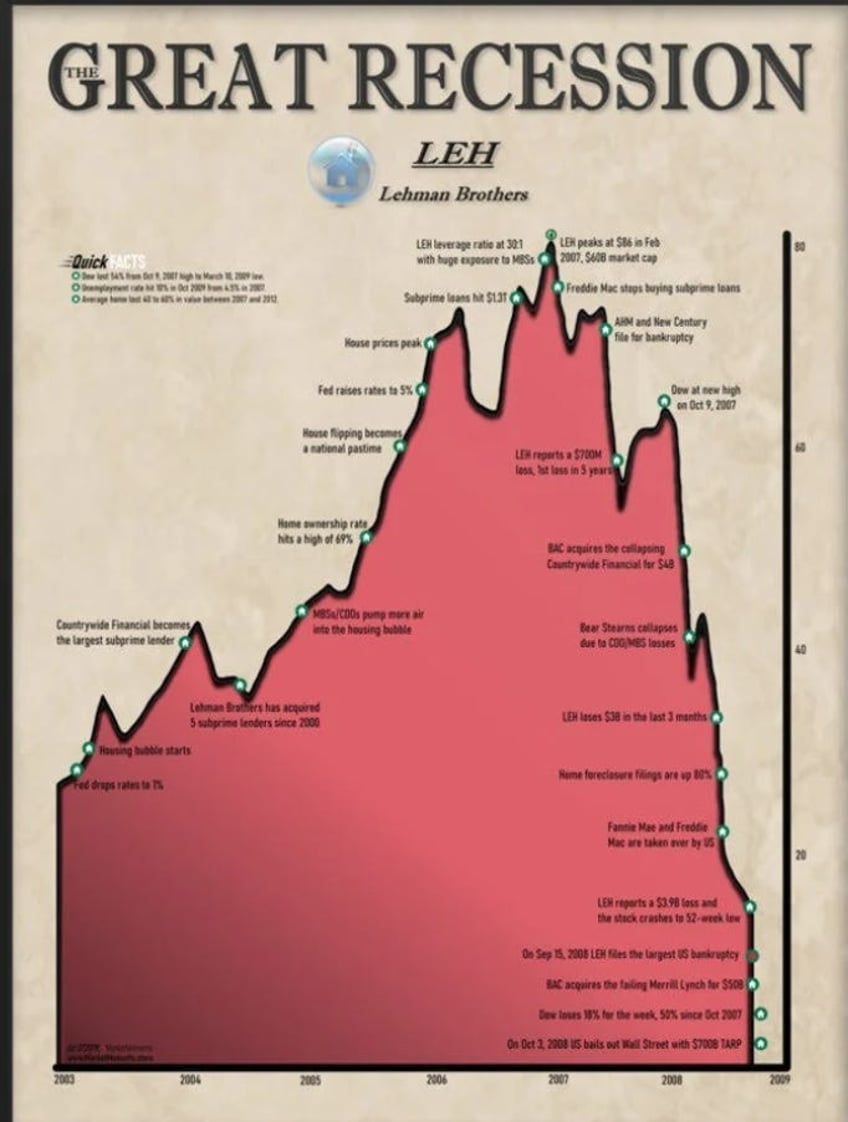

There were differences between China and the United States in the past, but they were within normal limits and did not affect the overall situation. Big cracks began to appear in 2008. After the financial tsunami broke out in the United States, the Federal Reserve launched QE continuously to fight the financial tsunami.

China held nearly 3 trillion U.S. debt back then and was extremely shocked that the United States started printing money indiscriminately without even touching base with one of the US’s biggest creditors.

China’s Emissary to US “Ineffective", Russia Comments

Then the central bank governor Zhou Xiaochuan was sent to the United States to communicate, but the result was ineffective. China had to face reality. In fact, it had no choice but to accept reality.

[Edit-Zhou Xiaochuan until 2023, despite the events unfolding here, remained a staunch supporter of not de-dollarizing aggressively and not taking the RMB more internationally. VBL]

It was also during this time Russia asked China to sell U.S. debt together and “kill” the United States, but China refused. Our government told Treasury Secretary Paulson about all these developments

[EDIT- this could be one reason for the unrelenting anti-Russian bias the US establishment harbors toward Russia- VBL]

However, Paulson was unable to change the Fed's QE policy. China swallowed this bitter pill with considerable regret. It was at this time that China began to be wary of the United States. Central high-level officials had held many internal meetings to discuss how to respond to the impact of the U.S. financial tsunami and the U.S. QE issue.

The GFC Re-Sensitizes China to Gold’s Value

At that time, the golden strategy began to be proposed. Unfortunately, since the disintegration of the Bretton Woods system in 1971, the Chinese government had also begun to ignore the value and role of gold, and had barely mentioned gold for more than 30 years. Gold is merely decorative.

[Edit: in January 1976 the US finalized Gold’s death in the Jamaica Accords, and in February that year, Nixon made a second visit to China cementing the relationship further- VBL]

[EDIT: No doubt this was in part an ideological byproduct of accepting US terms for owning Treasuries and getting US support at the IMF and WTO- VBL]

Post 2008, senior central officials suddenly realized the serious problems of currency and began to reiterate the strategic value of gold.

Gold Promoted Domestically

According to the new strategic intentions of the CCP’s top leaders back then, CCTV, the propaganda mouthpiece of the Chinese Communist Party, filmed 8 episodes of the political feature film “Gold”2to remind the entire CCP that only gold is the most reliable guard of wealth. (This seems to be the words of the famous British economist Keynes)

[Edit- and they have been ramping up both domestic pro-gold rhetoric and purchases ever since. They even put pictures of Digital Yuan on billboards recently depicting the currency as a gold coin.- VBL]

2009: Long Term Gold Strategy Begins

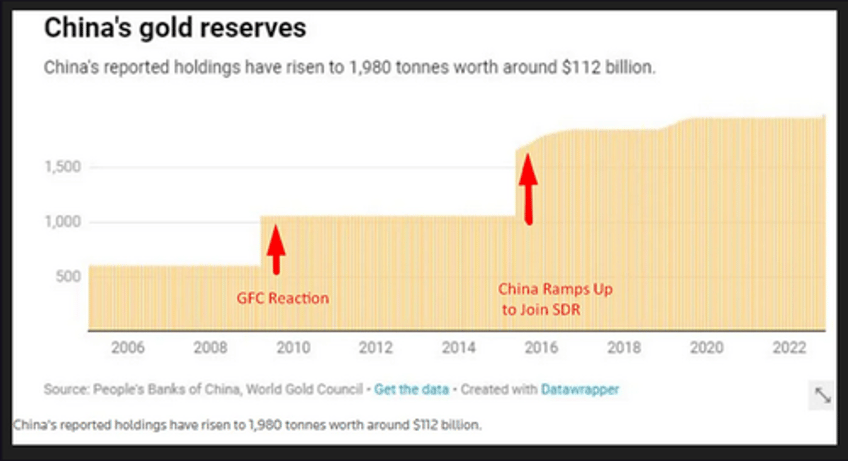

Since 2008, the Chinese Communist Party had formulated and implemented a long-term gold strategic principle of "hiding gold in the people", which means to encourage hundreds of millions of people to buy gold and let the people hold large amounts of gold.

[Edit- More on this in context of the 1998 Asian crisis in Part 2 here- VBL]

Gold, The Logical Choice in a Return to Sensibilities

[EDIT- As China dropped the hard left ideology of Communism and Maoism, they needed something to replace it to keep their people together. Thus Nationalism replaced Marxism, and Confucianism replaced The wests relativistic Atheism.Gold itself was the logical step from a stability and traditionalist sense. Although, ironically, at this point in time, it was Progressive wing reformists like Xi who embraced Gold.

How big of a change is this?The equivalent to this in the USA would be if the whole country became Christian in one generation, consumerism and escapism banished, personal responsibility were reborn, and the Protestant work ethic were reinstated as our dominant ideology.- VBL]

In the future, the country will, in times of crisis, look to the people to support their country; and the country will get gold from the people.

2008-2022: The Dedollarization Battle

The rift in Sino-US relations is widening step by step. Before Sino-U.S. relations completely broke down, the main leaders in charge of economic work within the Communist Party of China did not agree with de-dollarization because the country has a large foreign reserve of U.S. dollars and a large amount of U.S. debt.

Therefore, there had been a debate within the CCP on whether to gradually increase the gold ratio of foreign exchange reserves. The CCP’s financial bosses do not agree to hold too much gold, and they dominate the situation before 2021.

[EDIT- It was also mentioned these powerful leaders and their extended families also held their personal wealth in a large amount of U.S. dollar assets.

It was not until the end of 2022 that there was meaningful unified resolve to move forward with de-dollarization, after those senior leaders’ financial dominance decreased.

[EDIT- Between the GFC’s end and 2016, China had largely shelved its more aggressive Gold Strategy as things seemed to quiet down. But in order to qualify for IMF status in the SDR basket at the World Bank, China was asked to purchase Gold to give assurances their currency warranted being included. They did this.- VBL]

2013: The Xi Jinping Era Begins

After Xi Jinping came to power, he gradually eliminated dissident forces and consolidated his power. Xi Jinping is the most controversial leader of the Chinese Communist Party since the reform and opening up. He had a large number of supporters in the country, as well as a large number of opponents.

[EDIT- Our friend reminds us he opposes many of Xi’s his practices but remains united behind his nation’s leadership- VBL]

2016: Qualifying for IMF and SDR Status

In order to join the World Bank's SDR Special Drawing Rights, China once increased its gold holdings for more than ten consecutive months, but after joining the SDR, it stopped increasing its holdings. Obviously, the increase in gold holdings that year was also an expedient measure and not a strategic act. The crisis awareness and gold concept that was revived in 2008 had since been gradually diluted.

Continues here ...