Submitted by QTR's Fringe Finance

As everybody knows, one of my favorite assets on the board right now for buying is gold miners. They are completely hated and totally undervalued, without even a semblance of pricing in the potential leverage they could gain from a spike in gold prices.

I could make the argument for gold seven ways from Sunday: I could talk to you about how it is real money, discuss commodity inflation, delve into its role as a hedge against both inflation and geopolitical and military risk, consider how BRICS nations are challenging the U.S. dollar as the global reserve currency, and explain how nations in the Middle East, as well as China and Russia, are hoarding the precious metal.

But if there's one thing that's apropos, especially given my piece on timing a couple of days ago, it's timing. Most of my readers already know why I love gold as a potential investment, but one thing I've talked less about is the timing of when I want to buy it in droves - more than just my usual recurring buys and speculation.

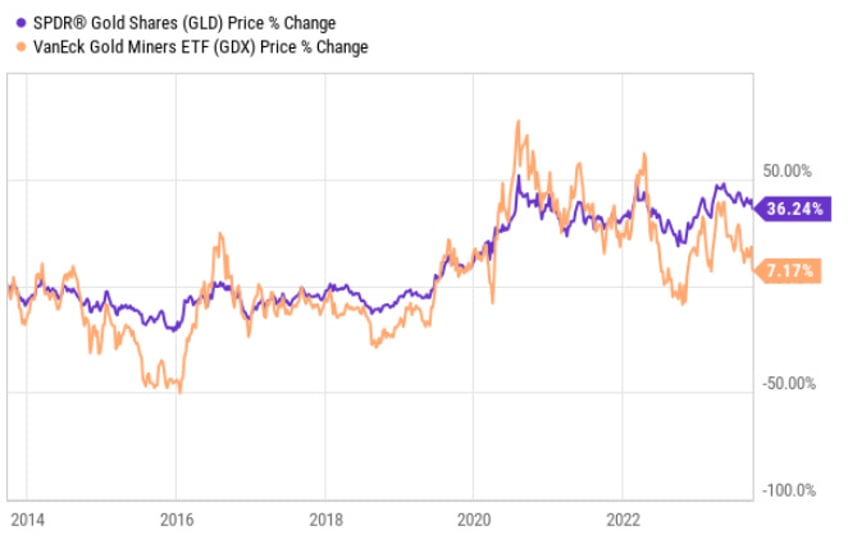

There's no doubt that miners are unloved. Here's how they have stacked up against the price of the SPDR Gold ETF (GLD) over the last 10 years - up just 7.17% while the GLD has been up 36.24%.

While almost all other commodities are seeing inflation, for some reason, gold has been late to the party. Food prices, raw material prices, and home prices are just three examples of assets that have gone bananas in the inflationary environment of the last few years. Oil is another story that speaks for itself. Yet gold miners, relative to the potential value they hold—especially if you continue to be bullish on the underlying asset—are basically hated right now. Here’s the GDX’s last 6 months versus the SPY:

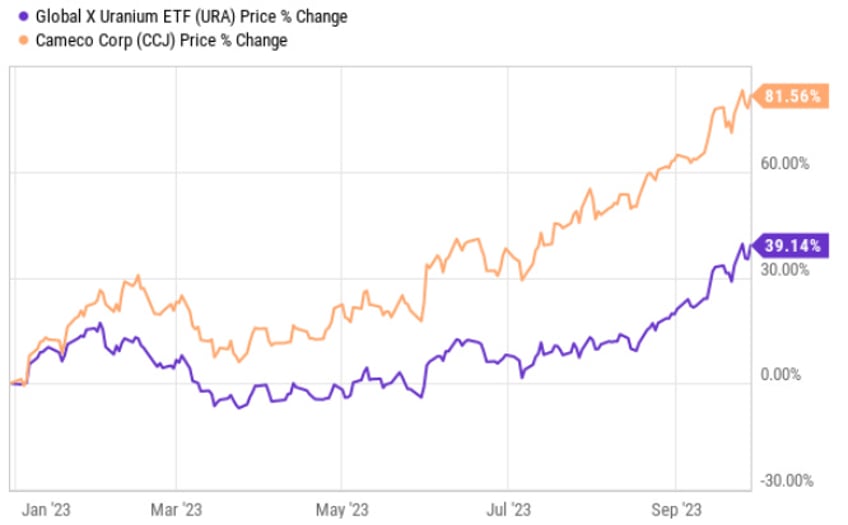

We saw the same type of sentiment towards uranium over the last five years. All the savvy energy bulls knew that nuclear power would be the inevitable solution to the ongoing energy crisis worldwide. Many of us were talking about uranium at the peak of its hype, and just recently, it started to see just the slightest bit of love. And with just a small sentiment change, uranium is now different game altogether, with my two favorite ways to play the idea up 81.6% and 39.1% YTD after having an atrocious last 5 years of being dead money.

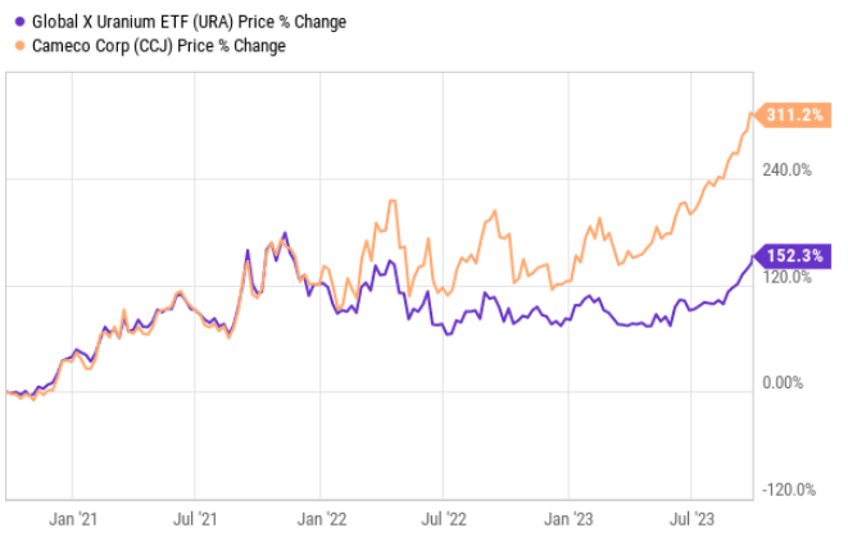

Over the 3 year period, despite being dead money most of 2021 and 2022, they are up 311.2% and 152.3% respectively.

Gold will have this type of adoption as well. It’ll come on quickly.

To me, the question isn't if; the question is when.

Those who have been reading me for a while know that the opportunity I've been eagerly anticipating to buy gold is when...(READ THIS FULL ARTICLE HERE).