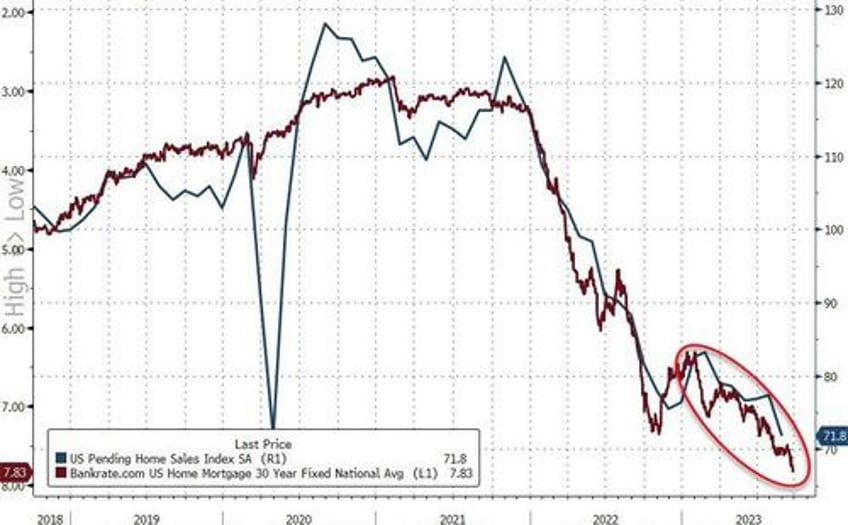

With existing home sales at their lowest since 2010 and new home sales finally hitting the wall, pending home sales were expected to decline MoM in August after an uptick in July (amid soaring mortgage rates and plunging affordability) and they did...bigly.

Pending home sales plunged 7.1% MoM in August (dramatically worse than the -1.0% expected) dragging sales down 18.8% YoY...

Source: Bloomberg

That is the biggest MoM decline since Sept 2022 and drops the overall index to exactly equal to its COVID-lockdown lows (the worst on record)

Source: Bloomberg

All regions saw declines in August. Contract signings in the South fell to the lowest level since 2010, while the West posted the weakest reading in data back to 2001.

The pending-home sales report is a leading indicator of existing-home sales given houses typically go under contract a month or two before they’re sold.

“Some would-be home buyers are taking a pause and readjusting their expectations,” Lawrence Yun, NAR’s chief economist, said in a statement.

“It’s clear that increased housing inventory and better interest rates are essential to revive the housing market.”

And given where mortgage rates have gone since, pending home sales don't look like bouncing back any time soon...

Source: Bloomberg

How long with Powell and his pals be able to keep this 'higher for longer' stress up as Americans' largest source of wealth evaporates?