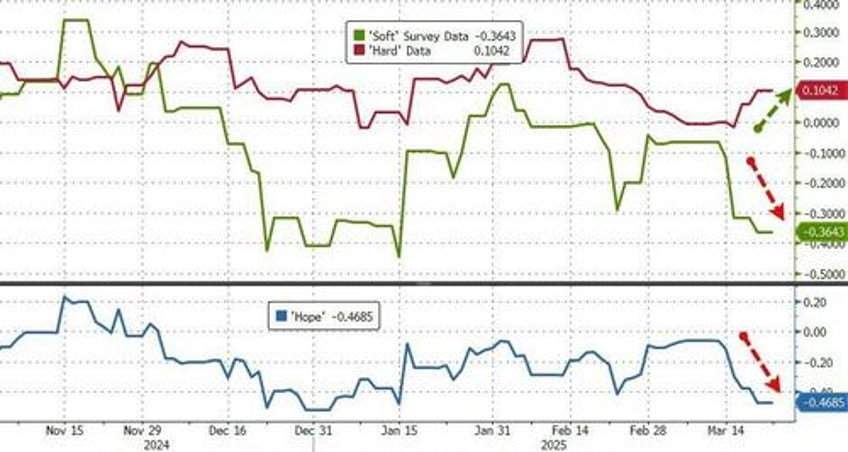

Continuing the trend of 'soft' data deterioration...

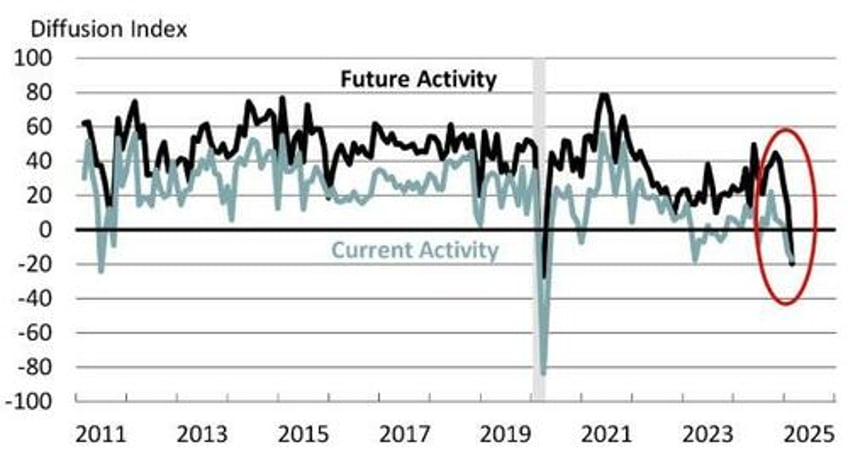

The Philly Fed Services Sector survey Current Activity collapsed from -13.1 to -32.5 - its weakest since May 2020. And at the same time, Future Activity plunged even more...

The diffusion index for future activity at the firm level fell 34 points to -19.8, its fourth consecutive decline and first negative reading since April 2020. Almost 46 percent of the firms expect decreases in future activity at their firms, 26 percent expect increases, and 23 percent expect no change. The future regional activity index fell from -1.1 to -24.0.

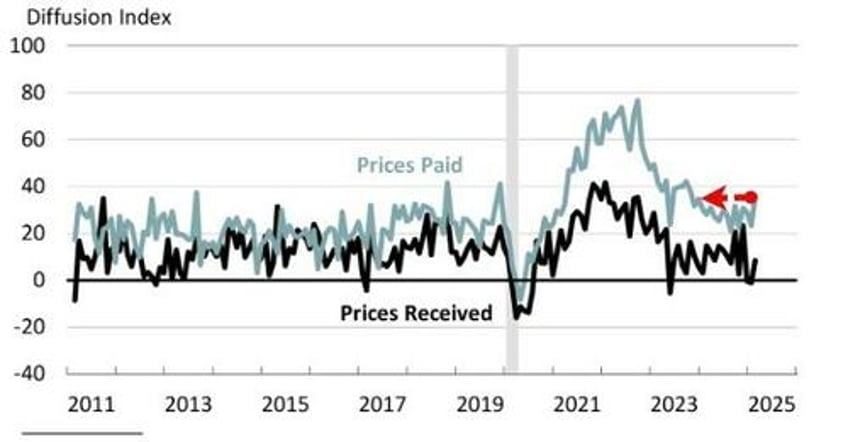

The indexes for general activity, new orders, and sales/revenues remained negative, with the former two declining further. Both price indexes rose and indicate overall increases in prices.

The full-time employment index fell 10 points to -7.5, its first negative reading since August.

It looks like the post-election honeymoon is over (in the soft data)... even if the hard data keeps improving.