Here We Go Again

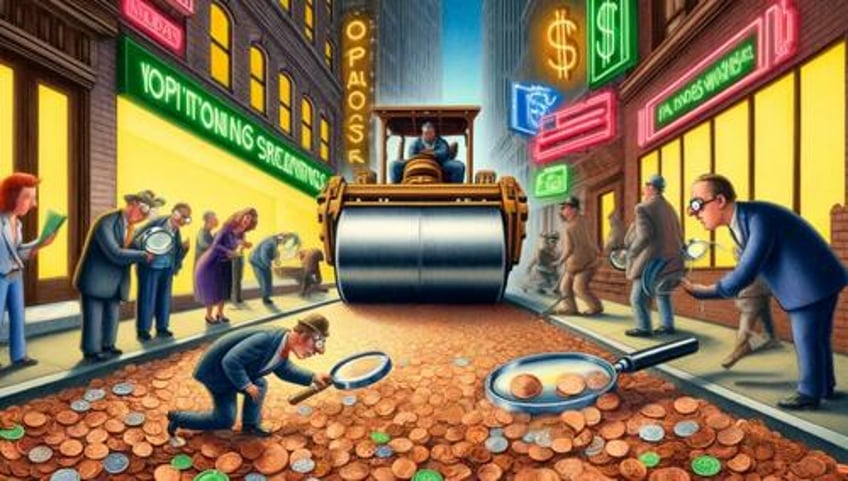

Famed short seller Jim Chanos noted on X recently that more investing accounts were pitching the "free money" to be made from selling naked options.

Speaking of selling options, I am seeing a lot more of these kinds of “free money” posts on my feed lately. As they used to say on the floor of the CBOE in the 80’s, “It’s time for a new class picture!” https://t.co/M0xcG9AoJr

— Diogenes (@WallStCynic) March 30, 2024

It seems that some young traders don't remember back to 2018, when James Cordier posted his infamous apology video after losing nearly all of his clients' money with this strategy.

Why This Is A Bad Idea

X user "@jaredhstocks" had an excellent thread earlier this week detailing how James Cordier blew up his fund, and tying that back to the current trend of selling penny puts on the SPX complex that Chanos mentioned above.

@Falba12 Hi! here is your unroll: https://t.co/vZBAN5lu5m Enjoy :) 🤖

— Thread Reader App (@threadreaderapp) April 3, 2024

Here's the key part:

8/ So how does the Optionseller story relate to $SPX “penny puts”? Well, as of late, we have seen a dramatic uptick in funds selling DOTM puts for 0.05 a piece like this example below. Why might they do this? Low correlations in a low volatility envrironement. The maximum profit is actually quite limited for the amount of risk they are taking on (Sharpe Ratio). Someone who is at the forefront of understanding this toxic flow is [volatility trader Kris Sidial]. He notes that tail selling is “making a comeback today in larger size than the last 10 years,” and desks are “jumping over one another” to sell these penny options.

2024 has no limit of geopolitical risks in the marketplace. Likewise, the record breaking interest in systematic vol selling programs imbeds further market risk if the trade were to be unwound and I’m not talking about call overwriting strategies. I’m referring to the elevates interest in selling the most toxic and convex parts of the distribution. While it’s to be foreseen what the catalyst will be, If a systematically shocking news event hits the tape over the weekend when participants can’t manage their trade, I fear what happened to James will happen to those selling these penny puts.

A Smarter Way To Trade Options

A smarter way to trade options is to make sure your risk is well-defined at the outset. Here's a recent trade of ours that illustrates that, a bet against the bitcoin hoarder MicroStrategy (MSTR).

Even Saylor is selling $MSTR at these prices. pic.twitter.com/nslYKfXBRv

— Portfolio Armor (@PortfolioArmor) March 29, 2024

Our trade there was a vertical spread expiring on June 21st, buying the $1,500 strike calls on MSTR and selling the $1,490 strike calls for a net credit of $5. Since one options contract covers one hundred shares, you would collect a net credit of $500 on one contract on this trade is MSTR is below $1,490 per share on June 21st. The worst case scenario for you here would be MSTR trading above $1,500 on that date, in which case, you would lose $500, but no more than that. The break even here is with MSTR trading above $1,495. Between that and $1,500, you would make a gain of less than $500, and between that and $1.490, you would incur a loss of less than $500.

The key point here is you're only risking a pre-determined amount at the outset, and there's no possibility of suffering higher losses than that if the trade goes against you. In this case, it's worth noting that our bearish options strategy is a much safer way to bet against MicroStrategy than simply shorting the stock.

If You Want To Stay In Touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).