Investors familiar with the business cycle and the Permanent Browne Portfolio understand the pivotal role of energy prices, particularly oil, in driving economic shifts between boom and bust, and ultimately between inflation and deflation as energy costs indirectly influence whether the bond market serves as a reliable store of value. Securing abundant and affordable energy should, therefore, be a top priority for governments worldwide. While energy prices are widely recognized as critical, the often-overlooked challenge lies in ensuring access. The 47th U.S. president-elect's ‘Drill Baby Drill’ agenda emphasizes easing regulations to boost production over the next four years. However, this overlooks a key reality: affordable energy depends as much on robust infrastructure to deliver energy from production to consumption as on regulatory freedom to drill.

The U.S. energy infrastructure, largely privately owned, is vital for economic and national security, delivering electricity, oil, and natural gas. The U.S. oil and gas infrastructure, one of the world's most extensive systems, includes over 2.6 million miles of pipelines, refineries, storage facilities, and export terminals. Pipelines form its backbone, efficiently transporting crude oil, natural gas, and refined products nationwide. Refineries, especially along the Gulf Coast, support domestic and export markets by processing crude into fuels and petrochemicals. Investments in liquefied natural gas (LNG) export terminals have solidified the U.S. as a global LNG leader. However, aging infrastructure, regulatory hurdles, and geopolitical risks threaten reliability and growth The Bipartisan Infrastructure Deal dedicates $62 billion to upgrading clean energy systems, boosting manufacturing, and strengthening supply chains.

Outside of its strategic and critical role in the well-functioning of the US economy, the US oil and gas infrastructure sector offers an interesting diversification from fixed income assets for income investors who understand the impact of currency debasement (i.e., inflation), on the return of the contract parts of the Browne Permanent Portfolio. In this context, it should come as no surprise to anyone with a modicum of knowledge about portfolio allocation in an inflationary environment that the Alerian MLP Infrastructure Index, a market-cap-weighted index of companies earning the majority of their cash from midstream energy and commodity activities, has outperformed the contracts within the Browne portfolio (i.e., the Bloomberg US Treasury Index and the Bloomberg US Treasury Bill Index) when the US economy is in an inflationary phase.

Upper Panel: Gold to Bond ratio (blue line); 84-Month Moving Average of Gold to Bond Ratio (red line); Lower Panel: Relative Performance of the Alerian MLP Infrastructure index to Bloomberg US Treasury Index (green line); Relative Performance of the Alerian MLP Infrastructure index to Bloomberg US Treasury Bill Index (yellow line).

Looking at the relative performance of the energy infrastructure sector versus the contract assets of the Browne Portfolio during an economic bust (i.e., when the S&P 500 to oil ratio is below its 7-year moving average), it's clear that an economic downturn is not necessarily a headwind for the energy infrastructure sector compared to Treasuries and T-bills over the long term. No PhD in finance from Yale or Harvard is needed to understand this dynamic.

Upper Panel: S&P 500 to WTI ratio (blue line); 84-Month Moving Average of S&P 500 to Oil Ratio (red line); Lower Panel: Relative Performance of the Alerian MLP Infrastructure index to Bloomberg US Treasury Index (green line); Relative Performance of the Alerian MLP Infrastructure index to Bloomberg US Treasury Bill Index (yellow line).

As the US economy shifts slowly but surely from an inflationary boom into an inflationary bust, the relative performance of the energy infrastructure sector during the most recent inflationary bust (from January 2022 to October 2023) shows that it has outperformed stocks, bonds, and cash. This indicates that an allocation to the sector has provided alpha to investors able to think outside the box and preserve wealth during an inflationary bust, a period of the business cycle where preserving capital is often more important than achieving returns on capital.

Relative Performance of the Alerian MLP Infrastructure index to S&P 500 index (blue line); Relative Performance of the Alerian MLP Infrastructure index to Bloomberg US Treasury Index (red line); Relative Performance of the Alerian MLP Infrastructure index to Bloomberg US T-Bill Index (green line) between January 2022 and October 2023.

Investors who have taken the time to study how to allocate their equity portfolio in an inflationary bust, unlike the YOLO investors still predominating in the current euphoric market environment, know that in such a phase of the business cycle, they must sell the rallies in stocks of equity consumers (proxied by the IT sector) and buy the dips in equity producers (proxied by the energy sector). Looking at the performance of the energy infrastructure sector versus the IT sector and the energy sector during the most recent inflationary bust (i.e., between January 2022 and October 2023), while the infrastructure sector underperformed the energy sector, it outperformed the IT sector. This suggests that investors should view the energy infrastructure sector as a substitute for the fixed income portion of their portfolio rather than the equity portion during an inflationary bust.

Relative Performance of the Alerian MLP Infrastructure index to S&P 500 IT index (blue line); Relative Performance of the Alerian MLP Infrastructure index to S&P 500 Energy Index (red line) between January 2022 and October 2023.

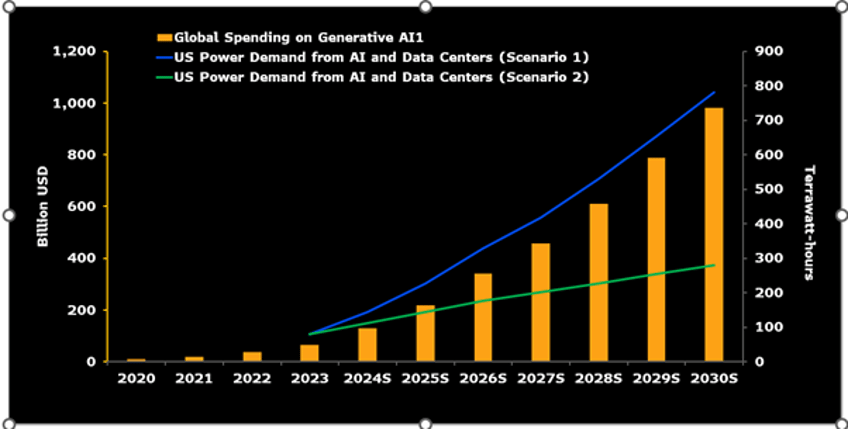

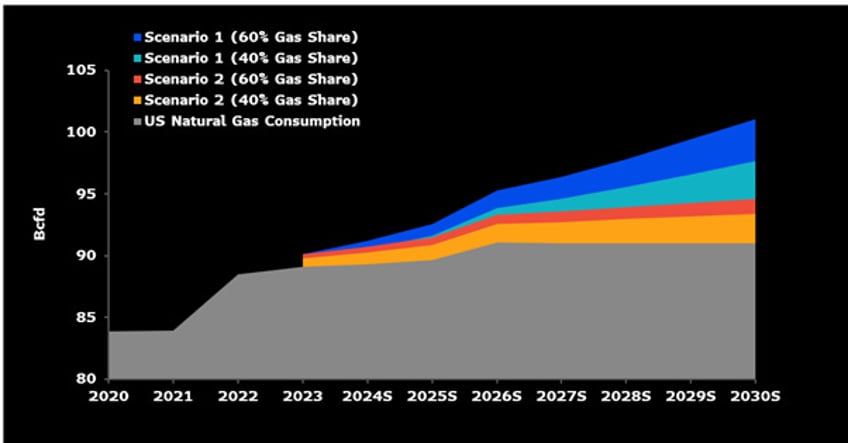

The Energy infrastructure sector is also a growth sector as the rise of artificial intelligence and data centres could add 3–10 billion cubic feet per day (bcfd) to U.S. natural gas demand by 2030, representing 10–30% of current gas-fired power generation and total consumption of about 90 bcfd. This surge, driven by the expansion of data centres and cloud infrastructure, would reshape the gas landscape. Upstream producers like EQT, Range, Southwestern, and Chesapeake are well-positioned to meet this demand, while midstream operators such as Kinder Morgan, TC Energy, and Energy Transfer will play critical roles in connecting supply to key consuming hubs.

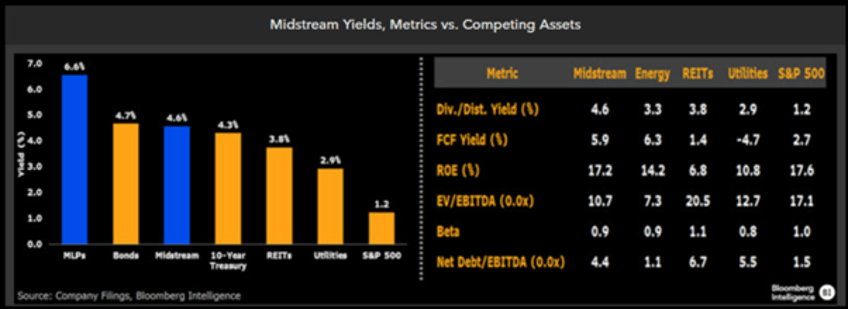

Energy infrastructure companies, particularly MLPs, are known to generate steady cash flows as fee-based businesses, offering attractive yields. Unlike other entities, MLPs are not taxed at the entity level, enabling them to distribute more cash as either qualified dividends or return of capital, which can provide tax advantages for investors. In 2025, midstream energy dividend yields remain higher than those of utilities, REITs, and the broader market, offering an alternative to Treasury and investment-grade bond yields.

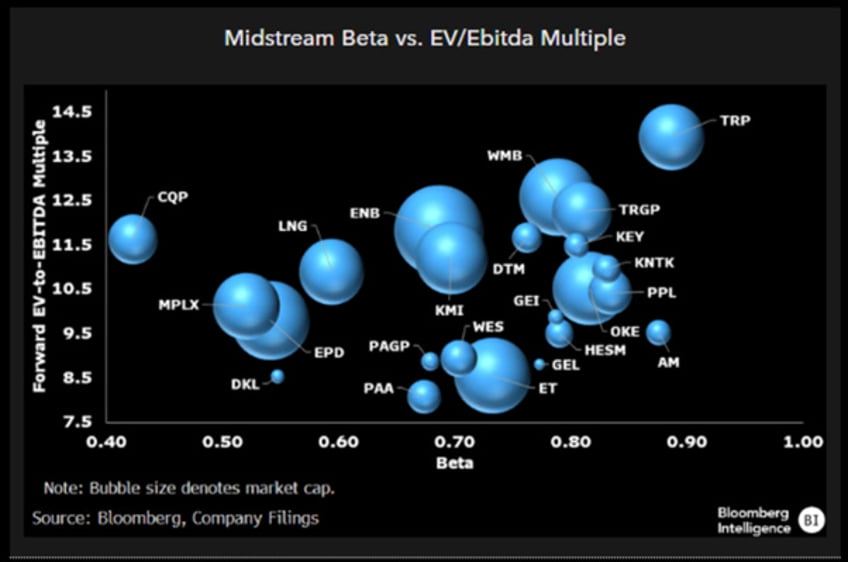

The midstream sector includes many lower-beta stocks, appealing for their stability and earning’s growth. Among 23 energy infrastructure peers, the average beta is 0.72. Cheniere Energy Partners (0.42), MPLX (0.52), and Enterprise Products Partners (0.54) are the least volatile, supported by low leverage and stable cash flows. TC Energy (0.89) and Antero Midstream (0.88) have the highest betas but remain below 1, indicating relative stability. Lower volatility in midstream stocks help mitigate portfolio risk especially in an environment where bonds have become the real risky asset.

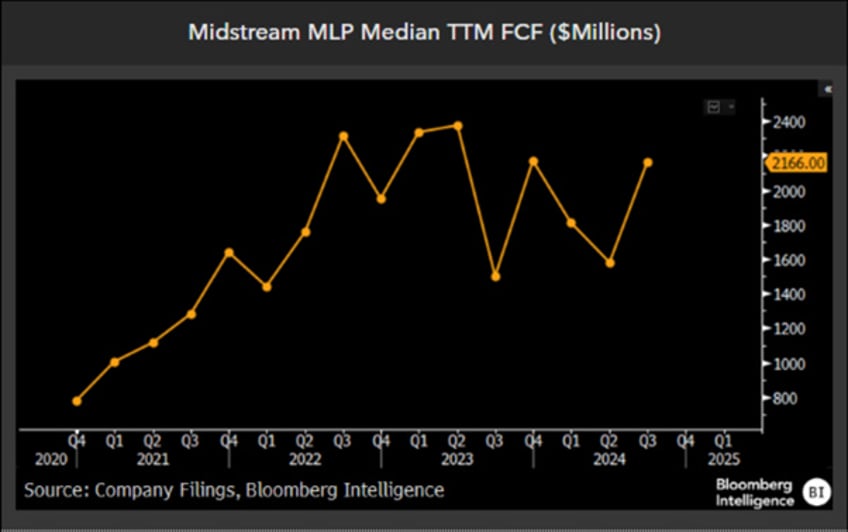

Midstream free cash flow (FCF) is expected to rise in 2025, supported by lower capital spending for some operators and favourable M&A comparisons for others. Consensus estimates suggest the sector’s average FCF yield could exceed 5% in 2024, though market capitalization shifts may affect yields. Distribution increases remain a priority, with excess FCF likely directed toward growth investments, M&A, and opportunistic buybacks.

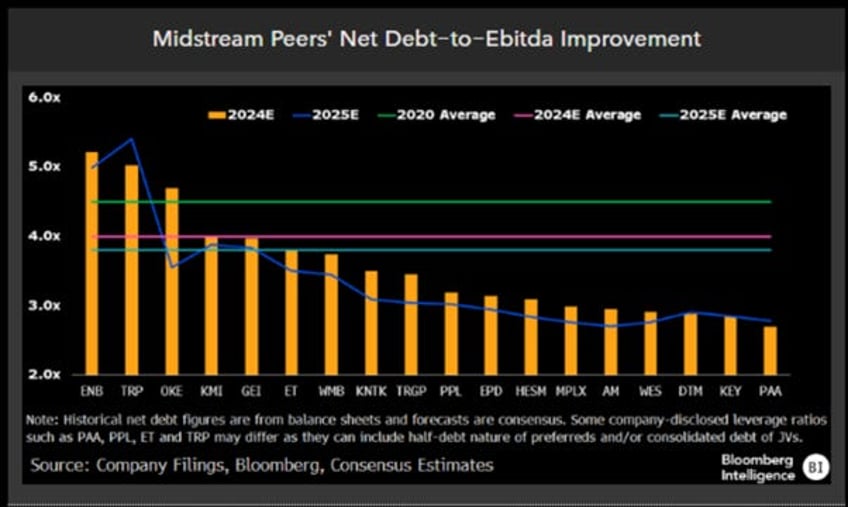

The average net debt-to-Ebitda ratio of midstream peers is expected to improve to around 3.8x in 2025, following a steady 4x in 2023-24. Strong Ebitda growth will offset modest increases in net debt. After significant deleveraging efforts in 2020-21, many operators now prioritize returning capital to shareholders through distribution hikes and buybacks, while also reinvesting in growth and M&A.

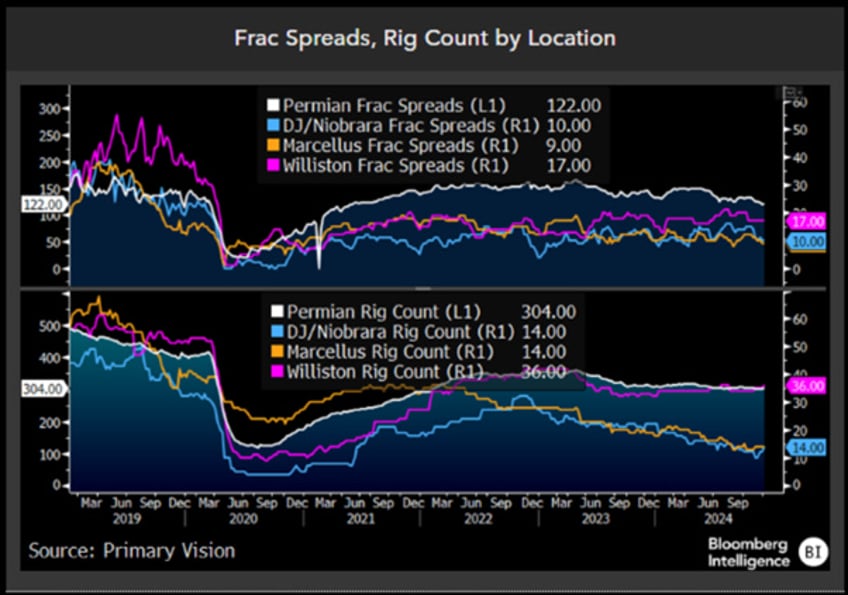

North American midstream capital spending is expected to remain flat in 2025, with declines at companies like TC Energy and Targa offset by increased investments and recent acquisitions by others. Growth projects coming online from 2022-25, along with M&A activity, are driving solid EBITDA expansion, particularly in the Permian and Gulf Coast regions. Blended production growth in North America may be limited to low-single digits, as many publicly traded E&Ps remain disciplined with capital spending amid forecasts of volatile oil prices and uncertain demand. While oil output in the Permian Basin is expected to rise modestly, natural gas prices could increase due to higher power and LNG export demand, benefiting Haynesville production. Infrastructure constraints may limit Appalachia gas output.

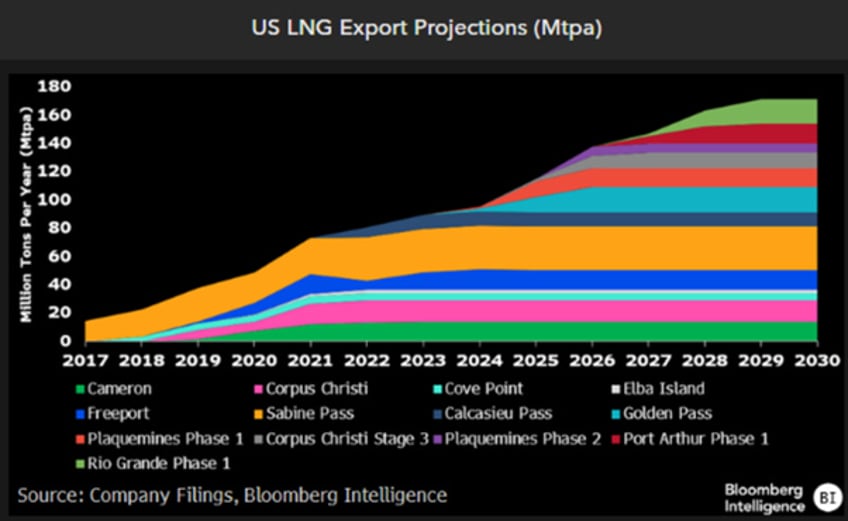

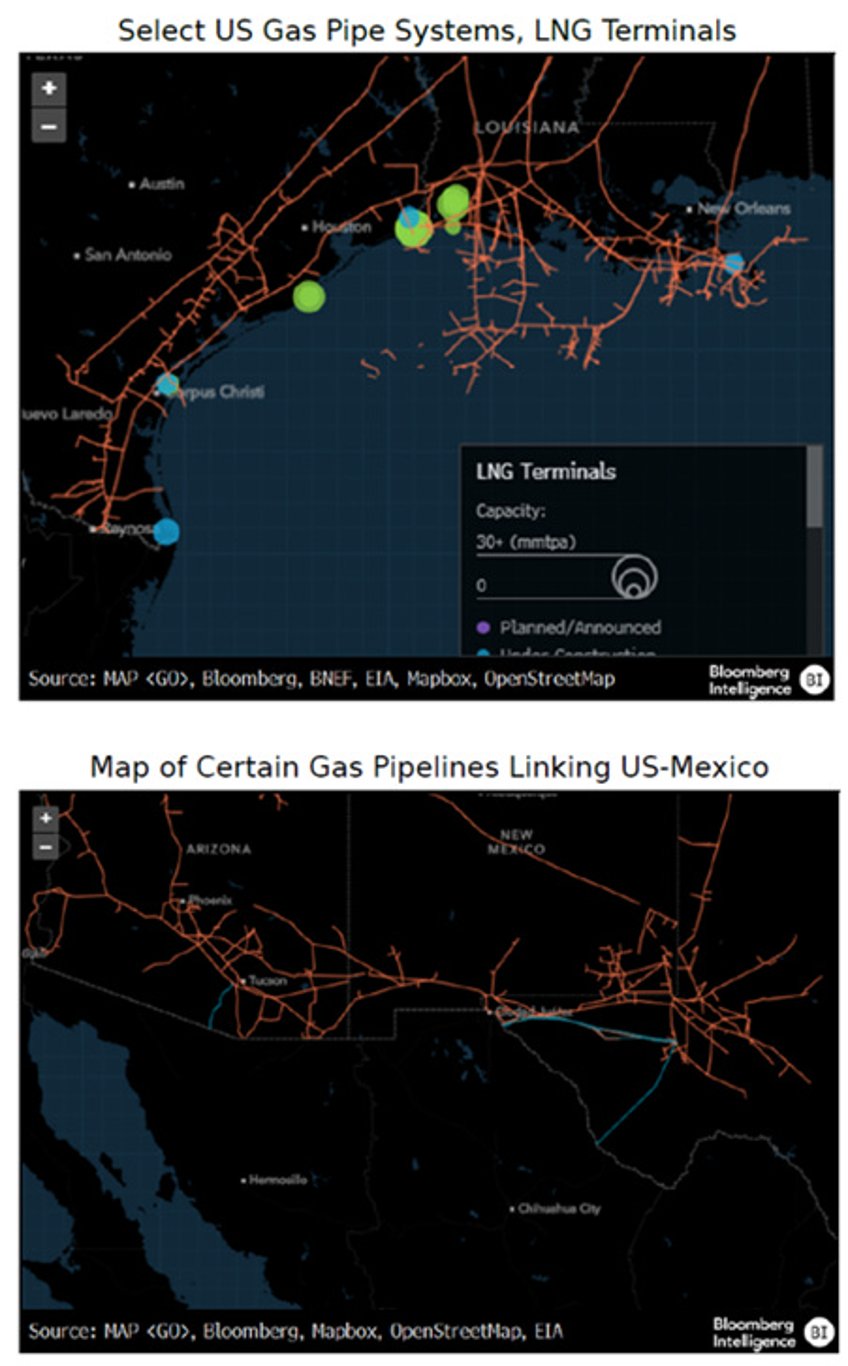

From a longer-term perspective, US natural gas demand could grow by at least 14 billion cubic feet per day (13.5%) from 2024-30, driven by rising LNG feedgas needs and pipeline exports to Mexico, boosting midstream EBITDA. This figure excludes industrial and AI-driven data-centre power demand, with LNG being the primary growth driver. Feedgas for US LNG exports is expected to rise by 12 billion cubic feet per day (90%) from 2024-29, driven by projects under construction and potential new terminals. LNG growth will benefit natural gas producers in the Permian, Haynesville, and Eagle Ford, as well as midstream operators like Kinder Morgan, which handles half of all gas to US LNG terminals, and Enbridge, which transports about 15%.

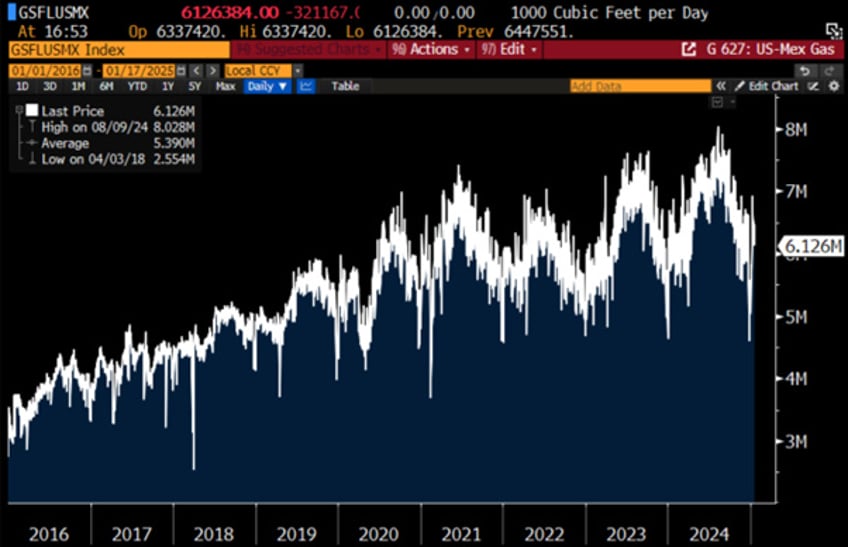

US natural gas exports to Mexico were up 4% in 2024 to 6.5 billion cubic feet per day, with potential for another 2 bcf/day growth by 2030. About 10 new combined-cycle gas plants in Mexico, expected to open by 2025, could require nearly 1 bcf/day of gas. The growing US gas supply, strained Mexican production, nearshoring, and data-center growth are driving cross-border trade. Wood Mackenzie forecasts 3 bcf/day growth in US-Mexico gas pipelines through 2030.

Pipeline operators in Texas and Louisiana, including Kinder Morgan, TC Energy, and Energy Transfer, are well-positioned to benefit from growing feedgas demand for LNG exports. Key projects like DT Midstream's LEAP, Momentum's NG3, and Williams' LEG will boost Haynesville gas to the Gillis Hub, while Energy Transfer’s Gulf Run will supply Golden Pass LNG. Plaquemines LNG will be supplied by Enbridge, Kinder Morgan, and TC Energy. Kinder’s Evangeline Pass projects could add $130 million in annual EBITDA, with Williams’ LEG contributing $80 million. Oneok may build the Saguaro Connector Pipeline if Mexico Pacific's Saguaro Energia LNG moves forward. These companies can capitalize on unused capacity to increase volumes with minimal extra spending, with Kinder Morgan handling about half of US-Mexico gas exports.

As the worst-case scenario of an inflationary bust materializes in market data, investors are reminded that GOLD, NOT BONDS, remains THE ANTIFRAGILE ASSET to hold. However, for investors seeking an income investment strategy, the energy infrastructure sector offers a way to boost returns during an inflationary bust, when the return OF capital must take priority over the return ON capital. By replacing bond allocations with energy infrastructure and using a diversified portfolio of short-dated investment-grade bonds to manage cash actively, investors will be able navigate this challenging period smoothly. Among equities, investors already know they will need to shift from energy-consuming sectors like IT to energy-producing sectors such as oil and gas.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/pipe-it-up

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.