Authored by GoldFix ZH Edit

Report Overview:

Weekly data indicates Hartnett’s “sell the last hike” idea is tracking. Works with ZeroHedge's "Nyet Zero": Hartnett Warns The Nasdaq Just Peaked..

The meat of the analysis starts at 6:30 time. Highlighted sections **labeled**. Run time 36:17.

Podcast Topics:

- 0:35- Context/ The story so far

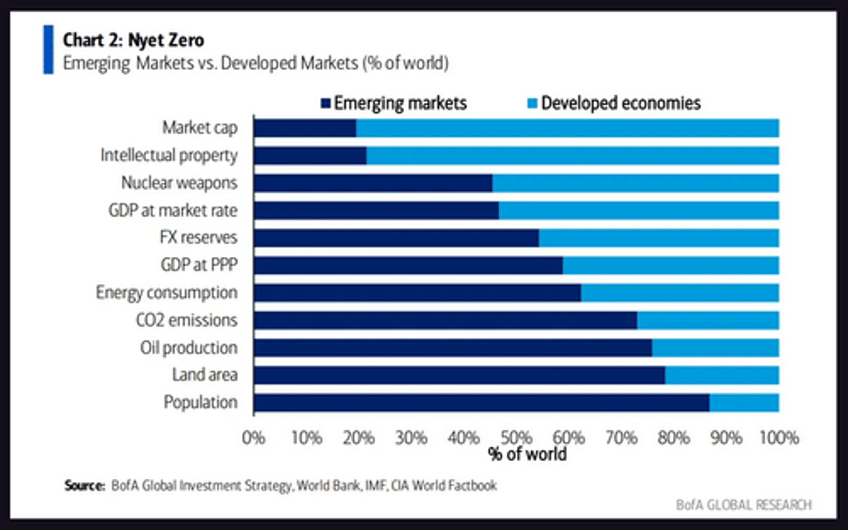

- 4:55- Net Zero will not happen

- 6:15- Scores on the Doors

- 7:30- Double Top technicals confirm the path

- 10:30-Central Bank and Tech stock correlation analysis

- ***14:10- The Biggest Picture- main idea described ***

- How we got to this

- economic challenges for East and West are supply chains vs value chains

- Deglobalization and mercantilism means reshore, onshore, repatriate, rebuild

- 20:45- Weekly flows, EM debt

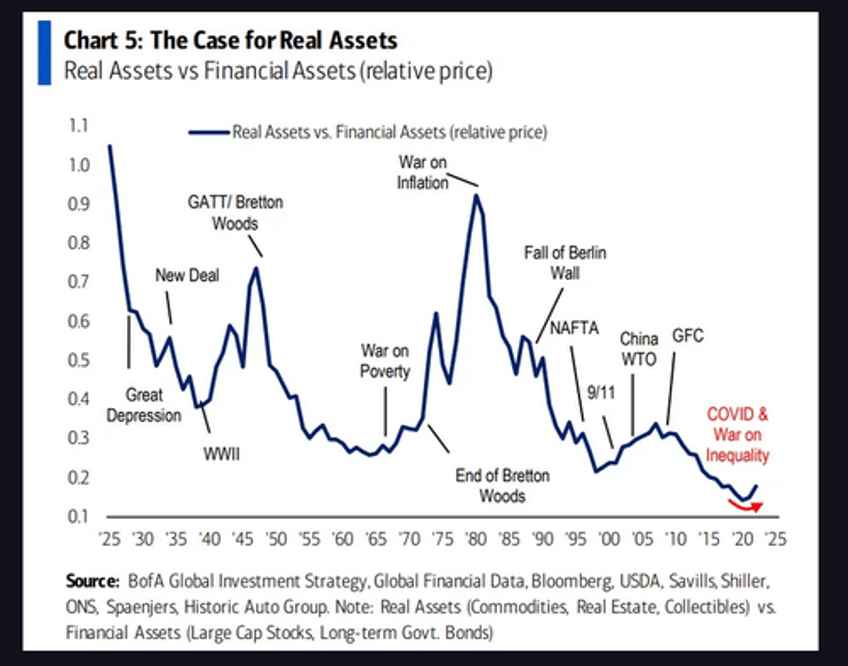

- ***22:30- Real vs Financial Assets turn around is now***

- Redistribute, rebuild implications

- Politics driving policy

- Populism, fiscal conservatives, and Trump

- Buffet Epiphany…

- 26:00- Housing market analysis

- 28: 05- What Hartnett focuses on in Housing

- 28:40- Hartnett’s Global Macro:

- Asian demand » Asian productivity» US demand still

- Services drop off in Asia is a sign as well.

- 31:00- US vs ROW stock valuations

- 4200 remains key

- ***32:45- Bubble and Boom to Pop and Bust***

- How it was

- How it is changing

- How it manifests- Inflationary headwinds

- 34:40- Sell the last rate hike

Related: Brics Summit, Great Reset Update, Best of the Week

Continues here ...