Right now, Russian banks are likely trading gold across the Middle East and Turkey to bypass U.S. sanctions and bans on the import of euros and dollars.

So, why not just bring them back into the fold and keep the Petrodollar shell game going?

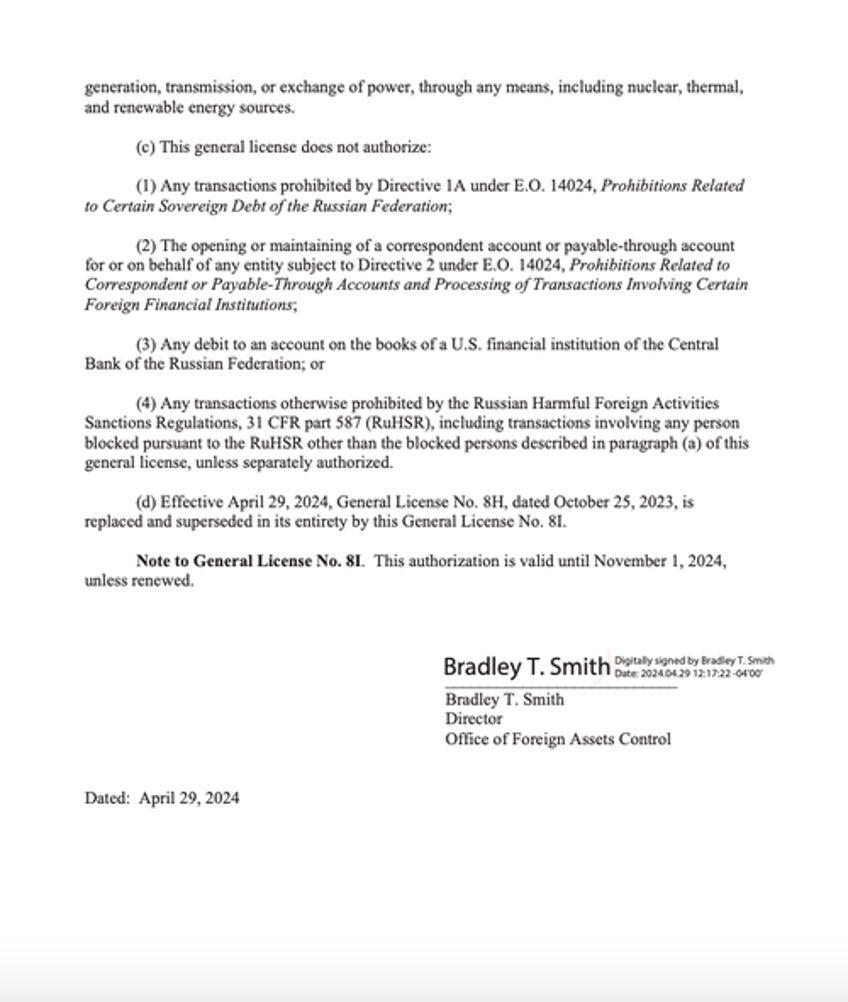

The US Department of Treasury will temporarily allow transactions with multiple Russian financial institutions, including Alfa-Bank, VTB, and Sberbank, through November 1, 2024, on energy-related transactions.

Oh... also on the list?

The decision, signed by Bradley Smith at the Office of Foreign Assets Control, doesn't lift sanctions.

But it comes at the same time that the U.S. is considering a ban on Russian uranium. Russia delivers about 25% of its enriched uranium to the United States, earning the country about $1 billion annually. The Biden Administration has said that such a reliance brings "risks to the U.S. economy."

The Treasury Department's letter signals that transactions can include anything related to extraction, production, processing, liquefaction, transportation, or oil purchase. It also relates to LNG, timber, coal, and uranium.

Why?

It could be anything with this band of Yale graduates and Brookings Institution alums. This week, oil prices are under pressure during diesel oversupply and concerns about global economic growth.

We'll see what Ms. Yellen is up to soon.