Crude prices slid back to unchanged this morning - from some overnight gains - after a hotter than expected CPI print took demand-seducing rate-cuts off the table.

However, as Bloomberg reports, oil is still up 19% this year as OPEC+ cuts supply and geopolitical tensions across the Middle East create strong tailwinds. The market is bracing for Iran’s response to a suspected Israeli attack on its consulate in Syria last week, and top traders have been striking an increasingly bullish tone in recent days.

API reported a sizable crude build and another gasoline draw - all eyes will be on the official data for any confirmation.

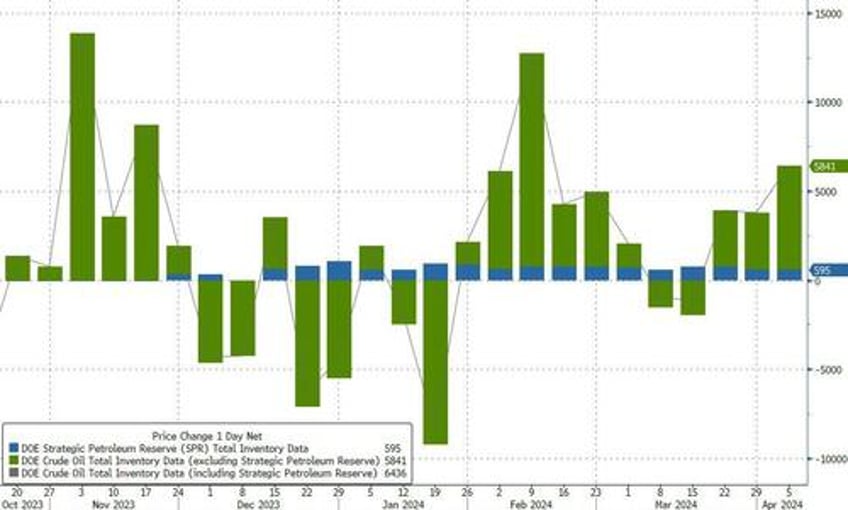

API

Crude +3.03mm (+800k exp)

Cushing +124k

Gasoline -609k (-1.4mm exp)

Distillates +120k (-600k exp)

DOE

Crude +5.84mm (+800k exp)

Cushing -170k

Gasoline +715k (-1.4mm exp)

Distillates +1.66mm (-600k exp)

Bigger than expected crude build surprised traders but a build in gasoline stocks was probably the most notable aspect of the report...

Source: Bloomberg

In aggregate, this is a pretty chunky nationwide inventory build. Total crude and product stockpiles climbed by 12 million barrels, excluding SPR last week. That’s the biggest weekly gain since July last year. In addition to crude build, there were also increases in the other oils category, as well as gasoline, jet fuel and diesel.

The Biden admin added 595k barrels to the SPR last week...

Source: Bloomberg

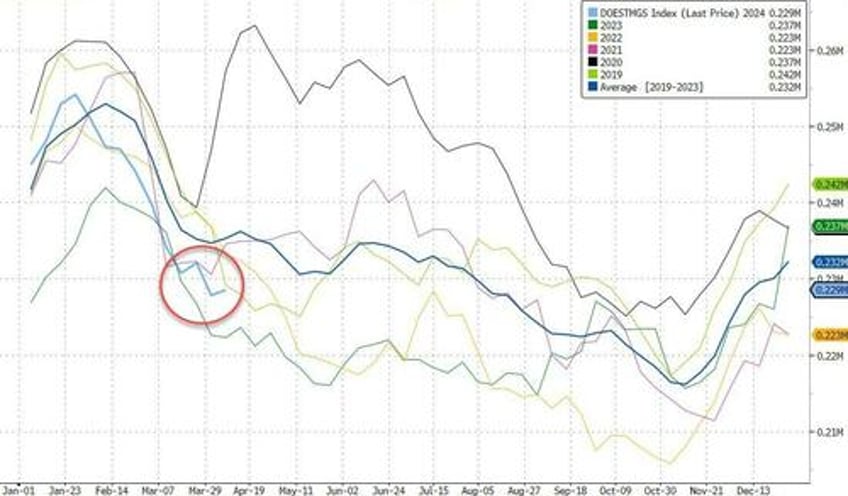

US gasoline stockpiles, which have plunged to the lowest levels this year, though they remain above the same period last year.

Source: Bloomberg

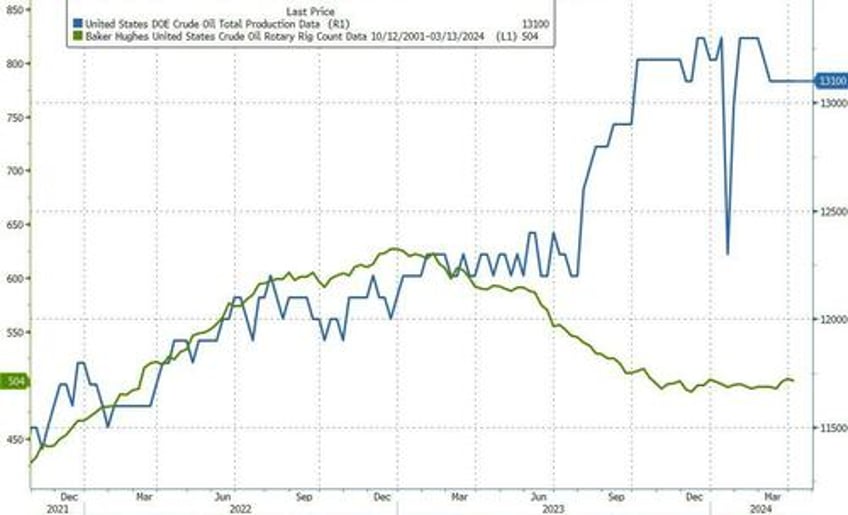

US Crude production was flat at 131.mm b/d, near record highs...

Source: Bloomberg

WTI was hovering around $85.25 ahead of the official data, dipped on the data then rallied higher...

Meanwhile, pump-prices continue to rise, as we expected, tracking wholesale gasoline prices higher...

Source: Bloomberg

...and if you think this morning's CPI was hot, with the highest pump-prices in six-months, just wait for next month...

Source: Bloomberg

Not at all what President Biden wanted to see, but we are sure it's all 'mom and pop' retail gas station owners' greed that is driving this!!!