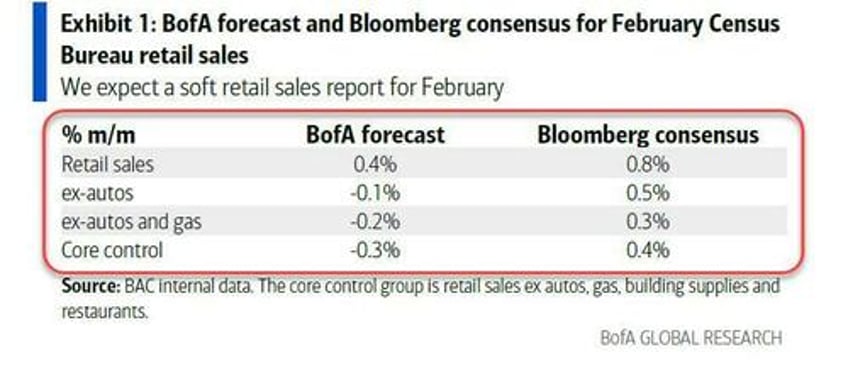

Following January's majorly disappointing decline in US retail sales, BofA's omniscient analysts forecast another disappointment in February, as we detailed last night...

...and they were right... again (10th month in a row)... as headline retail sales rose 0.6% MoM (vs +0.8% exp) and January's 0.7% tumble was revised even lower to a 1.1% plunge...

Source: Bloomberg

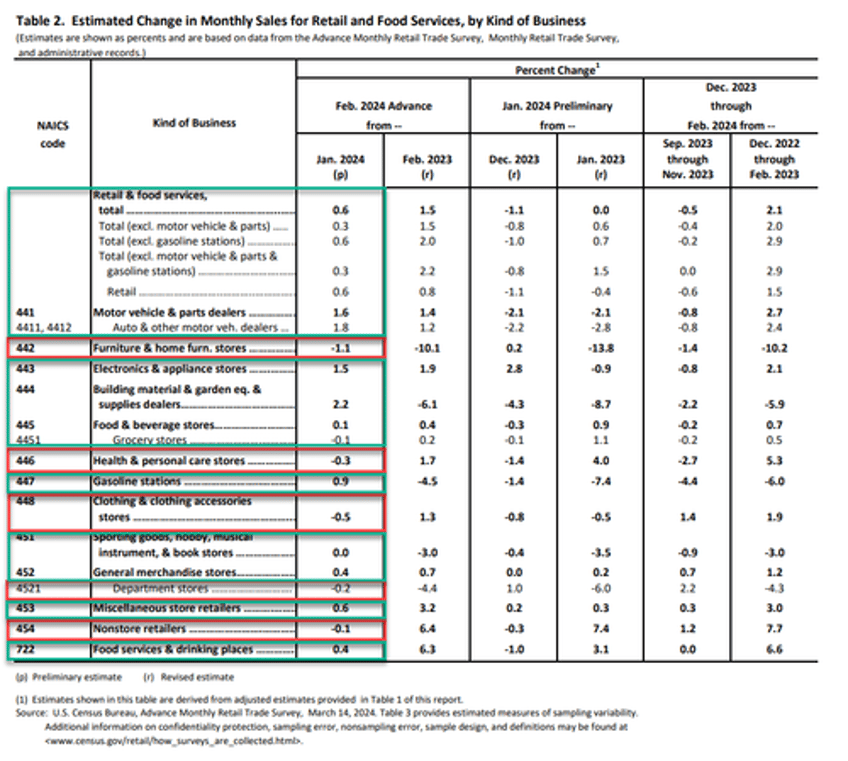

A mixed bag...

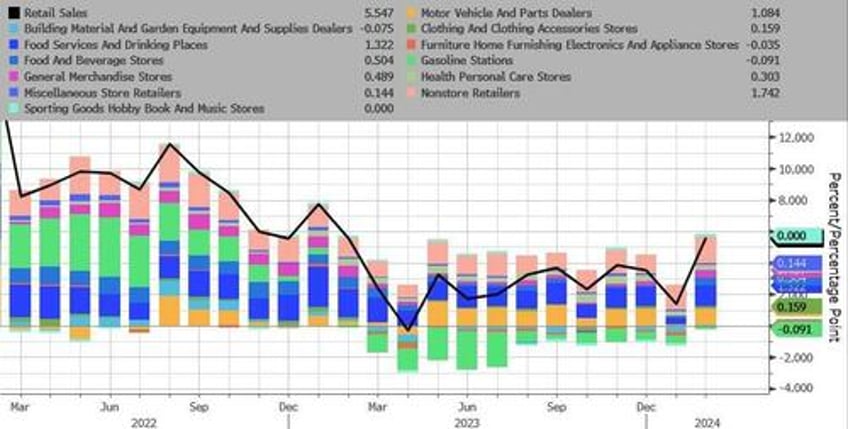

Motor Vehicle & Parts dealers were the biggest contributors to the MoM gains in retail sales while clothing and personal healthcare stores saw sales decline (and internet retailers saw sale decline too - very unusual)...

Source: Bloomberg

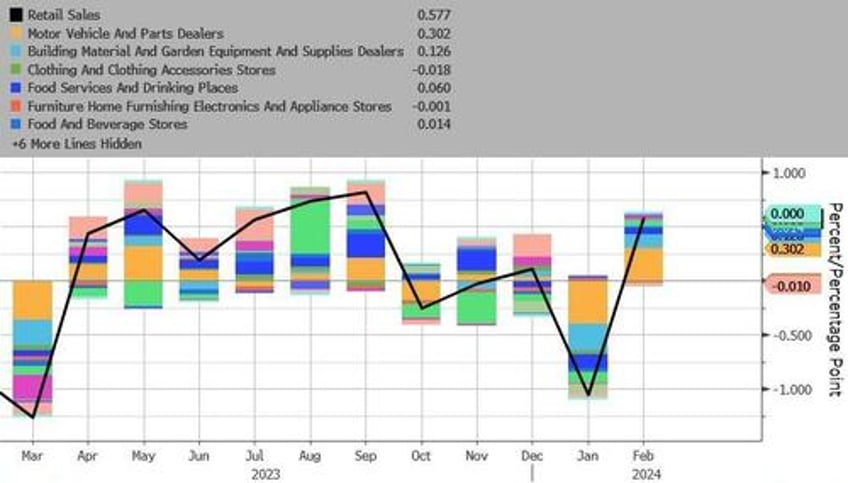

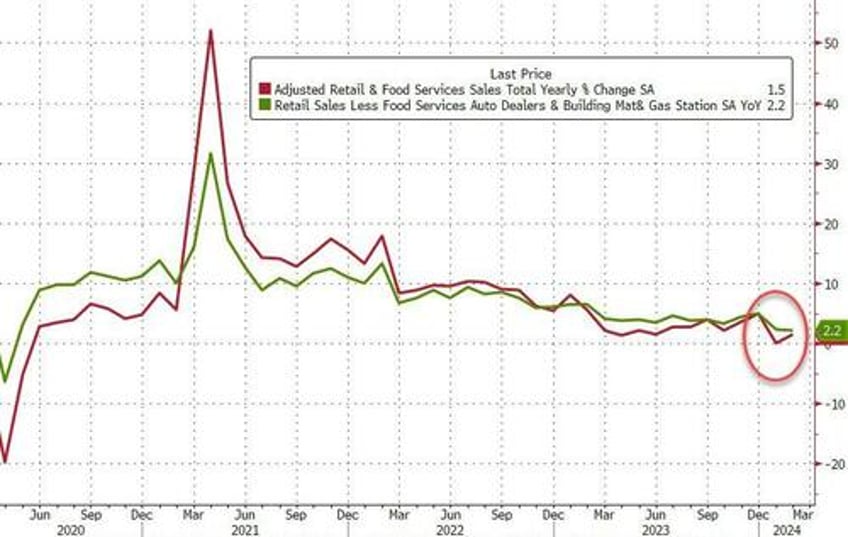

Core retail sales also disappointed (+0.3% MoM vs +0.5% exp), which heled the YoY levels down near their weakest since COVID lockdowns...

Source: Bloomberg

Gasoline stations sales were the biggest drag on a YoY basis (albeit small) while internet retailers and food services saw the largest YoY gains...

Source: Bloomberg

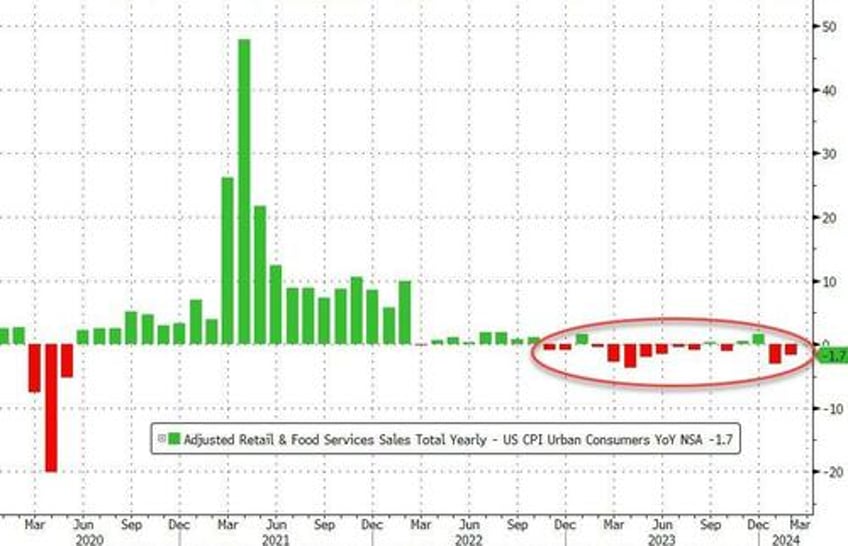

Adjusted (crudely) for inflation, this was a huge drop in 'real' retail sales. REAL retail sales have declined for 12 of the last 16 months - in other words, on a crude basis (Ret Sales - CPI), Americans aren't buying more shit.

Source: Bloomberg

Soft-landing morphing into a stagflationary crash-landing?