By Romina Boccia and Dominik Lett, CATO Institute

Imagine a future where the average American earns $15,000 more each year because Congress reduced federal spending and national debt. Too often, spending cuts are painted as a necessary evil—painful austerity measures that slow the economy. This narrative couldn’t be further from the truth. Economic research shows that stabilizing government debt by cutting spending can unleash economic growth.

Today, the federal government’s public debt is a staggering $28.8 trillion—equivalent to the nation’s annual economic output—and is projected to skyrocket to 166 percent of GDP by 2054 under optimistic assumptions. This ballooning debt is driven primarily by the growth of interest costs and just a few entitlement programs, including Medicare, Social Security, and Medicaid. High debt levels are already slowing economic growth, driving up inflation, and pushing interest rates higher. This makes it harder for families and businesses to borrow and invest.

Take the crowding-out effect. When the federal government borrows heavily, it competes with the private sector for limited financial resources, driving up interest rates. Between January 2022 and January 2025, for example, the prime bank loan rate doubled from 3.25 percent to 7.5 percent. As loans become more expensive, startups delay expansions, businesses scale back hiring, and innovation suffers. As one business owner noted in 2024, “We are a new business and our loans closed when the rates were at an all-time high … so that has increased our monthly expenses dramatically.”

The result is a less productive economy, lower wages, and reduced competitiveness. Cutting spending reduces this crowding-out effect by freeing up resources for private-sector investment, creating jobs, and boosting incomes.

Economic research reinforces the idea that spending cuts can enhance growth. A 2020 study by researchers at the Hoover Institution found that stabilizing and reducing the debt by restraining the growth in federal spending could boost short-run annual GDP growth by 10 percent and long-run growth by 7 percent. More specifically, Cogan, Hail, and Taylor find that an economic plan that curbs entitlement spending without raising taxes can deliver a powerful one-two punch for growth. A credible commitment to reducing future debt and taxes results in higher long-term disposable income for individuals, motivating more consumer spending today. This surge in consumption more than offsets the initial reduction in entitlement benefits, demonstrating that fiscal discipline can create a win-win for the economy.

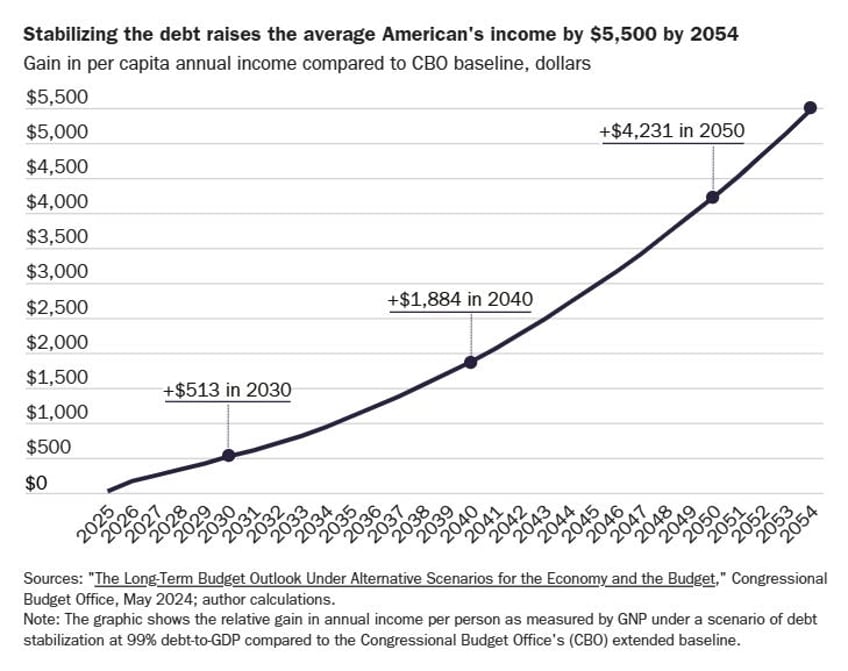

Additionally, the Congressional Budget Office (CBO) projects that stabilizing the debt could raise projected income per person by $513 in 2030 compared to baseline projections. The gain in annual income grows significantly over time, and by 2054, the average American’s income could be $5,500 higher (see the graph below). If debt grows faster than expected under CBO’s baseline—meaning the fiscal outlook worsens—the economic benefits of stabilizing the debt become more pronounced. Under one high debt scenario, the Committee for a Responsible Federal Budget estimates that the income gain from debt stabilization would increase to $14,500 per person by 2054.

Spending reductions also shield Americans from higher taxes. In the current fiscal environment, spending significantly outpaces revenues—a gap that will eventually necessitate tax increases. By cutting spending today...(READ FULL ARTICLE HERE).