Retail seems unfazed by the tension in the Middle East, according to stock sentiment, while they have continued to add to their bond positions despite rising yields.

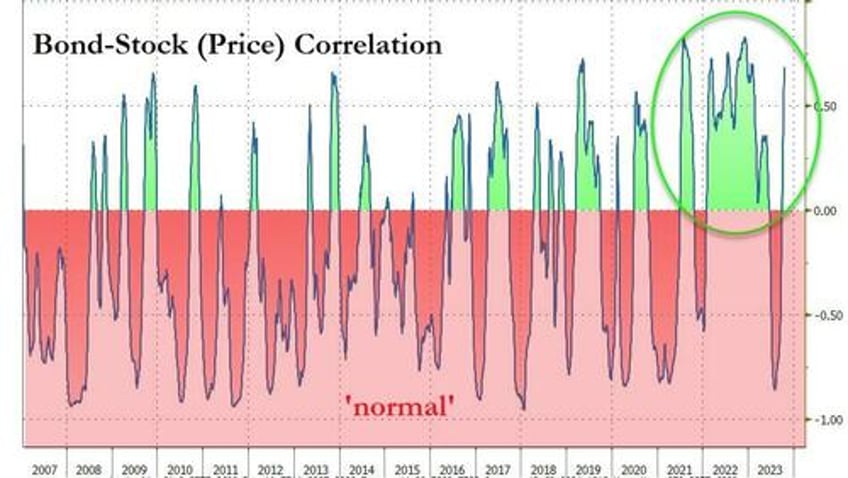

That will become increasingly uncomfortable as both stocks and bonds falling at the same time becomes a more common occurrence.

The recent period is a reminder that when the stock-bond correlation is positive...

...both assets can fall at the same time.

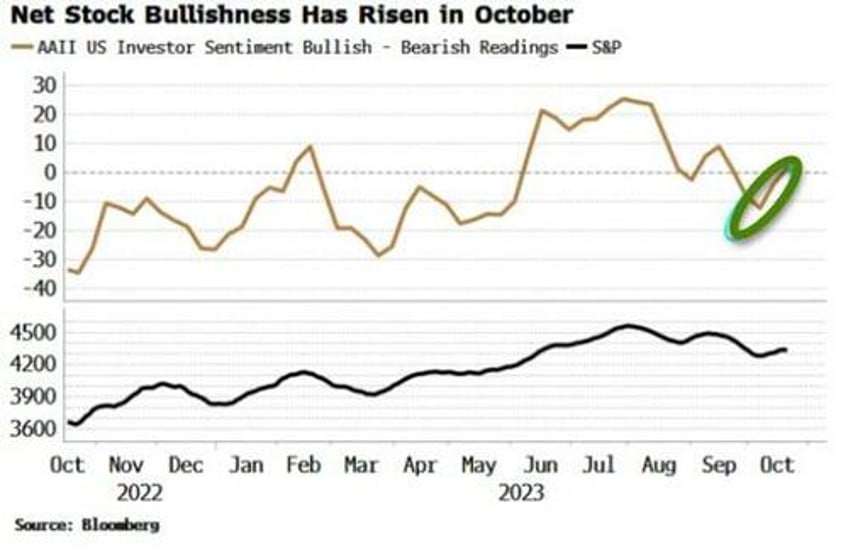

That might come as a shock to retail investors.

They have been net bullish for most of the second half of this year, according to the American Association of Individual Investors (AAII).

Further, they have increased their net bullishness in the last 2-3 weeks despite the situation in Israel and Gaza.

The stock outlook from a technical stand point has soured in recent weeks, even while there is a cyclical upswing in the US and global economy. Measures of breadth - such as the number of stocks trading below their 200-day moving average, the number of stocks making new 52-week lows, and the advance-decline line - are all weakening, but are not yet at capitulatory levels that would hint a rebound is imminent.

Moreover, the S&P has dropped through its 200-day moving average, so we may see more follow-through in the short term.

Excess liquidity, though, remains supportive for risk assets in the medium term, and as long as yields do not continue to accelerate higher (more dip buyers coming through perhaps), stock-market downside should be contained. (Note as well though the Nasdaq has a lot more downside than the S&P, being up 33% this year, versus 10% for the S&P.)

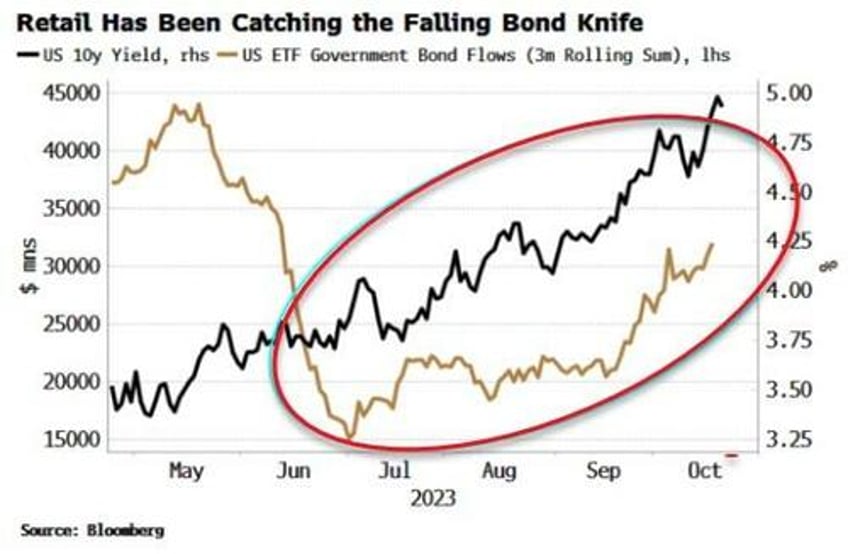

While retail may thus face more stock losses, they have also had their hands bloodied by trying to catch the falling bond knife this year.

Using ETF flows as a proxy, they likely accelerated their net purchases of government bonds in the summer as yield rises started to pick up, and have chased prices lower ever since.

According to the AAII, investors have increased their stock and bond allocations this year, and reduced their cash allocations, despite very attractive cash yields.

That shows either enormous faith in financial assets to deliver fairly exceptional returns despite an elevated inflation backdrop, or that they have yet to adjust to the new financial order.