Intro:

Edited by GoldFix ZH Edit

Last week news was broken in Russia Grows Gold, Fx Purchases by 600+%. The indirect implication from that news was revenues generated from oil sales will go towards increased purchases of Gold and FX. The author of the article below ties the two events even closer. Keeping in mind, no literal Quid-Pro-Quo can be assumed related to Russia on Oil/Gold.

China has been buying oil and settling in Gold and/or RMB (with a Gold option) since 2017. This was most recently discussed in The Petrodollar is Dead to China which Jefferies’ Chris Wood anecdotally confirmed that analysis in April 20231 from a completely different vantage point.

Russia earns a substantial amount of its GDP selling oil. Russia converts revenues into FX reserves like most countries do. Finally, Russia, having no use for dollars or Treasuries (or ability to hold without confiscation), buys gold with a good chunk of that money. The author's assumption below is not wrong.

Russia selling oil for gold in September

According to Russian news agency Interfax, the government will increase its gold purchases from 1.12 billion rubles per day to 8.2 billion rubles per day for the next month.

Russia using oil to get gold

The report states the finance ministry expects a significant oil and gas revenue of 162 billion rubles in September, a huge jump compared to the 10.9 billion rubles generated in August.

With that money, Russia plans to purchase more gold.

Embracing gold in Russia

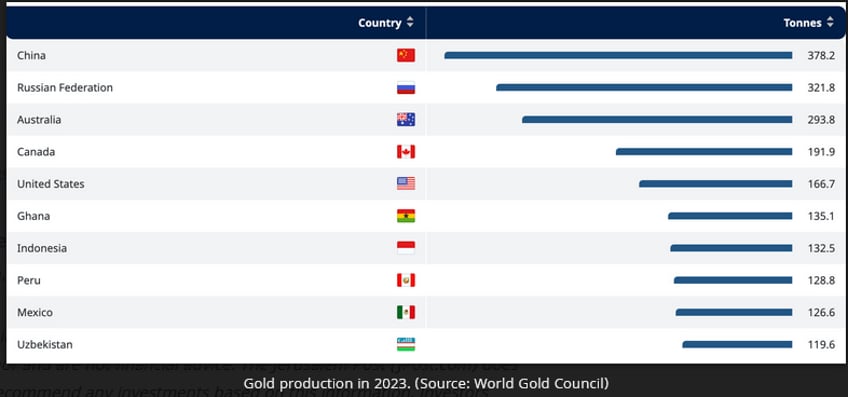

In early 2022, just as the war with Ukraine began, Russia married the ruble to gold and created a new gold standard. According to The Conversation, Russia shifted the currency to gold to isolate its economy from transactions requiring American dollars. That effort has been taking place since 2013.Russia has long been a top producer of gold. Last year, the country produced 321 metric tons, second only to China’s 378 metric tons.

So far, Russian leader Vladimir Putin’s bet is paying off, as gold hovers around $2,500 an ounce, near its all-time high.

//end

Continue here

Free Posts To Your Mailbox