A Crypto Coin To Save Us From AI?

Silicon Valley wunderkind Sam Altman is probably best known for being CEO of OpenAI, the artificial intelligence organization behind ChatGPT. He's also the co-founder of Worldcoin, the crypto coin with the stated purpose of protecting the world from AI disruption. In their own words:

[W]e believe Worldcoin could drastically increase economic opportunity, scale a reliable solution for distinguishing humans from AI online while preserving privacy, enable global democratic processes, and eventually show a potential path to AI-funded UBI.

If you want to hear Altman's Worldcoin co-founder make their pitch for this project, you can watch the video below, but in the interest of balance, I'm going to share a few other takes on it afterwards.

A Few Alternate Takes On Worldcoin

Mack DeGeurin and Thomas Germain of Gizmodo ("I Gazed Into Worldcoin’s Orb and Saw a Boring Dystopia Staring Back"):

OpenAI CEO Sam Altman’s buzzy startup Worldcoin has a relatively straightforward pitch to prospective users. First, you fork over a scan of your eyeball to one of several thousand iris-scanning, basketball-sized metal computers called “Orbs.” In exchange, you’ll receive a one-of-a-kind “World ID” that could one day be used to verify your identity throughout the web. In many locations, Worldcoin will actually trade you some of its own WLD cryptocurrency tokens “simply for being human,” per its website.

Gizmodo was invited for some face-to-face time with “The Orb’’ this week in New York City. The experience, which only took a few minutes, was easy, comfortable, relatively mundane, and unquestionably dystopian. We gazed into “The Orb’s” eye and saw a cynical, anarcho-capitalist dream world where displaced workers bow in servitude to Silicon Valley’s crypto philanthropists.[...]

A Silicon Valley founder responsible for bulking up some of the worst internet villains of Web 2.0 is now spending large parts of his days jump-scaring lawmakers around the world into believing his glorified autocomplete AI chatbot may decimate labor and potentially end human existence as we know it. Now, that same founder says he can actually solve the existential problem he’s helping breathe into existence if the citizens of the world simply submit to staring into the dark abyss of a cold, lifeless iris scanning robot. And yes, of course, Worldcoin plans to make plenty of money in the process.

Autism Capital. (The pseudonymous Twitter account best known for their analysis of Sam Bankman Fried's FTX):

Worldcoin is Sam Altman’s shitcoin monetizing the last bits of his reputation before “the world ends due to AI.” In our opinion Sam Altman is a charlatan and a huckster and we speculate will be making approx 9 figures off of dumping his Worldcoin premine on stupid retail AND collecting your valuable biometric data. Worldcoin was promoted using MLM tactics and literally supported by scanning the irises of naive third world humans in Africa and other undeveloped countries. It is the actual definition of white colonialist energy the media loves to rant about. The project is foul, wretched, and done in a bad way. They’ve tried to scrub much of the history but autism doesn’t forget. It is cringe and evil and if you value your personal data or have self respect stay away.

Kepano (A tech entrepreneur):

Sam Altman tells me he is worried that "bad actors" could try to use AI for world control and "full enslavement of everyone else"

— kepano (@kepano) July 29, 2023

Meanwhile, his project Worldcoin is creating a database of all humans by asking you to scan your eyeballs in exchange for his proprietary money pic.twitter.com/RC6LeQY9gq

Worldcoin is explicitly tied to Sam Altman's prophecy for AI.

— kepano (@kepano) July 29, 2023

If AI displaces the majority of jobs, then people will need another way to receive income. What better solution to distribute that money than one that Sam controls? pic.twitter.com/MLrBxmNXm6

Sam Altman has been on tour, meeting world leaders and regulators, fearmongering about the "risk of extinction" that AI poses, while OpenAI's work on developing superintelligence is proceeding at full steam.

— kepano (@kepano) July 29, 2023

My personal opinion is that open source AI is the only defense we have against centralized AI becoming a system of control for Sam Altman, big tech, and governments.

— kepano (@kepano) July 29, 2023

I don't see how Worldcoin-powered UBI doesn't end up becoming similarly oppressive and a bootstrapped CBDC.

I prefer optimism to cynicism. I prefer to invent better solutions than tear others down. This is an exception.

— kepano (@kepano) July 29, 2023

Having used the paid version of ChatGPT, and seen how Altman's attempt to make it politically correct has hobbled its usefulness, I'm inclined to agree with his critics above.

Let's wrap this up with a look at our exits last week in our trading Substack.

Last Week's Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. These are the trades I exited this week:

Stocks or Exchange Traded Products

None.

Options Trades

Call spread on Crocs (CROX 0.00). Entered at a net debit of $0.75 on 7/26; will expire worthless. Loss: 100%.

Put spread on Teladoc Health (TDOC 0.18%↑). Entered at a net debit of $0.49 on 7/25; will expire worthless. Loss: 100%.

Call spread on Snap (SNAP 0.00). Entered at a net debit of $0.38 on 7/25; will expire worthless. Loss: 100%.

Put spread on Ford (F 0.00). Entered at a net debit of $0.41 on 7/27; exited at a net credit of $0.81 on 7/28. Profit: 98%.

Call spread on Logitech International (LOGI 0.00). Entered at a net debit of $1.25 on 7/24; exited at a net credit of $2.25 on 7/25. Profit: 80%.

Put spread on Kimberly-Clark (KMB -1.20%↓). Entered at a net debit of $0.50 on 7/24; exited for a net credit of $0.90 on 7/25. Profit: 80%.

Call spread on Keurig Dr Pepper (KDP 0.33%↑). Entered at a net debit of $0.70 on 7/25; exited at a net credit of $1.55 on 7/28. Profit: 121%.

Comments

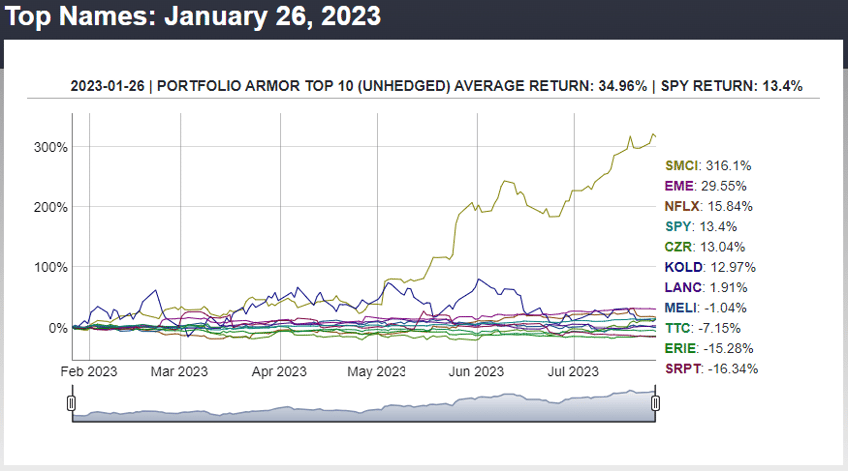

On the stock side, this was another week where we didn’t get stopped out of anything, as our system’s top ten names continue their strong performance. For example, if you missed yesterday’s top names post, our top ten names from January 26th were up 34.96%, on average, over the next six months.

On the options side, all of these exits were on earnings trades entered this week. Looking at some of the social data trades I didn’t place this week, we could have made money on about two thirds of them. Next week, I’ll try to cast a broader net for these.

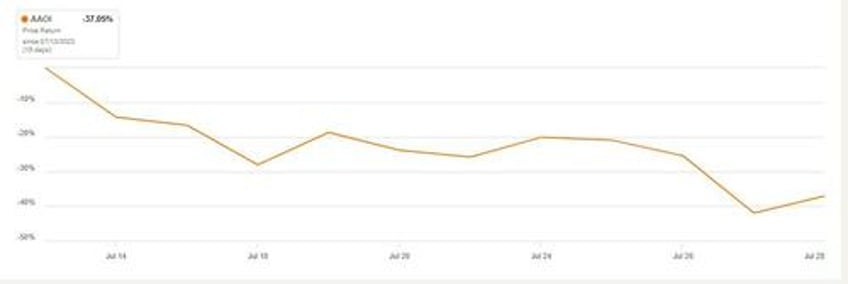

One trade we didn’t exit this week was our bearish bet against Applied Optoelectronics (AAOI 8.05%↑), but our timing on betting against it looks to have been pretty good (today’s bounce notwithstanding).

That AAOI trade wasn’t an earnings trade, but a bet that a parabolic stock with awful fundamentals would come back to earth. If you want a heads up when we place our next trade, feel free to subscribe to our trading Substack/occasional email list below.

If You Want To Stay In Touch

You follow Portfolio Armor on Twitter here, or become a free subscriber to our Substack using the link below (we're using that for our occasional emails now). You can also contact us via our website. If you want to hedge, consider using our website or our iPhone app.