Gold Stocks vs. Bullion: Why the Lag?

You might think that the price of physical gold and the performance of gold mining stocks should more or less always move together, since higher gold prices typically boost miners’ revenues. However, there are instances—like now—where physical gold prices surge while gold mining stocks stay flat or even decline. There are a lot of reasons this can happen, but it sometimes represents a buying opportunity.

Take 2000-2011, which of course includes the 2008 financial crisis. The price of physical gold rocketed up over 500%, but gold mining equities returned almost 700% during the same decade. During bull markets, the cost of gold production rises slower than the value per ounce of bullion, which gold miners can leverage.

However, any number of market factors could cause a gold mining stock to underperform bullion in the shorter term despite a boom in bullion prices, but the lag usually doesn’t last. This isn’t to say that gold mining stocks are a replacement for physical gold in a portfolio. Unlike physical gold, they aren’t money—they’re stocks. But they’re inextricably linked to gold, and as part of a diversified precious metals investment portfolio, Peter Schiff still recommends allocating investment capital to gold miners, especially when they appear undervalued.

Kinross Gold was down about 7% last week simply because analysts overshot the mark and expected earnings that Kinross didn’t meet. That’s in spite of an objectively strong 82% rise in earnings. But oftentimes, when markets react, they overreact.

Gold stocks as a group are barely up today, despite gold's $23 rise, to trade just below $2,930. I think that's entirely due to the market's over-reaction to Kinross's strong earnings report not being as strong as expected, despite the stock already being extremely underpriced.

— Peter Schiff (@PeterSchiff) February 13, 2025

Other times, inflationary pressure, rising prices, labor shortages, trouble at gold mines where a company is invested, legal surprises, and other factors can temporarily drag down mining stocks even as gold booms. In 2024, Barrick Gold Corporation (NYSE: GOLD) had to shut down a mine in Mali due to a dispute with authorities relating to new mining laws. Barrick hopes to reopen the mine, but had to revise their 2025 output projections because of the closure.

These kinds of geopolitical risks can disrupt production and negatively impact investor confidence, causing stock prices to fall even when gold prices are rising. Unlike Kinross, however, Barrick’s recent earnings and production report caused the stock to jump. But it’s still currently undervalued relative to the boom in bullion, which is likely to continue in 2025.

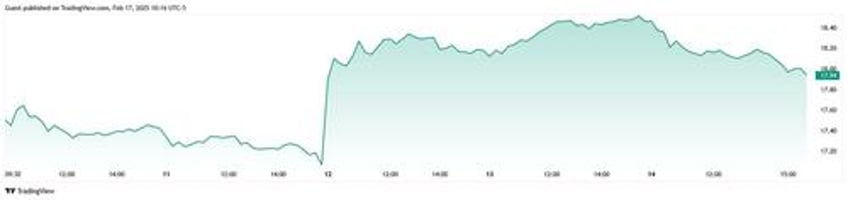

Barrick Gold Corp (GOLD) 5-Day Chart

Gold stocks can also go down due to investors reacting to gold and silver spreads. With the gold/silver ratio currently around $90, investors may be unwinding their positions to take profits or cut losses. As Peter Schiff noted last Friday on X/Twitter:

“Yes, gold is down nearly $40 today, but there’s no reason for gold mining stocks to be down too. Gold is barely below $2,900, and prices are going much higher. Yet most gold stocks would be cheap at twice the price. Some of today’s decline may be unwinding of gold/silver spreads.”

Another problem with the short-term valuation of gold stocks is coming from the inability of Wall Street analysts to understand and properly model when it comes to gold and gold miners. Forecasting earnings for these mining companies, in part, means having to forecast the price of bullion itself.

Wall Street is clueless about gold. Analysts who cover Barrick Gold have to estimate future earnings to rate the stock. To do that, they also must estimate future gold prices. With gold trading today above $2,900, they now estimate a $2,400 gold price to forecast 2027 earnings.

— Peter Schiff (@PeterSchiff) February 10, 2025

The Fed is not in control. Inflation is ripping as the money supply expands, prices are rising, and gold will respond with further gains. But Wall Street remains clueless about gold, which affects the valuation of mining stocks. As Peter Schiff said recently on X Spaces:

“All the Wall Street firms, when they rate these gold stocks, they assume the price of gold is going to be much lower in the future than it is now. They have no confidence in this rally. That’s why they don’t want to buy gold stocks because they expect the price of gold to fall, even though it’s going to continue to rise.”

Regardless of when Wall Street and retail investors figure it out, the yellow metal remains the undisputed safe-haven asset, especially with inflation hot and the possibility of QE later this year to “save” the system. Hard money will never change. But the broader global precious metals market is more than just physical.

With gold mining stocks potentially outperforming bullion during certain time frames, and a pattern of being undervalued during this latest bull market, diversifying into a group of winning miners is a move worth considering as gold readies to surpass $3,000 for the first time in history.