Spot gold prices climbed back above $3,000 an ounce on Wednesday morning after breaking above the key psychological threshold in mid-March. The surge comes amid escalating tariff wars and rising recession risks, fueling demand not only for gold bars as a safe haven—but also for gold Rolexes on the secondary market.

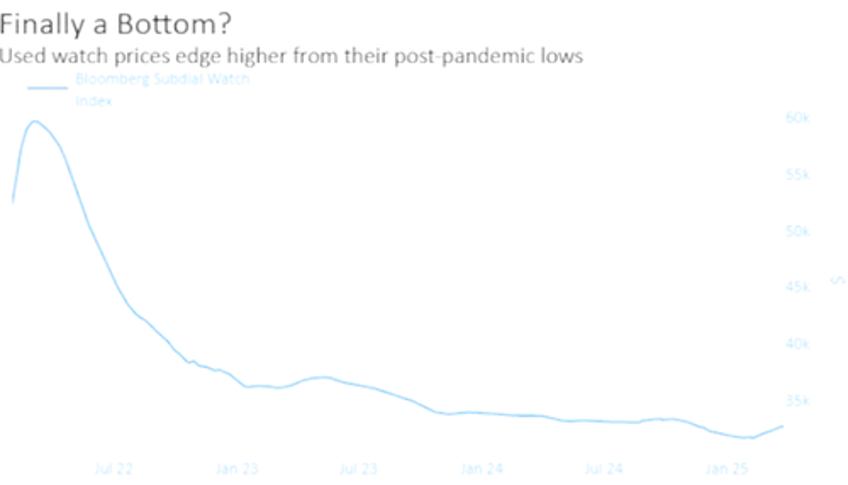

Since its launch in 2022, the Bloomberg Subdial Watch Index—which tracks prices for the 50 most-traded watches by value on the secondary market—shows that three gold Rolex models have seen the largest gains in value.

As per a Bloomberg report:

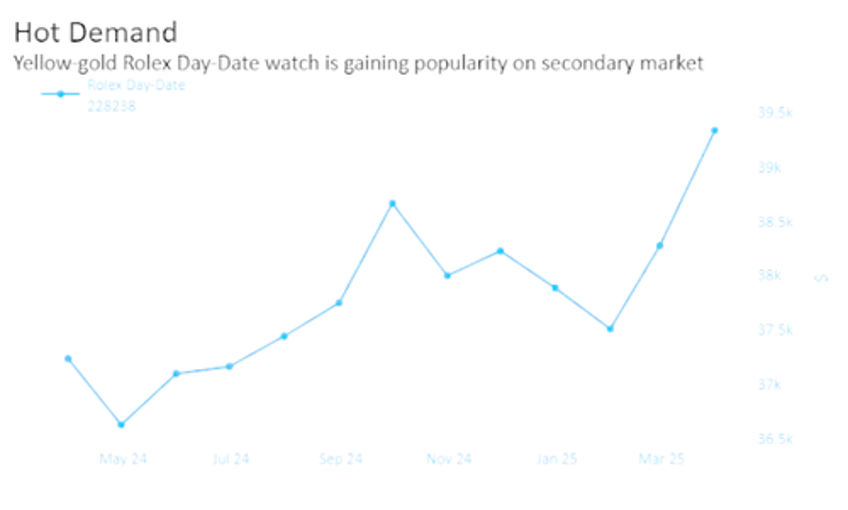

The yellow-gold Day-Date 228238, which Rolex suggests retailing for €43,800 ($48,050), was the index's fastest climber, rising from 30th place to ninth in that period.

The bi-metal Rolex Datejust 16233 model gained 19 spots,

while the yellow-gold Day-Date 18038 moved up 17 places.

The surge in gold Rolexes comes as gold prices have doubled from around $1,600 in late 2022 to as high as $3,100 in recent weeks. Some of the drivers behind gold's bull market include deepening trade wars and rising recession risks.

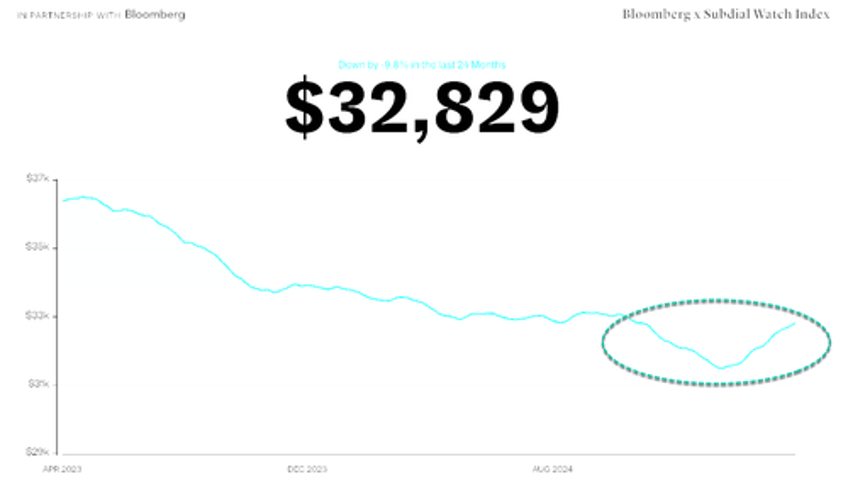

Meanwhile, the Subdial Watch Index has been in a multi-year bust, with interest rates elevated and the easy money spigot turned off. The index touched a low of $32,000 in January and has since recouped some losses, nearing the $33,000 level. Over the past two years, the index has lost about 10%.

Finally, a bottom?

"Trump's tariffs could add to watchmakers' pain," Bloomberg noted, adding, "Switzerland faces a 32% duty on exports to the US, far higher than the European Union's 20% levy, which may force companies to raise prices."

Since this time last year, we first asked: Did The Used Rolex Watch Market Finally Bottom?