After weak Manufacturing surveys for October (growth slowing but prices reaccelerating), the Services sector surveys are forecast to be mixed with PMI expected higher and ISM expected to decline, but both are forecast to remain above 50 (in expansion).

S&P Global's Services PMI actually disappointed, dropping from the preliminary 50.9 print to final 50.6 (but that is still above the 50.1 print from September) - strongest since July 2023

Services PMI also disappointed, dropping from 53.6 to 51.8 (below the 53.0 exp) - weakest since May 2023.

And that all occurred as US Macro data is serially disappointing...

Source: Bloomberg

The ISM survey shows prices paid considerably hotter than expected and employment notably worse than expected (despite new orders improving modestly)...

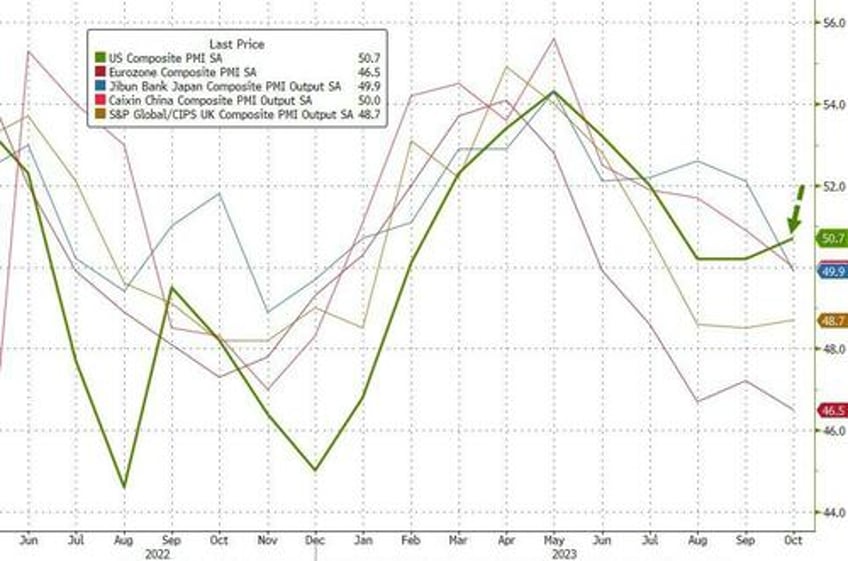

The final S&P Global US Composite PMI Output Index posted 50.7 in October, up from 50.2 in September, to signal a marginal rise in business activity at private sector firms. That makes the US the strongest region in the world (Eurozone is the weakest)...

Manufacturers and service providers saw a quicker rise in output, despite fragile demand conditions.

Aggregate new orders continued to decrease, as service sector demand waned.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

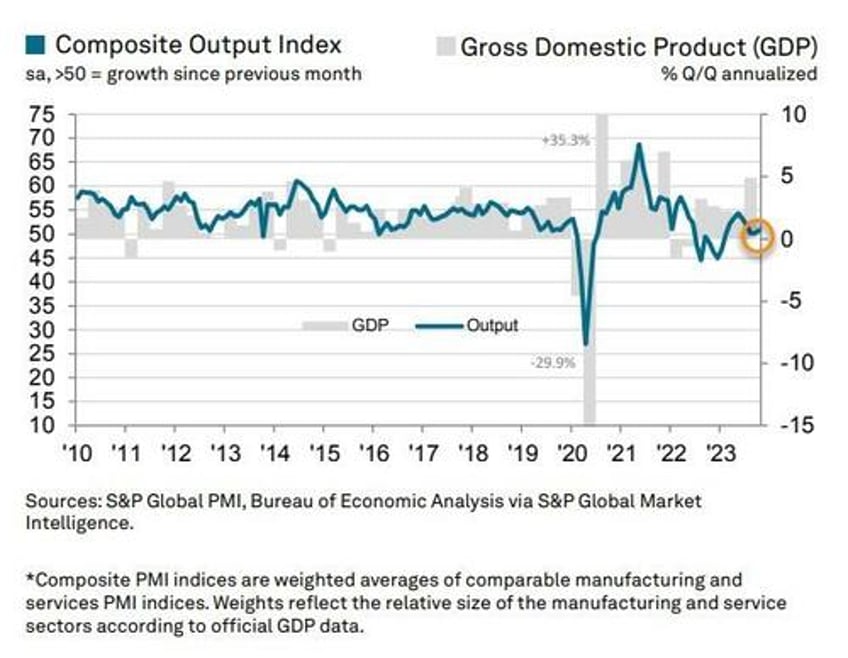

"The PMI survey paints a far more subdued picture of US economic health than the latest bumper GDP numbers, with October seeing very muted growth of business activity for a third successive month. A summer-surge in service sector activity, fueled by rising consumer spending, has stalled.

Manufacturing is meanwhile also struggling to regain momentum amid weak global demand.

As such, the survey data are broadly consistent with GDP rising at an annual rate of around 1.5%."

There is a silver lining though:

"An upside to the weak demand environment is the further cooling of price pressures in October, which brings the Fed's 2% target into focus for the first time in three years.

"The brighter outlook for inflation and hopes of a commensurate peaking of interest rates have helped lift business confidence in year-ahead prospects, but new business inflows need to pick up in both services as well as manufacturing to ensure robust growth can be sustained as we head towards the end of the year."

Finally, we note that the recent dramatic tightening of financial conditions (heralded by The Fed as 'doing their job for them') may be about to steal the jam out of the economy's donut...

Source: Bloomberg

Of course, as the last few days shows (dark red line suddenly shooting higher), excitement about The Fed hinting it's done is actually easing financial conditions, prompting a reflexive vicious cycle that will bring back a hawkish Fed, and around we go.