“Shifting just 1% of global reserve assets into silver would be equivalent to 5 years’ worth of silver supply.”

-BOA Metals

Silver EFPs: The Canary in the Mine

Contents (1900 words, 14 slides)

- Overview: Silver Market Dynamics and Prospects

- Resilience Amid Macro Headwinds

- **Tariff Risks Mean Higher Price Risk

- **The EFP Canary in the Silver Mine

- **India and China Premiums Persist

- **Global Central Banks as Silver Buyers

- Supply Constraints and Production Trends

- Conclusion and Comments

Overview: Silver Market Dynamics and Prospects

On January 15th Bank of America released a special report titled Silver won’t lose its luster long-term covering Silver from the perspective of upside risk due to ongoing developments potentially coming to a head. We had already covered the Tariff and ETF risk in SILVER: Tariffs, EFPs, and Stockouts and were pleasantly surprised when a major Bullion bank took up the topic only days after our coverage.

Their report provides a comprehensive exploration of the silver market, dissecting near-term headwinds (Macro), structural fundamentals (BRICS demand), and potential shifts in demand dynamics ( Tariff/EFP risks).

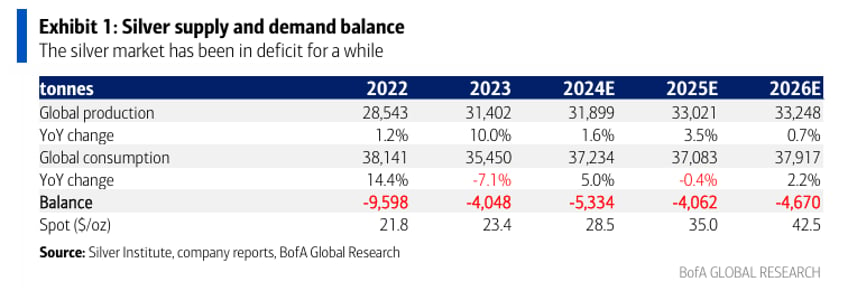

This analysis underscores the metal’s resilience despite significant macroeconomic challenges, examining supply deficits, industrial demand, and the interplay of recent escalating geopolitical and regulatory factors in this regard.

Resilience Amid Macro Headwinds

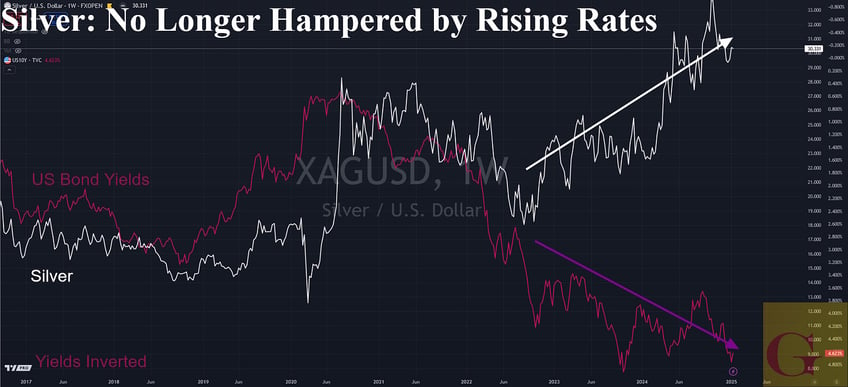

Silver prices have remained steady at approximately $30 per ounce over the past nine months, defying macroeconomic pressures such as a strong U.S. dollar, rising Bond yields and weakening industrial activity.

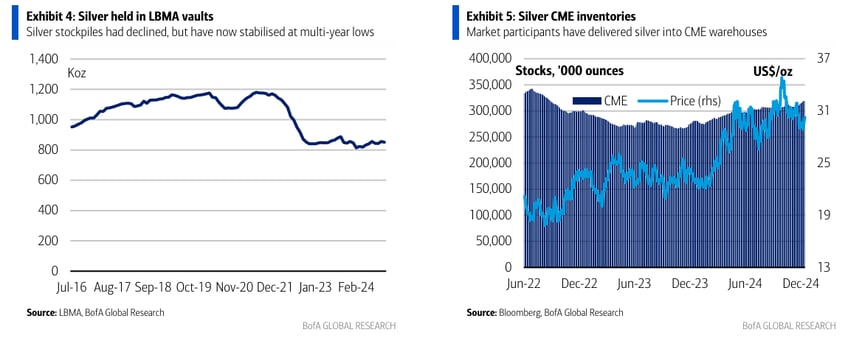

BOA attributes this stability to persistent supply deficits, exacerbated by underinvestment during prior bear markets. Global production is forecasted at 27Kt for 2024, still well below the 2016 peak by 1Kt.

- The Tariff Risk to Supply and Developing Price Risk

- Global Central Banks Potential as Silver Buyers

Tariff Risks Mean Higher Price Risk

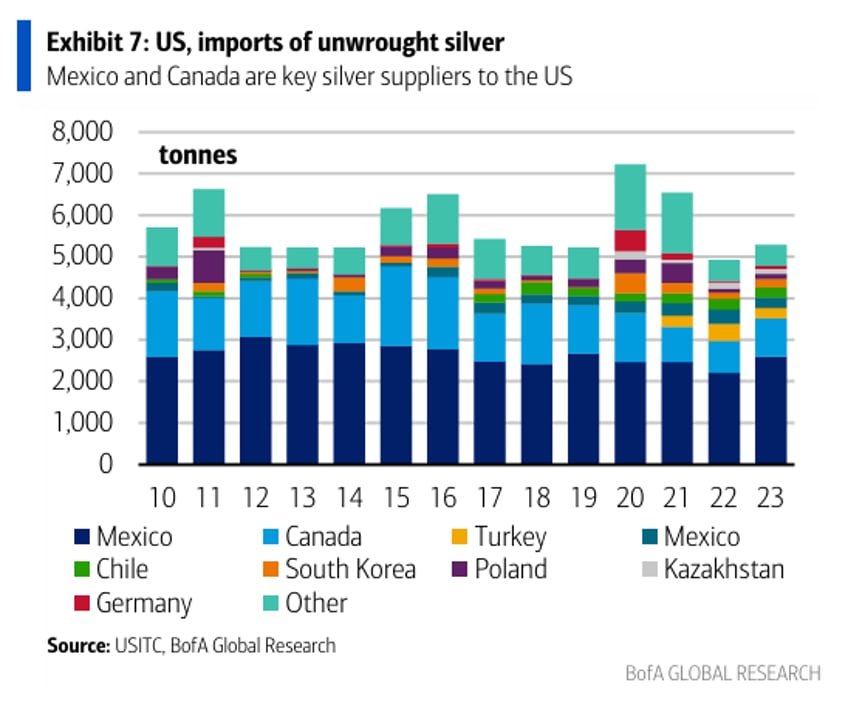

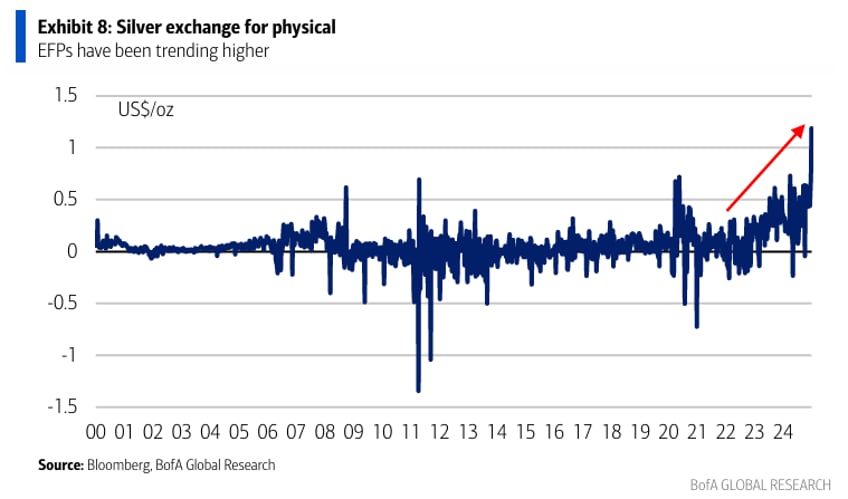

The analysis highlights potential trade disruptions arising from U.S. tariff policy. Speculation around President-elect Trump’s proposed 25% duty on Mexican and Canadian imports has already impacted global silver flows.

To that effect BOA states: “Tariffs from the next US administration might lead to dislocations in metal markets.” As key suppliers to the U.S., Mexico and Canada’s inclusion in potential tariffs would heighten on hand physical liquidity issues particularly in London as metal will alternatively be drained for US delivery or taken off the market altogether for fear of profit opportunity missed.

The recent torrid redirection of physical silver to the U.S. in anticipation of tariffs has further tightened supplies in London, raising more concerns.

The EFP Canary in the Silver Mine

(Partial)

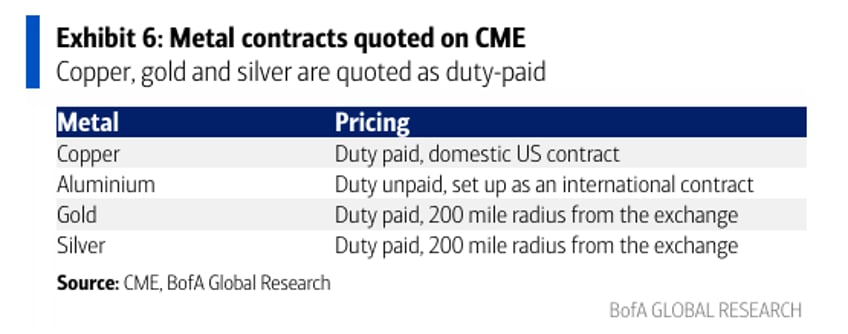

The EFP, an institutional measure of regional physical metal supply/demand balances, is directly and measurably discounting the potentiality of current Tariff developments. EFPs involve the exchange of a paper futures position (such as a CME contract), in return for physical silver in the LBMA spot market. When normally functioning, EFP pricing reflects a combination of spot silver prices and carrying costs associated with futures contracts.

Free Posts To Your Mailbox