By Graham Summers, MBA | Chief Market Strategist

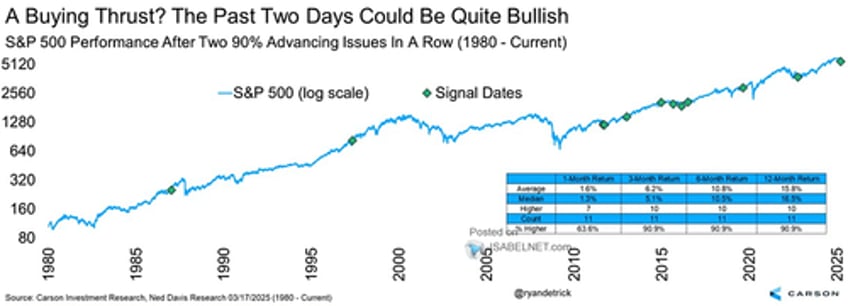

The S&P 500 has now performed back to back “90% up days”.

A 90% up day is a day in which 90% or more of the stocks that comprise a stock market index rise. Historically, this is a very bullish development. And back to back 90% up days are even better! In fact, back to back 90% up days like the ones the S&P 500 staged on Friday and Monday are usually a hallmark of a market bottom!

As Ryan Detrick has noted, since 1980, two consecutive days with 90% advancing issues in the S&P 500 have resulted in positive returns 12 months out ~91% of the time. Even better, the median return over that time period is 16.5%.

See for yourself:

Put simply, a major metric is signaling to us that the odds greatly favor stocks have bottomed . The odds favor a rally, NOT a crash.

To start receiving these kinds of actionable insights, join 56,000 readers in over 56 countries in receiving our daily market alert every weekday before the markets open (9:30AM EST).

Subscribe to Gains Pains & Capital!

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research