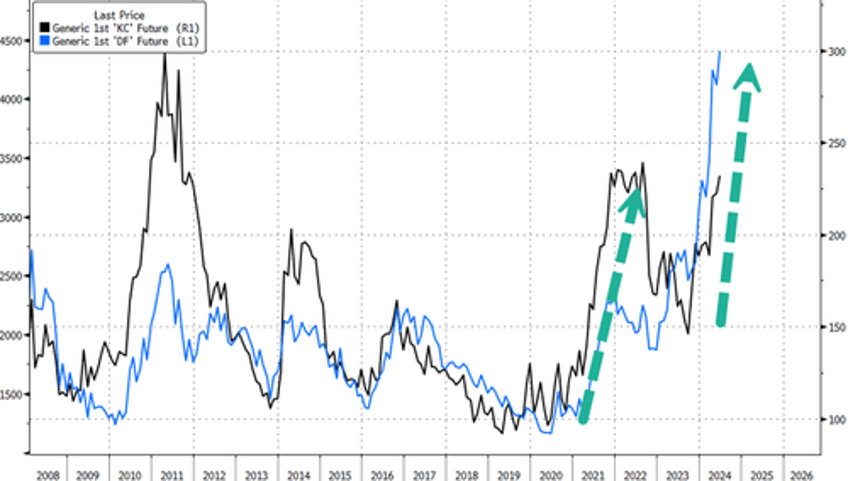

Arabica and robusta coffee bean prices have been soaring this year due to supply crunches hitting some of the world's top bean producers. It was only a matter of time before higher bean prices impacted major US food brands, forcing them to announce imminent price hikes at the supermarket.

Let's start with our recent coverage of the global coffee market:

- This Next Bean Is Hyperinflating, And It's Not Cocoa

- Arabica Coffee Prices See Largest Weekly Jump In Nearly Three Years

- Robusta Coffee Bean Prices Near Half-Century High As Vietnam Supply Woes Spark World Crunch

In markets, Arabic futures in New York have surged, but the robusta prices on the ICE exchange are skyrocketing the most.

The impact of higher bean prices is now concerning, as it's finally squeezing major food companies, such as J.M. Smucker Co., whose brands include Folgers, Dunkin', Café Bustelo, Pilon, and Medaglia d'Oro.

On Thursday, the company revealed in an earnings report with prepared remarks from management about imminent price hikes across its coffee portfolio.

The coffee category continues to experience commodity volatility and overall meaningful inflation. In response to recent higher green coffee costs that we will begin to incur during the first quarter, we are taking a list price increase across parts of our portfolio in early June. As always, we will continue to manage our coffee business through a strategy that demonstrates a balance between recovering inflationary input costs, while providing consumers with attractive options ranging from value to premium.

Translation: Supermarket prices for coffee, especially J.M. Smucker's brands, are set to move higher, if not already, thus raising food inflation for consumers.

Meanwhile, Biden's PR team and Democrats pushed the narrative that inflation is a function of corporate 'greedflation'...

Unless we see a severe recession or depression, food inflation will remain elevated for years. This is the new normal.