Summary:

Authored by GoldFix ZH Edit

BOA is suggesting that if you are bearish, that longer dated puts offer the best risk reward of anything out there. If you agree with their rationale and even agree with their valuation (we do), it might be better to buy a lottery ticket, and be prepared to keep buying them every month for 6 months for better payoff potential and better defined risk mgt. The longer dated expression is definitely more undervalued and less tactically risky for sure.The shorter dated play with active money mgt may pay off more.

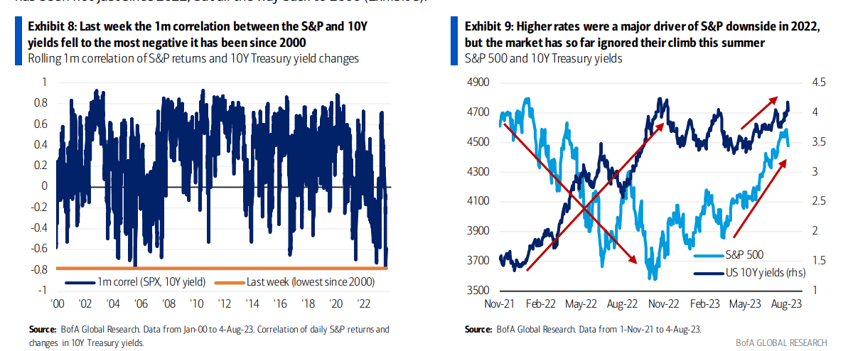

The Potential Catalyst: Rate/ Stock Divergence

The BOA team is noting the “cheap” bear play opportunities now

Should concerns about recession keep fading (our economists dropped their recession call in last week’s US Econ Weekly) and fears of inflation or a tighter-than-expected Fed return, there is a risk that higher rates once again become a headwind for stocks.

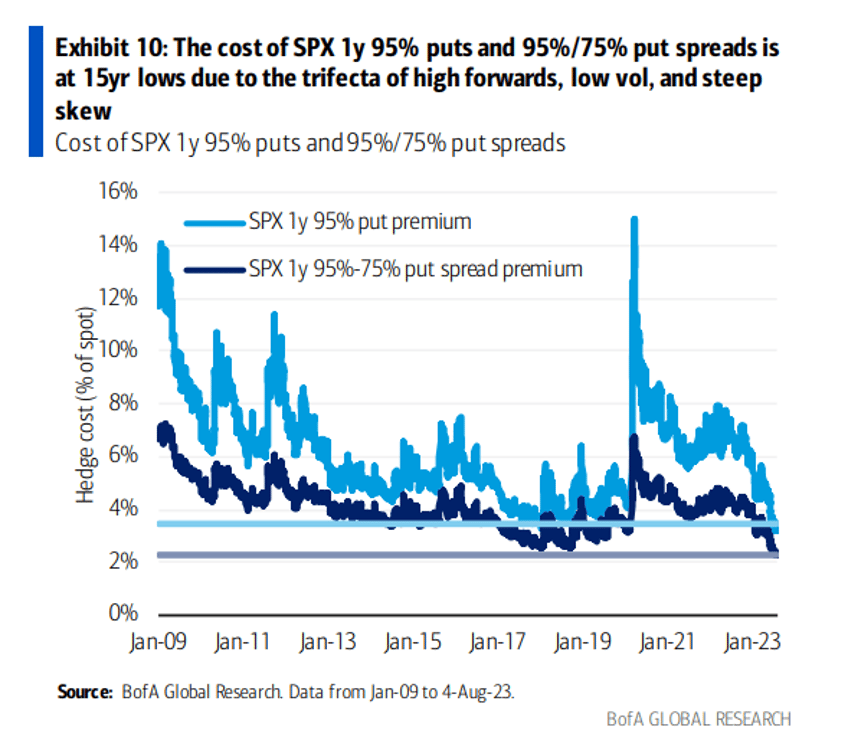

Puts are as cheap as they have ever been going back 20 years and stocks are beginning to show signs of interest rate related stress.

What Does it Really Mean?

What it is:

- The market is not hedged against bearishness. Therefore, the payout if the market were to drop might be very asymmetrical.

- Therefore the risk/reward right now is in being long downside protection.

That does not mean it will necessarily pay off. This is what a lottery ticket feels like.

- CORRECT: The lottery is as big as it has ever been… how can you not buy a ticket?… is the correct way to look at this.

- INCORRECT: the market is due for a selloff, look at how cheap puts are.

Lottery Ticket Time

This is the best advice we can give ourselves when these type things pop up:

- Buy a lottery ticket if you like the payoff odds

- Buy only a lottery ticket, not your week’s earnings

- Do not expect to win

- Be pleasantly surprised if you do.. it will be huge if it hits

- Do not buy a long dated put, that only keeps you married to the position if you lose money every day.. buying a long dated put is like shorting the index anyway.

Bottom line: When this type of play is around we have found 99.9% of the time when it pays off it is not because the market drops from some normal event like earnings or rates. It is almost always a black swan event that precipitates the monster play when the market is this lopsided long.

Markets in this type mode frequently stay sideways until the event actually happens. They are waiting for news. Sideways is bad for options!

Therefore, if you like the idea , you make sure you can buy a lottery ticket once a month for 6 months or so. This is not a market timing thing. This is frequently an asymmetrical payoff that will stay asymmetrical until something flushes it out.

The low cost of the puts gives you the opportunity to re-buy every month for some time. It is not a license to load up on one expiration. The market is now short black swan event risk. Be long that risk it if you understand the play and can afford the repeated toll it asks.

Why are puts cheap? According to BOA

Vol is just low- This is the basis for the risk reward existing

Rates are high: the higher interest rates are, the cheaper deferred puts get due to the interest rate opportunity cost

- Skew- in no small part due to the 0DTE speculation in the market- may be opportunity short term, but long term, not so much unless you plan on *holding* long term. 0DTE behavior has changed the Vix market materially and all deferred plays are big picture speculation now.

Continues here ...