S&P: "The lack of quality discoveries in the recent decade does not bode well for the gold supply"

(Originally titled: Gold from major discoveries grows 3%, although recent discoveries remain scarce)

Based on the latest monthly Gold Commodity Briefing Service, we expect gold supply to peak in 2026 at 110 Moz, driven by increased production in Australia, Canada and the U.S. - countries that also account for most [of the] discovered gold. Gold supply is expected to fall to 103 Moz in 2028, resulting from a decline in supply from these countries."

No Gold found in largest discoveries since 1990 for 10 Years…

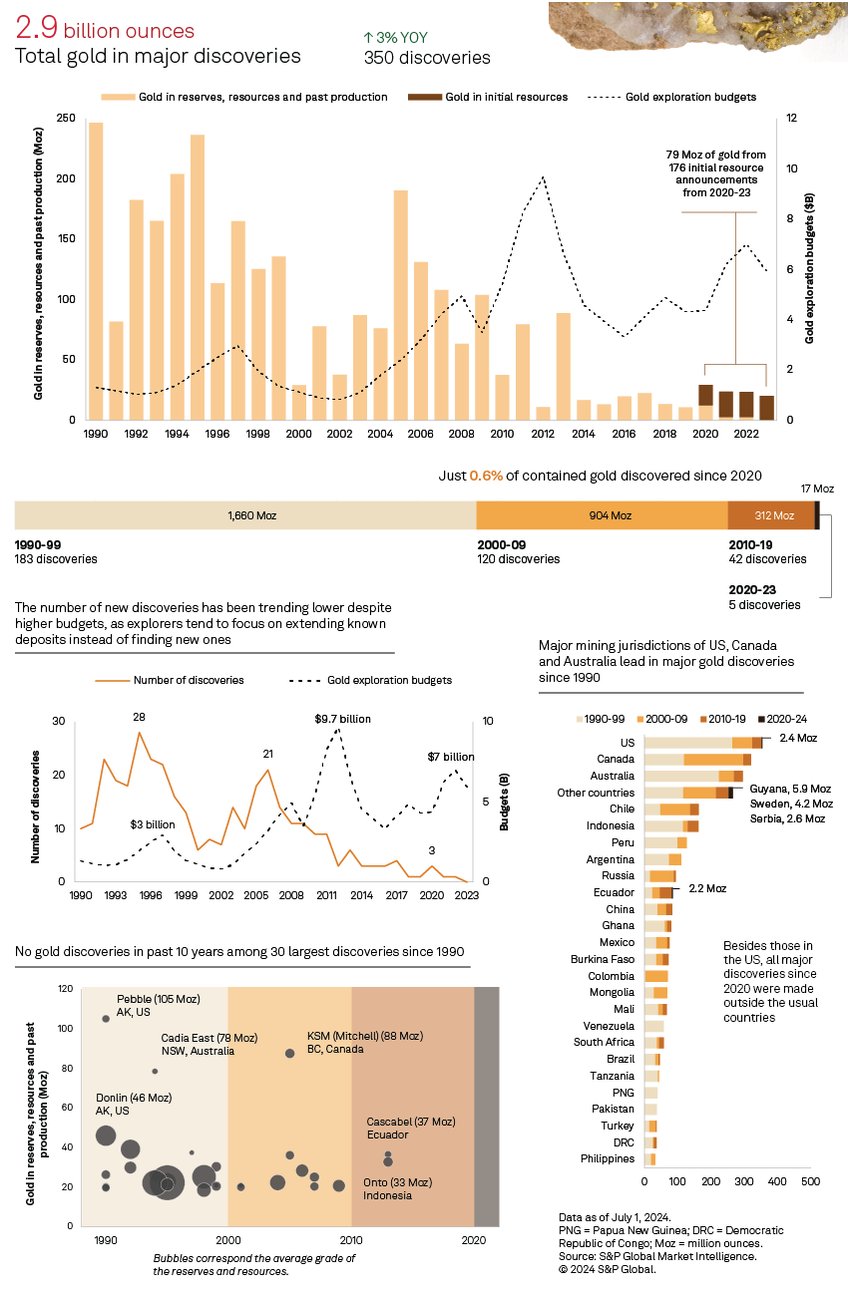

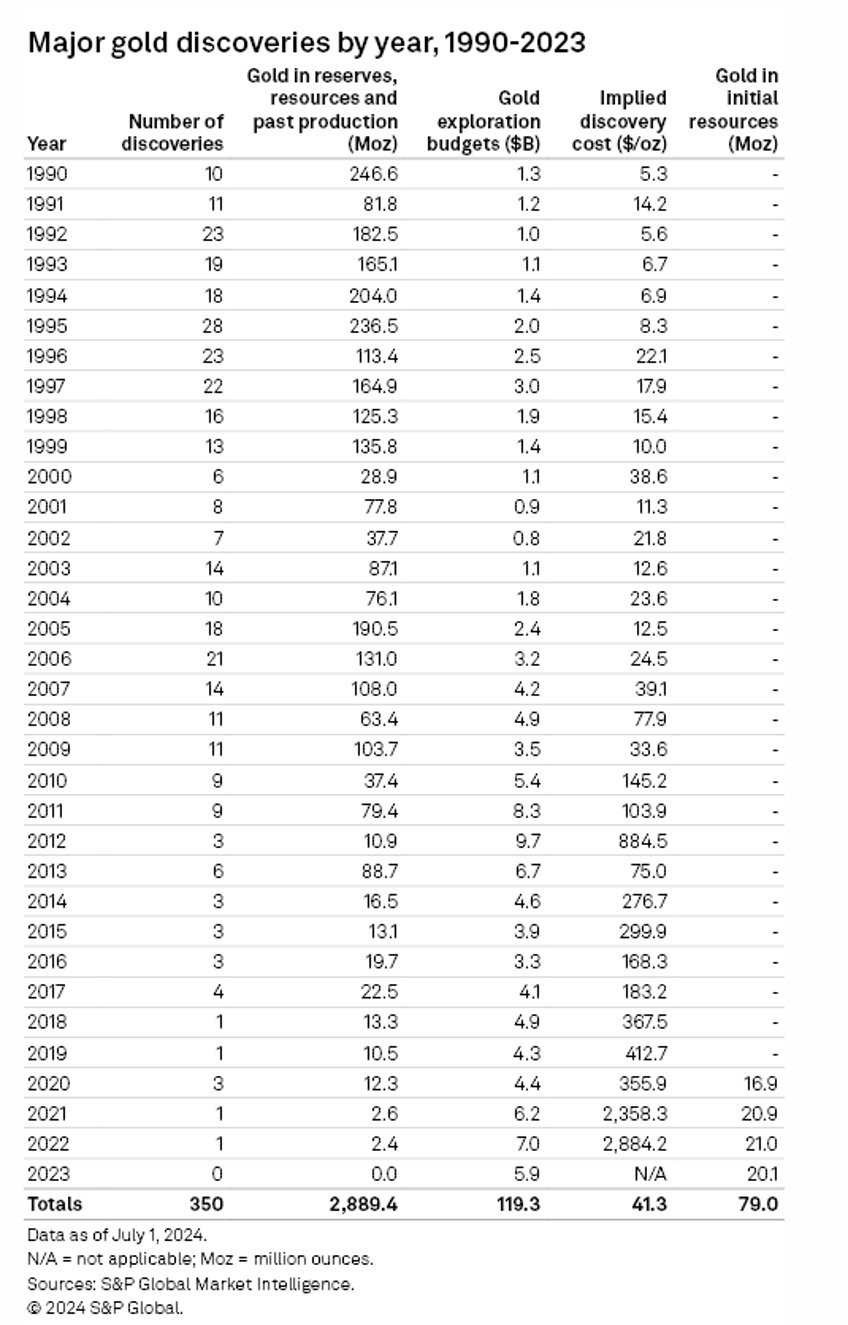

According to our annual analysis of major gold discoveries, 350 deposits were discovered between 1990 and 2023, containing 2.9 billion ounces of gold in reserves, resources and past production. This is an increase from the 2023 analysis, which identified 345 deposits with 2.81 billion ounces of gold.

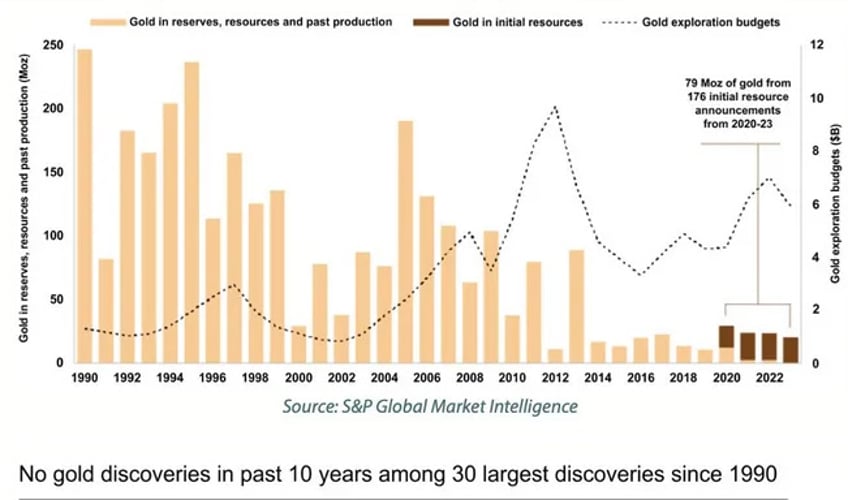

While the number of major discoveries and the total amount of gold continue to grow each year, it is important to note that most of the assets added to the list were discovered decades ago and only recently met the criteria of having at least 2 million ounces of gold in reserves, resources and past production. Since 2020, there have been only five major discoveries with a total of 17 Moz of gold, accounting for just 22% of the additional 79 Moz of gold added in the 2024 update. Recent discoveries are scarce and smaller in size, with an average of 3.5 Moz compared to the 5.5 Moz average from 2010 to 2019.

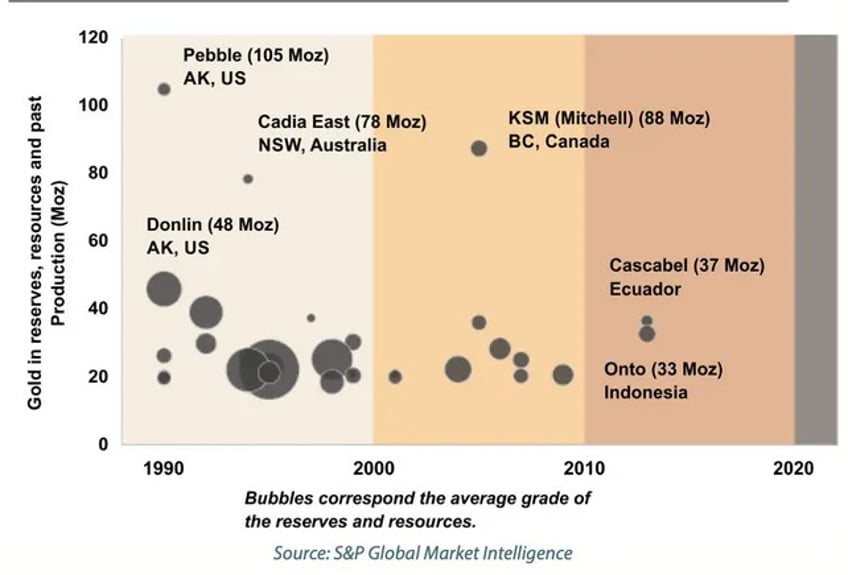

None of the discoveries made in the last 10 years have entered the list of the largest 30 gold discoveries, supporting our long-held view that the decade-long focus on older and known deposits limits the chance of finding huge discoveries in early-stage prospects.

It is important to note that while recent significant discoveries are sparse, reserves and resources grow over time, and there is still potential for growth in these recent discoveries.

The lack of quality discoveries in the recent decade does not bode well for the gold supply. Based on the latest monthly Gold Commodity Briefing Service, we expect gold supply to peak in 2026 at 110 Moz, driven by increased production in Australia, Canada and the US — countries that also account for most discovered gold. Gold supply is expected to fall to 103 Moz in 2028, resulting from a decline in supply from these countries.

In addition to analyzing past discoveries, we have examined prospects using our data on initial resource announcements, which we track monthly in our Industry Monitor series. By excluding any announcements of discoveries already included in our list, we identified 176 initial resource announcements with a total of 79 Moz of contained gold. Only 78, or 44%, of these announcements are from greenfield assets, while the rest are from newly discovered deposits within existing projects, demonstrating the industry's preference for exploring known assets.

Spending More and Finding Less…

While not all of these assets will become major discoveries, the increasing number of announcements in recent years brings much-needed optimism to an industry that has experienced fewer and smaller discoveries. Since 2017, annual gold exploration budgets have more than doubled, reaching a peak of $7 billion in 2022 after a low of $3.3 billion in 2016. Although budgets fell in 2023 due to tighter financing conditions, they remain elevated compared to previous years. This trend is likely to continue as long as gold prices remain high. The higher exploration budgets since 2017 have contributed to more and larger initial resource announcements. From 2017 to 2023, there were an average of 42 announcements with an average of 24 Moz of gold each year, compared to an average of 30 announcements and 13 Moz of gold from 2013 to 2016, when gold budgets were declining.

The future of gold supply is a mixed bag. The focus on old and existing assets has taken a toll on the number and size of discoveries in recent years, as proven by the lack of substantial discoveries in the last decade. However, the increasing gold budgets since 2017 bring a tad of optimism for the future of gold supply, as the number of initial resource announcements continues to grow in size and number.

//End

Continues here (Goldman on Aussie Miners)