Stagflation and War: The 1970s Redux

Themes discussed [added by us]

- A World Shaped by Former Empires

- America’s Diplomatic Missteps

- The Second Cold War Heats Up

- The Middle East Flashpoint

- The Fed’s Role in Financing War

- Gold as the Ultimate Hedge

- The Looming Threat of Stagflation

- The True Cost of Empire

Submitted by GoldFix

The world is mostly a mosaic of former empires, Europe being an exception. European imperial ambitions, whether by Charlemagne, Napoleon, even Hitler, now the EU, constrained themselves to reconstituting the supremacy that was Rome’s or conquering primitive lands such as in the Americas or Africa. Political dominance shifted but not as much peoples or culture (the fringes were impacted by the expanding and contracting Russian and Ottoman empires). Chinese empires similarly comprised like geographies through the dynastic cycle.

Less familiar to Western audiences are the successive empires that have dominated the Near East, especially Canaan, which today encompasses Israel, the West Bank and Gaza, Jordan, and the southern portions of Syria and Lebanon. The Akkadian Empire subjugated Canaan as early as 2000 BC, the Egyptians took their place from 1500–1069 BC, the Israelites then established self-rule, but soon the Assyrians took over, then the Babylonians, followed by the Persians, then the Greeks under Alexander the Great and his successor the Seleucid Empire, then the Israelites reasserted independence, but were soon conquered by the Roman Empire, which was succeeded by the Byzantine Empire, which succumbed to the Arab invasion, which brought about the Ottoman Empire, which was succeeded briefly by the British Empire, which handed the territory to modern Zionists to establish the current Israeli state.

Unlike the histories of Europe or China, where culture was largely unchanged as the ambitious fought for political control, the Near East in general and Canaan in particular has been subjected to shifting cultural dominance for four thousand years. The proposition that America—a country that followed its founding fathers’ advice to avoid foreign entanglements until hegemony made it care not what other nations thought—can navigate the layers of historical and cultural animosities in the region is not just absurd but dangerous.

Applicants to the U.S. Foreign Service must list every trip abroad and every non-U.S. acquaintance, a near-impossibility for any sophisticated person with prior international experience. Holding a passport is a liability. The State Department does not want nuanced operators but drones who can be trained to push whatever geopolitical narrative serves the interests of American imperial ambitions. To ensure that diplomats do not “go native,” they are rotated out of their assigned country every three years, five being the maximum allowed. It is joked within diplomatic circles that the British representative speaks the native language plus some local dialects, the French is having an affair with the president’s wife, and the American is packing his bags by the time he figures out which cabaret is the local equivalent of Rick’s American Cafe.

This American diplomatic arrogance destroyed the prospect of a century-long Pax Americana. The collapse of communist ideology brought an eagerness to Eastern Europe and Russia to embrace a capitalist system. But the U.S. was not content with ideological victory; it demanded political dominance. Clinton took the fateful step of bombing Serbia, a close Russia ally, to distract from his Lewinsky scandal, killing two thousand civilians. A humiliated Russia could only stand and watch and seethe and then witness NATO expand relentlessly towards its borders.

“They effectively forgot about the promises made to the Soviet Union and later Russia in the late 1980s and early 1990s that the bloc would not accept new members. Even if they acknowledged those promises, they would grin and dismiss them as mere verbal assurances that were not legally binding,” Putin recently told a domestic audience. “Western countries, confident not so much in the righteousness of their cause as in their power and ability to impose whatever they wish on the rest of the world, simply disregarded other perspectives.” Disregarded may be the wrong word—were negligently unaware of is probably more accurate.

“Later, these same approaches [as were applied to Serbia] were applied in various countries, which we know all too well: Iraq, Syria, Libya, and Afghanistan. These interventions have done nothing but worsen existing problems, ruin the lives of millions of people, destroy entire states, and create hubs of humanitarian and social disasters, as well as terrorist enclaves. In fact, no country in the world is immune from joining this tragic list.” No one in the West likes Putin, but where is the error in his statement? It is the same complaint made by Calgacus the Briton opposing Rome: “They make a desert and call it peace.”

This second cold war with Russia, which Clinton stumbled into in 1999, has been growing hotter over the years. First there was NATO expansion. Then there were the U.S. CIA bases in Georgia that oversaw jihadist forays into Russia, which prompted direct Russian military intervention. Recall that a U.S. official admitted: “At best Georgia would win, in which case Russia would fall apart, and at worst the spectacle of Russia crushing little Georgia would reinforce Russia’s reputation as the cruel Goliath. So Cheney was telling Misha [Saakashvili], ‘We have your back.’”

Then there was the CIA-orchestrated coup in Ukraine, an attempt to move that country from being a buffer state to being in the U.S. orbit. Then the provocation to invite Ukraine to join NATO, pushing the U.S. military right to Russia’s frontier. And now the U.S. is blurring the lines between supporting a proxy and being in direct conflict with Russia: the U.S. is not only delivering weapons but also directly assisting Ukrainians in strategic planning and missile targeting, perhaps more.

“The self-centeredness and arrogance of Western countries have led us to a highly perilous situation today,” noted Putin. “We are inching dangerously close to a point of no return. Calls for a strategic defeat of Russia, which possesses the largest arsenals of nuclear weapons, demonstrate the extreme recklessness of Western politicians. They either fail to comprehend the magnitude of the threat they are creating or are simply consumed by their notion of invincibility and exceptionalism. Both scenarios can result in tragedy.”

He’s right. The average American cannot comprehend the nastiness and thuggery in that part of the world, which only a nation state can hope to contain (though, notably, the Bidens and the Clintons have no problem operating in such an environment). Pursuing a policy that, if successful, would move the control of 5,580 nukes from a centralized state to regional bandits is insanity.

The tragedy is now spreading to the Middle East. Israel recognizes none of its adversaries’ red lines given its confidence that U.S. military might is supreme and that the U.S. will always intervene to protect it no matter the circumstance. The most recent provocation was Israel’s assassination of the leader of Hamas in Tehran. Iran views the situation as if a head of state were assassinated on a state visit, which fully justifies war. There are reports of Russian cargo planes rushing in heavy weapons while high Russian military officials are on the ground in Iran.

The Middle East is evolving to be the inverse of Ukraine. Instead of a U.S. backed proxy in conflict with Russia, the Russians will be backing their proxy that will end up in direct conflict with the U.S. military. Biden has rushed war ships and fighter planes to support the roughly 45,000 American troops already in the region. The world holds its breath to see how far the Iranians will go and how far they can go: whether American military hardware, which has failed so dramatically in Ukraine, has success against Russian arms optimized in the Ukrainian conflict.

War is expensive—especially for the U.S. with its corrupt and bloated procurement budgets. The CBO now estimates that 2024 direct federal spending will be $6.9 trillion (24.2% of GDP), which is $400 billion higher than its February estimate. The agency blames the increase on “aid to Ukraine, Israel, and countries in the Indo-Pacific region.” And this is before the second proxy front gets hot. And this addition to the deficit is being financed at 5.5% interest rates, not the 0% that prevailed from 2008 to 2015 and then again in 2020 and 2021.

The U.S. relied on the Fed to finance previous wars. In World War I, the government altered the new Federal Reserve’s charter—which originally constrained it from financing anything other than bills with maturities at the time of discount of not more than ninety days—to allow it to finance long-term government war bonds. During World War II, the Fed adopted the policy of purchasing all Treasury bills offered at a fixed rate of 3/8 percent: its holdings of government securities leapt from $2.2 billion in 1941 to $23.7 billion by the end of 1945. The Fed continued this policy during the Korean War, with a cap of 2.5% for long-term bonds.

Not surprisingly, all three episodes experienced soaring consumer inflation, which peaked at 20% in 1920, 20% in 1947, and 10% in 1951. But there was a major difference between those episodes and today: the U.S. was a solvent nation at the outbreak of these previous wars. In 1949, even after World War II and Franklin Roosevelt’s profligate spending, the Fed’s balance sheet was backed 51% by gold (down from 84% in 1941). Today at spot prices (assuming the gold on the Fed’s balance sheet is real), that figure is 8.8%.

The U.S. debt-to-GDP ratio is now 122%, well above levels that get countries into distress. This level of debt was matched in 1946, but that was at the end of war spending and only at the very beginning of the ponzi entitlement state: the debt figure fell to 32% of GDP by 1980. This time, the outlook is dire. The CBO reports that as a baseline, assuming no economic, political, or military crises: “Debt increases in relation to GDP, exceeding any previously recorded level in 2029 and continuing to soar through 2054. It is on track to increase even more thereafter.” Much of that increase is due to interest payments, which now exceed military spending. And there will be crises. And if no one else will buy the Treasury bonds, Congress will force the Fed to do so.

The modern debt bubble began in the 1980s as a housing/corporate bubble. Inflation during this period was caused by easy credit granting excessive purchasing NOTE: This material is for discussion purposes only. This is not an offer to buy or sell or subscribe or invest in securities. The information contained herein has been prepared for informational purposes using sources considered reliable and accurate, however, it is subject to change and we cannot guarantee the accurateness of the information. Myrmikan Research August 13, 2024 Page 4 power, which was quickly unwound when the credit cycle turned. When the credit bubble popped in 2008, Congress and Bernanke shifted the losses to the government’s balance sheet. The government then compounded the problem with trillions of extravagant COVID payments. And let’s not forget the trillions spent on war over the past few decades. The inflation this time is because of monetary debasement, which shows no sign of abating.

The Fed may still be shrinking its balance sheet slowly, but the growing deficit must be financed, and Janet Yellen has figured out that financing the growth with short-term bills is like QE: Money market funds and banks pay cash to the Treasury and receive bills, which, unlike bonds, function just like cash in the financial system—so they get a yield without losing any credit creation capacity. The government then spends the money raised into the economy, raising consumer prices.

Nouriel Roubini published a paper in July that estimates that Yellen’s strategy, which he names “activist Treasury issuance (ATI)” “has reduced 10-year yields over the last year by roughly a quarter of a percent, providing similar stimulus as a one-point cut in the Fed Funds rate, the central bank’s primary policy tool.” This is one reason why the markets have not collapsed despite the sharp increase in interest rates.

[EDIT- Roubini’s Paper attached in footnote1- VBL]

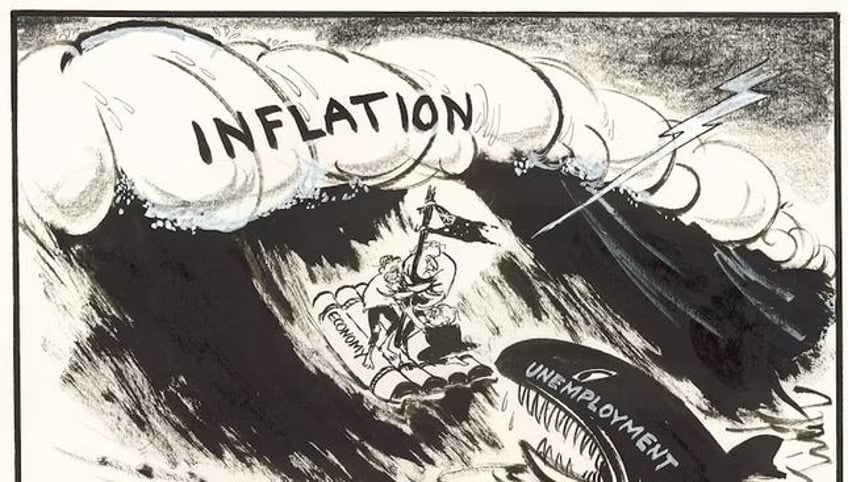

Even if ATI is cushioning the markets, the economy is beginning to sour: the COVID stimulus hangover will be a nasty one. The Fed’s mandate is to keep both inflation and unemployment low, but the July 31 FOMC statement added the line: “The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.” There is a word for high unemployment occurring in context of high inflation: stagflation.

The previous prolonged stagflation occurred in the 1970s and was exacerbated by the Yom Kippur War in 1973. That war did not emerge spontaneously: Egypt began bombing Israeli positions in 1967 using Soviet military hardware. Israel responded in kind using U.S. weapons, and both sponsors ramped up their military support until the denouement six years later.

The 1970s stagflation was actually worse for stocks than the 1930s, but in a different way. The 1920s bubble was simply a credit bubble, there was no monetary debasement. The S&P 500 crashed 88% in nominal terms from peak to trough. In the 1970s, the S&P 500 from its peak in 1967 to its trough in 1980 fell only 14% in nominal terms but 94% in terms of gold.

If we are living through a repeat of the 1970s—and the parallels seem so perfect— we should not expect a cataclysmic collapse of the stock market despite the ridiculous valuations. Stocks would, instead, lurch higher and lower within a trading range for the next decade, ending at roughly the same nominal price but worth 90% less.

Gold, on the other hand, will reveal the carnage. It rose twenty-four fold from 1971 to 1980. The way we look at it, gold went from being 12% of the Fed’s balance sheet to 133% in the final dollar panic. Gold currently represents just 8.8% of the Fed’s assets, so it would need to jump 36% to $3,300/oz just to get to the 1970 low.

This inflationary episode is likely to be worse than the 1970s. The U.S. debt position is far worse; the Fed is stuffed with long-term, illiquid assets; American international arrogance has alienated all but its most dependent allies; the U.S. military is weighed down with DEI rot and overly-complex, expensive weapons systems; the U.S. has exported its manufacturing base; and the U.S. is no longer a culturally homogeneous society (increasing the potential for domestic unrest). The most important change for investors, however, is none of those: it is the fate of the Eurodollar system.

The Soviet Union inadvertently created the Eurodollar system in the 1950s when it found itself with U.S. dollars and convinced European banks to accept dollar deposits. European banks then started lending out Soviet dollars, and the fractional reserve system meant they could expand that lending well beyond the quantity of raw dollars on deposit. When the Bretton Woods gold-backed dollar standard collapsed in 1971, Kissinger convinced the petro-states to recycle their profits into dollar deposits both at U.S. and non-U.S. banks, expanding the dollar debt system. Suddenly, all the major players in the world owed each other dollars, granting the Fed control over the global economy and the U.S. Congress a method to extract seigniorage to support the costs of empire.

Blinken’s idiotic sanctions on Russia threatens to destroy this monetary architecture. As Putin understands:

By stealing Russian assets, they will take one more step towards destroying the system that they created themselves and that for many decades ensured their prosperity, allowed them to consume more than they earn, and attracted money from all over the world through debts and liabilities. Now it is becoming clear to all countries, companies and sovereign wealth funds that their assets and reserves are far from safe, both legally and economically. And anyone could be the next in line for expropriation by the United States and the West, those foreign sovereign wealth funds could also be the one.

There is already a growing distrust of the financial system based on Western reserve currencies. There has appeared a certain outflow of funds from securities and bonds of Western countries, as well as from some European banks, which were until fairly recently considered to be absolutely reliable to put capital in. Now gold is also being taken out from those banks. And this is the right thing to do.”

Empires are expensive. Trump wanted to withdraw gradually. Instead America is following Alcibiades’s logic: “We cannot fix the exact point at which our empire shall stop; we have reached a position in which we must not be content with retaining but must scheme to extend it, for, if we cease to rule others, we are in danger of being ruled ourselves.” If America’s military cannot perform, and its economy cannot perform, and its debt cannot perform, neither can its empire: Without its sponsor, the Israeli state risks becoming but another entry in that long list of powers that have controlled Canaan; Ukraine, instead of being a buffer state or U.S. client state, risks becoming a Russian client state. Already the U.S. is being ruled by those who accept bribes from foreign powers. Whatever our opinions about Russia and Putin, he is a keen observer of international affairs: buying gold “is the right thing to do.”

Source: Myrmikan Capital, LLC

Continues here