Most markets rose Wednesday after China unveiled plans for $137 billion in extra debt to boost infrastructure spending, while oil extended losses on hopes Israel will scale back its plans for a Gaza ground invasion.

Traders tracked a rally on Wall Street that was helped by a strong set of earnings from big-name firms including Coca-Cola, Verizon and 3M that fuelled optimism for the reporting season.

Still, geopolitical crises continue to cast a shadow, with a broader Middle East war still possible, and many fearing it could send crude and inflation soaring.

After another painful start to the week, Hong Kong led gains Wednesday after China approved a plan to issue 1 trillion yuan in sovereign bonds to be distributed to local governments to support national disaster prevention and recovery.

The move will lift the fiscal deficit ratio for 2023 to about 3.8 percent of gross domestic product, the official Xinhua news agency said Tuesday, well above the three percent usually considered Beijing’s limit.

Leaders rarely alter the budget mid-year, but it did happen in 2008 after the Sichuan earthquake and during the Asian financial crisis in the late 1990s.

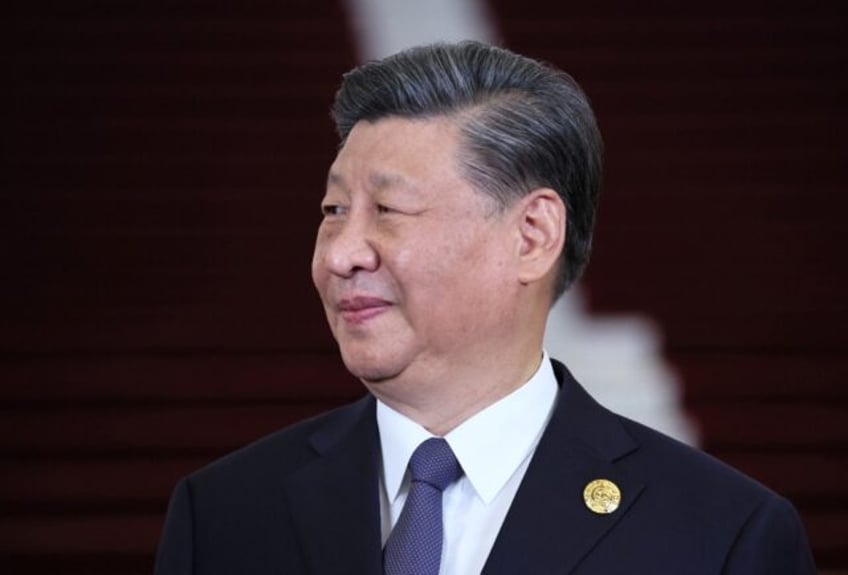

Bloomberg News reported that President Xi Jinping paid his first known visit to the central bank, indicating the increased focus the government is putting on the economy.

Zhang Zhiwei of Pinpoint Asset Management said the “surprise” move was “another step in the right direction –- China should make its fiscal policy more supportive, given the deflationary pressure in the economy”.

The announcement follows a series of small, targeted measures aimed at lifting the economy, which has struggled to recover from the impact of years of zero-Covid measures.

It also comes after officials came under pressure for a bigger, wider-ranging spending pledge similar to that seen during the global financial crisis.

“This is not the bazooka, but one of the most significant incremental moves so far,” Societe Generale Cross Asset Research wrote in a note.

Hong Kong was the stand-out performer Wednesday, jumping more than two percent, while Shanghai, Tokyo, Sydney, Taipei, Manila and Jakarta were also up.

Traders were aware that the crisis in the Middle East could spiral out of control at any minute as Israel presses on with a bombing campaign of Gaza after Hamas’s October 7 attacks.

Iran — which has warned of a pre-emptive strike on Israel — has recently activated regional militias, fanning fears of a conflagration, while Tel Aviv has also issued broadsides against Hezbollah militants in Lebanon.

However, while Israel has built up a huge force on the Gaza border, it has yet to move into the territory, giving observers hope that leaders are recalibrating their plans for wiping out Hamas.

That optimism has weighed on oil prices, which sank two percent Tuesday, and extended losses in Asian trade.

“Given the global political pressure, not to mention two US aircraft carrier strike groups prowling the Mediterranean, providing the ultimate ‘iron dome’, perhaps cooler heads will eventually prevail in the region,” said SPI Asset Management’s Stephen Innes.

“But the crux of the matter is that there has been no interruption in the Middle East’s oil supply.”

Key figures around 0230 GMT

Tokyo – Nikkei 225: UP 1.3 percent at 31,466.92 (break)

Hong Kong – Hang Seng Index: UP 2.4 percent at 17,402.77

Shanghai – Composite: UP 0.7 percent at 2,983.25

Dollar/yen: DOWN at 149.82 yen from 149.89 yen on Tuesday

Euro/dollar: UP at $1.0598 from $1.0593

Pound/dollar: UP at $1.2172 from $1.2161

Euro/pound: DOWN at 87.05 pence from 87.08 pence

West Texas Intermediate: DOWN 0.1 percent at $83.64 per barrel

Brent North Sea crude: DOWN 0.1 percent at $87.12 per barrel

New York – Dow: UP 0.6 percent at 33,141.38 (close)

London – FTSE 100: UP 0.2 percent at 7,389.70 (close)