Nobody told me there'd be days like these, Nobody told me there'd be days like these

Nobody told me there'd be days like these, Strange days indeed

Most peculiar mama

John Lennon

Strange days have found us, strange days have tracked us down,

They’re going to destroy, our casual joys,

We shall go on playing or find… …a new town

Jim Morrison

Yup, a two-fer. No extra charge. And no need to thank me. I just happen to be in a generous mood.

John Lennon and Jim Morrison. For what they did, no one could touch either of them. Ironically, the latter was born on the same calendar day as the murder of the former, who died mysteriously on my mother’s 35th birthday.

Such are the peculiarities of our existence, the strangeness of our days. And, as I gaze out around me, I am thinking that maybe, our days are now stranger than they have been in quite some time. If one cares to ponder over it, one can see that the old, longstanding protocols have fallen by the boards, and this across many realms – including the obvious ones of race, gender, and other such foci of our obsessions.

But certainly, it extends beyond these overtrodden roads. Consider, for the second consecutive week, basketball, which has, for me become unwatchable, if for no other reason than that they don’t call travelling anymore. Not in college and certainly not in the pros. Highfliers can now begin their nominally allotted 1.5 dribble-free steps from the opposite free throw line, or, at minimum from half court. In result, among other matters, this caused the aggregate final score of the already-farcical NBA Allstar Game to rise to within a shade of an idiotic 400 points.

Then there’s politics. Which are so strange that they must be glossed over. On Thursday, the two presumptive candidates who no one wants, took to the airwaves to insult one another and their respective constituencies, one doing so from the Senate Chamber, the other, presumably, from the comfortable confines of the Mar a Lago resort.

But more to the point, and what got me thinking about all this is the odd doings of the Capital Markets. It has, more specifically, given me the notion that when future generations look back at this pass, they will have no alternative but to conclude that we had no idea, back in those quaint, early days of 2024, what on earth we were investing in.

Examples abound.

Take crypto for instance. While confidently rendered theories flourish as to its logical role in the capital and commercial economy, to me it’s all spit balling. Crypto may become the standard funding mechanism for all commercial activity, or, failing that, a suitable alternative thereto. Conversely, it may be consigned to the ash heap of economic faddishness, joining such other denizens as SPACs, NFTs, and, going back further in time, Dutch Tulips. My theory is that crypto is what it will become, and that as of now, we simply don’t know.

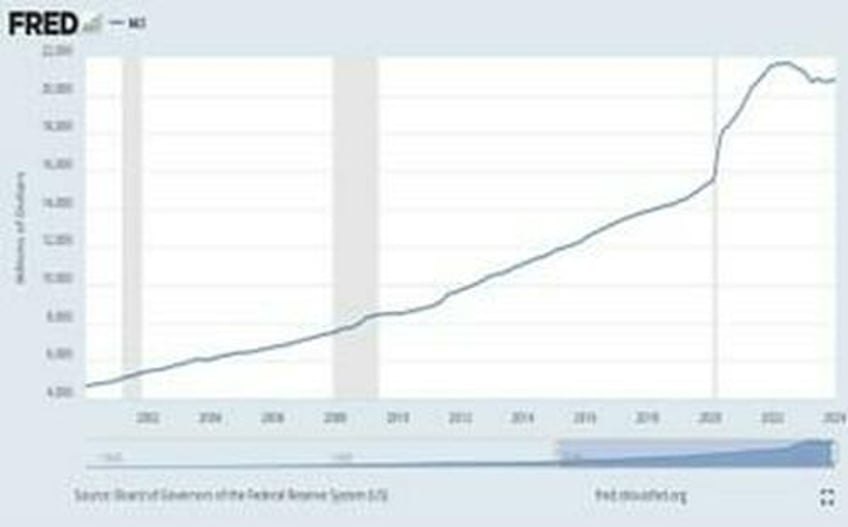

And, for that matter, what is money? I once had a hunch -- until > $50 T of it was created out of thin air over the past generation – one that has witnessed a 5-fold increase in the money supply:

Money has always been somewhat of an obtuse phenomenon, having, like crypto, no value other than what we choose to bestow upon it. It unilaterally reflects nothing other than the amount of perceived utility which can be extracted from its exchange.

And, because money, by definition, is only a relative construct, the quintupling of its quantity clearly changes its essence. From what? To what? You tell me.

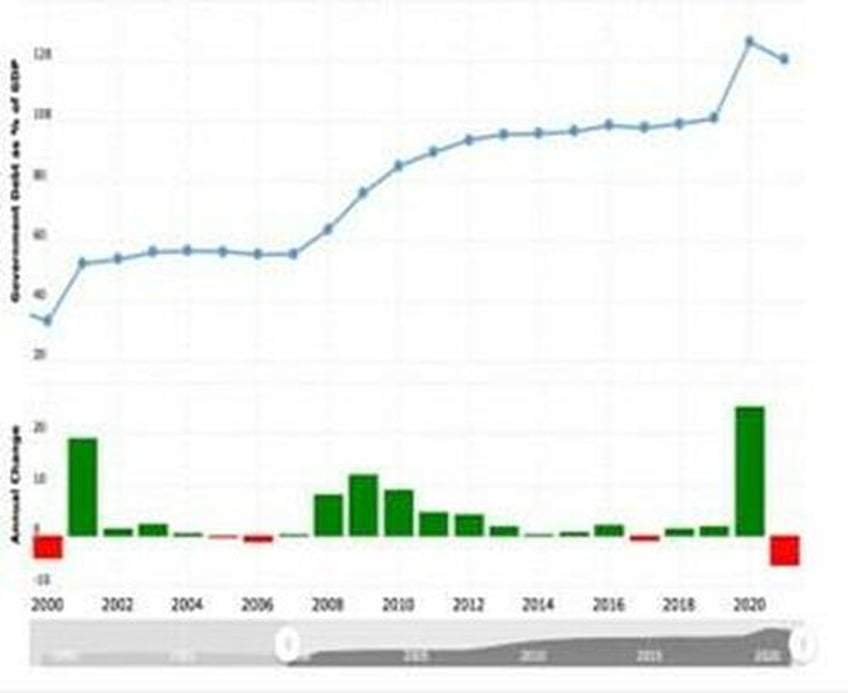

Moving down the same line of argument, what is debt? An asset for one subset amongst us; a liability for another. It, too, has exploded in proportion – not only against money, but against any asset by which it is measured. Just what Washington owes has grown much faster than even M2 since the turn of the millennium, rising 7x -- from ~$5T to ~$35T, and expanding at an accelerating rate. When measured against GDP, the path, over the same period, it looks like this:

We thus entered the new century owing as a country about 30% of what we generate in output; now that figure is well over 100%.

There’s a lotta talk about this, but to analogize it in one imperfect way, consider two economic agents – one who has borrowed 30% of their salary, the other >100%. I believe that any objective comparison would lead to the conclusion that what debt to one is very different from what it is to the other.

I thus no longer believe we have a handle, as borrowers, lenders or bystanders, as to what is meant by the concept.

Among the main differentiator between money and other monetary assets is the time value embedded in the latter, as captured economically by the interest rate. The core of the current conundrum is whether, or more specifically, when, the Central Banks will reduce these, and the associated vibe has migrated over the last several months from euphoria (they’re gonna meat axe ‘em in early Spring) to disappointment (ho, not so fast), to renewed hope, the last of these based upon the soothing comments of Chair Pow at last week’s Humph Hawk.

But why even consider cutting rates? Why now?

I mean, the country is running at full employment, with robust GDP and no recession in sight. Inflation remains a concern and could go either way. Risk assets are at all-time high valuations.

Has the Fed ever cut rates against such a backdrop? No, not if memory serves.

A reduction in yields would accomplish… …what? More borrowing? Swell. Further bloating of equity valuations? Probably. Incremental disadvantages to hard-put-upon savers? Natch. There may, however, be a perceived political benefit to, say, a timely cut in the months leading up to the big November throwdown. If so, I say shame on those behind it. You cut rates when needed, not when expedient, because the need will inevitably arise. I believe this powder should remain dry. But no one asked me…

Moving along, I’m also not sure I can define the essence of the prevailing Equity markets. Here we sit at another round of all-time highs, some of which is undeniably a by-product of all that money printing, but there are other factors at play.

New technologies are enticing to contemplate, but what do they reflect? Everyone is giddy about AI, and perhaps rightfully so, but what impact will it have? Or quantum computing? Fact is, we don’t know, and won’t for quite some time.

Heck, we haven’t even begun to get our arms around the lockdown-abetted explosion in telecommunications. No one, for the moment for instance, knows even where to be. Are we supposed to be in an office? At home? Some hybrid combination of the two? Presumably, new paradigms will more firmly establish themselves. But here, in March ’24, nobody really has a discernable clue.

I don’t know but suspect that the virus response fostered huge breakthroughs in both preventative and response-based medicine. If so, they have yet to be anything but minutely harvested.

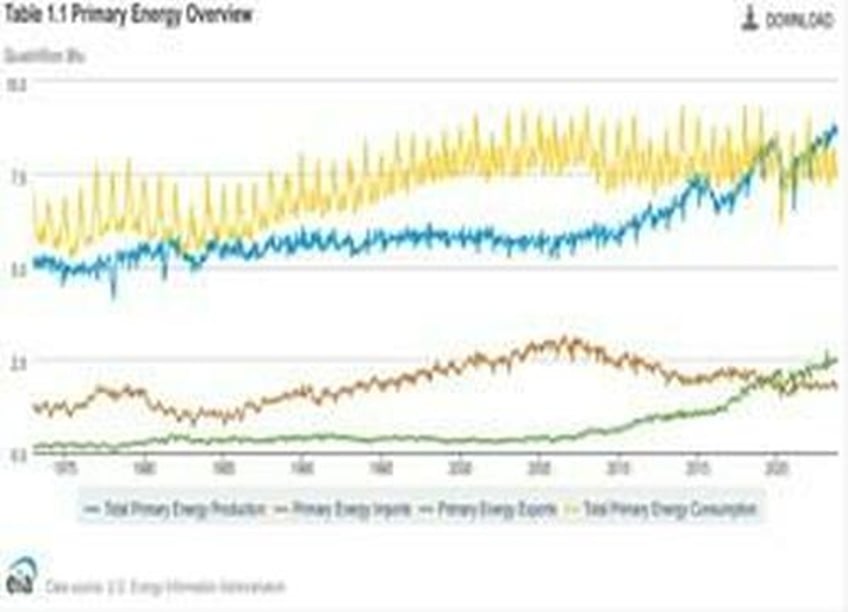

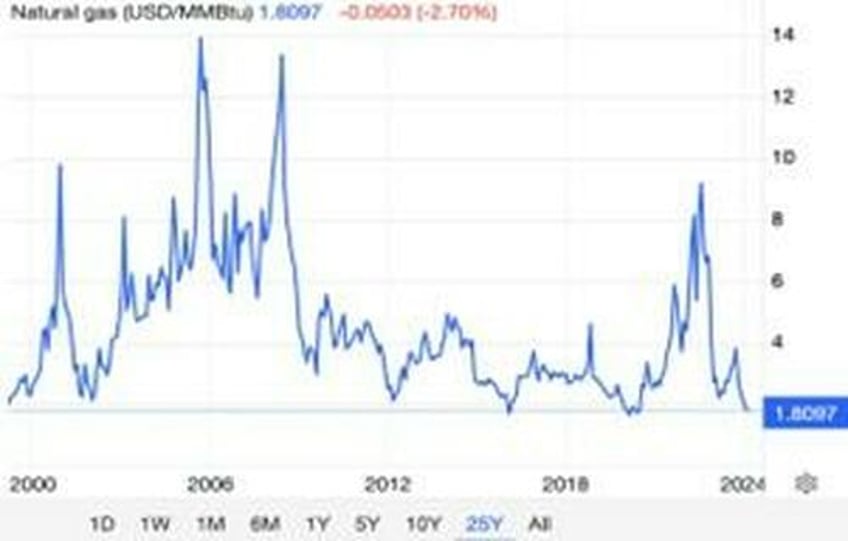

Then there’s the odd case of the Energy Complex. As illustrated below, U.S. Production is at an all-time high, while the cost of Nat Gas is at a 25-year low.

What gives? I thought we was shutting down that evil fossil fuel industry, and doing so quickly, lest the entire earth is incinerated in the meanwhile.

The main government response, near as I am able to discern, derives from the Securities and Exchange Commission, taking time out of its busy oversight schedule to force public companies into disclosing their fossil fuel consumption. Forgive me for stating this, but securities regulators policing energy consumption sort of brings to mind Hunter Biden’s lucrative turn on the Board of Burisma.

Perhaps we should simply turn the job of fossil fuel eradication over entirely to Hunter – provided, of course, that he can take time out of his schedule already jammed with criminal defense worries and, you know, painting.

But more to the point, we have no idea what form the future energy matrix may take. We may get greener, but the consensus estimates are that it will take decades to wean ourselves off fossil fuels, that such a transformation will cost untold treasure and considerable annoyance, and that whatever righteous steps we take in this direction, the Chinese, Indians and third world types are unlikely to follow suit.

While I’m ranting and rolling, and on a related note, the NY AG just dropped a whopping lawsuit on the industry’s biggest meat producer, for setting methane gas reduction targets at levels that she believes are unrealistic, and using this pledge as a means of – get this – selling more meat to its customers.

Apparently, and at least in New York, this is a civil transgression.

In summation, everywhere one cares to cast a Capital Markets glance – from crypto to currency to credit to commodities, AND equity sectors ranging from TMT to Health Care to Manufacturing and beyond, the line of sight is blurred and the future more than likely to unfold in ways that we currently do not understand and CANNOT anticipate.

None of which is likely to impede the current buying frenzy, nor should it. Capital assets are, one way or another, likely to become even more expensive than at present, and the best way to address this reality is to own as much of them as one can.

No, nobody told me there’d be days like these, and yes, it’s most peculiar Mama.

But like Jim once prophesied, unless we’re willing to find a new town, we shall keep on playing.

In my estimation, it is fitting and proper that we do so. But let’s not pretend we know, for the moment, what any of this is about.

Strange days indeed.

TIMSHEL