'I think it leads to a certain amount of animosity,' economics professor says of debt cancellation

Biden's student loan bailout creates inequities, has no upside: Doug Holtz-Eakin

Stony Brook University professor of economics Stephanie Kelton and former CBO Director Doug Holtz-Eakin discuss Biden's plan to cancel $39 billion in student loan debt on 'America Reports.'

Media outlets are promoting narratives of former students agonizing over student debt repayments returning after a three-year break, as the debate emerges over whether efforts to cancel student debt is righteous or wrongheaded.

More than 40 million Americans have to make their monthly payments again after the end to the pandemic pause that began in March 2020. The Supreme Court also struck down President Biden's $400 billion debt erasure program in June in a massive political setback, and the administration has sought other workarounds and ways to lower monthly payments.

Multiple student loan recipients said that the prospect of returning payments in October was "scary" in an NBC News story headlined, "The ‘terrifying’ trade-offs millions of Americans face as student loan repayments resume."

"Now to have the student loans stacked on top of it, it’s really, really scary. We are going to be living on the brink," one borrower said. "There have been a lot of expenses that we’ve been trying to tear down to try to prepare for this."

INTERNET DIVIDED OVER BIDEN PUSHING FORWARD WITH STUDENT LOAN DEBT REMOVAL: 'SLIPPERY SLOPE'

Some media outlets are promoting narratives of students anxious and fearful of student debt repayments returning after a three-year break. The pause on loan repayments was extended multiple times since 2020 as a pandemic-related measure. (SoFi and Getty Images)

"I think that’s the scary reality of having gone to college and having sought a degree in a profession where even if you are living paycheck-to-paycheck, you think it’s going to be stable," another borrower said.

The Associated Press reported on a 38-year-old with "$38,000 in student debt" who said she has "started asking for October shifts with a catering company and a winery to supplement her income."

Professor John Rosen, who teaches economics at the University of New Haven's Pompea College of Business, said student debt forgiveness sent the wrong message.

"I do not think the government should cancel the loans," he told Fox News Digital. "That sends all kinds of bad signals throughout society. People who have other loans for other reasons raise their hands and say, ‘Well, why aren’t you going to bail out my loan?' And it will become hard, in my opinion, for the government to resist that.

"I think it leads to a certain amount of animosity," he added. "Do I think it's so horrid we're just going to run society asunder, we're going to have some kind of civil war? No. But I think there'll be a lot of resentment and a lot of, you know, ‘When do I get my bailout? My fraternity brother got his bailout. When do I get mine?' And that leads to disturbing politics."

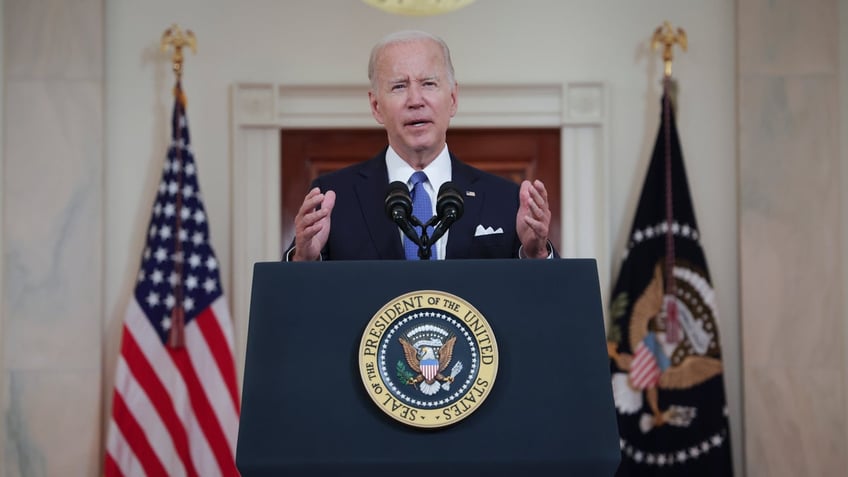

President Biden has been dealt several setbacks by the Supreme Court, including to his student loan handout plan. (Photo by Alex Wong/Getty Images) (Alex Wong/Getty Images)

Josiah Poletta of Van Wert, Ohio, was featured on Fox News Digital last year discussing how he and his wife Courtney paid off more than $120,000 in debt without government aid. He said Tuesday that the student loan repayment plan is "not something new," but is the "continuance of something that people have been avoiding for too long."

"If it is a problem of affordability, get on a budget," he said. "Create a monthly budget that includes every dollar that is spent and where it is needed. Find where money can be cut and where it is needed and live off of that. Do what is difficult now, to reap the rewards of being debt-free and financial stable."

SENATE REPUBLICANS POSITION FOR SECOND SMACKDOWN OF BIDEN'S STUDENT LOAN PLAN

Demographic strategist Bradley Schurman said, however, that the massive economic weight of student loan debt is a barrier to growth.

"The outstanding student loan debt of $1.7 trillion pulls capital out of consumer markets and threatens economic growth," Schurman told Fox News Digital. "While I am no fan of debt forgiveness, failure to ease at least some of the burden on these borrowers isn't good for American business or the economy. America needs to rethink education and the costs associated with it. Future borrowers need to have better information at hand, outlining the risk of borrowing large sums of money and how debt can cripple their long-term prospects for having a family and owning a home."

Financial coach Lisa Chastain told Fox News Digital that the issue of student loan repayment was a complex one.

"There's no easy answer or quick fix when it comes to student loan repayment," Chastain said. "What's fair and what's right will be debated for years to come. For many, the hope of forgiveness means that they will choose to defer payments as long as possible. For others, income-driven repayment seems to be the best possible option. With the new income-driven option, borrowers will have more in their pockets to spend, that's a good thing for the economy."

But Chastain advised holders of student debt to get a handle on how much they owe as soon as possible.

"However, this new repayment option kicks the can of actually paying their loans off down the road," she said. "For borrowers, it's absolutely necessary that you log into your loan servicer NOW so that you can choose an option that best suits your situation while the option is still available. Don't wait for the government to notify you."

OPINION: BIDEN PLANS EVEN BIGGER STUDENT LOAN HANDOUT, DUMPING THE BILL ON YOU

Supporters of student debt forgiveness demonstrate outside the US Supreme Court on June 30, 2023, in Washington, DC. (Photo by OLIVIER DOULIERY/AFP via Getty Images)

Personal finance expert and co-host of The Ramsey Show George Kamel told Fox News Digital that student loans were a trap for many borrowers.

"Student loans are selling the American Dream but delivering the American Nightmare," Kamel said. "I sympathize with these borrowers completely because I’ve been there, too. I graduated over a decade ago with $36,000 in student loan debt."

Kamel said that stopping the "federal student loan program" was an effective but unrealistic way to solve the problem due to the slow movement of government, and instead told borrowers to get on a budget and pursue "debt freedom."

Personal finance expert Jade Warshaw said students have to ultimately "take responsibility" for their own future and pay off the debt over time.

"I don't think there will ever be a magic policy that's going to fix the student loan problem," Warshaw said. "We have to wake up and realize the system will never put you first."

The Biden administration has repeatedly pushed to forgive student loan debt for federal borrowers, in legal battles that have been largely rejected in court. In June, the Supreme Court rejected the Biden administration's student loan forgiveness plan that would have canceled $10,000 in federal student loan debt for millions of borrowers and up to $20,000 for a special class of borrowers.

A Biden White House official told Fox News Digital that the president believed college should be a "ticket to the middle class" rather than a burden on families. They added that Biden would announce Wednesday an additional $9 billion in debt relief for 125,000 borrowers through fixes to income-driven repayment (IDR), Public Service Loan Forgiveness (PSLF), and by granting automatic relief for borrowers with total and permanent disability.

"This brings the total approved debt cancellation to $127 billion for nearly 3.6 million borrowers so far under the Biden-Harris Administration," the official said.

For more Culture, Media, Education, Opinion, and channel coverage, visit foxnews.com/media

Jeffrey Clark is an associate editor for Fox News Digital. He has previously served as a speechwriter for a cabinet secretary and as a Fulbright teacher in South Korea. Jeffrey graduated from the University of Iowa in 2019 with a degree in English and History.

Story tips can be sent to