As we approach the final quarter of the year, and with the understanding that the last three months are likely to be the most eventful of it, investors will need to remain calm and composed to navigate the weeks ahead. In this context, understanding the basics of investing is crucial to manage these challenging times. On that note, while many may think they understand how the world economy works, it is, in fact, extremely complex. The world economy is an incredibly intricate, physics-based, self-organizing system. Its three major elements can be summarized as extracted resources, including energy resources, the human population, and demand generated through the financial system.

All three of these elements tend to increase over time, but both population and extracted resources are constrained by the finite nature of the world. Financial demand, however, is often emphasized by politicians because it appears to have no limits. The extraction limit is not immediately obvious; it is determined by the amount consumers can afford to pay for resources and the products derived from them. This limit cuts off resource extraction at levels far below what geologists estimate is available for extraction.

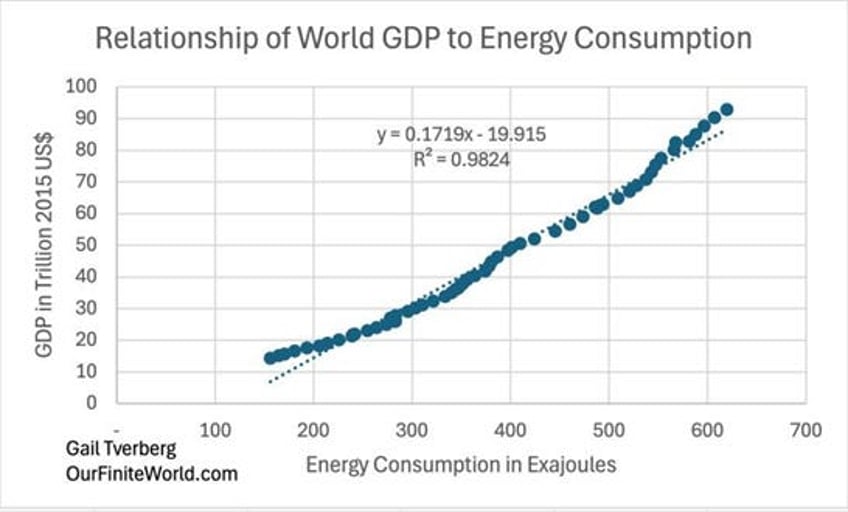

Physics tells us that every action, even the movement of molecules, requires energy dissipation. Within the economy, this energy can come from human labour, the sun, or sources such as burned biomass or fossil fuels. In physics terms, the world economy and many structures within it are dissipative structures. These structures are self-organizing and often grow over time. Examples include plants, animals, hurricanes, and businesses. Dissipative structures require the right kinds of energy for their continued ‘life’ and growth. For example, animals require food, while hurricanes derive energy from warm sea water. The concept of the economy as a dissipative structure has been understood for ages and continues to be discussed today. Given that economic growth is fundamentally energy transformed, it should come as no surprise that there is a close relationship between global energy consumption and economic growth.

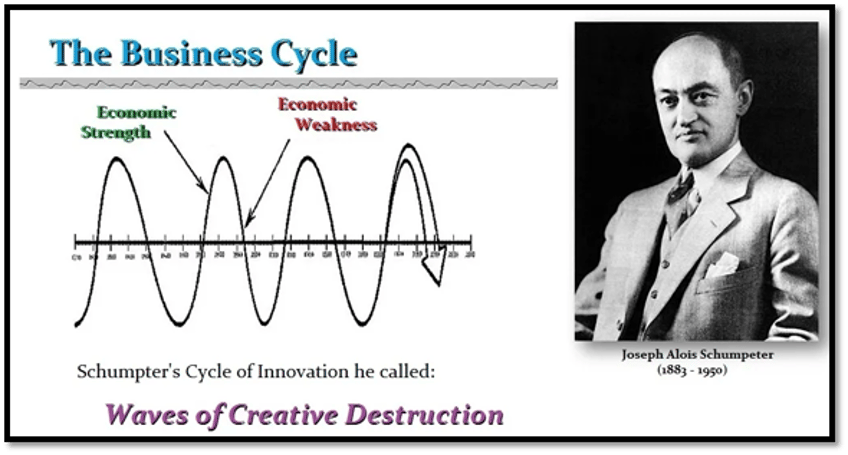

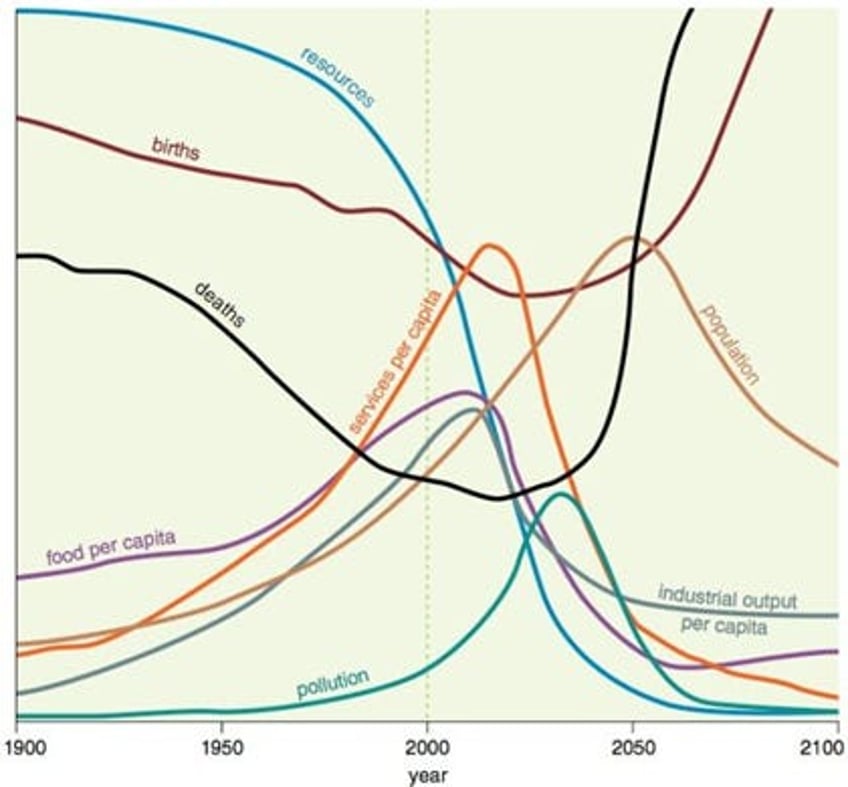

History shows a repeated pattern of overshoot and collapse (i.e. boom and busts). Populations would grow until the carrying capacity of the local area was reached. Food surpluses would diminish, leaving less to buffer against fluctuations in rainfall and temperature. Eventually, civilizations would succumb to one problem or another: disease, attack by neighbouring groups, climate fluctuations, or governments overthrown by dissatisfied citizens. While many of us might think that overshoot and collapse cannot happen in a world dominated by productivity gains led by AI, it is evident that the origins of the business cycle will continue to prevail. As the Biblical story of Joseph and the Pharaoh illustrates, the world experiences periods of abundance followed by periods of scarcity, seven years of plenty and seven years of drought. This remind us that the business cycle is inevitable, and everyone must prepare for it to mitigate its impact on society.

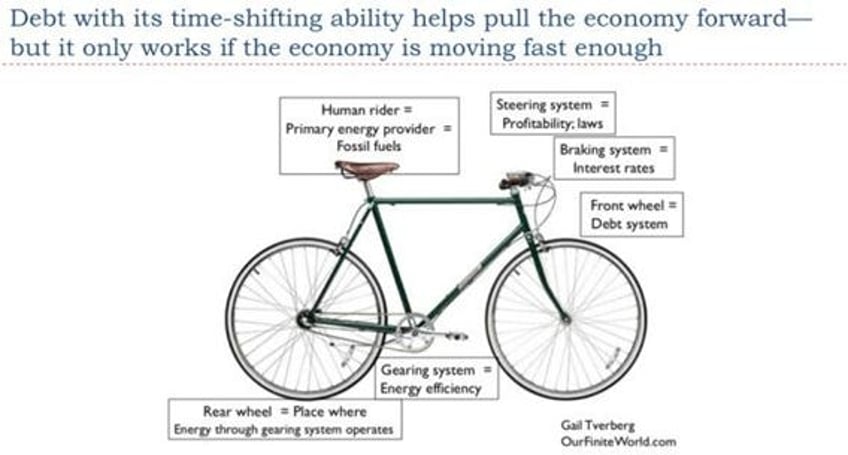

Debt plays a crucial role in driving the economy forward by enabling investments, such as building factories and hiring workers, which in turn help GDP grow. As long as these investments yield returns sufficient to repay the debt with interest, the system works well. Debt is not the only mechanism that propels the economy. Stock issuance, promising dividends, functions similarly by allowing investments before new products are created. Pension plans also stimulate the economy by reducing the need for personal savings. Rising home or stock prices can boost demand, as individuals sell appreciated assets to fund new investments, like building a factory. The key is the time-shifting aspect of debt and similar financial instruments, which allows for immediate spending on projects with long-term benefits. The expectation is that returns will be sufficient to cover debt repayments or stock dividends.

When the economy is growing rapidly, even high interest rates don't hinder growth. Conversely, if energy costs are high or industries stagnate, achieving returns on debt-related investments becomes challenging, potentially leading to defaults and sluggish economic growth and ultimately lower interest rates. In their study of government borrowing over eight centuries, Reinhart and Rogoff found that countries with rapid growth tend to have low default rates, noting, the non-defaulters are, by and large, hugely successful growth stories. The complex interplay of debt; energy supply; growing efficiency; profitability and government regulations can be schematized by how a bicycle effectively works.

Models have played an increasing role in explaining the economy, but they can often be misleading, even if they appear to be scientific. The simplest models assume that the future will closely resemble the past or that past trends will continue. These models are popular because they imply that good times will persist, which is a comforting notion. As a result, they are often accepted as ‘scientifically valid.’ In the 1970s, David Meadows developed a computer model to determine whether humankind was exceeding the Earth’s carrying capacity by integrating indicators such as global population, industrial production, climate change, and oil and metal use. While this model was largely Malthusian in nature, it examines resources used in each six-month period. The proportion of these resources needed to extract and transform them into usable work cannot be too high, or the economy tends to collapse. (Nature doesn’t use accrual accounting!) In such calculations, quick payback on an energy investment becomes crucial. The amount of supplementary equipment, such as electricity transmission lines and batteries, also becomes significant. Wind, solar, nuclear, and liquefied natural gas (LNG) would perform relatively poorly in such calculations. Oil, coal, and burned biomass would fare much better because their energy payback is immediate when they are burned. Additionally, oil, coal, and biomass require relatively little specialized equipment for transportation and storage.

A common belief is that financial demand is the key to economic health. Politicians can influence this by creating more debt, which may then trickle down to ordinary citizens, boosting their purchasing power. However, as Milton Friedman famously said, citizens should keep their eyes on ‘how much the government is spending because that is the true tax.’ Ronald Reagan also emphasized this view, noting that ‘everyone is looking at the government for an answer, and the government is the problem.’ He added that ‘there's very little that government can do as efficiently and economically as the people can do themselves’ and concluded that ‘the answer to curing inflation is a balanced budget’ and that "balancing the budget is like protecting your virtue; you have to learn to say no."

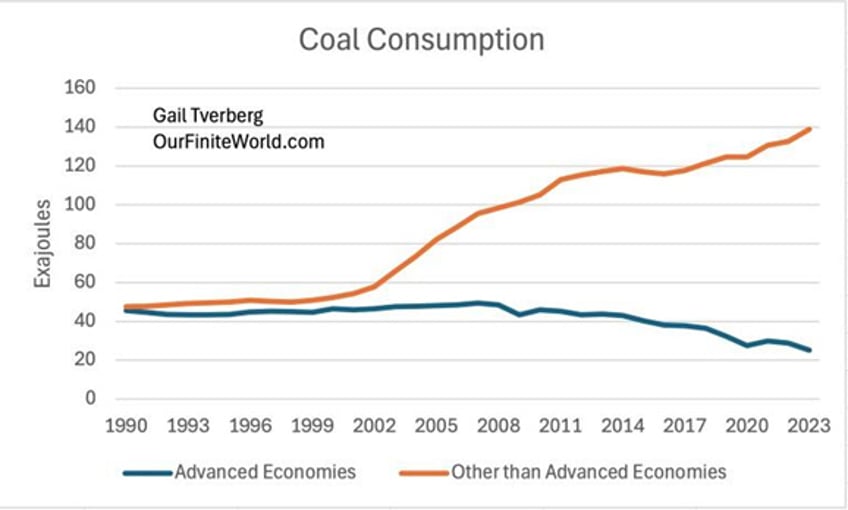

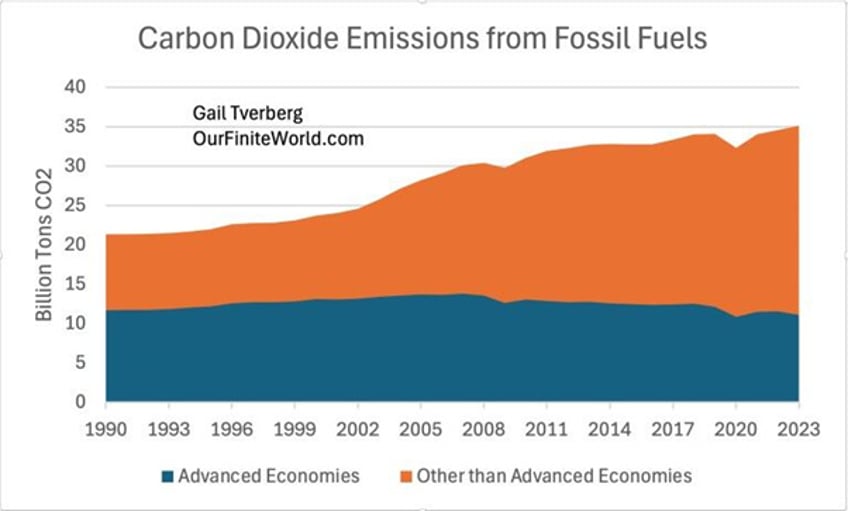

Another narrative claims that climate change, driven by excess CO2, is the world's biggest problem and that transitioning away from fossil fuels will solve it. Yet, moving away from fossil fuels would result in widespread starvation, as they are crucial for global food production. Thomas Malthus warned in 1798 about population growth outpacing food supply before the widespread use of fossil fuels. Today’s population exceeds 8 billion, compared to 1 billion then and most of the world is not starving. The climate change narrative might also be used to shift manufacturing to countries that rely heavily on cheap coal and have lower wages. Since China joined the World Trade Organization in 2001, the US has increasingly exported coal to countries like India and China.

And subsequently as everyone might expect world CO2 emissions from fossil fuel use have soared.

At the same time, energy costs have been rising in countries that have imposed climate change policies on their citizens, often relying on inefficient energy sources for both consumers and businesses.

Complexity can manifest as increased specialization, more education, larger businesses, greater globalization, and advanced devices that might use energy more efficiently. However, rather than reducing energy demand, added complexity often increases it. For instance, relocating significant manufacturing to China since 2001 has boosted global coal demand and CO2 emissions, as Chinese-produced goods are cheaper and more affordable than those from the US or Europe. Complexity also makes systems more prone to breakdowns, as seen with recent issues like the CrowdStrike software update disrupting networks worldwide. While nature uses complexity, it also incorporates redundancy to minimize breakdowns. Additionally, complexity often results in reliance on global supply chains, with many US and European products depending on Chinese suppliers, even for military goods. In an increasingly polarized geopolitical environment, this kind of reliance in global supply chains will need to be increasingly rethought and ‘friendshoring’ or re-shoring is structurally inflationary.

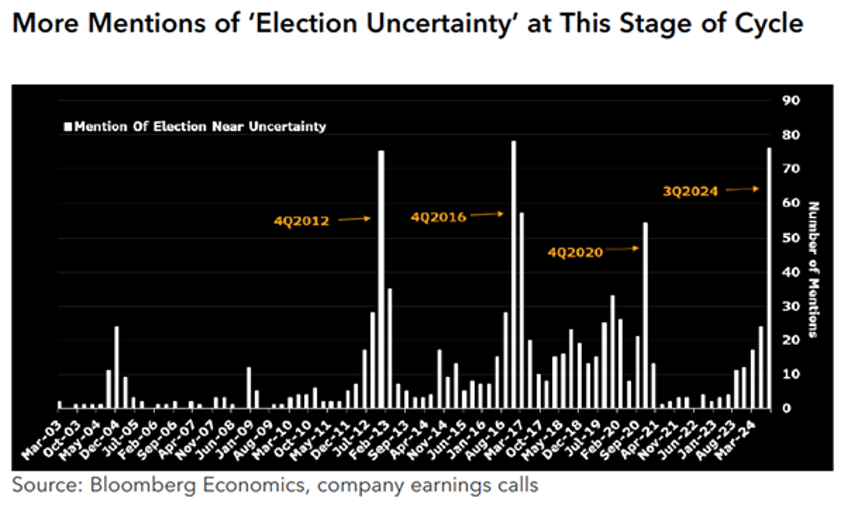

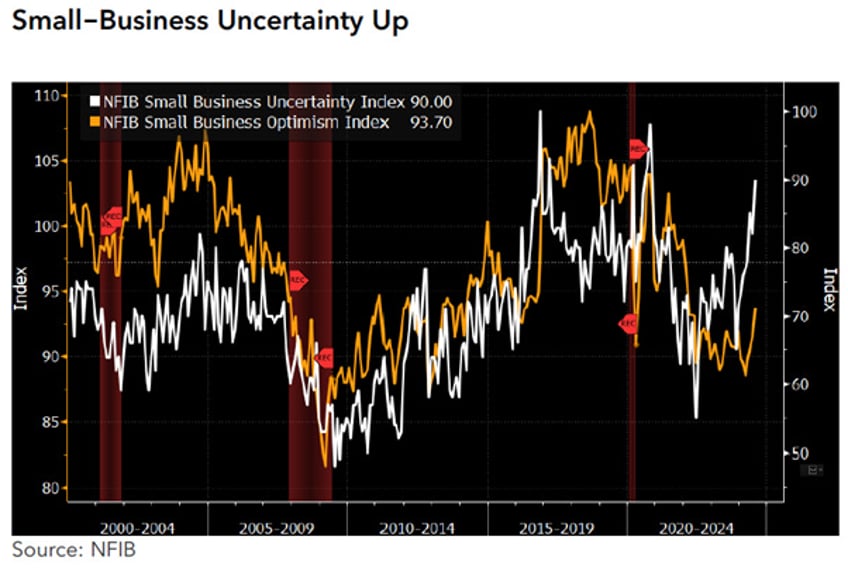

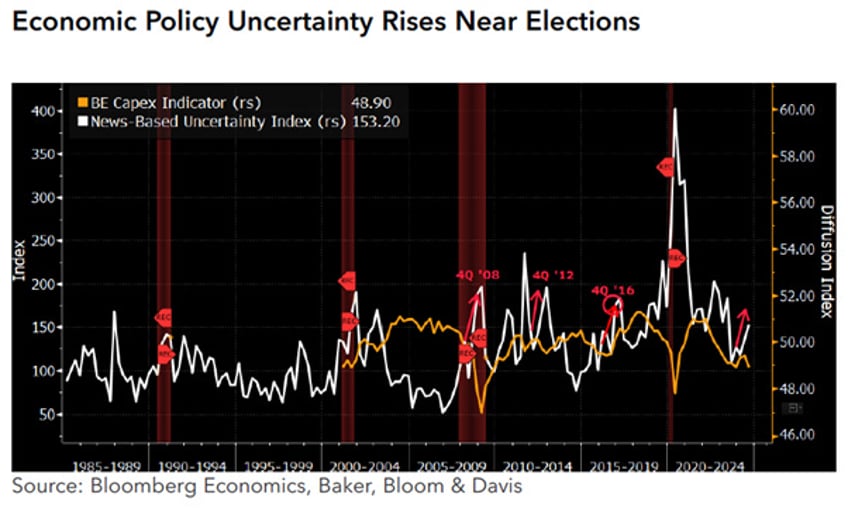

Outside the economy, investors' focus this year has been on elections, as 2024 will be remembered as ‘the year of political hell’. Unless you've been living under a rock, you should know that the year will peak on November 5th, when Americans will choose their 47th president. The initial impact of the election is the uncertainty it creates for firms and consumers. Economic uncertainty generates a temporary negative demand shock, causing firms to delay investments and households to postpone purchases of durable goods. While some degree of uncertainty about the economic outlook is always present, it is particularly high ahead of November’s presidential election. The longer the uncertainty persists, the more negative the impact on the economy. Given the stark differences between the proposed policies of Kamala Harris and Donald Trump, the range of potential economic outcomes is wide, and uncertainty is expected to remain elevated even well after the election.

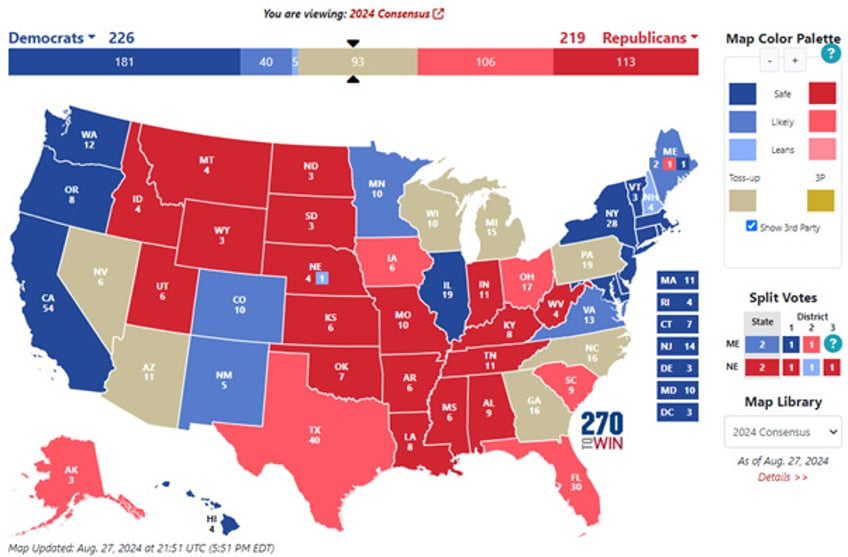

Recent polls show Vice President Harris, the Democrat candidate, and former President Trump, the Republican candidate, in a dead heat on their path to 270 electoral votes. While RFK just announced that he is ‘suspending his campaign and not ending it,’ he is not out of the race. He is betting on a contingent election by depriving any of the 2 other candidates of the 270 votes needed to win, which can be achieved by winning just 37 Electoral College votes. This can be easily done by winning 2 or 3 of the 6 states where Democrats and Republicans are tossing up.

The candidates’ economic policy proposals are starkly different, especially regarding taxes. Therefore, the outcome could influence whether households receive tax rebates, whether corporations face higher or lower taxes, and whether capital gains are taxed more heavily. Anecdotal evidence suggests that uncertainty is already causing business owners to delay investments and households to postpone major purchases, at least temporarily. Election uncertainty can also impact consumer behaviour through financial markets. Consumers are already worried about their finances: Recent consumer sentiment surveys revealed a significant drop in sentiment among those with substantial portfolio exposure. High-income households, which make up about 30% of US consumer spending, are particularly affected. If market volatility leads to reduced spending by these households, it could negatively impact the economy. While market rallies over the past two years have alleviated the pressure of rising prices and supported spending, recent volatility driven by uncertainty about the economic outlook threatens to dampen spending as consumers become more uncertain about their financial futures.

The Baker, Bloom, and Davis news-based uncertainty index indicates that policy uncertainty increases in the months leading up to an election. Rising polarization is amplifying these pre-election spikes in uncertainty. As the two parties have become more divergent in their policy positions compared to past decades, election outcomes may lead to more significant shifts in economic policy. These potential changes are likely to influence both business and consumer behaviour, heightening uncertainty as the vote approaches.

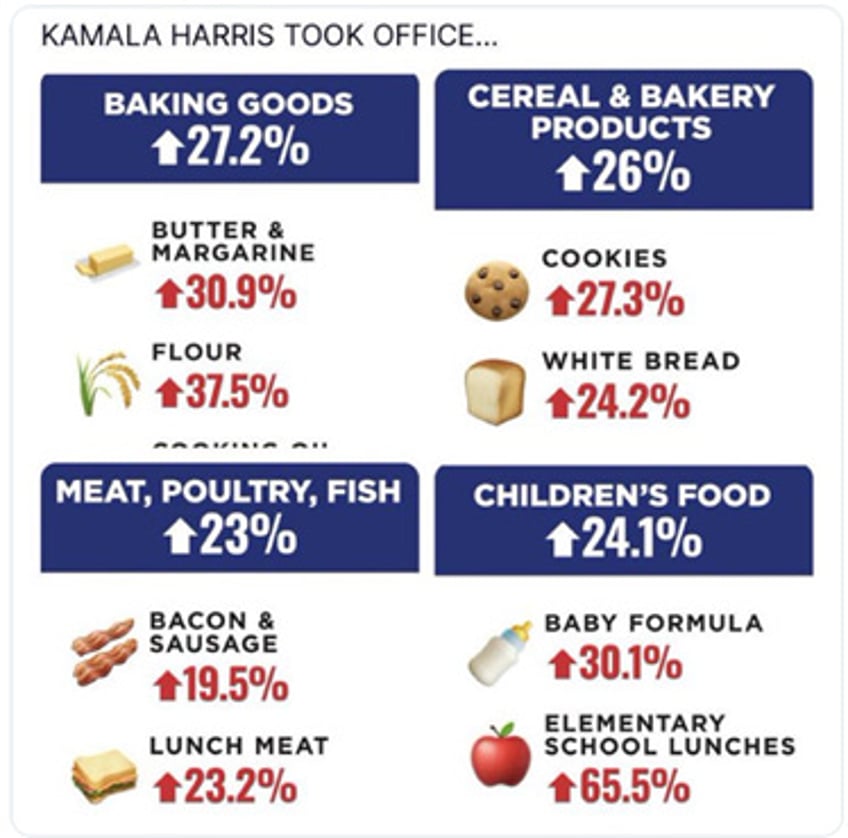

Those following the US presidential campaign are aware that the focus has been on the economy and inflation and the impact of a disruptive immigration policy over the past 3 and half years. At a rally in North Carolina, Vice President Kamala Harris, the Democratic nominee, introduced her plan for 'price controls,' which resembles a communist-style economic approach. She blames capitalism and corporations for rampant inflation, despite the fact that reckless government spending under her and President Biden is widely seen as the primary cause of soaring prices, particularly in grocery stores.

No PHD degree is needed to understand that price controls have historically failed. The likely consequences of implementing price controls on grocery retailers can be summarized as follows:

Grocery stores, operating on thin margins of 1-2%, can't absorb rising supplier costs. If the government imposes price controls on food producers (like Kraft Heinz and Tyson), grocery stores face financial strain.

Stores in lower-income areas, which sell more low-margin prepackaged foods, suffer more than those in wealthier areas. These stores may close, worsening food deserts.

Food producers experience shrinking margins due to rising costs for ingredients, energy, and labour, reducing their ability to cover overhead and invest in capacity.\

Grocery chains repurpose their stores to sell non-price-controlled items, making them resemble discount retailers like Walmart.

With price controls in place, grocery chains compete for limited inventory through payment terms rather than prices, further straining smaller chains and food producers.

Smaller grocery chains and food producers struggle to stay afloat. Major chains like Kroger may acquire smaller ones, and smaller producers face business closures.

As supply chains break down, grocery stores face shortages, long lines, and increased security measures. The government steps in with block grants and seizes production facilities.

The government imposes price controls on all key food costs, struggling to manage the complex food supply chain, leading to widespread disruptions.

This scenario could lead to severe consequences, including economic collapse and widespread food shortages.

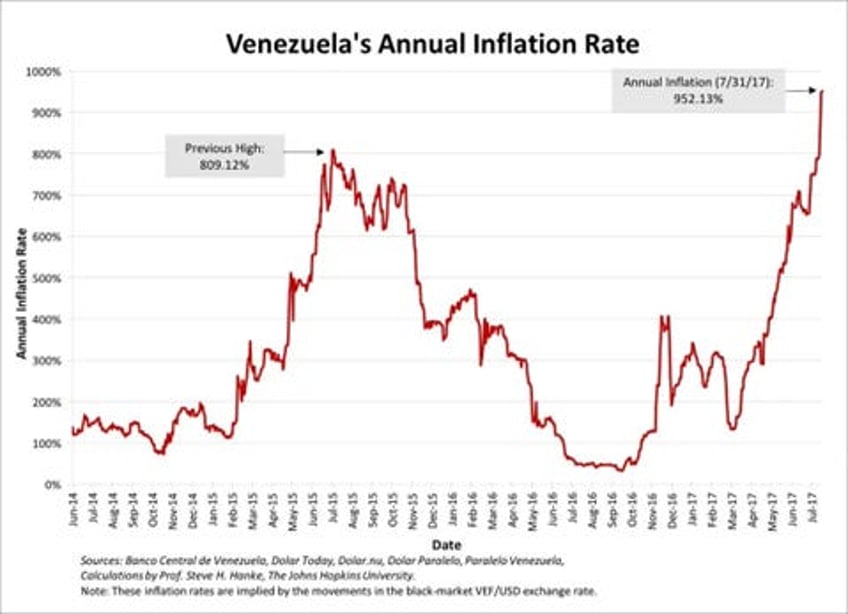

For those seeking to understand the dramatic consequences of price controls, Venezuela offers a compelling example. Hugo Chávez implemented price controls to combat inflation, but the policy backfired, leading to some of the highest inflation rates in the world. The government set prices arbitrarily, ignoring demand, supply, and costs borne by the private sector. As a result, businesses became unprofitable, small mom-and-pop stores disappeared, and those that remained struggled to operate, facing severe shortages of basic goods like food. The population panicked, hoarding supplies in uncertainty about when goods would be available again. A black market emerged as people resorted to bartering and smuggling goods from neighbouring countries. Venezuelans stopped using their currency, much like during the German hyperinflation, and the Bolivar rapidly became worthless. The struggling private sector could not retain staff, leading to soaring unemployment. With hyperinflation spiralling, confidence in the government and currency collapsed, wiping out savings even for the most financially savvy citizens.

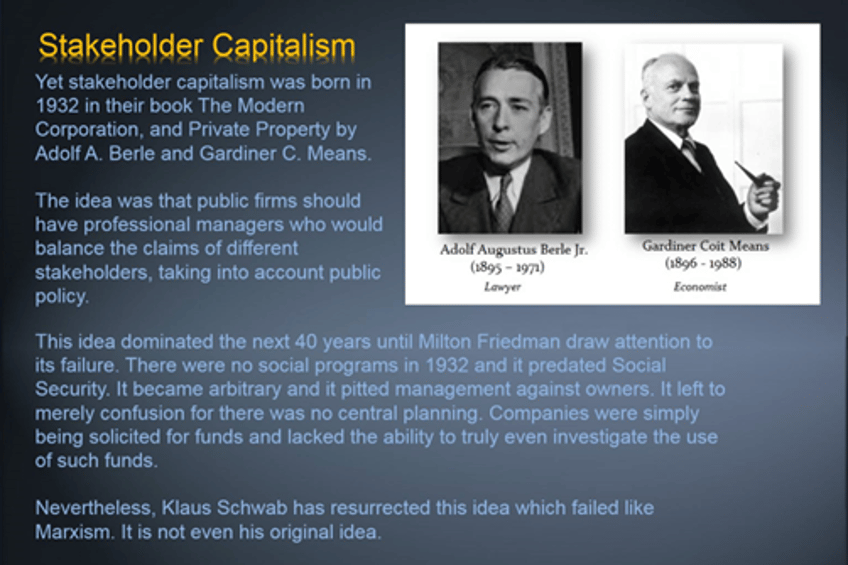

Every single nation which has implemented price controls has failed and while this is the backbone of ‘Stakeholder Economics’ it will fail again and again. Investors are therefore likely to ask what Stakeholder Economics is.

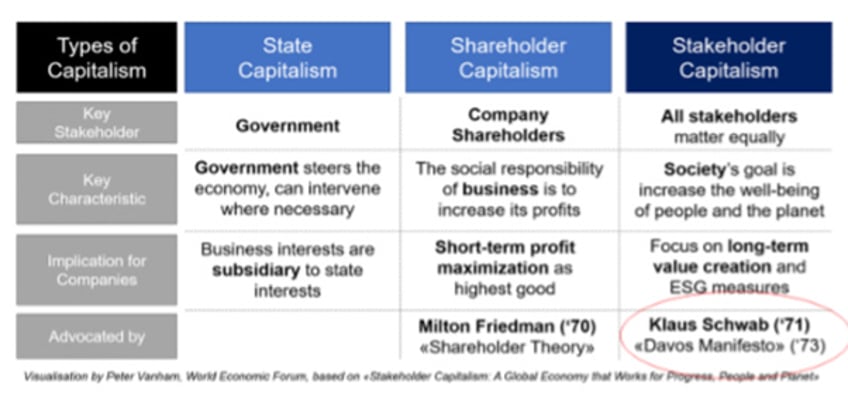

Stakeholder capitalism is a system where corporations supposedly prioritize the interests of all stakeholders’ customers, suppliers, employees, shareholders, and local communities over solely maximizing profits for shareholders. The goal is to create long-term value, rather than just enhancing shareholder value at others' expense. Supporters, such as economist Joseph Stiglitz, argue that this approach is both a sensible business strategy and an ethical choice, contrasting with Milton Friedman's shareholder primacy. Friedman advocated that a company's sole social responsibility is to increase shareholder profits while adhering to ethical competition rules.

Stakeholder capitalism has been a key used by the globalists’ toolkit which has been used as the most apt way to characterize the rebranded fascism.

It was not until Stakeholder Economics collapsed with Bretton Woods that its failure was widely recognized. August 15th marks the anniversary of the ‘Nixon Shock’ in 1971, when President Nixon suspended the US dollar's gold convertibility and imposed a 90-day freeze on wages and prices. This move came amid soaring inflation, trade deficits, and economic stagnation. The 1970s also saw Canada's Trudeau enact the ‘Anti-Inflation Act of 1975,’ capping wage increases at 6% and price increases at 5%, which failed to mitigate the economic woes.

Gold prices surged from $35/oz at the time of the Nixon Shock to $850/oz by 1980, reflecting the crisis. It wasn’t until Paul Volcker's high interest rates, which caused significant distress when he was appointed by President Carter, that inflation was brought under control.

FED Fund Rate (blue line); USD Gold Price (red line) between 1970 and 1980.

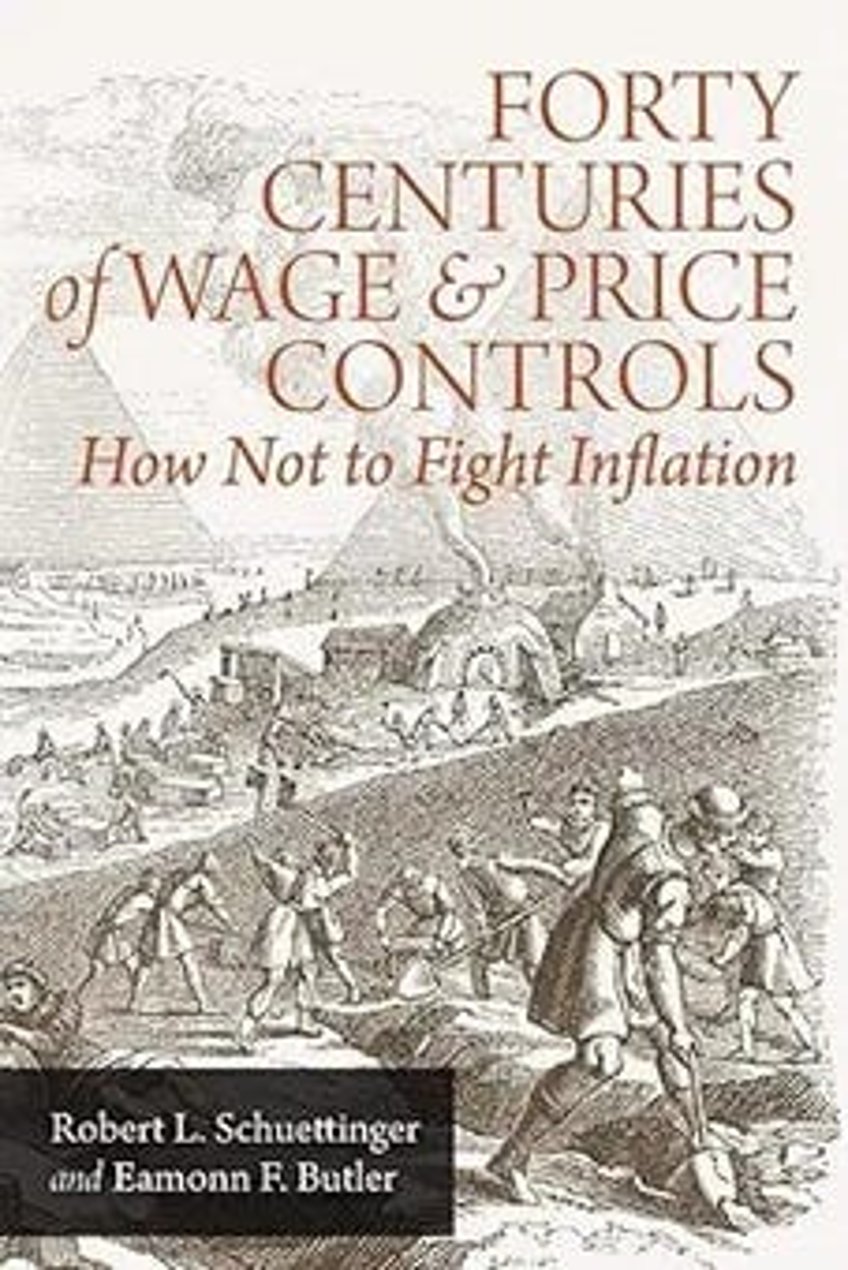

Today, with a monetary regime far more lenient than the 1970s, the global monetary system faces risks even with modest interest rate adjustments, as seen with recent developments from the Bank of Japan. With unprecedented levels of monetary expansion and soaring debt, policymakers and central bankers find themselves cornered. This has led to a resurgence in calls for price controls by politicians who blames grocery store CEOs for inflation. For those who are interested in the subject, Robert L. Schuettinger and Eammon F. Butler’s book, ‘Forty Centuries of Wage and Price Controls, or How Not to Fight Inflation’. provides a comprehensive historical account of the failures of price controls.

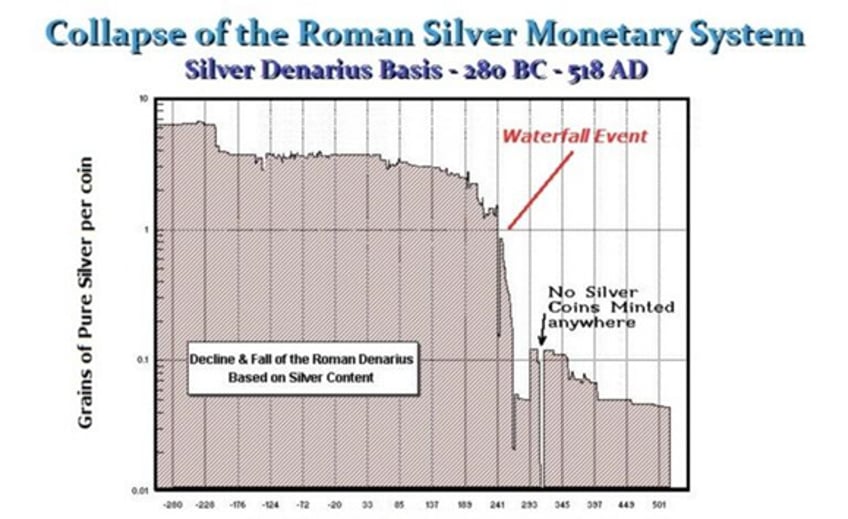

History is full of examples where government-imposed wage and price controls have failed, leading to starvation, riots, and revolution. When labour and production costs rise due to shortages and the government controls the final price, disaster always follows. During the reign of Diocletian (284-305 AD), the introduction of the silver Argentius coin, which was only 90-93.5% silver, was an attempt to stabilize the economy. However, these coins quickly disappeared from circulation, being hoarded or used in foreign trade. Within 15 to 17 years, their silver content dropped to below 50%.

A similar pattern of failure dates to the Code of Hammurabi (circa 1780 BC), one of the earliest comprehensive legal codes, issued by Babylonian King Hammurabi (1792-1750 BC). Comprising 282 rules, it established standards for various aspects of society, including commercial law. The code set prices, tariffs, and trade regulations, and addressed issues such as defective goods and debt, aiming to maintain fairness and order in economic transactions. Despite its detailed provisions, such attempts at price controls have historically led to economic disruption rather than stability.

During World War I, multiple government agencies were involved in price regulation, including the Fuel Administration and the Food Administration, which had explicit authority for price-fixing. Other agencies like the War Industries Board, the Price-Fixing Committee, and the Federal Trade Commission also played roles in regulating maximum prices. The War Industries Board, established on July 28, 1917, by the Council of National Defence, was particularly influential, with the mandate to consider price factors.

During World War II, the US adopted a different strategy to combat inflation, using rationing instead of price controls. Faced with skyrocketing federal deficits, soaring from about 3% of GDP in 1939 to nearly 27% in 1943, and a shift in resources to support the war effort, the government implemented a rationing system with ration stamps to manage shortages and ensure fairness.

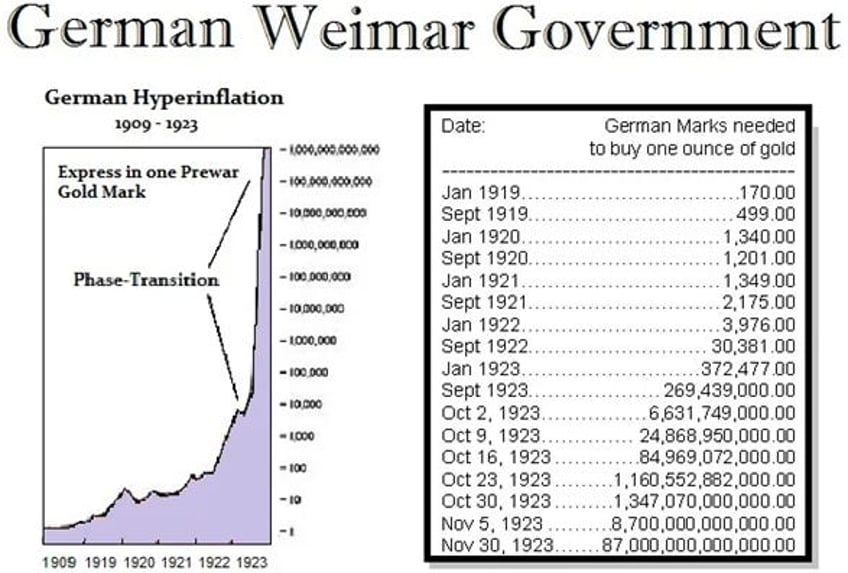

Outside the US, before World War I, Germans had little experience with inflation. However, the war caused severe shortages of food, fuel, and other essentials, leading to rising prices. To cover its expenses, the German Empire borrowed money, sold bonds, and printed more currency, causing the value of the German mark to plummet by 50% during the war. Price controls mitigated some inflation, but these ended with the government's collapse in November 1918, followed by the rise of the Weimar Republic after a Communist Revolution. Fearing the same fate as Russia, wealthy Germans fled, and prices soared. The Weimar Republic continued the previous government's fiscal policies, printing money to fund the transition to peacetime and support welfare programs. In 1921 and 1922, inflation was deliberately increased to demonstrate to the Allies that Germany could not pay reparations. By December 1922, the Weimar Republic confiscated 10% of assets and issued bonds that quickly became worthless, leading to hyperinflation that surged tenfold from pre-confiscation levels.

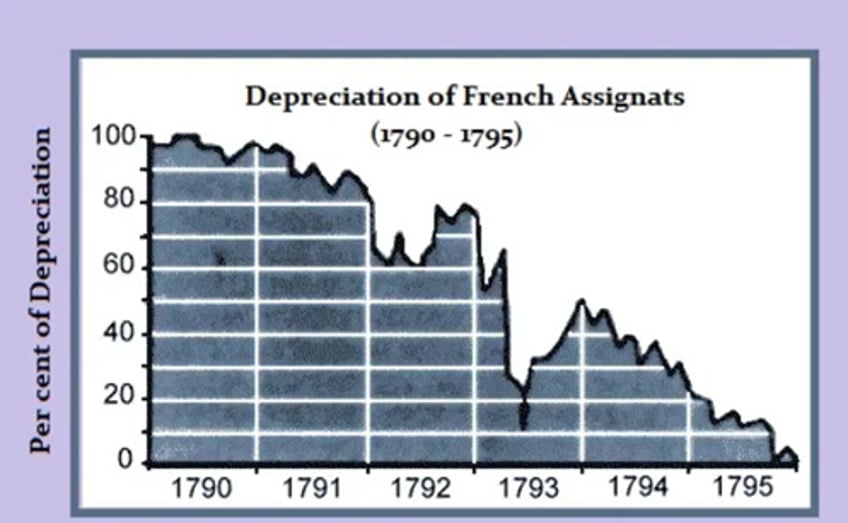

Regardless of the country or the time in history, the pattern remains consistent. The French Revolution, for instance, began due to food shortages. Marie Antoinette's supposed remark, ‘Let them eat cake,’ which was actually a misunderstanding of the crust left over after making bread, fuelled public anger and contributed to the revolution.

Communism in its modern form emerged in France in the aftermath of the French Revolution, influenced by thinkers like Gabriel Bonnot de Mably, Jean Meslier, Étienne-Gabriel Morelly, Henri de Saint-Simon, and Jean-Jacques Rousseau. It is the French Commune, established in 1871 after the fall of Napoleon III which set the basis of radical egalitarianism and a rejection of private property as it was theorized by Karl Marx.

The examples are endless. PRICE CONTROLS DO NOT WORK. SOCIALISM DOES NOT WORK. This policy is an absolute insanity.

If elected, the Harris Administration and its policymakers may turn to similar measures, including rationing, to address inflation. Concerns have emerged that such policies might unfairly impact citizens, with speculation that resources could be redirected in ways that benefit illegal aliens who are supporting this communist agenda. In a few words, everyone must understand that inflation is experienced at the grocery store, but always manufactured by the government. It's the same story every time. The politicians who create it by spending recklessly, villainize and blame companies that have nothing to do with it to distract from their reckless spending.

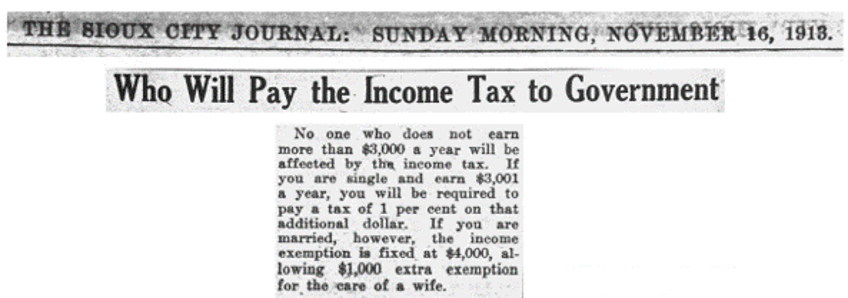

Nobody also needs a PhD in Economics or Finance to understand that the inflationary impact of price controls will be harmful to those holding long-dated bonds, and this will push US Treasury yields much higher than they were even during the 1970s. Indeed, no investor with a minimum of common sense would participate in a Treasury bond auction in this environment. That’s why one doesn't need to be a conspiracy theorist to understand that, beyond the idea of controlling prices, the Democratic candidate for the next occupant of the White House, who appears to be completely financially illiterate, also announced as part of her budget proposal for the 2025 fiscal year that she supports a minimum tax equal to 25% of a taxpayer’s taxable income and unrealized capital gains, less the sum of their regular tax, for taxpayers with wealth over $100 million.

This idea, which has been floated by Keynesians who are never satisfied with increasing government spending, is being sold to the public in the same way the income tax was in 1913, supposedly only for people who earned more than $3,000 at that time.

Even if taxing unrealized gains applied ONLY to those at the $100 million level and up, those individuals would be forced to sell their shares (1) ahead of the tax or (2) to pay the taxes. This would create a stock market crash that would impact everyone’s savings and pensions. Of course, the geniuses who only know how to increase taxes for their own interests don't want to talk about that. ‘Kamunism’ would create a Great Depression, and the market could crash for years. If they succeed in their assassination of Trump next time and rig the election to implement a socialist republic in America, it will mark the end of the equity bull market. Indeed, there is no question that once any unrealized gains tax is passed, it will eventually apply to everything. Additionally, that would mean that the forever wars promoted by the Washington warmongers have put the 'United Socialist States of America' even closer of unavertable default.

This paints a negative picture of ‘average Americans’ being forced to pay taxes on unrealized gains in their asset values without being credited for losses. While this may not apply to real estate, it certainly could apply to stocks. If it were applied to homes, it could trigger a revolution. If so, the military might split between ‘real Americans’ and others. It could resemble a Soviet-style revolution, with the ‘have-nots’ against the ‘haves.’ Ultimately, the $5 trillion in tax hikes proposed by Kamala Harris might be the catalyst, much like the Stamp Act sparked the American Revolution in 1765, for a second US civil war leading to the disunion of the USA.

While Kamala Harris is uncontestably ‘financially illiterate; her advisors behind the scenes are much more demoniac that any of us can imagine and that that’s why the real reason for combining price controls and a tax on unrealized gains is that it will likely drive some of the funds that investors would sell in the stock market into US Treasuries, which will remain untaxed. This would undoubtedly help the Washington warmongers finance their forever wars at a slightly lower cost than they would otherwise pay in a structurally higher inflationary environment.

US 10-Year Yield (blue line); US CPI YoY Change (red line); Correlations and US Recessions.

In a nutshell, as Benjamin Franklin famously stated that ‘in this world, nothing can be certain except death and taxes.’ In the ‘United Socialist of America,’ death and taxes will come even faster for those not being part of the Washington plutocracy, which recklessly spends money it neither earns nor owns.

This decision to implement price controls is closely linked to rising geopolitical tensions between the US and the Western world on one side, and Russia and China, which have begun to unify the mercantilist global south, on the other. Washington and Brussels warmongers understand that by instigating World War III, they could justify rationing food when price controls fail. Because the government is now the largest debtor in the system, the Federal Reserve can no longer control inflation by raising interest rates; doing so would increase the government's interest expenditures. Moreover, no one in government dares suggest reducing spending to combat inflation, effectively stripping central banks of their power.

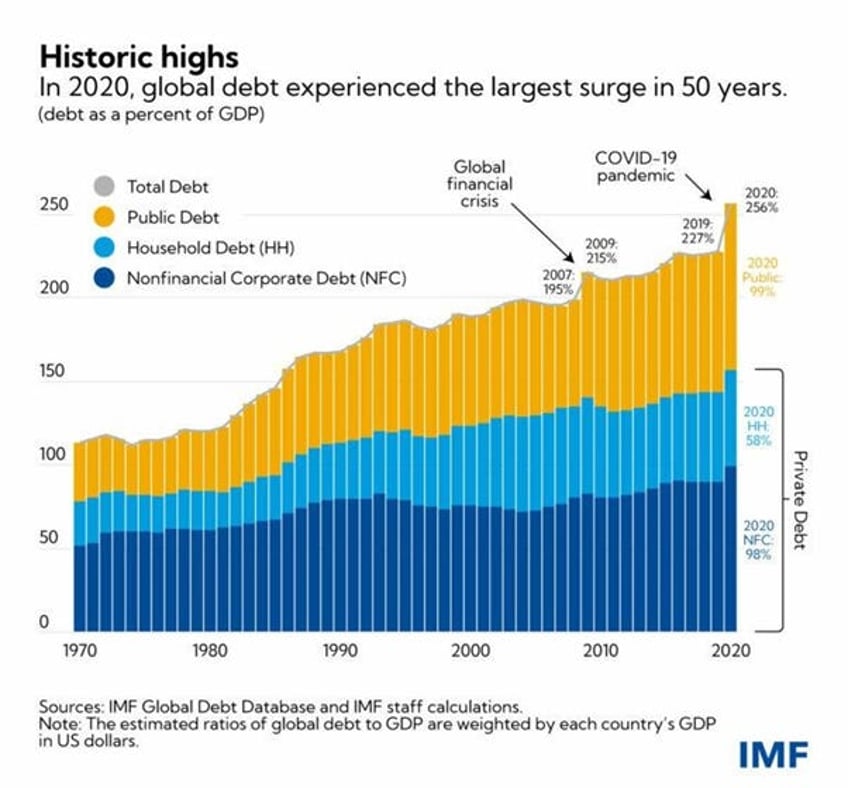

Much like during the reign of Diocletian, the world is drowning in debt, with debt-to-GDP ratios more than doubling from 100% to over 256% since the Nixon Shock. After decades of artificially low interest rates, austerity measures are no longer viable, and the unprecedented monetary stimulus during COVID has left Western governments trapped.

While politicians and central bankers are taking a victory lap for 2.9% inflation (hedonically adjusted and frequently revised), few are noticing that the official inflation target is quietly being raised from 2% to 3% or even higher. Indeed, the FED is getting ready to cut interest rates, the Bank of Canada, the Bank of England and the ECB are already cutting, and the Bank of Japan just showed the world that they can’t raise rates without creating a massive tantrum among investors.

For the first 50 years after the Nixon Shock and the end of the Bretton Woods era, monetary debasement largely flew under the radar. Following the stagflationary 70s, it was mainly confined to asset inflation, driven by a 50-year bond super-cycle that reduced the cost of capital and fuelled an asset bubble. Consumer inflation remained subdued until the post-COVID period when central banks hiked rates to rein it in (likely to have room to cut later). At Jackson Hole, Jerome Powell reminded investors that, two years prior, the FED had warned of potential ‘pain’ from this interest rate hike cycle. So far, this pain has mostly impacted Joe Six Packs who face higher borrowing costs amid rising housing prices and have seen his grocery bills rising by more than 20% on all the essential staples Americans consume every day.

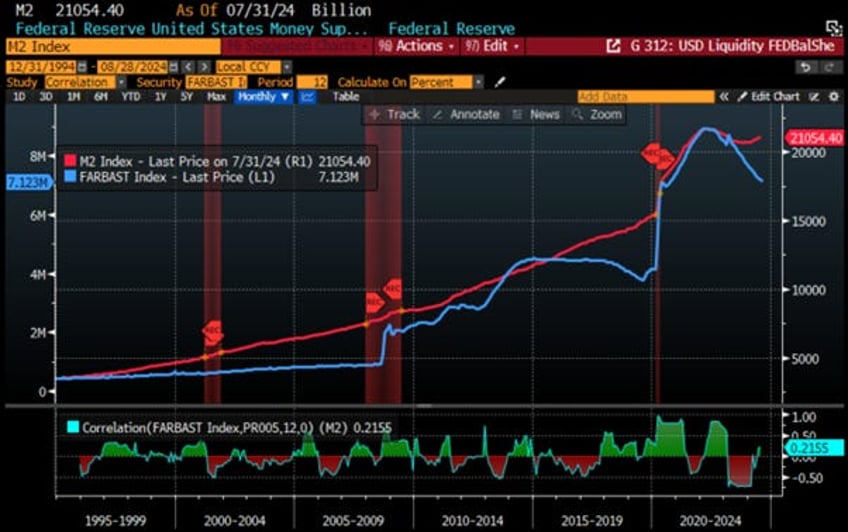

Meanwhile, the rate hikes led to the collapse of three regional banks in March 2023, which were quickly patched up with FDIC backstops on all deposits, as the FED resumed inflating the money supply through measures like the Bank Term Funding Program (BTFP). Since then, there has been a slow-motion pivot by the FED. Although the FED's balance sheet continues to shrink, the money supply (M2) surged to near all-time highs by June 2024.

FED balance sheet (blue line); FED US Money Supply (M2) (red line); correlation & US recessions.

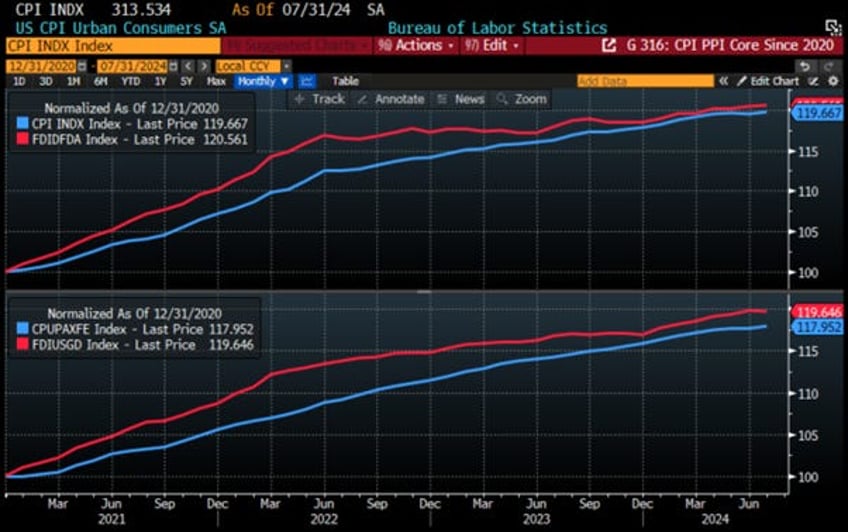

Rather than being mesmerized by political rhetoric, everyone knows that numbers never lie, unlike politicians and Wall Street bankers. So, the question is whether there has really been 'price gouging' by retailers over the past four years. A look at average cost paid by businesses (i.e PPI and Core PPI) and costs charged to consumers (i.e. CPI and core CPI) it shows that if businesses have greedy since the start of the presidency of the 46th US president, they have done it all wrong.

US CPI (Blue line); US PPI (red line) (upper panel); US Core CPI (blue line); US Core PPI (red line) (lower panel) since December 31st 2019.

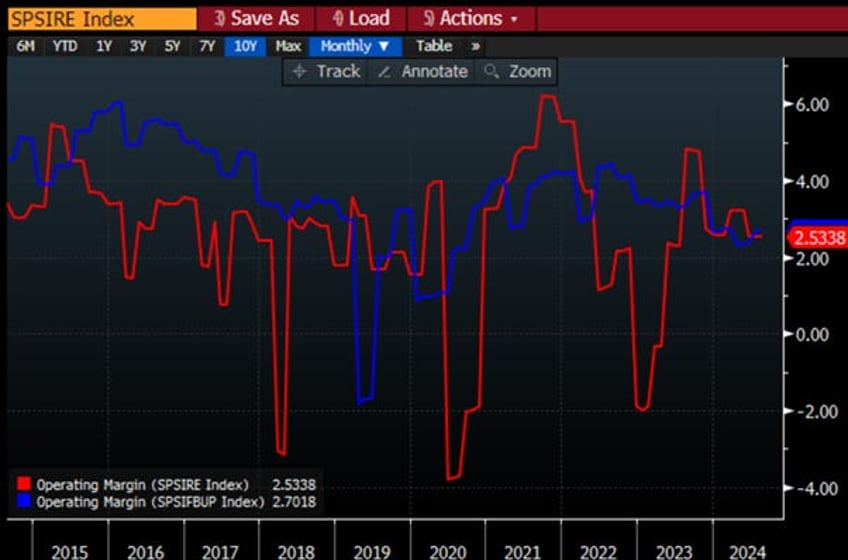

A closer look at the operating margin of companies in the S&P 500 retail industry index shows it is currently at 2.53%, similar to where it was in March 2020, before the Covid pandemic. The same trend is observed in the food and beverage sector, which has seen its operating margin decline to 2.70% from a 10-year high of 6.1% in 2016, though it is higher than the 0.9% in March 2020. With margins just above 2% for both retailers and food producers, it is hard to argue that these sectors have been price gouging. The rise in prices at grocery stores has been primarily driven by higher input costs and the expenses of complying with tighter regulations related to the climate change scam and DEI rules, which have increased the cost of doing business by requiring companies to comply with rules set by bureaucrats who do not produce any wealth for the country.

S&P 500 Food & Beverage Industry Operating Margin (blue line); S&P 500 Retail Industry Index Operating Margin (red line)

What about corporate America in general? Did we really see price gouging from US corporations during the recent years of inflation? Looking at the operating margins at the S&P 500 level, we can see that margins in this cycle bottomed in March 2021 and rebounded until March 2022, when the CPI YoY change peaked at 9.1%. Since then, margins have pulled back to 13.4%, a level consistent with the period from 2010 to 2020, when inflation rates were lower than they are today. While rising operating margins can also result from businesses improving efficiency through technological advancements, it would be unfair to say that corporate America has engaged in massive price gouging over the past few years. The rise in operating margins has been largely driven by higher inflation, which is still mostly caused by supply shortages, something that even the Federal Reserve now acknowledges is not as transitory as previously thought.

US CPI YoY change (blue line); S&P 500 index Operating Margin (red line); Correlations and US Recessions.

Equity investors should note that there is a strong correlation between the year-over-year change in US CPI and the S&P 500 index's 12-month forward EPS. This means that if AI does not deliver exceptional efficiency gains for US corporations sooner rather than later, a decline in US CPI growth will likely lead to lower EPS in the coming months which will inevitably lead to lower performance for equities. This scenario could be exacerbated if the current consumer-driven recession deepens and the new administration, along with Congress, decides to raise taxes to finance another round of extravagant and unproductive government spending.

US CPI YoY change (blue line); S&P 500 12-month forward EPS (red line); Correlation and US Recessions.

While some may think that they will solve the supply driven inflation by implementing price controls, nobody seems to have ever read history books and understand that this type of policies has never worked across civilization as they ultimately lead to starvation and food shortages. In a nutshell, those who never study history are doomed to repeat it. Yet those who do study history are doomed to stand by helplessly while everyone else repeat it.

For those who believe that communism, or more correctly ‘Kamunism,’ is an utopia where everyone benefits and that price controls will solve all economic problems while policies like reporting on neighbours, eliminating free speech, population control will lead to an abundant society, they should remember that Mao Zedong killed more people than Adolf Hitler. Mao’s policies claimed the lives of around 80 million people, though the true death toll is unknown. The Great Leap Forward famine wiped out up to 45 million citizens through starvation or overwork. The Cultural Revolution claimed up to 3 million lives, and his land reform campaigns killed around 2 million. About 20 million Chinese died in forced labour camps under Mao.

Praising Mao, as Vice President candidate Tim Waltz openly did during his career as a lecturer, is no different from praising Kim Jong-Il, Adolf Hitler, or any dictator who destroyed their own country in the quest for power.

In conclusion, the world is now caught between a kleptocracy (a government ruled by thieves) and a kakistocracy (a government run by unprincipled career politicians, corporations, and thieves that panders to the worst vices in human nature and has little regard for the rights of the citizens), the good news is that with ‘Socialism government eventually run out of other people’s money’ and end defaulting and being replaced by a new regime.

When it comes to monetary and fiscal policies, it never rains but it pours. This is a broader adaptation of Milton Friedman's famous metaphor of the central bankers as the 'fool in the shower.' Everyone who stands under a shower can relate you start with water that's too cold, so you turn up the heat, and suddenly it's scalding. Then you turn down the hot water, and the shower becomes freezing. If you replace the hapless person trying to adjust the water temperature with a central banker and a government trying to regulate the money supply and the economy, you see the problem with monetary and fiscal policies. When financial markets stand in for the shower, they have their own tendency to overshoot. Markets tend to go too far in both directions, and there’s little we can do about it. If rates seem likely to rise, markets suddenly tighten financial conditions. At any sign of rates coming down, investors rush to get ahead of the change. While the fool in the shower can only adjust the taps and hope to get the balance right, a central banker and the government can also try to influence those driving the money flow. As we enter the last quarter of the year of political hell, investors are like Vera Miles in Alfred Hitchcock's 1960 movie ‘Psycho,’ complacently showering in anticipation of a FED pivot and the nonchalance of the Ides of September before being slaughtered by central banks and governments.

As governments begin to realize they are losing power, they will become NASTY, to put it mildly, and everyone knows that a desperate man is a dangerous man. In this context, the Washington warmongers, who are in a desperate position and understand that ‘war is nothing but the continuation of politics by other means,’ could start World War III as soon as possible, providing them with another excuse to implement price controls and rationing before ultimately defaulting on their debt. As complacency has again prevailed in recent weeks, investors should remember that it is crucial to hedge when they can rather than when they need to. In this environment, they should continue to rigorously implement a few simple rules to limit the impact of rising volatility on their wealth. The first rule remains to tactically hold a significant amount of cash (at least 20% to 30% of their portfolio), which can be easily deployed when the markets have found a bottom and the outlook for investors in 2025 and beyond becomes clearer. Those who wish to remain invested in equities should consider hedging their portfolio, as the cost of hedging against risks from a contested US presidential election and a 10& pullback in equity markets is currently extremely affordable as it cost less than 1% premium to do so.

As recent developments in Europe have shown, European governments aligned with the WEF agenda are even more desperate than their US counterparts to stay in power. In this context, anyone with a view that conflicts with the WEF's warmongering agenda should avoid traveling to Europe, including Britain, which is attempting to extradite individuals for criticizing the current British prime minister's implementation of the WEF agenda. European readers should consider moving their assets out of Europe, including both the EU and Britain, as these governments may ultimately impose capital controls to retain power. This is a common response from governments in their final stages before defaulting.

In the meantime, investors should always remember to follow their process and avoid listening to unscrupulous Wall Street bankers and parrot journalists. These individuals do not have investors' best interests at stake but are focused on selling products that do not meet long-term risk-return goals. As risk management to avoid severe drawdowns should remain a priority for everyone, investors should not be fearful of adding exposure to physical gold, silver, and quality stocks during the upcoming pullback. While In Gold We ALL Trust it, ‘Everybody’s gone surfin’ ’ ‘Surfin’ United Socialist America’…

Read more and discover how to position your portfolio here: https://themacrobutler.substack.com/p/surfin-united-socialist-america

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.