Published by GMG Research

A simultaneous rise in oil prices, the dollar, and interest rates point to a potential economic slowdown, warranting investor caution. If these three fall, expect risk assets to rally. Otherwise, be patient.

Wait until bad news is actually bad for stocks then you take action.

Bitcoin is still in great shape

FED swaps show more than 100 bps of easing priced in for 2024

Stanley Druckenmiller is playing the long game on 2-year notes against 30-year bonds, betting on a steepening yield curve.

With supply-side inflation pressures easing, the Fed's attention is turning to wage inflation, a critical factor for upcoming monetary policies.

BlackRock anticipates we are nearing the end of the rate hiking cycle.

While new mortgage rates have soared past 8%, the average remains at 3.6%. Experts forecast it will take 5 years to get the avg above 5%.

Goldman Sach’s Prime Book: US single stock short flow increased last week and has risen for 13 straight weeks (the longest shorting streak on our record). Even for the names that rallied the most last week, the Prime book did NOT see outsized covering.

Follow us @ gmgresearch

S&P 500: Back to the scene of the crime.

Sugar is beyond flying. People are stress eating Pepsi and snacks.

Good risk/reward for Disney

Lisa Su is the best. AMD will eat Intel’s lunch.

Japanese rates are parabolic but it is just the start. Inflation is too high there.

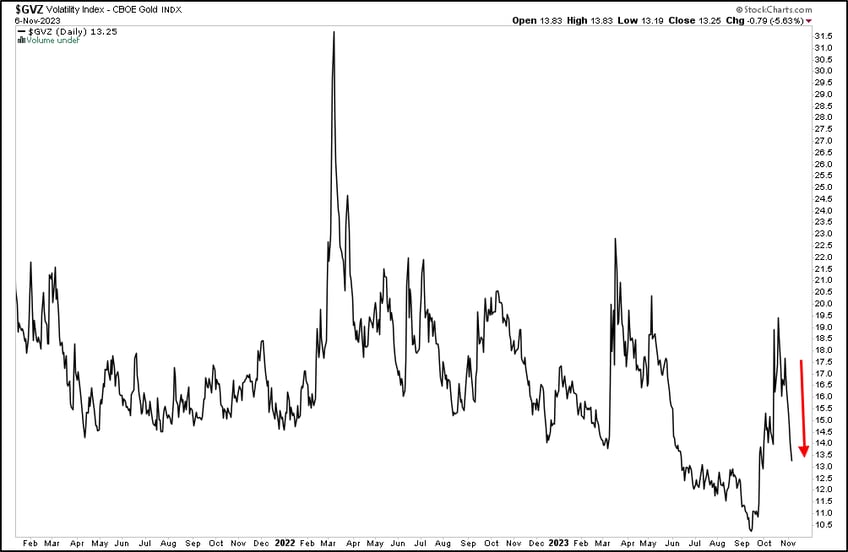

Gold vol falling off a cliff

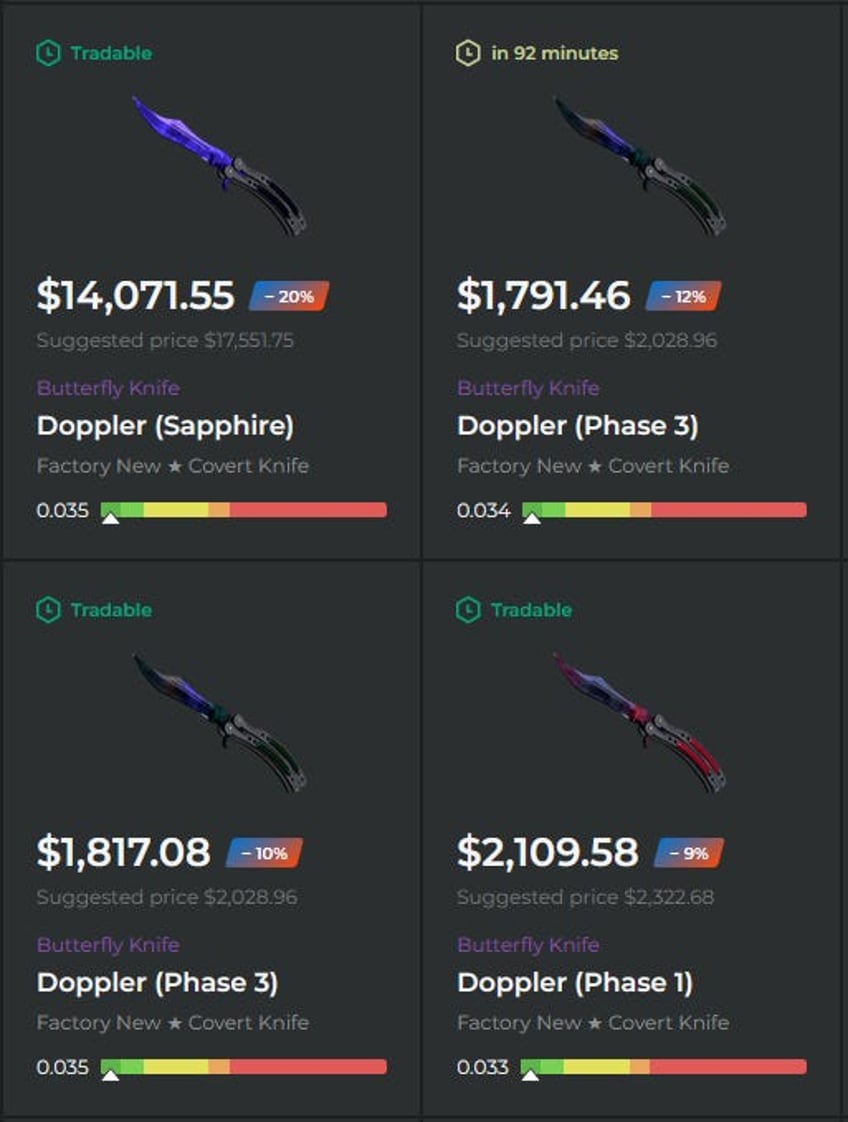

Spreads between the steam market and third party sites are above 30% now. HFT engineers wanted.

Return always wants its risk payment.

NOT INVESTMENT ADVICE. Only for entertainment.

Enjoy the alpha.