An excerpt from Stanphyl Capital's October 2023 letter, discussing their short position in Tesla Inc (NASDAQ:TSLA). The full letter is available on HedgeFundAlpha.com.

In October Tesla reported a disastrous Q3, with sequentially declining deliveries despite continual price-cutting (and it kicked off Q4 with yet more price-cutting!) and diluted GAAP earnings of just .53/share—down 44% (!) from the year-ago quarter. (And around .08 of that .53 came from interest on Tesla’s cash balance, not the business itself!) Operating margin declined to an auto industry-average of just 7.6% vs. 17.2% a year ago, and that 7.6% included massive regulatory credit sales—without them it was only around 5.2%! Tesla is undeniably now just an average-margin car company* forced to continually cut prices to maintain delivery volume, and with annualized earnings of just $2.12/share in an industry with PE ratios of 4x to 8x, it’s generously a $20 stock.*(Tesla’s nearly irrelevant “energy business” accounts for less than 7% of revenue.)

To make matters worse, Tesla recently announced that it will open its U.S. charging stations to cars from most other manufacturers which, in turn, will adopt Tesla’s connector and charging protocol. (Those competitors are building their own networks, too.) Seeing as many people only buy a Tesla instead of a competing EV in order to access those chargers, and seeing as all the competing charging networks will also adopt this protocol while paying Tesla nothing (Tesla open-sourced it), this will cost Tesla far more in lost auto sale profits than the pennies per share it may gain from charging profits.

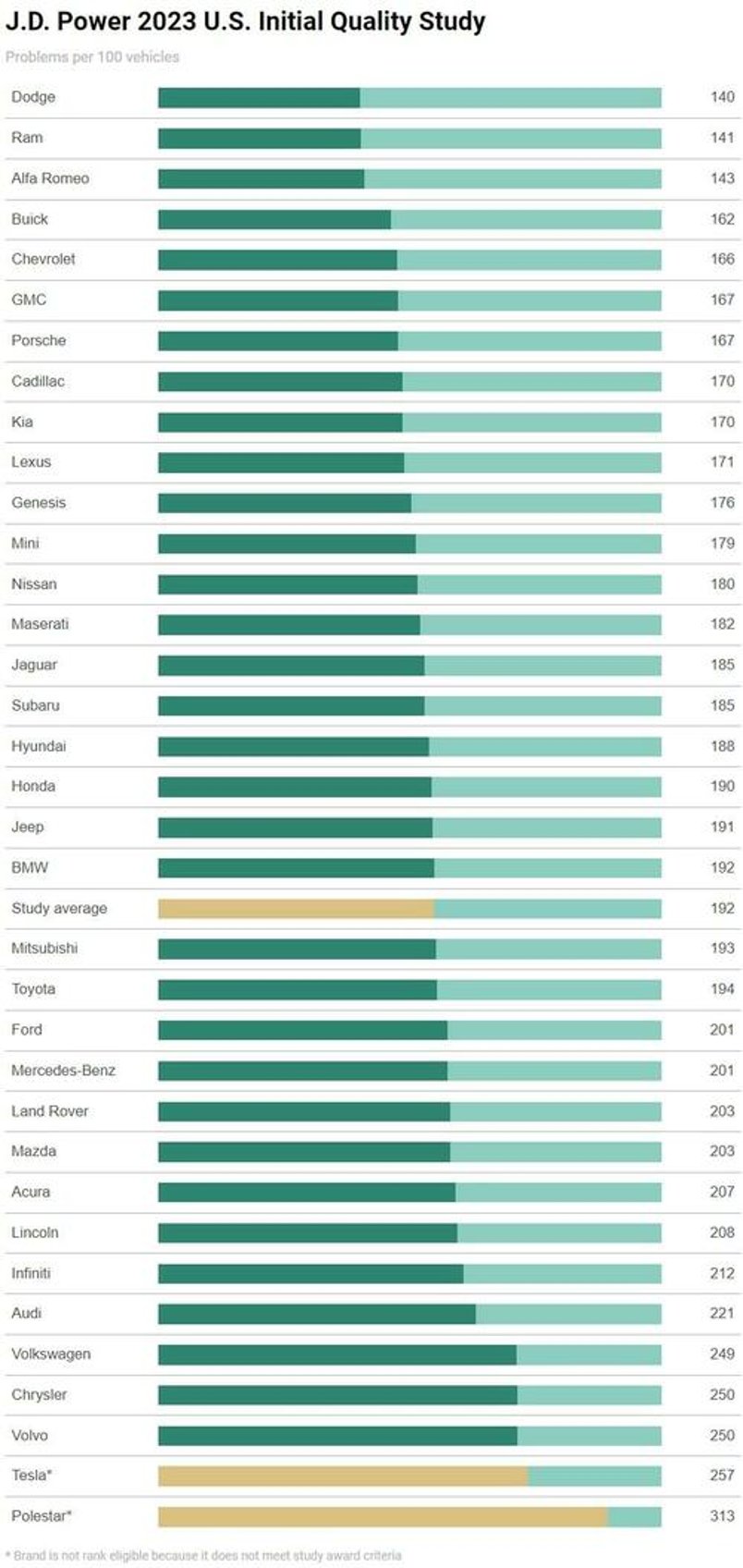

Meanwhile, Tesla has objectively lost its “product edge,” with many competing cars now offering comparable or better real-world range, better interiors, similar or faster charging speeds and much better quality. In fact, Tesla ranks near the bottom of both Consumer Reports’ reliability survey and the 2023 JD Power survey:

Tesla’s poorly-built Model Y faces competition from the much better made (and often just better) electric Hyundai Ioniq 5, Kia EV6, Ford Mustang Mach E, Cadillac Lyriq, Nissan Ariya, Audi Q4 e-tron, BMW iX3, Mercedes EQB, Chevrolet Blazer EV & Equinox EV, Volvo XC-40 Recharge, Honda Prologue and Polestar 3, as well as multiple Chinese models in Europe and Asia. And Tesla’s Model 3 has terrific direct “sedan competition” from Volvo’s beautiful Polestar 2, BMW’s i4, Hyundai’s Ioniq 6 and Volkswagen’s ID.7, as well as many local competitors in China.

And in the high-end electric car segment worldwide the Porsche Taycan outsells the Model S, while the spectacular new BMW i7 and i5, Mercedes EQS and EQE, Audi e-Tron GT and Lucid Air make the Tesla look like a fast Yugo, while the BMW iX, Mercedes EQS SUV and Audi Q8 eTron do the same to the Model X.

And oh, the joke of a “pickup truck” Tesla first previewed in 2019 won’t be much of “growth engine” either, as by the time it’s in meaningful mass-production in 2024 that grotesque-looking kluge will enter a dogfight of a market vs. Ford’s F-150 Lightning, GM’s electric Silverado, the Dodge Ram REV and Rivian’s R1T.

Meanwhile, in August Tesla’s CFO suddenly quit (or was fired) on no notice, the latest in a series of sudden and unexplained Tesla CFO departures. This may be tied into the possibility that the DOJ is close to criminally indicting Elon Musk following the revelation of a massive & systemic Musk-directed consumer fraud regarding the range of Tesla’s cars, his alleged attempted theft of company assets to build himself a house, and Handelsblatt’s story about a massive & systemic Tesla safety cover-up while people continue to die in (or because of) Teslas at an astounding pace. In fact, Tesla’s Q3 10-Q confirmed that the company has received multiple subpoenas regarding all these transgressions. Whether from these crimes or something else, Musk will go down because fraudsters like him always do… even if he thinks he has an “airtight strategy” (blackmail?) to combat these regulators:

Meanwhile, the NHTSA has initiated the first of what will likely be multiple recalls of Tesla’s fraudulently named “Full Self Driving” (even before the aforementioned safety cover-up revealed by Handelsblatt), and in January it was revealed that Elon Musk personally directed its fake, fraudulent promotional video (something extremely similar to what Theranos did with its blood machines and Nikola with its truck). The refund liability potential for Tesla for this is in the billions of dollars, and possibly even the tens of billions if a class action lawsuit proves that the cars involved were purchased solely due to the (fallacious) promise of “full self-driving.” And, of course, there will be a massive “valuation reappraisal” for Tesla’s stock as the world wakes up to the fact that its so-called “autonomy technology” is deadly, trailing-edge garbage that Consumer Reports now ranks just seventh vs. competitors’ systems (behind Ford, GM, Mercedes, BMW, Toyota and Volkswagen) and Guidehouse Insights now rates dead last:

Yet Tesla has sold this trashy software for seven years now…

…and still promotes it on its website via the aforementioned completely fraudulent video!

Another favorite Tesla hype story has been built around so-called “proprietary battery technology.” In fact though, Tesla has nothing proprietary there—it doesn’t make them, it buys them from Panasonic, CATL and LG, and it’s the biggest liar in the industry regarding the real-world range of its cars. And if new-format 4680 cells enter the market, even if Tesla makes some of its own, other manufacturers will gladly sell them to anyone, and BMW has already announced it will buy them from CATL and EVE.

Meanwhile, here is Tesla’s competition in cars...

(note: these links are regularly updated)

- Porsche Taycan

- Porsche Macan Electric Coming in 2024

- Volkswagen ID.3

- Volkswagen ID.4 Electric SUV

- Volkswagen ID.6 SUV EV in China

- Volkswagen ID.Buzz Electric Van

- Volkswagen ID.7

- VW's ID.2all compact EV will cost under €25,000 when it arrives in 2025

- VW’s Cupra Born

- Volkswagen Group Will Spend $200 Billion To Boost Its EV Business

- Audi Q8 e-tron electric SUV

- Audi e-tron GT

- Audi Q4 e-tron

- Audi Q6 e-tron electric SUV

- Audi A6 E-tron due in early 2024 with saloon, estate and hot RS6

- Hyundai Ioniq 5

- Hyundai Ioniq 6

- Hyundai Kona Electric

- Genesis GV60

- Genesis GV70

- Kia Niro

- Kia EV6

- Kia EV9

- Kia EV5

- Kia EV4

- Jaguar’s All-Electric i-Pace

- Mercedes EQS

- Mercedes EQS SUV

- Mercedes EQE

- Mercedes EQE SUV

- Mercedes EQC electric SUV available in Europe & China

- Mercedes EQV Electric Passenger Van

- Mercedes EQB

- Mercedes EQA SUV

- Mercedes CLA (2025 model)

- Ford Mustang Mach-E

- Ford F-150 Lightning

- Ford to launch 7 EVs in Europe in big electric push

- Ford unveils Lincoln Star electric SUV concept as it readies to add four new EVs by 2026

- Chevrolet Blazer EV

- Chevrolet Equinox EV

- Chevrolet Bolt

- Chevrolet Bolt EUV electric crossover

- Cadillac All-Electric Lyriq

- Cadillac to start making 3 more EVs in 2024

- GMC Electric Hummer Pick-Up and SUV

- GM electric Silverado pickup truck

- GMC Sierra EV Denali

- Honda Prologue

- BMW iX1

- BMW iX3

- BMW iX

- BMW i4

- BMW i5

- BMW i7

- BMW Neue Klasse (2025 model)

- Nissan Ariya: All-Electric Crossover SUV

- Nissan LEAF e+

- Polestar 2 sedan

- Polestar 3 electric SUV

- Volvo EX30

- Volvo XC40 Recharge electric SUV

- Volvo C40 Recharge electric crossover

- Volvo EX90 electric SUV

- Acura ZDX

- Jeep will launch 4 all-electric SUVs by 2025, including Wagoneer and ‘Wrangler’ EVs

- Renault Scenic E-Tech

- Renault Zoe electric

- Renault to boost low-volume Alpine brand with 3 EVs

- Renault's Megane E-Tech

- Dodge Ram 1500 REV

- Peugeot e-208

- Peugeot E-2008

- Peugeot E-308

- Peugeot's full-electric 3008 and 5008 SUVs will have up to 700 km range

- Citroen E-C3

- Subaru Solterra

- Subaru accelerates U.S. electric plans with local production and 8-model EV lineup

- Honda, Sony to start premium EV deliveries in 2026

- Honda pours $40 billion into electrification, targets 2 million EV production by 2030

- Rivian electric pickup trucks & SUVs

- Maserati Grecale Folgore

- Mini Cooper SE Electric

- Toyota bZ4X

- Toyota and Lexus Will Launch 10 New EVs By 2026

- Opel Corsa-e

- Opel Astra electric

- Vauxhall Mokka electric

- Skoda Enyaq iV electric SUV

- Skoda Enyaq electric coupe

- BYD presents three BEVs for European market

- Nio expands into Europe and beyond

- Lucid Motors: Electric Luxury Cars

- Fisker Ocean

- Rolls-Royce Electric Spectre

- Bentley will start output of first full EV in 2025

- Aston Martin will build electric vehicles in UK from 2025

And in China...

- BYD is #1 in Chinese EVs, selling FAR more than Tesla

- Volkswagen Group Accelerates Electrification Drive to Boost Presence in Chinese Market

- Audi, SAIC EV Tie-Up a ‘Coming of Age’ for Chinese Automaking

- Audi-FAW's $3.3 billion electric vehicle venture

- Nio

- Xpeng Motors

- Hozon/Neta

- Li Auto

- GAC Aion

- Leap Motors

- GM plans to launch over 15 EV models in China by 2025

- Ford Mustang Mach-E Rolls Off Assembly Line in China

- Cheaper than Tesla: Honda takes aim at China's middle class

- BMW i3 Debuts As All-Electric 3 Series Only For China

- Hongqi

- Geely

- Zeekr Premium EVs by Geely

- Baidu and Geely put nearly $400 million more into their electric car venture

- China-made Mercedes-Benz EQE hits market

- BAIC

- Hyundai, BAIC Motor to inject $942 mn in China JV for EVs

- Toyota partners with BYD to build affordable $30,000 electric car

- Lexus RZ 450e Steers For China

- Dongfeng

- SAIC

- Renault launches sales of first EV in China

- Nissan expects 40% of sales in China to be electrified by 2026

- Changan forms subsidiary Avatar Technology to develop smart EVs with Huawei, CATL

- Chery

- Seres

- Enovate

- Singulato

- JAC Motors

- Iconiq Motors

- Aiways

- Skyworth Auto

- Youxia

- Human Horizons

- Xiaomi announces plans for four electric vehicle models

Here's Tesla's competition in autonomous driving; the independents all have deals with major OEMs...

- Waymo ranked top & Tesla last in Guidehouse leaderboard on automated driving systems

- Tesla has a self-driving strategy other companies abandoned years ago

- Waymo operates robotaxis NOW

- GM’s Cruise operates robotaxis NOW

- Mobileye operates driverless test fleets in Europe and the U.S.

- Cadillac Super Cruise™ Sets the Standard for Hands-Free Highway Driving

- Ford’s hands-free “Blue Cruise”

- Mercedes Launches SAE Level 3 Drive Pilot System

- Honda Legend Sedan with Level 3 Autonomy Now Available in Japan

- Motional (Hyundai) & Uber Announce Autonomous Ride-hail and Delivery Services

- Stellantis Completes Acquisition of aiMotive to Accelerate Autonomous Driving Journey

- Amazon’s Zoox will test its autonomous vehicles on Seattle’s rainy streets

- Baidu to further deploy 200 driverless vehicles in China in 2023

- Baidu Apollo City Driving Max

- Alibaba-backed AutoX unveils first driverless RoboTaxi production line in China

- Pony.ai approved for public driverless robotaxi service in Beijing

- SAIC-backed Xiangdao Chuxing kicks off Robotaxi pilot operation in Shenzhen

- WeRide greenlighted for autonomous road test with empty driver’s seat in Beijing

- GAC-backed Ontime greenlighted for pilot operation of Robotaxi service in Guangzhou

- Xpeng debuts most advanced semi-autonomous driving system to rival Tesla

Here's where Tesla's competition will get its battery cells...

- Panasonic (making deals with multiple automakers)

- LG

- Samsung

- SK Innovation

- Toshiba

- CATL

- BYD

- Northvolt

- Volkswagen to Build Six Electric-Vehicle Battery Factories in Europe

- GM’s Ultium

- GM to develop lithium-metal batteries with SolidEnergy Systems

- SK On and Ford form BlueOval SK, an EV battery joint venture

- Hyundai teams with SK to make batteries for U.S.-built EVs

- Hyundai Motor developing solid-state EV batteries

- BMW & Ford Invest in Solid Power to Secure All Solid-State Batteries for Future Electric Vehicles

- Stellantis affirms commitment to build battery factory in Italy with Mercedes, TotalEnergies

- Stellantis and Samsung SDI to Invest Over $2.5B in Battery Production Plant in United States

- Stellantis and LG to Invest Over $5 Billion CAD in Joint Venture for Li-Ion Battery Plant in Canada

- Stellantis and Factorial Energy to Jointly Develop Solid-State Batteries for Electric Vehicles

- Mercedes-Benz to build 8 battery factories in push to become electric-only automaker

- Mercedes-Benz and Sila achieve breakthrough with high silicon automotive battery

- Toyota pledges $2.1bn more for U.S. EV battery plant

- Toyota to roll out solid-state-battery EVs as soon as 2027

- Nissan preps an old engine plant to make solid-state EV batteries

- Honda and LG Energy Formally Establish Battery Production Joint Venture

- Honda, GS Yuasa agree to collaborate in lithium-ion batteries

- Daimler joins Stellantis as partner in European battery cell venture ACC

- Renault signs EV battery deals with Envision, Verkor for French plants

- Nissan to build $1.4bn EV battery plant in UK with Chinese partner

- Nissan Announces Proprietary Solid-State Batteries

- Foxconn breaks ground on first EV battery plant

- Envision-AESC

- ONE

- EVE

- Freyr

- Verkor

- Farasis

- Microvast

- Akasol

- Cenat

- Wanxiang

- Eve Energy

- Svolt

- Romeo Power

- ProLogium

- Morrow

- Amprius

- CALB

And here's Tesla's competition in storage batteries...

- Panasonic

- Samsung

- LG Energy Solutions

- CATL

- BYD

- AES + Siemens (Fluence)

- Hitachi ABB

- Toshiba

- Saft

- Johnson Contols

- EnerSys

- SOLARWATT

- Sonnen

- Generac

- GM Energy

- Canadian Solar

- Kokam

- Eaton

- Tesvolt

- Leclanche

- Lockheed Martin

- Honeywell

- EOS Energy Storage

- ESS

- Electriq Power

- Redflow

- Primus Power

- Simpliphi Power

- Invinity

- Murata

- Bollore

- Adara

- Blue Planet

- Aggreko

- Orison

- Powin Energy

- Nidec

- Powervault

- Kore Power

- Shanghai Electric

- LithiumWerks

- Natron Energy

- Energy Vault

- Ambri

- Voltstorage

- Cadenza Innovation

- Morrow

- Gridtential

- Villara

- Elestor

- SolarEdge

- Q-Cells

- Huawei

- Toyota

- ADS-TEC

- Form Energy

- Enphase

- Sumitomo Electric

- Stryten Energy

- Freyr

- Growatt

- Polarium

- Alfen

- Quino Energy

- Gotion

- ZincFive

- Dragonfly Energy

- Salgenx

- Lunar Energy

Thanks,

Mark Spiegel