This is how bubbles collapse: the "vital few" 4% sell at whatever the market will bear, pushing prices down, and the 64% awaken to the rapidly narrowing window for locking in bubble capital gains.

Here's how we can tell if a speculative bubble is a bubble: everyone says it isn't a bubble - the market has reached a "permanently high plateau" because valuations are now fairly priced, etc.

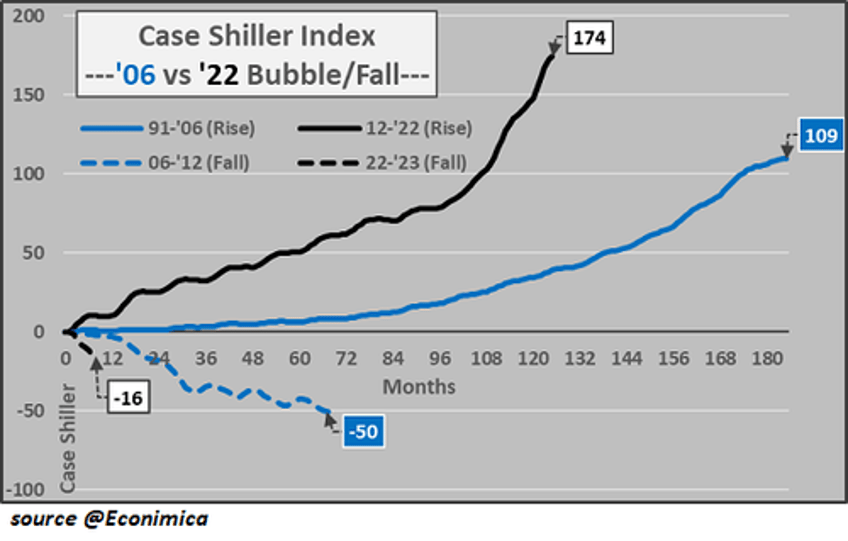

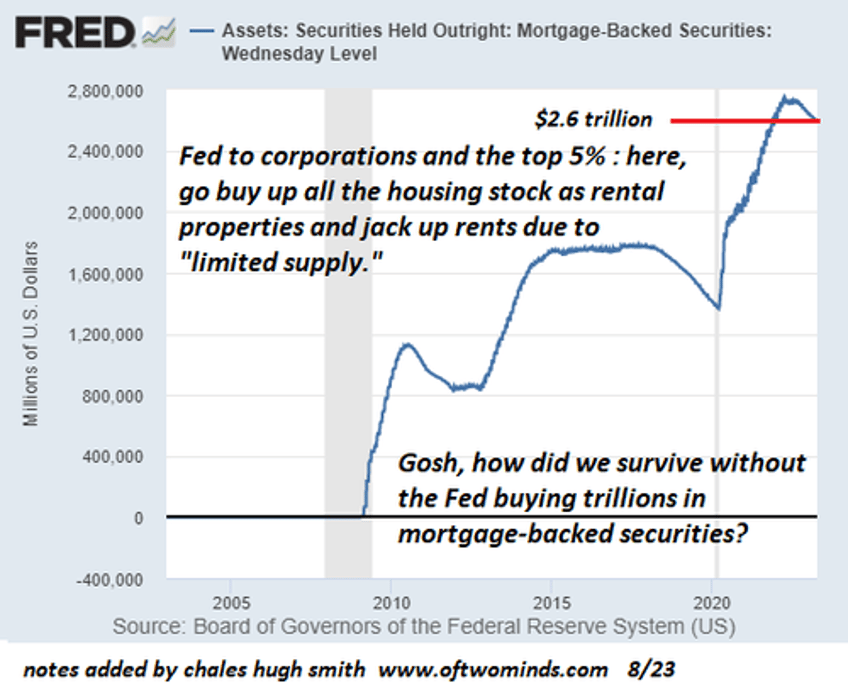

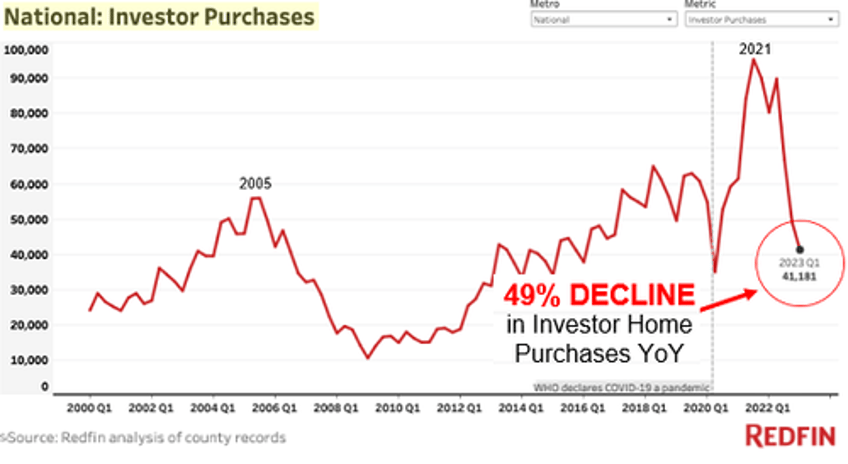

Housing globally is in a bubble (See chart below) which we're constantly assured isn't a bubble. As I discussed yesterday ( The Problem Isn't a Housing Shortage, It's the Concentration of Ownership by the Wealthy), this bubble is fundamentally an artifact of central bank and government policies that enrich the already-rich, who were incentivized to outbid each other with low-cost credit to snap up "investment properties" with their "surplus capital" that generate more income and capital gains that cash, which until recently was "trash" due to near-zero savings yields.

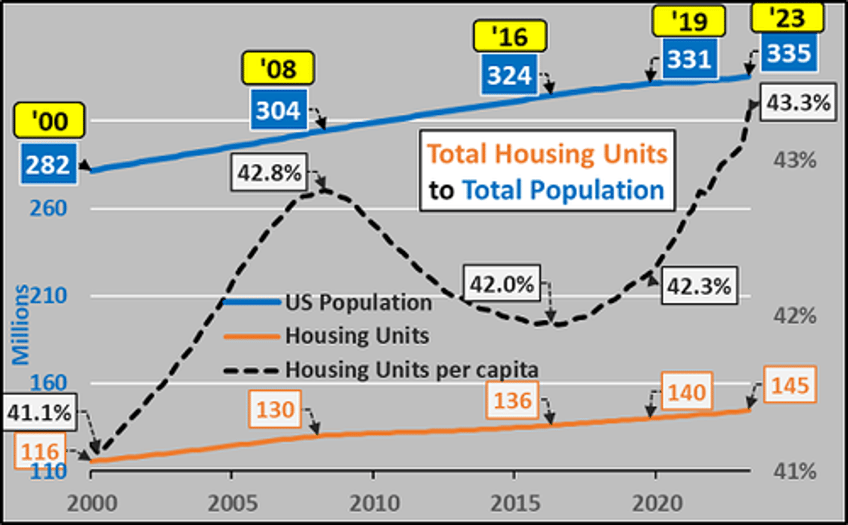

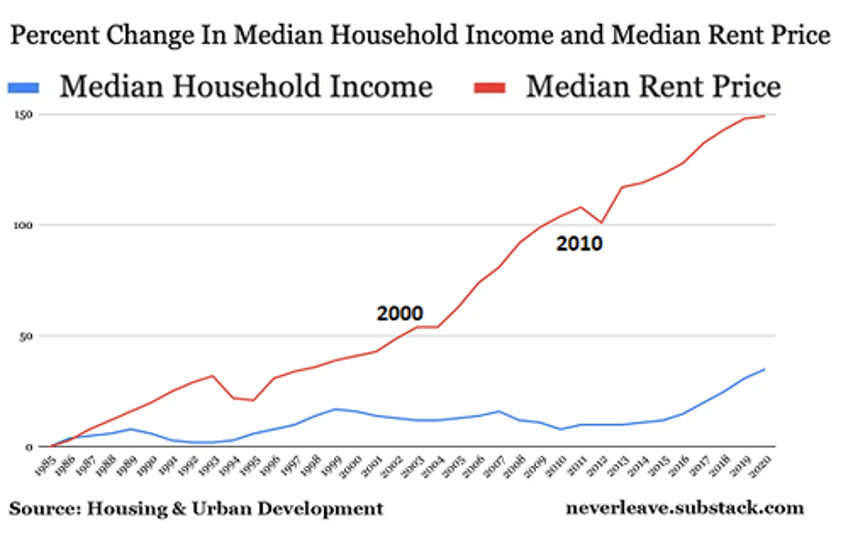

Many wealthy families collect multiple properties via inheritance, as second (vacation) homes or as long-term rentals. This hoarding is (as I explained) the only possible result of policies that asymmetrically distribute credit, and thus income and capital gains, to the already-wealthy rather than to the not-yet-wealthy. This policy-driven hoarding / concentration of housing in the top 10% is one factor driving rents higher due to artificial scarcity--a scarcity created by central bank and government policies, not the "market."

(Regulations and bureaucratic friction that push the cost of new constriction to the moon are another factor, but that's a topic for another post. I also want to stipulate that I am not talking about people of modest means who acquired rental properties by scrimping and saving their earned income and making sacrifices for decades--a strategy that is part of Self-Reliance; I'm talking about the already-wealthy who are seeking to "maximize returns" on their unearned "surplus capital.")

A systemic driver of this bidding war for rental properties is the "AirBnB" model of monetizing individual properties to compete with hotels and resorts for lodging. This model is called short-term vacation rentals (STVR), and the already-rich have been pouring their wealth into STVRs for the past 15 years.

This has led to an artificial scarcity of housing in popular tourist destinations. It's not uncommon to visit tourist-magnet cities and see entire buildings with only a few lights on, as many units are owned by the wealthy and left empty, as rents are not as important as having a safe place to "park surplus capital." Thousands of other units have been pulled from the long-term rental market to reap the higher returns of STVRs.

Many cities and locales are finally pushing back against the housing hoarding of the global wealthy, taxing empty units and limiting and/or licensing STVRs.

As I explained yesterday, the flood of post-pandemic price-insensitive "revenge spending" pushed tourist lodging rates to the moon as resorts and STVRs competed on exploiting price-insensitive tourists.

What's often forgotten about real estate is prices are set on the margin. The Pareto Distribution is a handy tool for understanding how an entire neighborhood's home prices are re-set by a mere handful of sales.

The Pareto Distribution is often summarized as the 80/20 Rule. The 80/20 rule can be distilled down to 80% of 80% and 20% of 20% to the 64/4 Rule: the "vital few" 4% exert outsized influence over the 64% mass. So 4% of sales can re-set the valuation of 64% of all neighboring houses.

So 40 houses selling for around $450,000 will re-set the valuation of 1,000 nearby homes from $800,000 to $450,000. This is why an apparently modest number of fire sales of money-losing STVRs will dissolve the floor under bubble valuations.

The STVR bubble was entirely an artifact of 1) historically absurdly low mortgage rates and 2) post-pandemic price-insensitive "revenge spending". Both are over. There is no way the bottom 90% can afford homes at today's bubble valuations, so the pool of buyers is limited to the top 10% already-wealthy, whose appetite for owning "surplus capital" rentals vanishes once the lofty weekly rates and low vacancies reverse into high vacancies and collapsing rental rates.

The bottom 90% have tapped out their pandemic windfalls and their lines of credit. The erosion of the global economy will deflate bonuses, capital gains and all the other sources of the top 10% "wealth effect," and credit will tighten as risk aversion and higher rates turn the spigot of easy credit off for the already-wealthy.

The collapse of the STVR bubble will topple a line of dominoes as corporate owners will awaken from their fantasies and realize they better sell now to lock in their gains before they vanish. Wealthy households who "land-banked" properties for capital gains and places to park "surplus capital" will also awaken to the the need to lock in gains by selling.

This is how bubbles collapse: the "vital few" 4% sell at whatever the market will bear, pushing prices down, and the 64% awaken to the rapidly narrowing window for locking in bubble capital gains. This rush for the exits triggers a strike in buyers, who realize there is no way to know how low valuations will fall, and so waiting for a bottom makes much more sense that playing "catch the knife," i.e. buying as a bubble deflates, hoping you don't get burned by prices falling after overpaying.

* * *

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century. Read the first chapter for free (PDF)