Contents: 1400 words

- Intro

- Porsche Pulls Back on EVs

- PGMs Rising

- PGM Demand Lags But on the Move Now

- Mining Costs are Killing Supply

- Platinum Deficits Persist

- How to Play it

- Early Alert System

- Bottom Line: They like Amplats

- BONUS: The 2024 BMO Platinum Week Report

1- Intro:

This week’s narrative entitled “The next uranium?” written by Evan Lorenz and presented by Grant’s Interest Rate Observer begins by addressing the delayed transition to electric vehicles (EVs) by prominent automakers like Porsche. This delay is significant as it underscores broader implications for the platinum group metals (PGMs) market.

The newsletter suggests that the prolonged use of internal combustion engines (ICEs) might present a silver lining for platinum bulls, given the continued demand for PGMs in traditional and hybrid vehicles.

2- Porsche Pulls Back on EVs

Porsche A.G. recently acknowledged that the shift to electric vehicles is taking longer than anticipated.

“The transition to electric vehicles will take longer than we assumed five years ago,” Porsche A.G. July 22nd

The luxury automaker reported a 51% drop in first-half sales of its Taycan sedan, an electric model priced over $100,000.

EV Target is Too Ambitious…

Furthermore, Porsche admitted it would not achieve the goal of having 80% of its vehicle lineup be emission-free by 2030. This admission mirrors the broader automotive industry's struggle with EV adoption, impacting companies from Ford to Aston Martin.

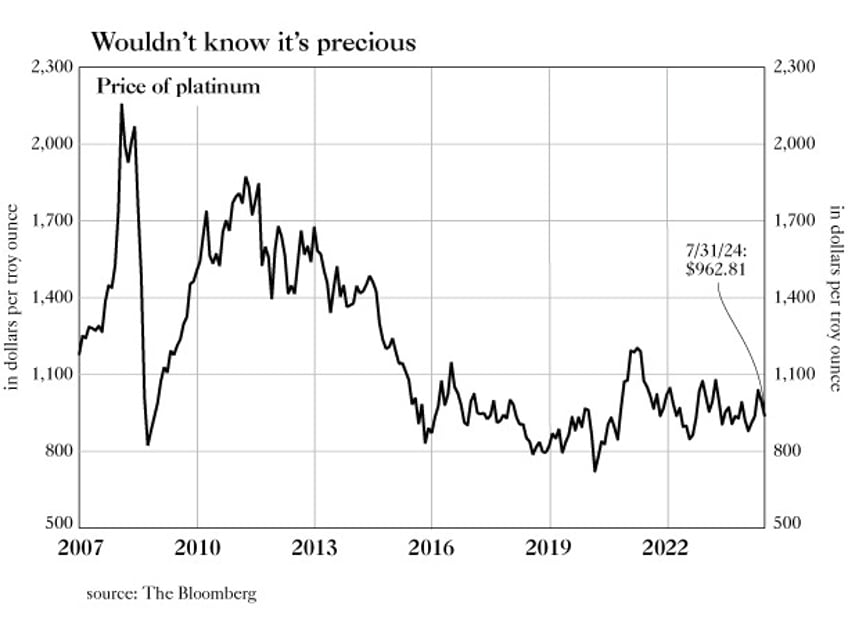

3- PGMs Rising

Long-suffering investors in PGMs might find optimism in these developments. Grants posits a bullish stance on platinum and Anglo American Platinum Ltd., the largest platinum miner.

The author, Evan Lorenz notes the unique attributes of the six PGMs—ruthenium, rhodium, palladium, osmium, iridium, and platinum—which are crucial for their catalytic properties in car exhaust systems.

4- PGM Demand Lags But on the Move Now

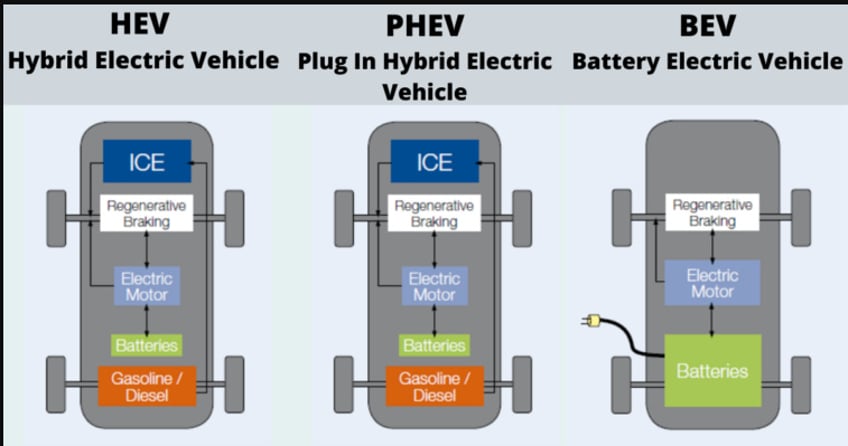

[N]ot all EVs are created equal.- Evan Lorenz

Despite concerns that growing EV sales might diminish PGM demand, not all EVs are the same. Battery electric vehicles (BEVs) do not use PGMs, but hybrid and plug-in hybrid electric vehicles (PHEVs) do. These hybrids, with their smaller and intermittently running engines, still require significant amounts of PGMs to meet emission standards. Thus, hybrid vehicles may sustain PGM demand even as BEVs grow in market share.

Anglo American Platinum forecasts that battery EVs will account for 13% of global fleet sales in 2024, up from 12% in the previous year, but still below initial expectations of 14%-16%. Conversely, plug-in hybrids are expected to make up 6% of global sales in 2024, more than doubling their share from 2022. These trends suggest that the decline in PGM demand might not be as severe as feared.

8- Early Alert System

To add a tactical two-cents to all this: In the past recoveries in PGMs could take years as Copper got all the attention. But this time, after over a year of higher rates, (some say too high) and a Chinese economy on the verge of Japanification, a global recession will likely bring multiple bazookas in the form of fiscal stimulus from China and monetary ease in the US. This time, we feel, it is unlikely Platinum will remain subdued long.

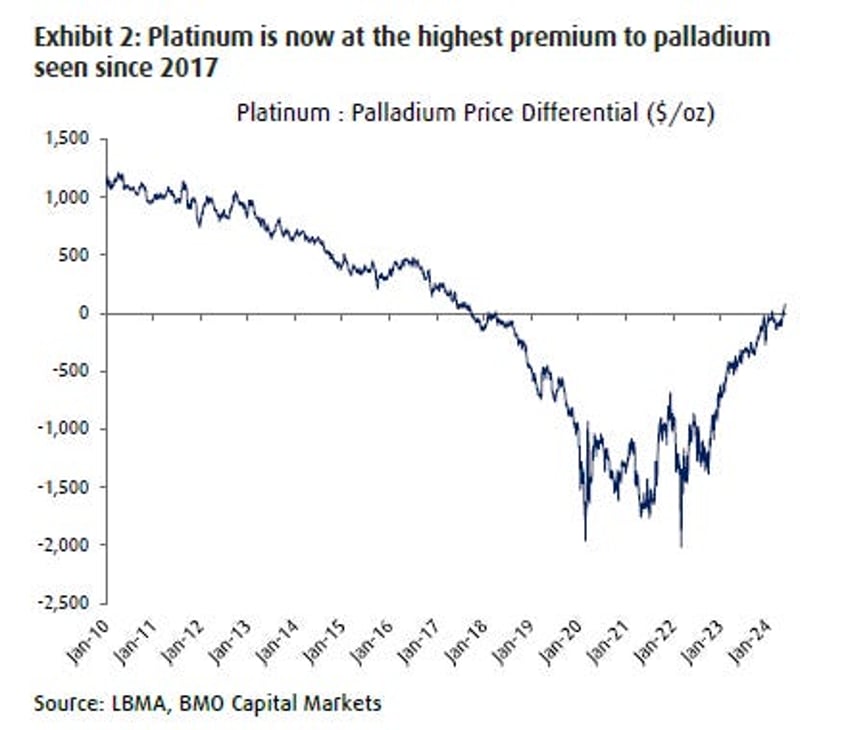

It is also worth noting that Platinum has finally turned premium to Palladium again. Watch for Platinum spreads to go backwardated if the PGM flip-flop persists. If that happens, the market will feed off itself into a massive bull run over a 2 year period.

The PGM investment market is beginning to rotate back into Platinum…

There are then two things worth watching for emerging problems in low price sustainability. The first is talk of stock drawdowns, which will we suspect come from Banks who handle the business.

Palladium (orange) went Backwardated in 2019. It may Soon be Platinum’s (yellow) turn…

The second and more observable is the platinum futures term structure. If backwardation starts there, and then creeps.. that will create the bull market recipe similar to Palladium starting 2019. Current the market is in contango going out 6 months.

More here

Free Posts To Your Mailbox