The Case for Strategic Allocation to Gold for Swiss Pension Funds

Contents:

- Introduction: Europe Has a Problem

- Swiss Pension Funds' Recent Performance

- The Strategic Role of Gold

- Gold Actually Frees Up Cash Now

- Impact on Portfolio Risk

- The Swiss Conclusion

- Full Reports

Find below our breakdown of report by the World Gold Council comparing gold to bonds in the euro zone with an eye on Swiss pension funds, amidst their recent struggles1.

1- Introduction: Europe Has a Problem

There is a problem in Europe. And that problem stems from a dogmatic belief that bonds always and everywhere reduce risk. The data of the last year proves that otherwise. Smart banks like UBS have been telling their clients to be careful for over the last 18 months. Now, the data proves it. And the WGC lays the whole “bond as safe Haven“ fallacy bare for all to see in what amounts to a statistical mandate for pensions to buy gold and sell bonds.

In short: data like this in combination with the Bond markets’ increasing portfolio risk translates to bigger allocations into gold globally. Euro-Keynesian fund managers who had been reticent to buy, will soon wake up and smell the Gold.

These types of reports by WGC, (frankly, not historically known for being impulsively bullish on gold) aren’t so much recommendations as part of a bigger picture movement. (Also find reattached the first report telling fund managers to buy gold (posted in December 2023) at bottom)

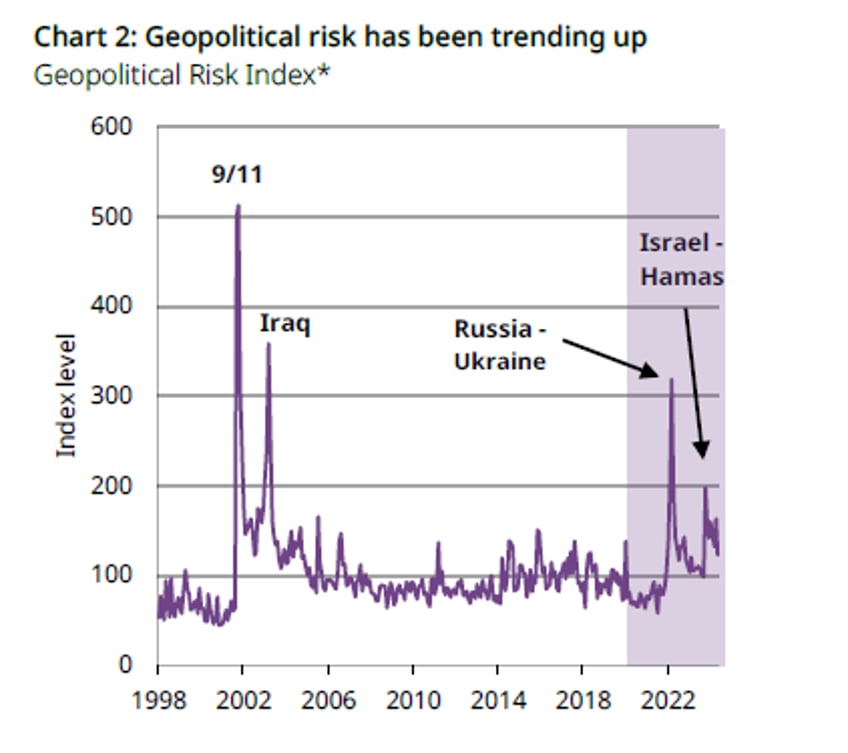

Swiss pension funds are facing an increasingly uncertain economic environment, with inflationary pressures, geopolitical risks, and the end of an era of low interest rates creating challenges. In this context, gold emerges as a strategic asset that offers diversification, risk management, and potential for long-term growth.

2- Swiss Pension Funds' Recent Performance

In the past few years, Swiss pension funds have had to navigate a volatile financial landscape. Contrary to expectations that market conditions might stabilize post-pandemic, geopolitical tensions, rising energy prices, and inflation have created a challenging environment.

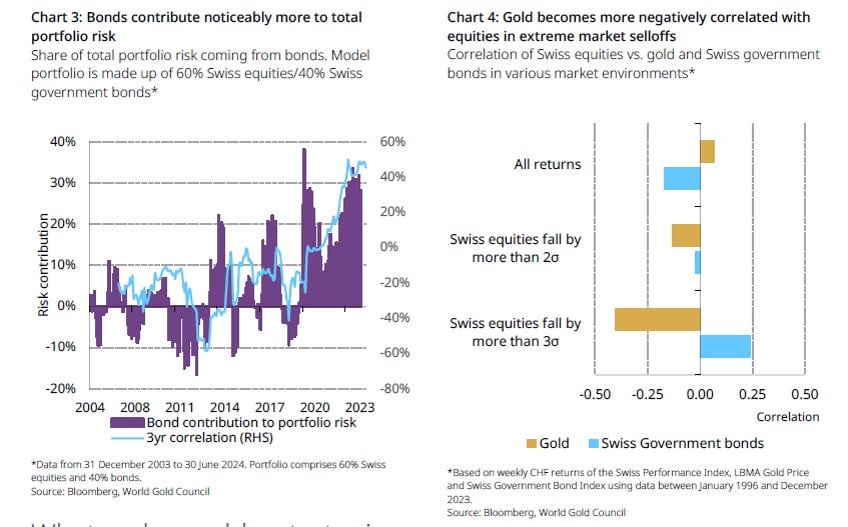

WGC says the quiet part out loud. Bonds contribute to risk, they do not mitigate it.

Notably, 2022 saw a significant drop in pension fund asset values due to simultaneous declines in both bond and equity valuations. The average coverage ratio fell from 115.3% to 104%. Although there has been some recovery, with the coverage ratio estimated at 112% by mid-2024, the ongoing global economic uncertainties make it essential for pension funds to maintain these gains

3- The Strategic Role of Gold

Gold has historically served as a hedge against systemic risks and a reliable store of value. During periods of extreme market stress, gold's negative correlation with equities and other risk assets increases, providing downside protection.

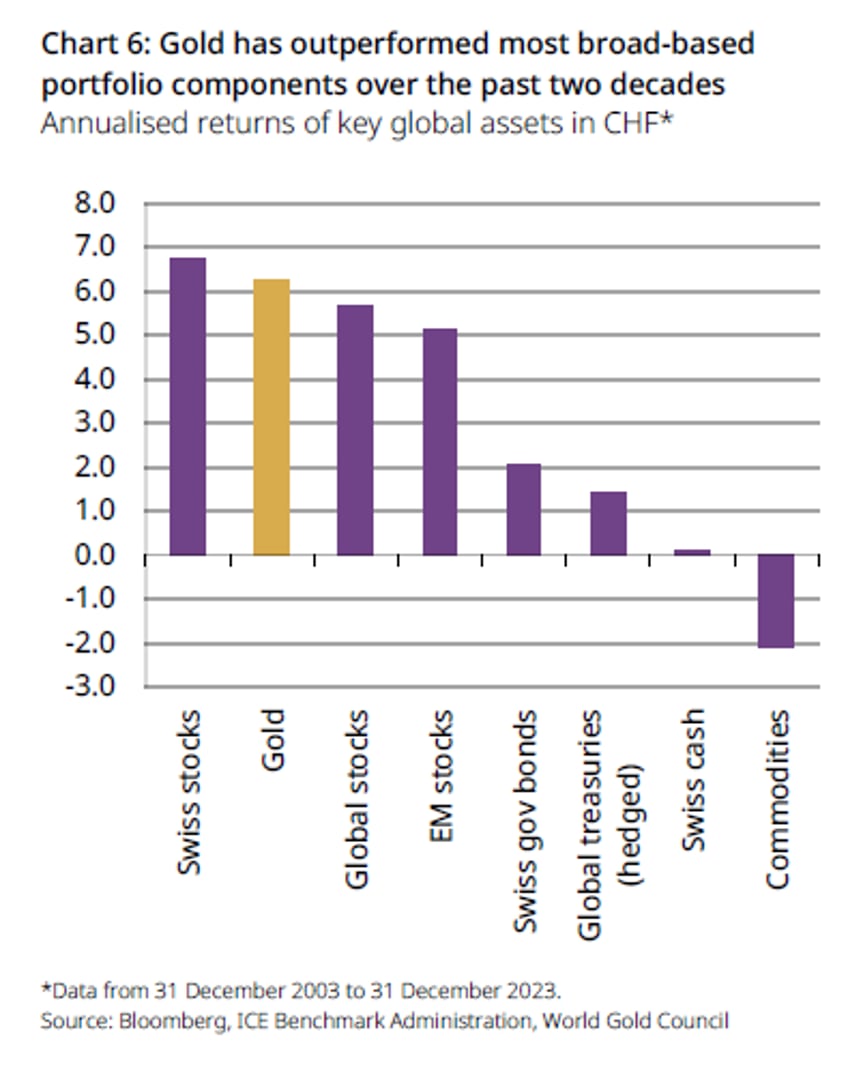

Gold has outperformed most broad-based portfolio components over the past two decades and provides downside protection….

In the Swiss context, gold has generated positive returns in eight of the ten worst years for the Swiss equity index. This resilience makes gold a valuable addition to pension portfolios, enhancing risk-adjusted returns and providing liquidity during market downturns

4- Gold Actually Frees Up Cash Now

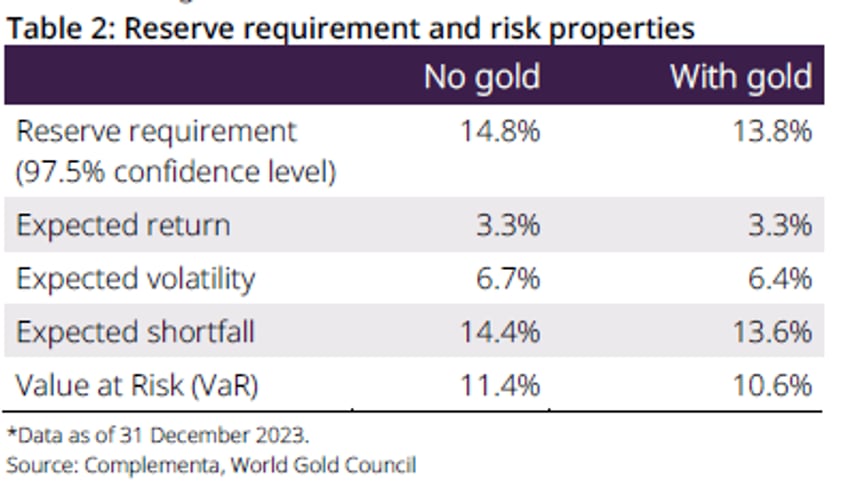

Allocating a portion of a pension fund’s portfolio to gold can help reduce the reserve requirements mandated by Swiss regulations. For a typical Swiss pension fund, which might allocate around 1% to 5% of its assets to gold, the reserve requirement could be reduced from 14.8% to 13.8%.

This reduction is achieved without sacrificing expected returns, thereby improving the return on reserve requirement ratio. By diversifying into gold, pension funds can maintain a higher coverage ratio, ensuring their ability to meet future pension obligations even in turbulent time

Continues here

Free Posts To Your Mailbox