Subscribe on our website www.gmgresearch.com

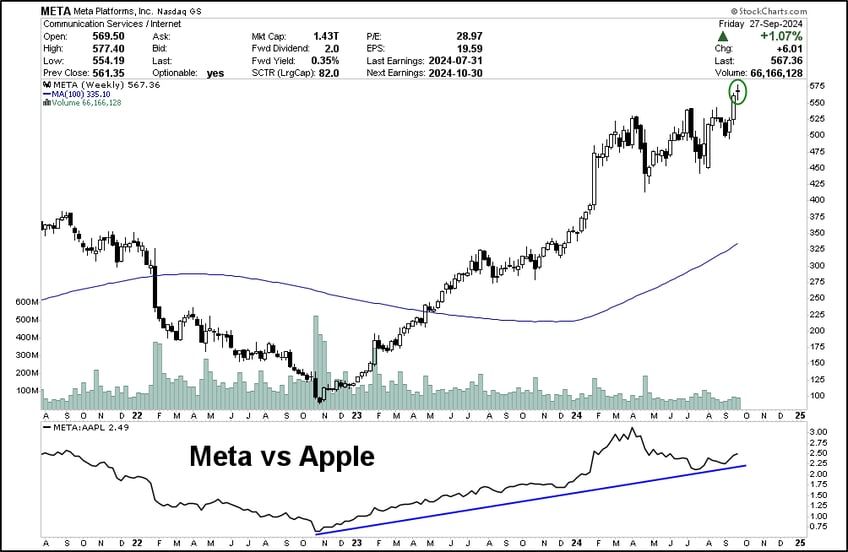

Meta: We believe the long Meta / short Apple theme will continue. Companies are racing to dethrone the iphone with other devices. It is only a matter of time.

Openai already confirms they are working on a device, link here.

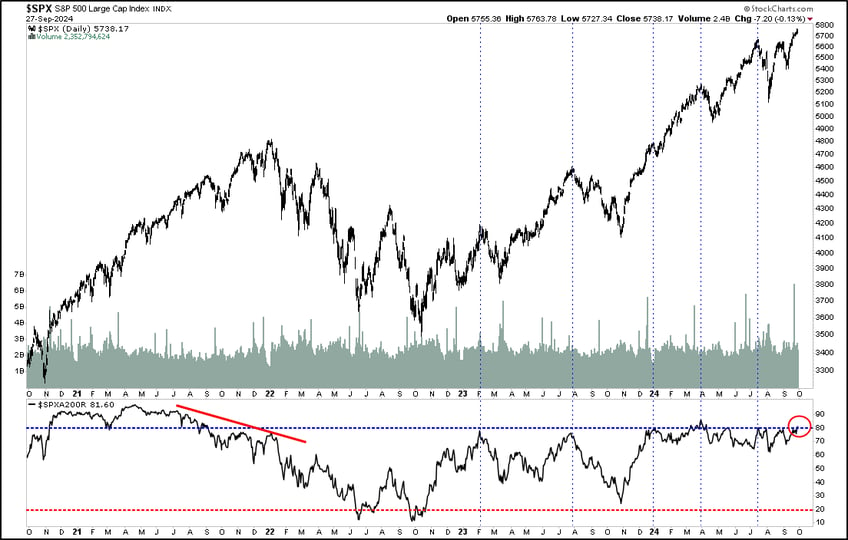

Macro: Most “investors” on Wall Street are brainless with a bottom-up mindset (CFA) which can lead to a lot of confusion when macro forces take over the narrative.

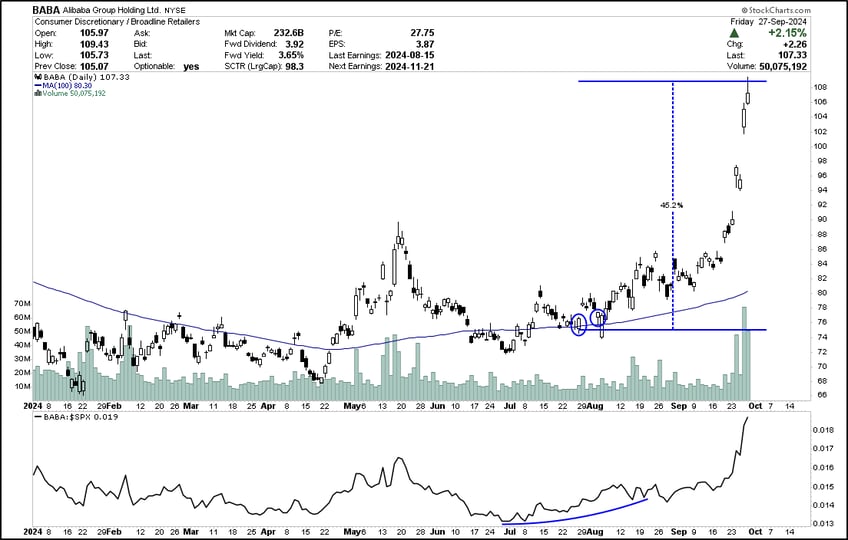

China shot the stimulus bazooka last week at their markets. The STAR 50 index is up 12% today alone. This will contribute to inflationary pressures in Japan. This will result in higher rates in Japan interest rates, a stronger yen (JPY), and lower equity markets.

The Nikkei index experienced a significant decline on Friday night, indicating potential volatility ahead.

Breadth in the S&P is starting to look a bit stretched

Alibaba: Up +42% since our call in July

Tencent: Up +44% too.

Meta: The major narrative will be the fall of the iphone to other devices. Long.

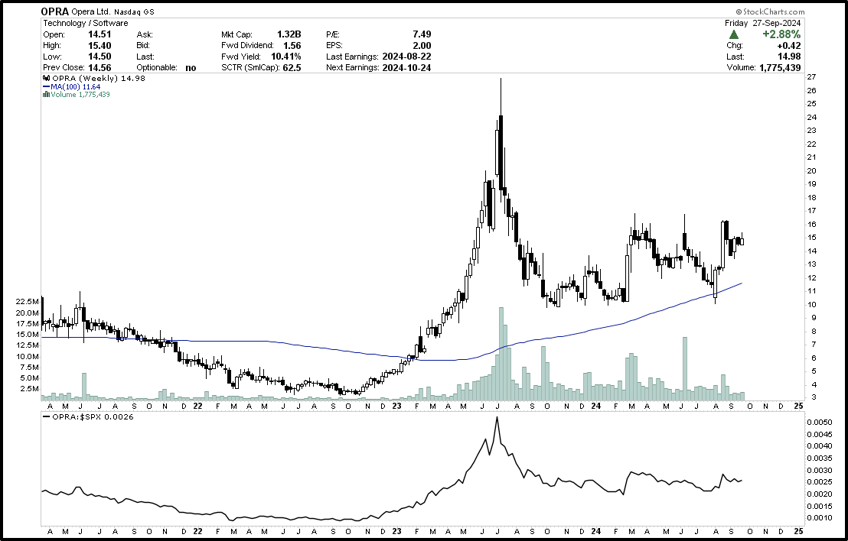

Opera Browser is catching our eye.

AMD: Looking to breakout

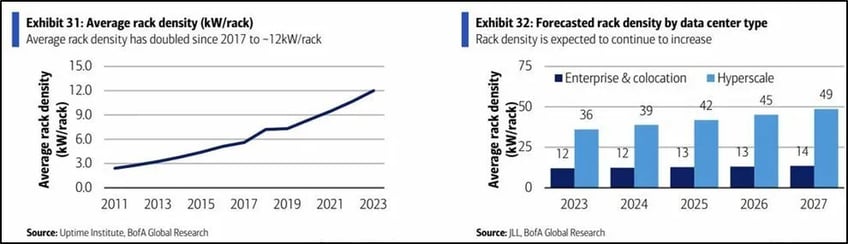

Johnson Controls (JCI) will win the race in liquified datacenter cooling.

Understanding Factor Exposures

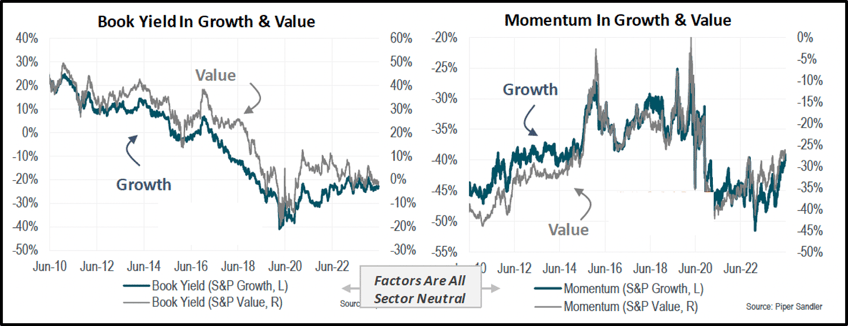

Growth: Earnings growth is the best growth factor.

Value: FCF to EV is the best value factor.

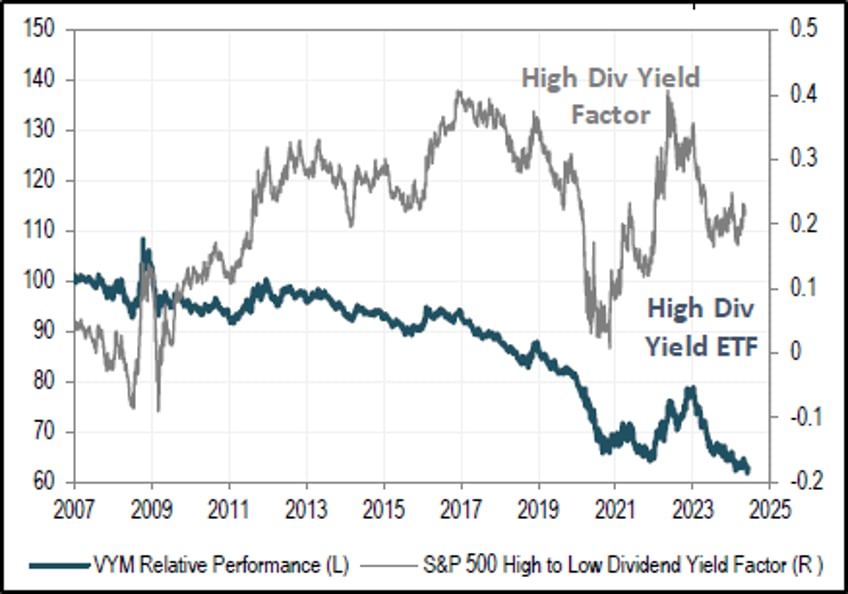

High div yield” factor exposure is way better than the HY ETF.

Factor Leaders Are Not Bound By Size Or Sectors.

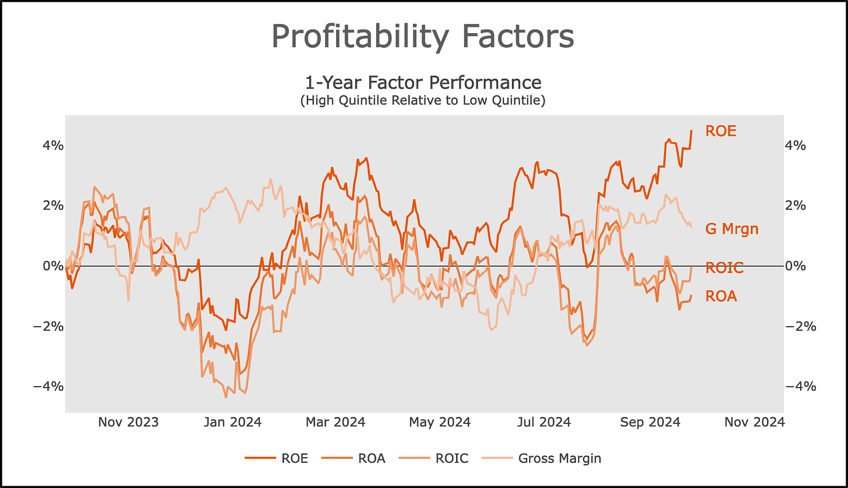

ROE is the best performing profitability factor right now.

Return always wants its risk payment.

NOT INVESTMENT ADVICE. Only for entertainment.