Assessing The Broader Impact Of DeepSeek

As regular readers know, we were slightly ahead of the curve on the DeepSeek news, betting against Nvidia (NVDA) on Friday in our trading Substack,

And warning ZeroHedge readers on Saturday,

— Portfolio Armor (@PortfolioArmor) January 25, 2025

Now that everyone has jumped on this bandwagon, we will be presently turning our attention elsewhere. Before we do though, we're going to share one of the more thoughtful posts we've on the implications of the Chinese AI breakthrough, by our friend David Janello, PhD, CFA.

For those unfamiliar with Dr. Janello, he is veteran options trader and technologist who literally wrote the book on momentum options trading:

Before we do that, a couple of quick reminders:

- To get a heads up when we place our next trade, you can subscribe to our trading Substack/occasional email list below.

- If you want to add some downside protection here, you can use the Portfolio Armor optimal hedging app, which you can download by aiming your iPhone camera at the QR code below, or by tapping here, if you are reading this on your iPhone.

Now on to Dr. Janello's guest post.

The Competency Crash

The recent market decline originating from the DeepSeek AI release has the potential to be big. Really, really big. Much bigger than the 500 billion dollar decline in NVIDIA market cap so far. Bigger than the promise of “cheap” AI. If all goes well, it will provide the catalyst for an extinction level event that hits Silicon Valley’s H1-B business model and transfers wealth to a new generation of technically competent founders and co-founders.

What is the impact so far? After DeepSeek’s AI release, the biggest loser in terms of total market cap is NVDA (-15.3% at this time). A technically proficient firm by anyone’s definition. Long term, NVDA will be fine. Everyone there is used to 80-90% declines in the stock price and they have a good shot at recovering back to the all time highs in a few years or maybe a decade if things take a bit longer than usual. At the same time, NVDA customers’ share prices are down much less. Google, for example, is trading down about 3.5%. If NVDA’s sales crash, this benefits GOOG to a certain extent because it lowers capital expense and increases profit, all things being equal. But this is a first order effect. What about second order impacts from DeepSeek’s open source product as it gets integrated into other product offerings? Or third order effects from engineers applying insights from the DeepSeek development approach, which is radically different from Silicon Valley’s current operating procedure?

Silicon Valley’s current approach to engineering is most eloquently expressed by Elon Musk:

The reason I’m in America along with so many critical people who built SpaceX, Tesla and hundreds of other companies that made America strong is because of H1B.

— Elon Musk (@elonmusk) December 28, 2024

Take a big step back and FUCK YOURSELF in the face. I will go to war on this issue the likes of which you cannot…

Musk describes the philosophy of the quintessential non-technical manager, which he is. His H1-B visa “employees” are cheaper per hour than highly skilled American engineers and developers. But they are much less productive. The Silicon Valley solution to the technical skills gap is to hire larger teams of engineers, on the assumption that the larger team will still be cheaper than using more expensive native talent. As Joseph Stalin said, “Quantity has a Quality all of its own.” Although this insight won World War 2, it does not work in engineering. Which is why Boeing planes are dropping from the sky and Tesla cars are exploding in the 2020s, as opposed to earlier decades when product liability concerns forced manufacturers to adopt a more meritocratic approach to product design — after a few high profile failures like the Ford Pinto. More important for Musk than the exploding cars is looming competition from Chinese electric car companies. We will soon see what happens when Musk’s cars go head to head in the marketplace with cars manufactured by firms with an engineering culture and no H1-B labor.

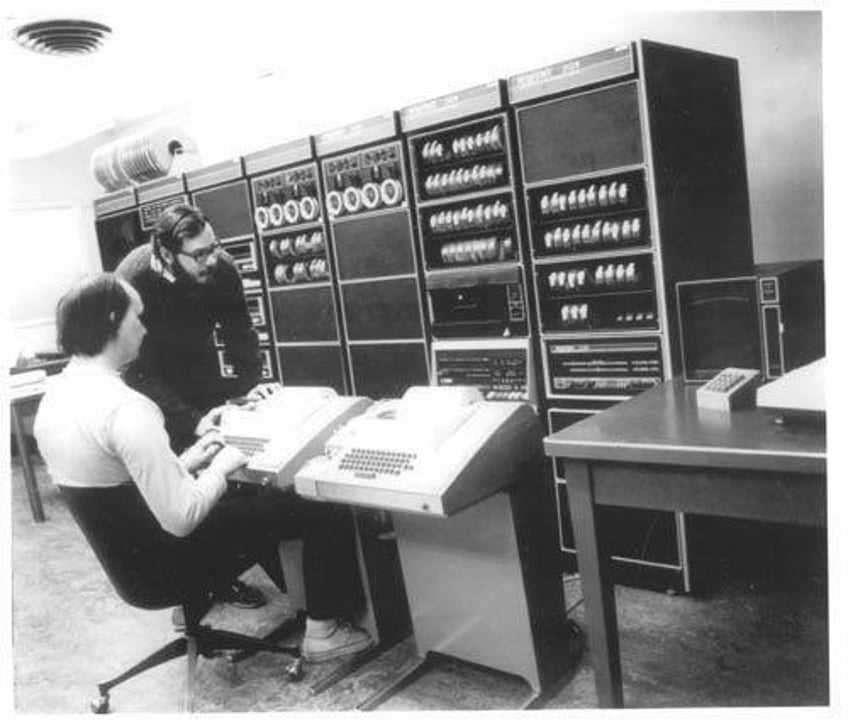

The real lesson behind the successful DeepSeek AI project is that they used a small team of highly trained developers to target a narrow, well defined use case. Although this is almost unheard of in Silicon Valley, it is nothing new in technology. To cite one example, the UNIX operating system that powers 95% of the Internet was developed in three months, by three developers (Dennis Ritchie, Ken Thompson, and Brian Kernighan). At the same they were developing UNIX, Dennis Ritchie designed and implemented the C programming language, which together with its offshoots C++ and Java underpin the vast majority of computer programs written today.

The H1-B problem, however, is much more ominous than the problem of efficiency alone. If an American engineer can do the same job for a lower cost than the army of H1-Bs, this is not the worst thing that can happen. An important factor in favor of the H1-Bs is that they have a very deep labor pool. If one engineer fails, there are always a couple of hundred thousand more to fall back on. The real problem occurs when the H1-Bs cannot complete the project at all, even with larger teams. When this happens, the Silicon Valley response is to dumb down the projects to fit the ability level of the underachieving engineering pool. This explains the explosion of technically underwhelming social media and AI applications that have gotten close to 100% of Silicon Valley Venture Capital Funding in recent years, as opposed to firms doing interesting things like high performance, real time processing, embedded systems, hardware and other advanced technology.

DeepSeek didn’t fall into this trap because they are a hedge fund. Developers working on High Frequency Trading projects don’t have the luxury of hiring large teams of underachievers, who might easily generate enormous trading losses in the unlikely event that they finished the project in the first place. Hedge fund trading is also highly intermittent in nature. Although they didn’t mention it in the news articles, it’s not hard to imagine that the edge in some of the DeepSeek hedge fund strategies was evaporating, and the technical managers at the firm redeployed their extra engineers to try something new while they reworked the strategies to adapt to changing market conditions.

This raises the question: what happens next?

Here are a few possibilities:

A group of unemployed High Frequency Trading System Developers decides to combine the open source component of the Deep Seek AI algorithm with a high performance, open source search engine that was mysteriously wiped from the Internet two years ago to take on slower moving competitors like Google in custom hybrids of AI and search technology, together with cheaper ads to kneecap the competition. NOTE: if the github link disappears I will post full source code for this search engine for download on the Nuclear Option Trading Substack. Because they are not using venture capital, the technical team in question can get their product to market much faster than their well connected peers who are forced to waste time explaining sophisticated engineering concepts to low IQ investors at pitch deck meetings on Sand Hill Road and other Silicon Valley hotspots.

A group of electrical engineers uses free resources written by senior ex-Soviet and US engineers to produce electronic defense products based next-generation FPGA System On A Chip technology from AMD. Sales of this technology were actually down last quarter, another sign of Silicon Valley ignoring technology that isn’t H1-B friendly. This opens up even bigger opportunities for startups without H1-Bs who have the technical expertise to execute on ambitious designs without managerial or VC overhead.

A visionary academic or small team decides to overhaul the entire aniquated World Wide Web protocol stack with an innovative design described in this abandoned patent.

Because the Silicon Valley culture is so deeply embedded in publicly traded companies, most of the impact of the DeepSeek release will take place in the startup space, with the exception of AMD and a set of potential short candidates that will emerge as the new technologies take hold. If you have an strong engineering background and want to make an impact, DeepSeek just gave an inspiring lesson in how it’s done.

DISCLAIMER: The Nuclear Option Substack is for Education and Information Purposes Only. It is not a solicitation or recommendation to buy or sell any security. Before trading stock or options, consult with your professional investment advisor and read the booklet Characteristics and Risks of Standardized Options Contracts, available from the Options Clearing Corporation.