By Graham Summers, MBA | Chief Market Strategist

Is the stock market about to crash?

Everywhere I look on social media, the defining narrative is that the stock market is in a massive bubble that is about to burst, triggering a devastating crash.

The dirty little secret about the people pushing these narratives is that they have never actually called a crash. Instead, they’ve been bearish for years and years, and like a broken clock, they’ve been right once or twice. And I can guarantee you they didn’t make ANY MONEY from a market crash when it DID happen.

Let’s start with the basics here.

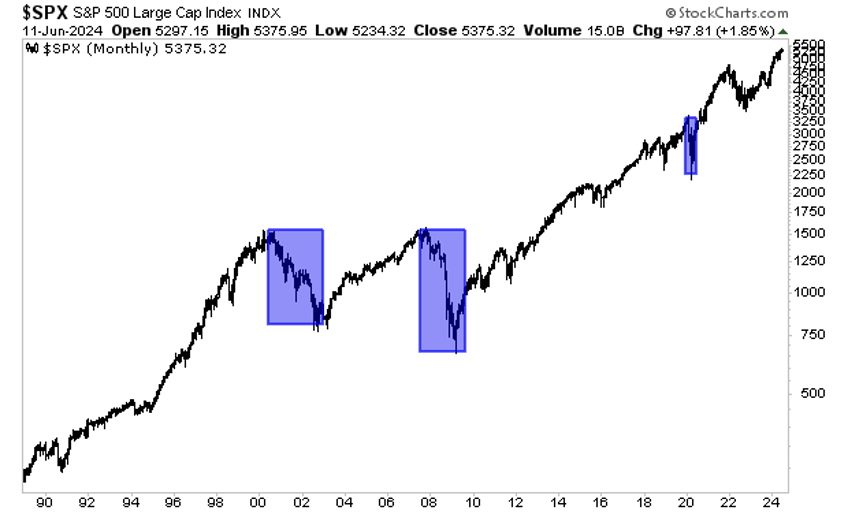

Crashes, DO happen, but they are RARE. There have been THREE in the last 35 years:

1) 2000-2003

2) 2007-2009

3) February-April 2020

Bear in mind, I’m talking about REAL crashes here or full-scale crises, not garden variety corrections of 10%. I’ve illustrated the crashes of note in the chart below.

Again, there were just THREE major financial catastrophes in a 35 year period, or roughly one every 10 years or so. That’s quite rare. Name another “1 in 10 years” event that people obsess about to this degree. I can’t. People get worked up about buying new homes or changing careers, both of which are “1 in 10 years”-type events… but I don’t see entire Youtube Channels and social media accounts that talk non-stop about those events the same way I see people obsessing about market crashes.

Again, when we talk about crashes, we’re talking about “1 in 10 years” events!

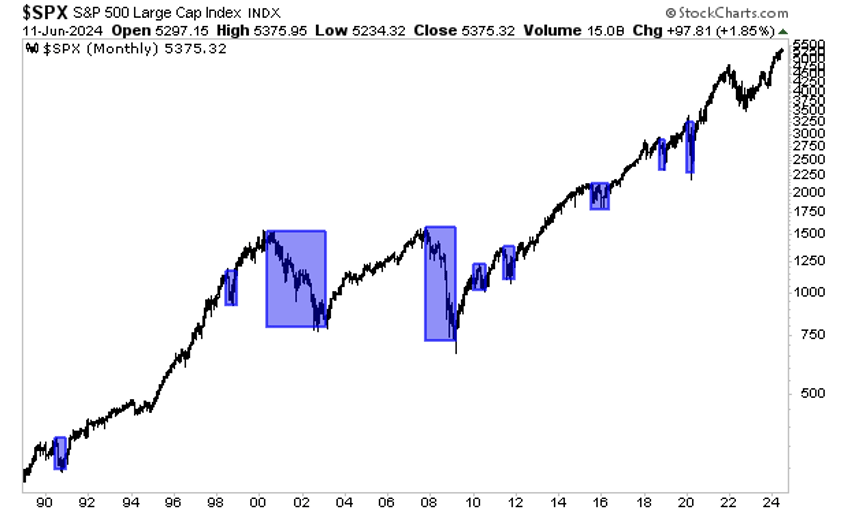

Even if we were to include EVERY time the market dropped more than 10% in rapid fashion, the number of “events” in the stock market is less than 10. Even if I missed a few here, you’re still talking about a “1 in 3 years” event.

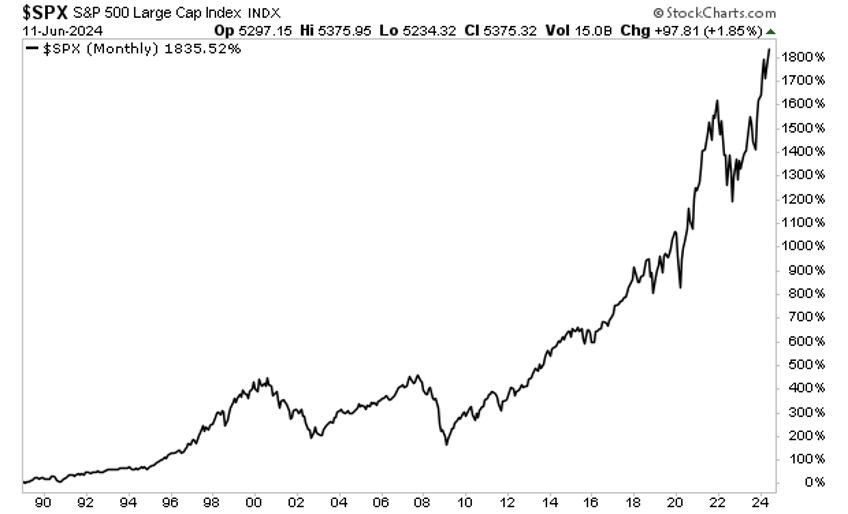

Meanwhile, throughout this 35 year period, in spite of these crashes/ events, stocks rose nearly 2,000%. Anyone who obsessed about crashes to the point of avoiding stocks completely, or even worse, betting on a collapse non-stop, missed one of the greatest periods of wealth generation in human history.

So why not simply buy stocks non-stop and hold for the long-term?

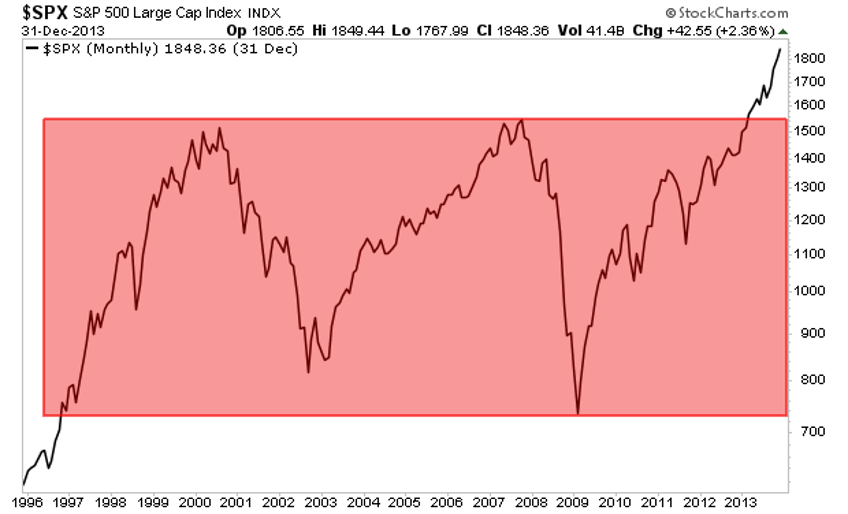

Because when crashes DO happen, stocks can take YEARS before they hit new highs.

Consider the period from 1996-2013. There were several MAJOR bull markets that saw stocks generate huge returns. Unfortunately, the subsequent bear markets/ crashes ERASED most if not all of those gains. As a result of this, stocks didn’t make a cent for 17 years!

Thus, investors are in a quandary.

One the one hand, crashes are rare events. And obsessing over them can lead to missing out on creating generational wealth from your investments.

However, on the other hand, when crashes DO happen, they can lead to 10+ years of ZERO returns for long-term, buy and hold investors. What are the odds that a REAL person would be willing to sit through a period like that and not despair?

Likely ZERO.

So obviously, investors need a tool of avoiding crashes, while riding bull markets for as long as possible.

I’ve developed PRECISELY such a tool. I detail it, along with what it’s currently saying about the market today in a Special Investment Report How to Predict a Crash.

To pick up a free copy, swing by

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research