FED Chair Powell reiterated caution and a hawkish stance during his House testimony, echoing recent FED sentiment. He emphasized the need for greater confidence in inflation before considering rate reductions and hinted at potential policy restraint easing this year. Powell underscored the importance of data in determining rate adjustments and the need for sustained inflation readings. He suggested significant rate decreases may be necessary in the coming year if the economy progresses as expected. Despite repeated remarks, Powell hasn't committed to the timing of the first rate cut, with markets not fully pricing it in until July, with June at an 92% implied probability. In a nutshell, the pushback and pushout of the still hypothetical FED pivot continues.

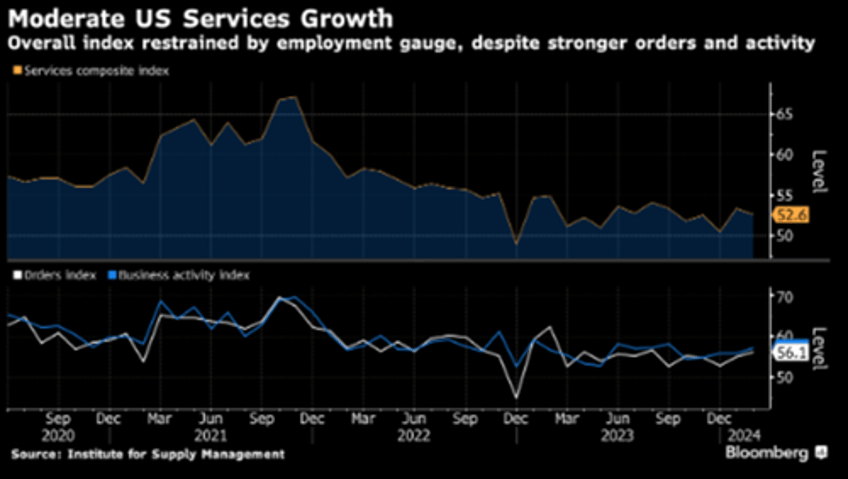

After the mixed manufacturing survey picture from the previous week, both the US Services PMI and the US ISM's Services indices fell in February, below expectations. While both indices remain above 50, under the hood, the surveys are indicating a revival of price pressures. In summary, slower growth in services, mixed manufacturing, and higher prices in both sectors are indicating that the Fed will not be able to cut rates this year.

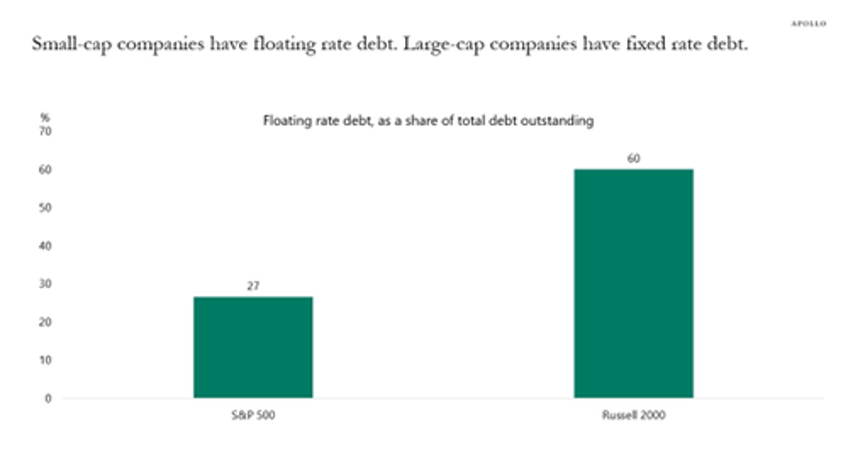

When discussing the resilience of the U.S. economy, many economists highlight Silicon Valley, unbridled capitalism, the prevalence of tech stocks, a flexible employment market, abundant natural resources, and a culture of innovation. While all of these factors are true, another advantage that should be mentioned is fixed rates. With the U.S. economy being dominated by larger companies, and larger companies typically having fixed-rate debt, the impact of FED hikes has been much more limited on the economy.

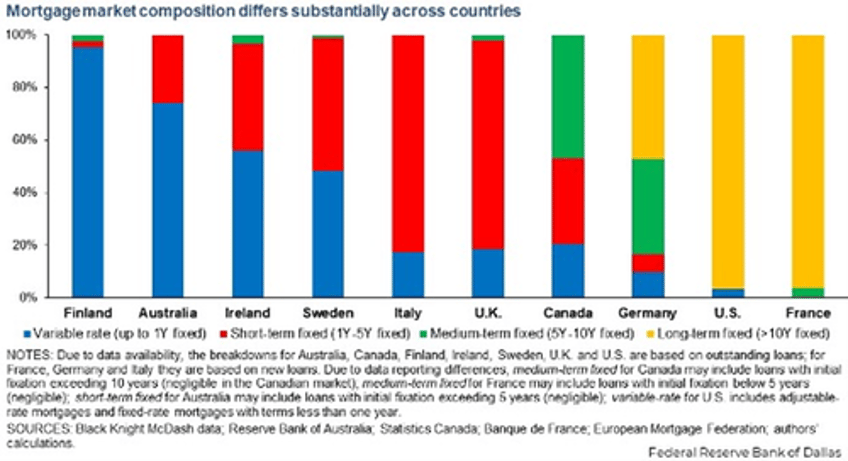

Unlike most major economies (except France), the US predominantly operates on fixed-rate mortgages. This shift occurred after the sub-prime crisis, prompting Americans to aggressively move away from floating-rate debt whenever possible. Fixed-rate mortgages offer stability to households and transfer risk from individuals to banks and other institutional investors. They provide certainty of income net of borrowing costs, enabling greater spending. Despite current mortgage rates around 7%, the average American continues to pay only around 4% and will do so for several more years.

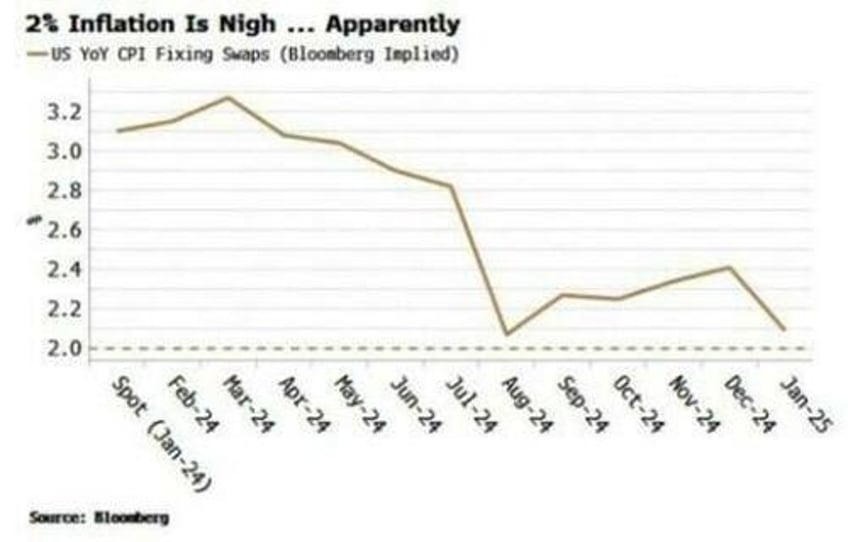

Ahead of this coming Tuesday February CPI, despite a hotter-than-expected January CPI, the market's response suggests that all asset classes are significantly unpriced for a potential resurgence of inflation. For instance, inflation complacency is evident in the continued steady decline in CPI fixing swaps, suggesting that inflation is dwindling to ZERO.

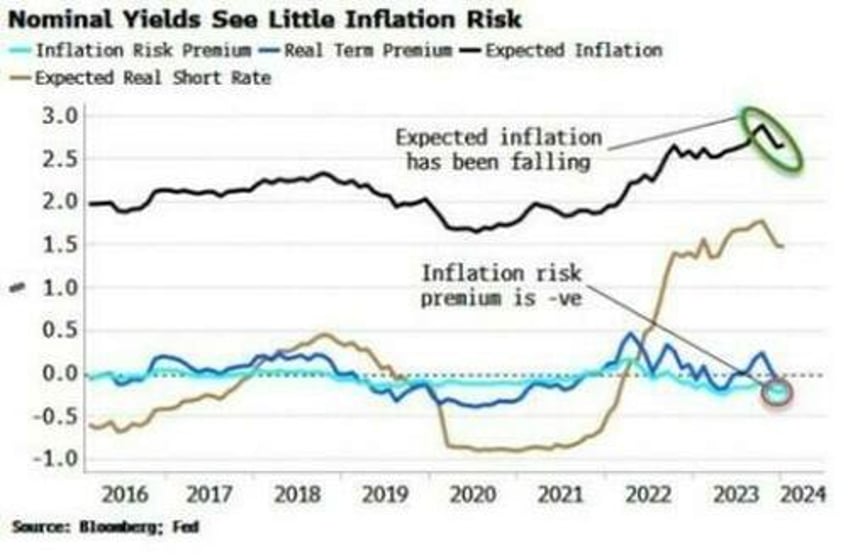

Not only are fixing swaps predicting a return to inflation utopia, but indicators across markets suggest they are not only under-pricing a revival in price growth but also ignoring the possibility altogether. The drop in the 10-year yield from its October high has been driven by a fall in the real expected short-rate, as well as a decline in expected inflation. However, there is no provision in the price for inflation's volatility to rise again, as it typically does when price pressures increase. In fact, the inflation risk premium is more negative than it was in the years leading up to the pandemic.

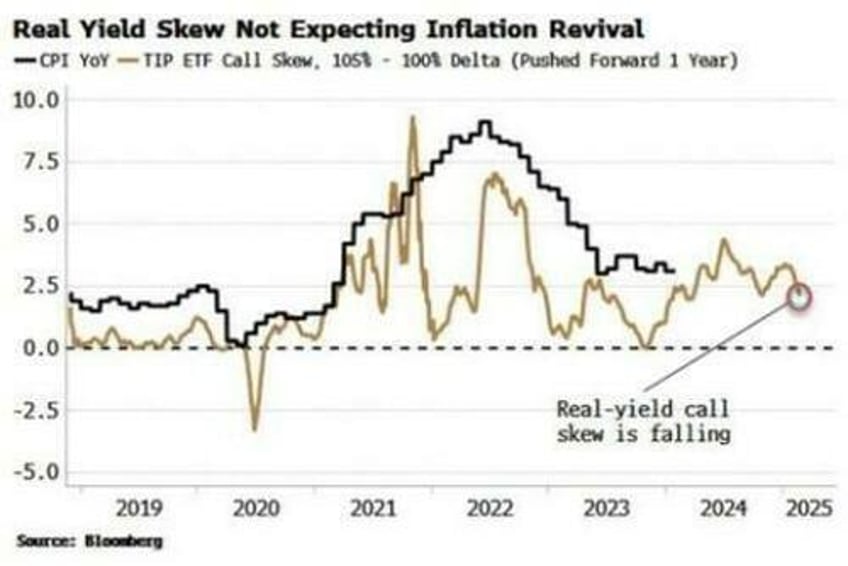

Real yields are also devoid of any risk premium for inflation. If the Federal Reserve fails to promptly react to rising inflation, as was the case in 2021 and may happen again this year if inflation resumes its uptrend as it is expected, real yields could face downside volatility. In other words, call skew for TIPS should increase. However, there are no signs of market nerves in this regard.

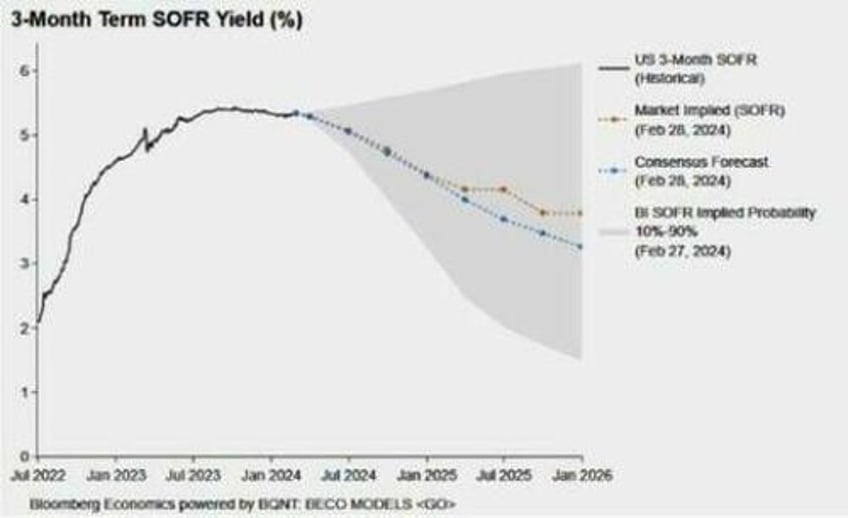

Short-term rates don’t seem more worried as the market still anticipates lower rates over the next year. This anticipation could be justified from a weighted-average perspective, considering that when things go awry, such as during a recession, they tend to do so dramatically. However, there is little likelihood priced in for substantially higher rates as the distribution for SOFR rates exhibits a clear downward skew.

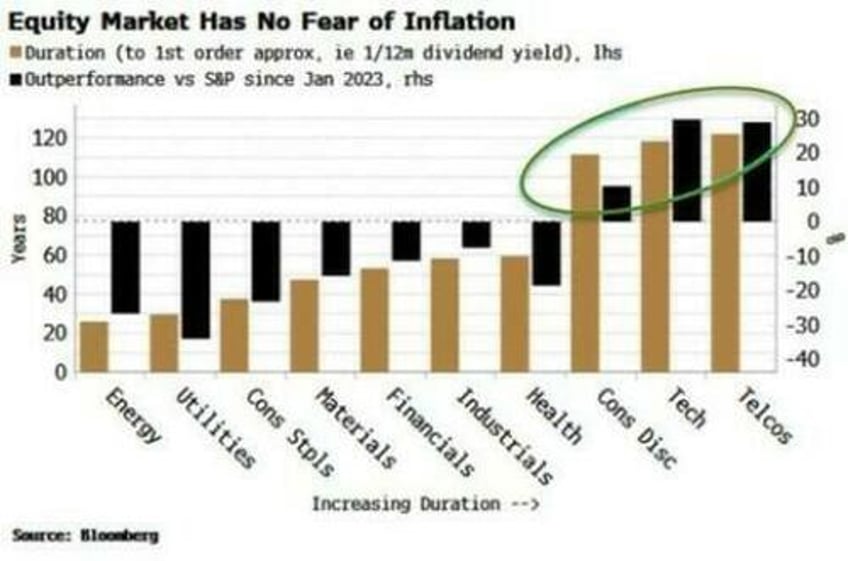

Stocks, particularly in high-duration sectors like tech and telcos, remain aligned with the view of more immaculate disinflation ahead, while sectors with low duration like energy and staples, historically better performers during high inflation, continue to significantly underperform.

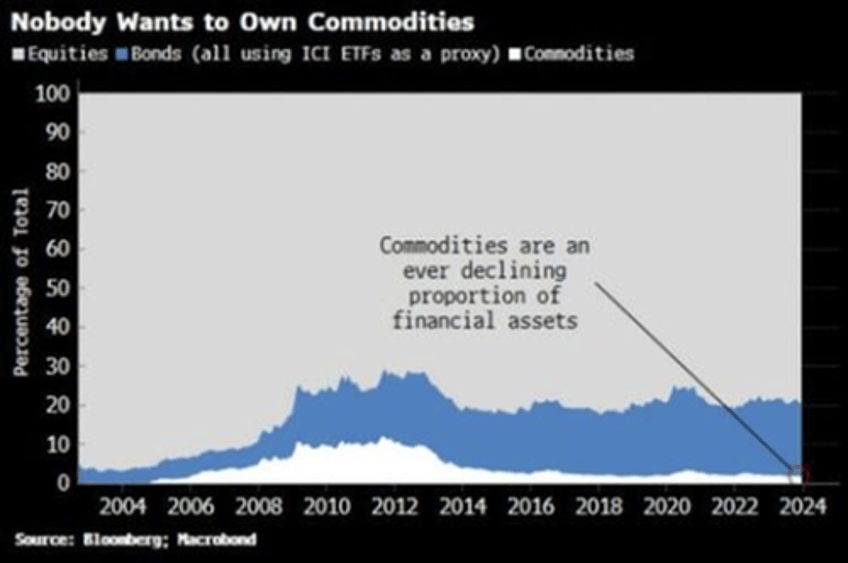

Investors tend to avoid bonds and stocks during inflationary periods, favoring commodities and real assets instead. However, there's little indication that investors are capitalizing on this trend, as commodity ownership relative to stocks and bonds remains low, comprising only 1.7% of the total.

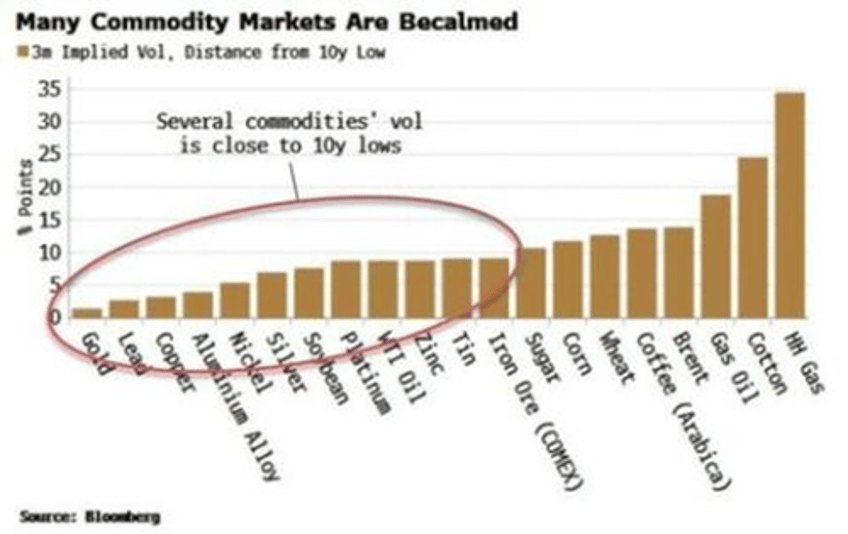

The current low implied volatility in various commodities, particularly metals like lead, copper, nickel, and notably gold and silver, could signify the calm before a potential storm in the commodity market.

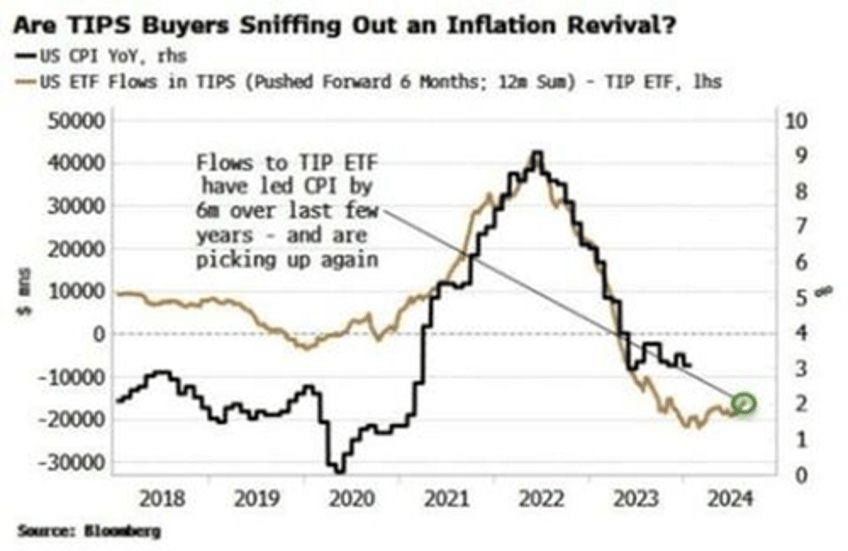

The only asset class potentially anticipating the return of the inflation boomerang could be the TIPS market, which has witnessed increasing inflows recently. This market had a prescient signal during the pandemic, beginning to rise approximately three months before CPI started its ascent in 2020, similar to the current trend where inflation leading indicators are also on the rise.

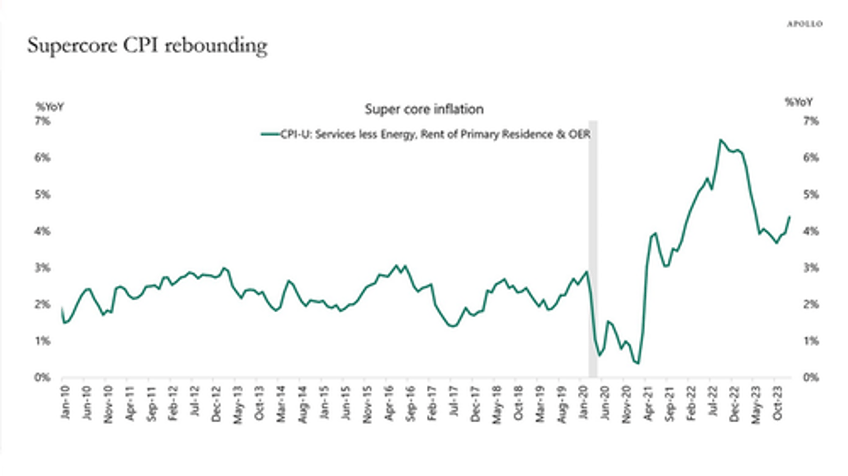

In that context, the likelihood of any rate cut seems unrealistic at this point, especially considering that all global markets, including the US, Europe, and Japan, are near all-time highs, and the inflation boomerang is coming back as Supercore inflation, the preferred measure by FED Chair Powell, is trending higher.

All of this comes at a time when breakeven rates and yields are moving together more closely, with breakevens exerting more influence on yields as the correlation between the 2-year breakeven rates and the 2-year yield is increasing.

Correlation between 2-year breakeven rates and the 2-year yield

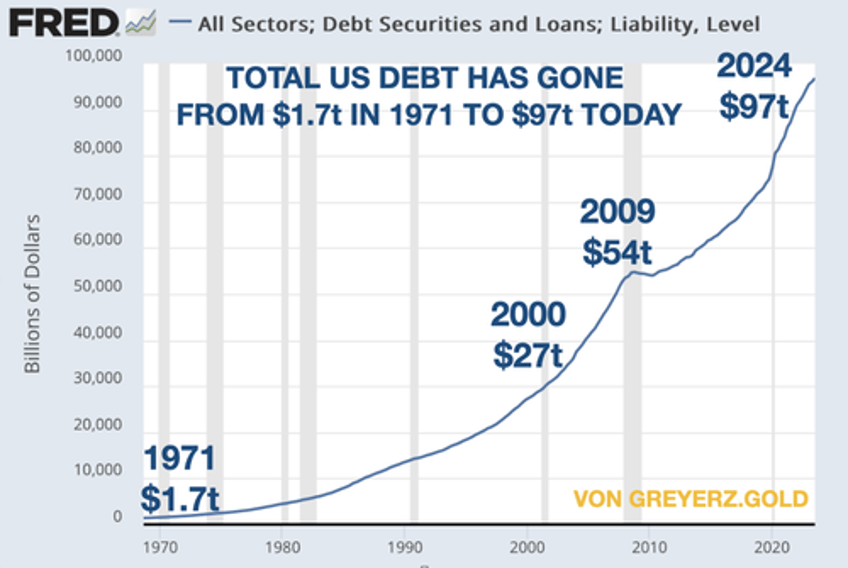

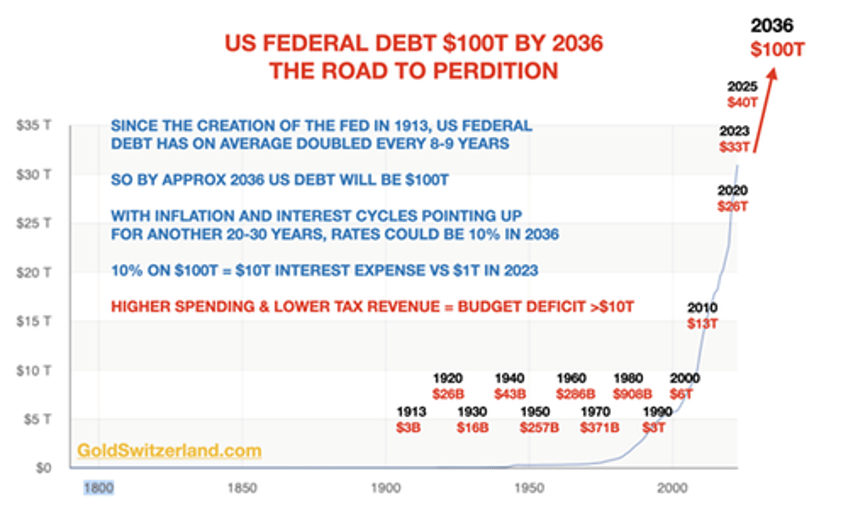

As wars will sadly not go away but instead escalate since there is ZERO desire for peace from the US and their European allies, inflation and interest rates are set to rise rapidly in the next few quarters, driven by deficits and debt growth. Historical patterns of empires show initial economic and military successes leading to illusions of grandeur, are followed by economic collapse and currency devaluation. At that stage wars are often started which generally have disastrous consequences. The risk of a collapse of the US-led geopolitical and economic system is evident, but the outcome and timing are uncertain. The current US administration's aggressive stance, particularly towards Russia. Iran and China, is taking a toll on the European economy and increasing US bankruptcy risks, with a deficit approaching $2 trillion and total debt nearing $100 trillion.

US debt has nearly quadrupled this century, and the interest cycle hit bottom in 2020, signaling a long-term upward trend for the next 20-30 years. US Federal debt has doubled every 8 years on average since 1980 and is likely to grow even more rapidly now. It's conceivable that $100 trillion Federal debt could be reached before 2036. If interest rates exceed 10%, the US economy could default, similar to the high rates seen in the late 1970s and early 80s when rates reached around 20%. The collapse of the USD could occur, potentially post the 2028 presidential election, if it takes place, making gold the preferred currency for central banks and investors given its hedge against governments.

Outside Russia, the US also wants to crush the Muslim/Arab world. Iran is currently the principal enemy. The Muslim world has no capacity for a major war against the West but they have a much more effective method of paralysing the West which is terrorism on a major scale and weaponizing oil supply.

Iran oil production.

The reaction to the recent 2-hour interview of Vladimir Putin with Tucker Carlson is typical of the propaganda-led hatred for the enemies of the West. Most people in the West have been conditioned by mass media to despise Putin and attribute all evil acts to him, thereby dismissing the interview. Putin is by no means an angel, but neither is any other leader, of course. Nevertheless, Sun Tzu, the Chinese general, strategist, and philosopher, told us 2,500 years ago: ‘’KNOW YOUR ENEMY and KNOW YOURSELF’’.

Aristotle's prediction seems to be unfolding as the US debt and deficit threaten the country and may soon affect its people. This could lead to revolution or internal conflicts in both the US and Europe. Recent truckers' actions in the US and Europe could be the beginning of social unrest, disrupting supply chains and increasing inflationary pressures. Extreme income and wealth inequalities exacerbate the situation, potentially leading to conflicts between various political factions. Those unaware and unprepared of the impending major calamities will soon face a rude awakening.

Looking at previous war cycles, equity markets, such as the Dow Jones, have delivered steady performance in the decade following the breakout of US-involved wars. Wars are not only inflationary but usually trigger a shift of confidence from public to private assets and this time will not be different.

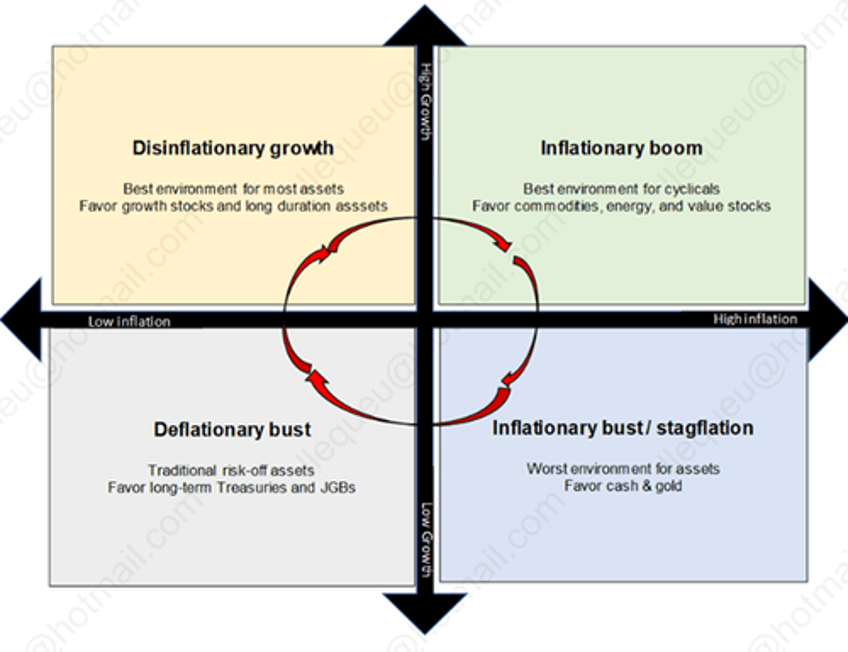

Coming back to the business cycle, it fluctuates between boom and bust, while the price cycle oscillates between inflation and deflation. This interplay creates four distinct periods akin to the four seasons of the year.

The economic cycle begins its "spring" after a deflationary bust, spurred by rate cuts and fiscal support, leading to growth upticks without immediate inflation. Financial markets thrive in this environment, marked by disinflationary growth and asset rallies, particularly in growth stocks. As the economy heats up into the ‘’economic summer’’, inflation rises, transitioning into an "inflationary boom" phase. During this period, cyclicals, emerging markets, and commodities outperform. However, accelerating inflation prompts rate hikes, impacting growth first leading to a gloomy stagflationary autumn. Periods of stagflation are the worst for most assets, with the exception of gold and USD cash. Inflation eventually slows as the economy falls into recession, paving the way for a deflationary winter bust, when long-term Treasuries outperform all assets.

Read more and discover how to position your portfolio to benefit from the next energy wave on : https://themacrobutler.substack.com/p/the-dark-side-of-the-trampoline-l…

The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.