Submitted by QTR's Fringe Finance

Ahead of this morning’s Jackson Hole commentary by Fed Chair Jerome Powell, yesterday morning Federal Reserve Bank of Boston President Susan Collins was out with comments basically reiterating that rate hikes could continue for the near future. Federal Reserve Bank of Philadelphia President Patrick Harker followed suit with additional, less-than-dovish comments.

“Nice view, eh Fred? By the way did I mention everything is completely f*cked with the dollar, the market and the economy? Oh, look, a bald eagle!”

"We may be near, we could even be at a place where we would hold…but certainly additional increments are possible, and we need to look holistically and be really patient right now and not try to get ahead of what the data will tell us as it unfolds," she told Yahoo Finance on Thursday morning. Here’s how her comments looked to hedge fund algorithms worldwide as they hit the tape on the Bloomberg terminal:

COLLINS: MORE FED RATE HIKES ARE POSSIBLE

COLLINS: EXTREMELY LIKELY FED HAS TO HOLD FOR SOME TIME

COLLINS: FED HAS MORE WORK TO DO; MUST BE PATIENT, RESOLUTE

COLLINS: PREMATURE TO SEND CLEAR SIGNAL ABOUT TIMING OF RATE CUTS

"We are in a restrictive stance, do we have to keep going even more and more restrictive? I'm in the camp of let the restrictive stance work for a while, let's just let this play out for a while, and that should bring inflation down," Harker added Thursday morning. Here’s how his comments looked when they hit the tape:

HARKER: CAN'T PREDICT WHEN FED WILL CUT RATES

HARKER: NEED TO SEE INFLATION FALLING BEFORE WOULD BE WILLING TO CUT RATES

HARKER: I SEE US KEEPING RATES WHERE THEY ARE ALL THIS YEAR; IF INFLATION COMES DOWN NEXT YEAR COULD CUT RATES

But it wasn’t just these comments and the overhang of today’s Jackson Hole comments that made Thursday an ugly day. There’s more to the picture and, in my opinion, the shitshow is only getting started.

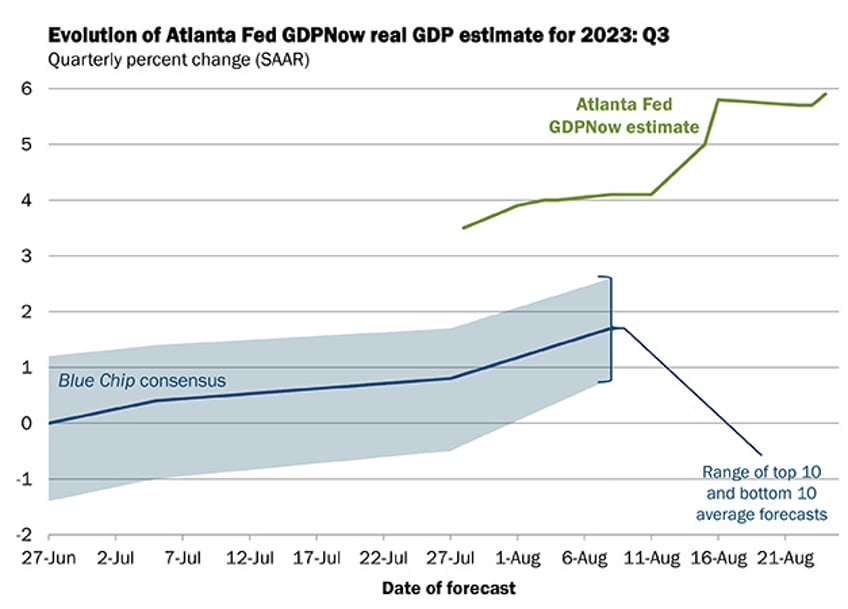

Collins’ and Harker’s statements hit the tape around the same time that the Atlanta Fed raised its GDPNow model estimate (yes, again) to 5.9%, indicating that despite the Fed’s best efforts, the goddamn economy just won’t stop growing.

As I said on my recent interview with Palisades Gold Radio, the Fed likens a robust economy with it not doing its job of curbing inflation, because it believes that it must crash the economy to win the inflation battle. Ergo, great economic news remains terrible news for the stock market.

Imagine if we didn’t need to introduce full on ridiculous Central Banking game theory into the market every time we got data and good news could...(READ THIS FULL PIECE HERE).