(Written by Bert Dohmen, contains excerpts from our latest report, “The Artificial Intelligence Rally: How You Can Thrive In The Greatest Wealth Opportunity In Decades”)

The latest big market rally has been driven by all the hoopla around Artificial Intelligence (AI) and how transformative it is and will be in the coming years.

While this huge technological advancement has surely been a big catalyst for stocks in and related to AI, there is one factor that has created this environment allowing for the latest frenzy to take place.

It’s not the “booming” economy, nor is it stock earnings.

It’s the Fed, which is often the instigator of speculative investment bubbles and will also be responsible for the end of the bubble.

You see, the Fed creates “excess” money, via excess bank reserves. That added liquidity tends to create an environment that is beneficial for speculation. When that coincides with the waves of human emotions, it gets very exciting in the markets.

In a speculative frenzy, there is no such thing as “expensive.” Stocks without earnings and even zero sales can soar, as we saw from 1998-2000 during the dotcom bubble.

The Fed is the biggest positive factor right now because the current Fed policy is the opposite of what they say. In our view, the Fed has been very accommodative this year and should continue to be. That is bullish for the markets and bullish for speculation.

The most important factor in our work is always to watch what the Fed is doing, not what they are saying.

THE FED AND “FIGHTING INFLATION”: Forty years ago, the Fed was the most important, daily topic on TV. The Wall Street Journal even called me “A Leading Fed Watcher” as we always looked below the surface and saw what the Fed was really doing, instead of what they were saying. Well, I did more than “watch.”

Fed watching seems to have become unpopular. We like that.

Money Supply growth is almost never mentioned by analysts anymore. When we started our business back in 1977, that was a very important indicator for anyone in our business.

Let’s look at M2 (Money Supply). The man-made Covid crisis, and the very destructive and insane response of governments at all levels, forced the central banks and the Fed to produce record amounts of money out of thin air to prevent depressions.

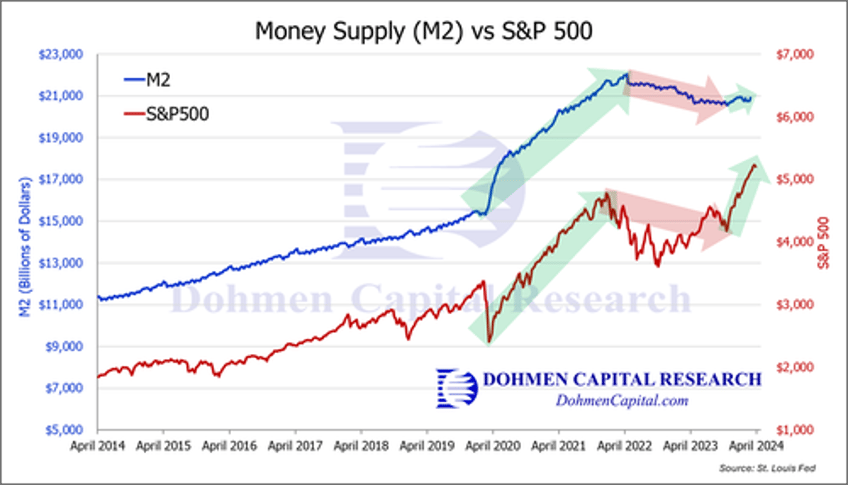

The comparison chart below shows M2 (non-seasonally adjusted, blue line) and the S&P 500 (red line) over the past 10 years. We can see the huge surge in Money Supply (M2, blue line) in response to the COVID crisis starting in March 2020. That gave us the big stock market rally into the top in late 2021 (S&P 500, red line).

The Fed started taking money out of the system and M2 declined starting in April 2022. That led to the bear market in 2022-2023.

However, late last year the Fed started stimulating again, contrary to what Fed officials said publicly. The chart of M2 vs the S&P 500 below confirms that money supply is growing again. The rate of change turned nicely positive. That is the green light for the markets….and inflation (M2 data goes through early March, the latest data available at the time of publishing).

In our work, this is a very positive factor for the markets as this produces “loose” money and market speculation. It is bad if the Fed wants to reduce inflation. Oh, we forgot, “reported inflation” (CPI) is now low. But those are faked statistics.

Several hawkish Fed officials spoke recently to assure people of the Fed’s vigilance with inflation. Yet inflation in so many things is now higher than what we saw in the last big inflationary binge over 40 years ago. Many groceries, airline tickets, and hotel rooms, among other items, are up 50% or more. The CPI hides that inflation.

Currently we see that the Fed is again injecting lots of money into the system, perhaps to prevent another banking crisis as in March 2023.

A trend change from declining to rising money supply is important. Artificial money injections by the Fed creates “loose money,” which breeds inflation and speculation.

An example of such speculation can be seen in AI stocks and Bitcoin, which confirms that it is wise to “not fight the Fed.”

Will the Fed start reducing Money Supply growth? We don’t think that is possible with the massive record US Treasury debt that has to be financed.

This is one big factor that will prevent the Fed from tightening credit this year. The US Treasury recently auctioned off $169 BILLION of debt securities. That is a record. Just a few years ago such auctions might have been around $25-$35 billion.

These huge Treasury auctions will continue for a long time and even increase in size as the government debt continues its astronomical growth, especially if the current people continue in power.

If you are interested in reading more about how the Fed is fueling the big AI rally, and want to learn about how you can profit in this rare market environment, check out our latest FREE research report, “The Artificial Intelligence Rally: How You Can Thrive In The Greatest Wealth Opportunity In Decades.”

In this 21-page report, we reveal why the current AI frenzy will exceed the dotcom bubble from the year 2000, which will offer incredible opportunities for those who know how to invest during speculative times.

We also provide our short-, medium-, and longer-term market forecasts in this pivotal and important election year, allowing investors to position their portfolios now for the great profit potential throughout 2024.

Get your copy FREE for a limited time only. Simply go to DohmenCapital.com or click this link: Get My Free AI Rally Report Now