Submitted by Portfolio Armor:

Despite Record Debt, The Dollar Still Rules

You'd figure that after the U.S. froze Russia's dollar assets last year, BRICS and other non-Western countries would rush to de-dollarize, especially with our government racking up evermore debit as it pours weapons into the Ukraine and Israel.

*US NEEDS SUPPLEMENTAL FUNDING TO SUPPORT UKRAINE, ISRAEL: KIRBY

— zerohedge (@zerohedge) October 13, 2023

$34 trillion in debt in 2 weeks it is

And yet, despite all that, the dollar index is trading near its high for the year.

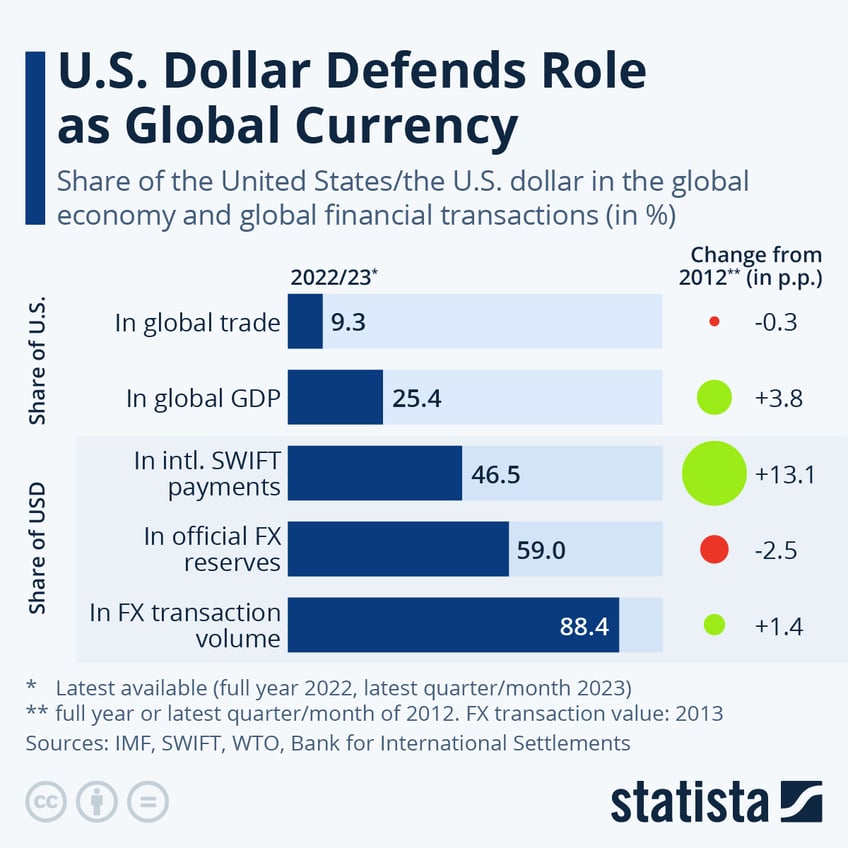

And over the last ten years, the dollar has stayed dominant as a global currency.

The Fed's Final Frontier

An interesting thread on X on Friday purported to detail the mechanics of how the Fed has managed this.

Since the Great Financial Crisis (GFC) of 2008, the Federal Reserve has operated a system, not built on sound pre-planning, but on its reaction to a seemingly endless number of crises in increasingly complex markets...

— Conks 🥷 (@concodanomics) October 14, 2023

The price of money (interest rates) would no longer be set by the Fed altering the level of bank reserves in the system but by implementing a set of rate levels. The outcome? The gradual emergence of the Fed’s “global jaws”... pic.twitter.com/QHN6Vr1vCF

— Conks 🥷 (@concodanomics) October 14, 2023

Named IORB or “interest on reserve balances”, this rate acted as an anchor on Fed Funds, holding it — and other short-term money market rates — within the Fed's newly established target range (shown in navy blue below)... pic.twitter.com/YwfgfbK7zd

— Conks 🥷 (@concodanomics) October 14, 2023

In late 2013, with rates and yields near zero and approaching negative territory, Fed officials grew worried, not only about yields on Treasuries turning negative, but that when the Fed hiked for the first time since the GFC, raising IORB was enough to drive rates higher...

— Conks 🥷 (@concodanomics) October 14, 2023

The initial versions of the Fed’s upper and lower jaws, however, were flawed and defective. Still to surface were various disruptive episodes, which would come to remold their initial structures...

— Conks 🥷 (@concodanomics) October 14, 2023

A few years later, the COVID market meltdown showed that the Fed required a permanent global backstop. Monetary leaders reintroduced official central bank swap lines, fortifying the Fed’s upper jaws. Still, the Fed’s job wasn’t done...

— Conks 🥷 (@concodanomics) October 14, 2023

Before a governmental-level calamity ensued, the Fed stepped in, adding another layer to its global jaws. The FIMA repo facility, the Fed’s “final frontier”, was born... https://t.co/dMirQusUzQ

— Conks 🥷 (@concodanomics) October 14, 2023

Since the rise of its post-WWII golden age, America has produced the deepest capital markets on record, which global finance has eagerly devoured. Meanwhile, via its treasury and central bank, the U.S. has also provided a range of assets exclusively for governmental entities...

— Conks 🥷 (@concodanomics) October 14, 2023

FRPs (repos conducted through the foreign repo pool) are secured dollar loans, where FOIs invest end-of-day dollar balances in their “master accounts” at the Fed, overnight, secured against Treasuries in the Fed’s asset portfolio: the System Open Market Account (SOMA)... https://t.co/kGmkK71Er1

— Conks 🥷 (@concodanomics) October 14, 2023

Moreover, because the U.S. central bank is deemed the safest dollar counterparty, the rate charged at the foreign repo pool (FRPR) forms a public dollar rate floor, much like the private dollar rate floor (ON RRP) set at the Fed’s regular (and separate) RRP facility... https://t.co/DQpCnvmQnf

— Conks 🥷 (@concodanomics) October 14, 2023

Following the Fed’s decision to pay a higher rate to those willing to park their cash overnight in RRPs, money primarily from foreign central banks poured into the FRP. Then, after leveling out for years, the FRP rose during the COVID panic, and the trend has continued upward...

— Conks 🥷 (@concodanomics) October 14, 2023

Amidst extreme stress in both Treasury and dollar funding markets during the COVID hysteria, the U.S. central bank responded swiftly. On the 31st of March 2020, the Fed assembled the Foreign and International Monetary Authorities (FIMA) repo facility...

— Conks 🥷 (@concodanomics) October 14, 2023

In a run on U.S. assets, America’s closest rivals were more determined to raise dollars than reduce their exposure to the Greenback. What's more, China was likely the largest user of the Fed’s FIMA facility, right as markets grew most unstable...

— Conks 🥷 (@concodanomics) October 14, 2023

Escaping Uncle Sam requires ditching the Greenback. But a modern-day exodus will result in most of its allies and, more importantly, its rivals demanding more dollar liquidity...

— Conks 🥷 (@concodanomics) October 14, 2023

Thanks for reading! If you enjoyed this, feel free to retweet the top tweet of this thread and follow @concodanomics for more.

— Conks 🥷 (@concodanomics) October 14, 2023

You can also subscribe below to receive more in-depth articles about markets, finance, and geopolitics in your inbox...

👉 https://t.co/Uavr0bjxrk 👈

Nevertheless, Gold Gets A Bid

Despite the consistent strength of the dollar, gold was up 3.43% on Friday, likely as investors sought it as a haven in light of the intensifying war in the Mideast. At the same time, the oversold gold miner we wrote about here a couple of weeks ago got a bid as well.

Our trade alert on this one just went out. Check Subst@ck link in bio. pic.twitter.com/BD6xj5R964

— Portfolio Armor (@PortfolioArmor) October 5, 2023

It's still oversold, but not quite as much as it was when we first wrote about it. Then, it had an RSI (Relative Strength Index) in the teens; now it has an RSI of about 27. It's possible we placed our trade on this one near a bottom.

If You Want To Stay In Touch

You can follow Portfolio Armor on Twitter here, or become a free subscriber to our Substack using the link below (we're using that for our occasional emails now). You can also contact us via our website. If you want to hedge or see our current top ten names, consider using our website (our iPhone app is currently closed to new users).