By Graham Summers, MBA | Chief Market Strategist

The Fed SHOULD have cut rates last week.

That is a fact.

Instead, the Fed stated it is on “hold” for rate cuts because the potential tariffs the Trump administration introduces might trigger inflation.

This is 100% nonsense.

Europe, Japan, China, and countless other nations have introduced tariffs, duties and other trade restrictions in the past with ZERO uptick in inflation.

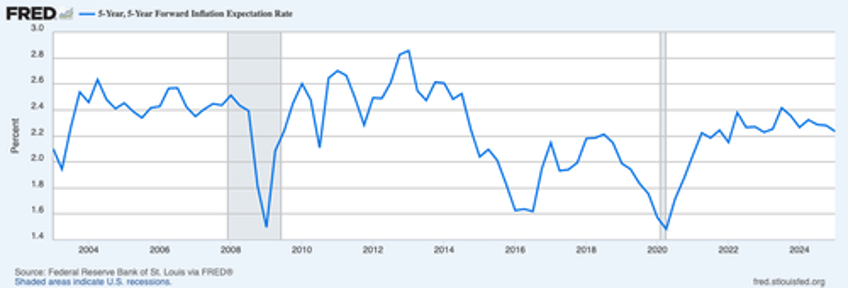

Moreover, there is NO evidence that inflation expectations are on the rise. The five year forward inflation expectations is THE gold standard for measuring inflation expectations.

Do you see an uptick here? I don’t.

So what is the Fed doing?

Playing politics.

They did this during Trump’s first term in 2018 when they intentionally tightened monetary policy to the point of triggering a stock market crash (if you don’t believe me, former Vice Chair Stanley Fischer admitted this in an interview).

This is a MAJOR screwup, and it’s only a matter of time before the Fed breaks something. When this happens, the Fed will be forced to panic ease monetary conditions triggering one of the greatest wealth building opportunities in years.

The last time the Fed screwed up and was forced to change course was in 2023 when it blew up the regional banking system. What followed was an almost 1,000 point rally on the S&P 500.

To start receiving these kinds of actionable insights, join 56,000 readers in over 56 countries in receiving our daily market alert every weekday before the markets open (9:30AM EST).

Subscribe to Gains Pains & Capital!

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research