Quick update: Over the coming days I’ll be joining Tom Luongo to discuss the contents of this report. It’s bound to be a riot…

Article originally published on Substack (including a 30-min. video report).

A series of bizarre developments that have unfolded in Great Britain over the last few weeks suggest that its financial system came to the verge of collapse, probably as a consequence of Ukraine’s debt default. The last thing the people in power will tell us is the truth, but if we dig in dark places and connect the dots, I believe the conclusion practically makes itself. The consequences for Britain, and probably for “his majesty’s” other dominions will be extreme. Let’s dive in…

The riots that weren’t (quite)

The stabbings of three young girls (6, 7, and 9 years of age) that happened in Southport, UK on 29 July apparently unleashed widespread rioting and clashes in Britain, notably between the immigrant Muslim community and what PM Keir Starmer called, right-wing thugs. The authorities' reaction has been nothing short of Orwellian including a radical and ongoing crackdown on free speech.

But it would appear that the riots and clashes haven't been quite as widespread or as violent as the media portrayed them to be. In a recent podcast, Alexander Mercouris pointed out that not only did everything seem calm in London, but that a number of his friends and acquaintances around the UK all told him the same, even for the cities where rioting had been reported. Could it be that the government overreacted and exaggerated the threat in order to justify stepping up its authoritarian control which is now gripping Britain?

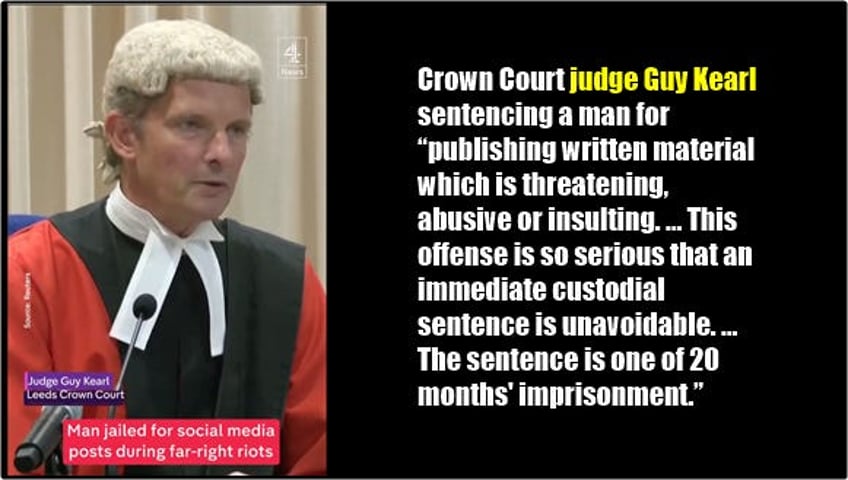

Rather than appealing for calm, the government’s messaging clearly aimed at intimidating the population. The UK's Home Office warned that "Actions have consequences," and boasted that over 1,000 arrests have been made thus far. British courts already sentenced many people to stiff prison terms for wrongthink expressed on social media and they made sure that these sentences got wide publicity.

Wrongthink shall not be tolerated.

For a supposedly free society, recent statements by policy makers and public officials in the UK started to sound as though they came from the plot of the 2005 dystopian sci-fi film, "V for Vendetta." The media personalities, even after a lifetime of indoctrination with free speech as the core Western value, suddenly seemed to have no qualms about advocating curbs on freedom of expression.

On Friday, 16 August, I joined Tom Luongo at the @CryptoRich podcast to discuss the situation, which turned into a bit of a brainstorming session: given that violent crime and knife stabbings are nothing new in Britain (they've been on the rise for years) and that people's resentment against immigrants isn't new either, it occurred to me to wonder, why is the government turning as radically authoritarian? And why now?

If the crackdown is being deliberately orchestrated and I believe that it is, then what is the reason for it? Our discussion converged on the idea that Britain might be facing an imminent financial crisis which could accelerate her economic and social collapse. My suspicion was that it might have to do with the fact that Britain got overextended in Ukraine trying to regain the leadership, affluence and the prestige which it has been steadily losing over the recent decades.

Britain’s long descent

Indeed, Britain's decline has been long in the making. In October 2021 I published an article titled, "The Fall of Global Britain - an Investment Hypothesis" together with a video report with the same title. Noting that Great Britain is displaying many of the symptoms of imperial powers in decline, I predicted that it won’t revert to simply minding its own domestic business as a neutral island nation. Here’s what I wrote back then:

"Today the UK could be in the early stages of the same sequence of events [as all other imperial powers in decline]: a severe crisis at home coupled with the dramatic loss of international leverage and a very costly addiction to imperial prestige. The UK will likely make all the mistakes made by other powers in that similar position through history: it will suffocate its domestic economic growth by imposing hard austerity at home while at the same time increasing military spending and foreign adventurism. Britain’s public debt will continue to outpace its GDP growth and the government’s budget deficits will be covered by Bank of England’s monetary inflation. This recipe reliably leads to stagflation and possibly to hyperinflation."

So far, so good: three years later, it is clear that the UK has continued making all the mistakes made by other decaying empires, particularly in terms of foreign adventurism.

A sudden deterioration, which developed during the course of this year seems to be related to the Western powers’ impending military defeat in their proxy war against Russia. Britain has been the principal cheerleader and sponsor of that conflict, and she seems to have gone "in over her head.” In addition to providing at least £7.5 billion in military aid (nearly $10 billion), Britain gave another £5 billion ($6.5 billion) to Ukraine in financial support.

Furthermore, Britain has also guaranteed multiple tranches of World Bank loans to Ukraine and many British financial institutions have purchased billions’ worth of Ukraine's bonds. Others made extensive direct investments there. In the timeline that follows we’ll trace the way Britain’s perfect storm shaped up in Ukraine.

Timeline of Ukraine’s slow-motion train wreck

It is clear that 2024 wasn’t going to be a good year for Ukraine. Public sentiment across Europe picked up on that, as confirmed in a poll of 17,023 respondents in 12 EU nations conducted in January by the European Council of Foreign Relations. It found that only 10% of the EU citizens believed that Ukraine could defeat Russia. A few weeks later things got still more bleak after Russian forces captured the strategically important town of Avdeevka.

But in addition to the near-certain military defeat, Ukraine was also facing a looming economic and financial collapse. Ukraine’s economic performance was already dismal before the conflict with Russia started in February 2022. But since that time, it has collapsed by another 25%. With tax receipts dwindling, Ukraine's 2024 budget deficit is expected to rise to nearly $44 billion. If Kiev were to service its debt obligations, they would eat up fully 15% of her GDP, the second largest expense item after defense (which stands at 31.3% of the GDP).

Keeping Ukraine’s government and military in operation has become entirely dependent on her Western backers. But by 2024, that support began to dry up as more and more decision makers started to doubt Ukraine’s prospects. In late March 2024, while the $61 billion US aid package was still stalled in US Congress, the World Bank approved $1.5 billion in financial support for Ukraine. The draft document on the allocation of these funds underscored the “catastrophic” state of Ukraine’s public finances and acknowledged the “extremely high” risk of cooperating with Ukraine.

A World Bank official involved with the matter noted that Ukraine was facing bankruptcy. Significantly, he added that, as with previous transactions, the World Bank did not provide its own funds for Kiev, but “once again took advantage” of guarantees from two of Ukraine’s donors, primarily Japan and the UK. Ukraine’s Prime Minister Denis Shmigal divulged that out of the $1.5 billion given to Ukraine, $984 million of the sum originated from Japan and $516 million from Britain. But Ukraine is now unable to service her mounting foreign debts.

Sunday, May 4, 2024: bondholders pressure Ukraine

On May 4, the Wall Street Journal reported that a group of foreign bondholders, including such behemoths as BlackRock, PIMCO and France’s Amundi put pressure on the government of Ukraine to start repaying some of its debts. Back in July 2022, this group granted Kiev a two year grace period to pause repayments of some $20 billion in bonds they had previously issued. That agreement was due to expire on August 1, 2024.

According to the media reports, the interest payments on those debts alone would amount to $500 million annually. I’m not sure how they came up with that figure: the bond issues in question are all listed in this document and the average interest rate on these bonds is about 7.54%, suggesting that Ukraine’s annual interest expense was $1.487 billion, nearly triple what media reports suggested.

And here we’re still talking about only $20 billion out of Ukraine’s total debt of $161.5 billion! Given the catastrophic state of the country’s finances, the repayment of these debts would collapse Ukraine’s government and its economy.

Sunday, June 30 2024: one month to avert default

The Economist published an article titled, “Ukraine has a month to avoid default,” or until the end of July 2024. Something had to be done.

Friday, 12 July 2024: negotiations with bondholders start

Private discussions began about restructuring Ukraine’s debts with members of an ad hoc creditor committee. The discussions would conclude on July 19. The government of Ukraine was advised by Rothschild & Co as financial advisors and White & Case LLP as legal advisors (odd how the same names tend to crop up in the works wherever a land is drenched in blood). Ukraine demanded a 60% debt reduction while creditors thought that 22% was “more reasonable.”

Thursday, 18 July 2024: Zelensky arrives in London

Zelensky arrived for an official visit to London. First, upon arrival he met with General Valery Zaluzhny, former Commander in chief of the Armed Forces of Ukraine and recently appointed Ambassador to Britain. Later in the day Zelensky participated at the European Political Community summit held at the Blenheim Palace in Oxfordshire along with delegates of 44 other countries. Speaking at the event, Zelensky underscored that the UK had been “one step ahead in its determination to support Ukraine” since the Russian invasion began.

The summit concluded, apparently with the participants reaching an agreement to target Russia’s “shadow fleet” of tankers: some 600 vessels enabling Russia to evade West’s oil sanctions. On the sidelines of the Summit, Zelensky also met with UK’s king Charles III and Prime Minister Starmer. Allegedly, he also met with the representatives of some of Ukraine's financial and corporate backers like BlackRock, JP Morgan, Bridgewater, Blackstone and ArcelorMittal.

Friday, 19 July 2024: Zelensky addresses Starmer’s cabinet

Zelensky paid an official visit to Prime Minister Starmer and on the occasion addressed the meeting of the British cabinet which greeted Zelensky with a standing ovation. This was the first time another head of state has done so since 1997, when Bill Clinton addressed Tony Blair’s cabinet. In opening the meeting, Keir Starmer said that, “Ukraine is, and always will be, at the heart of this government’s agenda and so it is only fitting that President Zelensky will make a historic address to my cabinet.”

If you can’t, if you can’t give us money, OK, OK, just give us credit and we pay you back money!

Addressing Zelensky, Starmer said that, “This is a very, very important meeting for us and you’re very welcome here. It is a real pleasure and a privilege to be able to welcome you to Downing Street this morning. This is a real piece of history.” The invitation extended to Zelensky to speak to the British cabinet, Starmer continued, was indicative of “the esteem you’re held in… in this country and around the world.” Incidentally, this same Friday was also the last day of discussions about restructuring Ukraine’s debts, so we can infer that those debts to private bondholders were among the “very, very important” matters discussed by the Starmer cabinet that day.

Monday, 22 July 2024: we have a deal!

Almost as soon as Zelensky’s visit in London concluded, the Government of Ukraine announced that a deal was reached with its main bondholders to restructure the country’s near-$20 billion worth of bonds, including a 37% reduction of the amounts owed. But this was only "an agreement, in principle," reached with an “ad-hoc creditor committee,” and it wasn’t binding on all the bondholders.

Instead, it imposed on Ukraine’s government “the Restructuring as soon as practicable,” to be implemented through a “consent solicitation.” In other words, Ukraine was expected to chase after its creditors and beg them to accept the deal, even offering them a 1.25% “consent fee.” Well, things were about to take a sharp turn for the worse…

Wednesday, 24 July 2024: Ukraine strikes the Fitch iceberg

Only two days after Ukraine announced the deal with their bondholders, Fitch downgraded Ukraine’s credit rating from CC to C, reflecting extreme credit risk reserved for countries that "entered default or default-like process." Significantly, Fitch made it explicit that “the publication of sovereign reviews is subject to restrictions and must take place according to a published schedule…”

Bad day: Ukraine and her sponsors struck the Fitch iceberg

For Ukraine, the next scheduled review date was set for 6 December 2024. However, Fitch determined that there was a “material change in the creditworthiness of the issuer” which would have made it “inappropriate for us to wait…” Thus, Fitch brought forward their credit rating review for Ukraine by nearly six months, either because her financial position suddenly and significantly deteriorated, or because somewhere, someone who had the power to pull strings, decided to capsize Ukraine (and the UK and EU along with it).

Monday, 29 July 2024: stabbings in Southport

The stabbing of three young girls took place in Southport, UK. The event reportedly unleashed widespread rioting and clashes around Britain. End of July was also the time when The Economist predicted Ukraine would face bankruptcy.

Wednesday, 31 July 2024: Zelensky ‘temporarily’ suspends debt repayments

Zelensky signed a law enabling Ukraine to suspend payments of external debts for two months (or longer).

Thursday, August 1 2024: debt repayments freeze takes effect

Bondholders’ grace period expires; Zelensky’s unilateral debt repayments freeze takes effect.

Tuesday, 6 August 2024: Ukraine launches Kursk incursion

Ukraine launched a surprise incursion into the Kursk region of Russia. The plan to attack the Kursk region had been made at least a year earlier, but it was never implemented, most likely because strategically, it made little sense. In fact, Prof. John Mearsheimer called the attack a fiasco. Here’s a part of his statement:

“I think it was a huge mistake on the part of the Ukrainians to invade Russia. … it's going to speed up their defeat. … It’s a giant killing zone. … the Ukrainians cobbled together a strike force that’s comprised of some of their most formidable fighting forces. That strike force went on the offensive. … you're presenting the other side with a huge number of targets. … the Ukrainians have been losing twice as many armored vehicles on a daily basis than they were in the war before August 6. … I think it [was] a remarkably foolish thing to do. … It's hard to believe that to make the Kursk offensive work, the Ukrainians had to pull forces off the Eastern front where this war is being settled, and where they're in deep trouble. And to pull forces away - it's not only that they didn't send reinforcements to the Eastern front, they pulled forces away from the eastern front. … it's quite clear that the Russians are doing better by the day because Ukrainian resistance is weakening by the day. Because Ukrainians have funneled and are funneling forces away from the Eastern front and into the Kursk region. This, in my opinion, is remarkably foolish…"

Noting that the Russians were taken by surprise at Kursk, the professor thought they were unprepared because “it's such a crazy idea that the Russians didn't think that the Ukrainians would be foolish enough to do it.”

If Professor Mearsheimer is right, this raises an important question: why did the Armed Forces of Ukraine pull the trigger now, as the country was already on the verge of military defeat and financial default?

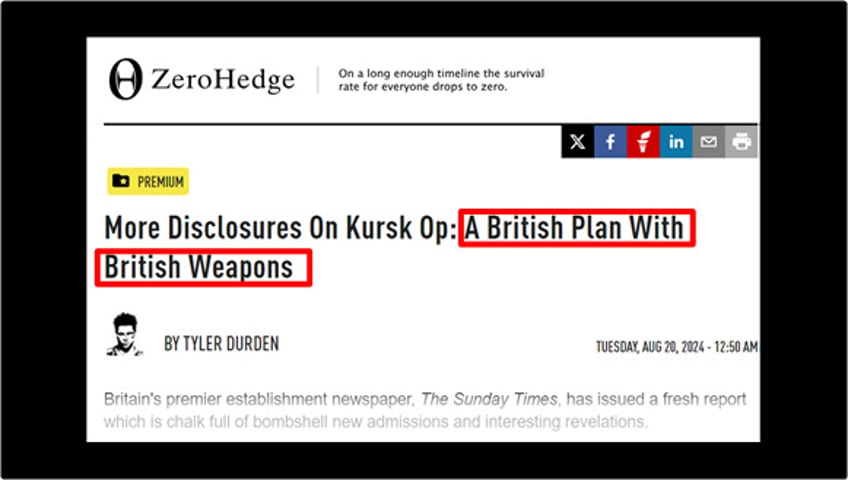

What we do know is that Ukraine launched the incursion only 18 days after Zelensky’s visit in London. Zelensky’s security advisor Mikhailo Podolyak admitted that the Kursk invasion was discussed with the British. On August 18, The Sunday Times of London revealed that Britain played the pivotal role in the operation:

“Unseen by the world, British equipment, including drones, have played a central role in Ukraine’s new offensive and British personnel have been closely advising the Ukrainian military… on a scale matched by no other country.”

ZeroHedge commented that the operation was, “A British Plan With British Weapons.” The leadership of Ukraine gave at least three unconvincing explanations for the incursion: (1) to improve Ukraine’s negotiating position vis-à-vis Russia; (2) to divert Russian forces from the Donbass front; and (3) to create a buffer zone inside Russia.

Neither explanation made much sense, but the move did create a window of opportunity for the West to talk up Ukraine’s great military success which could prove to be a turning point in the war. Wasting no time, on that same Tuesday, 6 August the European Council approved 4.2 billion euros in financial support for Ukraine. It would be the first regular payment out of the 50 billion euros financial aid package set aside for Ukraine by the European Union.

The European Council’s decision to approve the funds was based on the EU Commission's assessment that Ukraine had satisfactorily fulfilled nine reform indicators related to the first regular quarterly payment. These conditions included the government’s public financial management, management of state-owned companies, business environment and energy and mine clearance.

It was unclear however, whether the European Commission was equally impressed by Ukraine’s credit rating downgrade and the government’s suspension of external debt repayments, but what is important is that somehow the decision was made, and the money was transferred to Ukraine without undue delay.

Tuesday, 13 August 2024: Ukraine receives EU funds

The European Commission transferred €4.2 billion to Ukraine as part of the first tranche of the Ukraine Facility program. I wonder who got paid first out of those funds.

Wednesday, 14 August 2024: WHO declares Mpox pandemic

In addition to all this, on 14 August, the World Health Organization Director-General declared Mpox outbreak a public health emergency of international concern. We’re all in this together (again) and now further restrictions on public gatherings and freedom of expression might be justified.

Another two events coincided with Ukraine’s de facto debt default. On 30 July 2024, Israelis assassinated senior Hezbollah commander Fuad Shukr and an Iranian military advisor, Milad Bedi in Lebanon, along with five Lebanese civilians (including two children). The following day, on 31 July they also assassinated Ismail Haniyeh, the political leader of Hamas, in Tehran.

We can’t be sure whether all these events are related, but they do have this in common: they all had the potential to precipitate worldwide states of emergency either due to escalation of military conflicts or due to a pandemic. And they all took place within days from Ukraine’s default, which has put the western financial system in jeopardy. Further signs of panic in the banking circles came from the mothership itself…

And the month ain’t over yet…

Panic at the Bank of England?

On 22 July, the same day when the agreement between the government of Ukraine and the “ad hoc committee” of her private creditors was announced, the Bank of England also announced a seminar titled "The Future Bank of England Balance Sheet – managing its transition towards a new system for supplying reserves." The seminar took place the same day (a bit of a short notice for most people) and featured a speech by Victoria Saporta, Executive Director of the bank’s Markets Directorate. In the announcement, the BOE explained that its “balance sheet plays a key role in helping [the bank] achieve its financial stability and monetary policy objectives.”

Saporta’s speech, titled “Let’s Get Ready to Repo!” laid out the Bank’s latest thinking on the future of its balance sheet which would transition towards a demand-driven system for supplying reserves. Saporta suggested that the bank would need to accept a “broader range of assets” as collateral to make the system “usable for the widest range of firm business models.” She added that, “The single punchline is that both we, the Bank and you, the market, need to prepare ourselves for increased usage of both our short term and long term repo operations. Or in short, let’s get ready to repo!”

Seriously, where do they find these people?!

Here’s how Bloomberg’s macro strategist Simon White put it: in a demand-led system, “what banks use to settle balances each day *must* be ‘shiftable’ on to the central bank’s balance sheet in a crisis. If they are not, liquidity is at risk of seizing up altogether. Thus, in a crisis, potentially no asset under this scheme will be turned away.” That could include even Ukraine’s bonds.

What is clear from this and from the BOE’s language is that the bank is now anxious about Britain’s financial system collapsing and it has resolved to avert the collapse in the worst possible way: by loosening its credit standards and accepting junk quality collateral in exchange for cash. This is the clearest possible sign that the system came to the verge of collapsing. Not so long ago, we had a glimpse of just how fragile Britain’s financial system is.

Kwarteng’s “mini budget” was a foreshadowing

On Friday, 23 September 2022, shortly after the new cabinet led by Prime Minister Liz Truss took over, her Chancellor of the Exchequer, Kwasi Kwarteng presented his "mini-budget." The markets did not react well and both the British pound and the price of gilts sold off sharply (gilts are British government bonds). This in turn caused thousands of British pension funds to face margin calls.

The red and black labels on their vests read, “Proud to be safe,” I shit you not!

To come up with cash for those margin calls, the pension funds needed to urgently liquidate some of their gilt holdings. However, by Tuesday, 27 September, there were no buyers for long-dated gilts. To avert a price collapse, the Bank of England had to intervene. As the bank subsequently informed the Parliament in a letter dated 5 October, on September 27 and 28, the system had "come within hours" of collapsing. The bank came through as the buyer of up to £40 billion in gilts.

What’s peculiar about the British financial system is that the taxpayers are obliged to reimburse the Bank of England for any losses it sustains on its balance sheet assets. If the price of gilts on the bank’s balance sheet collapses, British taxpayers must cover those losses and make the bank whole. So, what kind of money are we talking about? As the the FT reported last July, the BOE has estimated it will require the Treasury to transfer a total of £150 billion by 2033 to cover expected losses on the central bank’s quantitative easing program.

Stand and deliver!

So how much is £150 billion? Provided that things haven’t deteriorated since July 2023 (they have), we’re talking £2,240 per man, woman and child in Britain. Stand and deliver: that’s the ransom that the BOE is claiming from them! But given that the British workforce is only about half the population, and that private enterprise accounts for less than 55% of the British GDP, this sum represents nearly £10,000 per employee working in the private sector.

In all, the situation is impossible and all the cabinet reshuffles and cosmetic patches changed nothing of substance in the UK; they amounted to a sort of rearranging the deck-chairs on the Titanic as the ship is already sinking. So where is all this headed? Let’s have a peak at the economic and social conditions in the UK to consider the possible outcomes of the crisis.

The dying economy

In addition to making heavy direct investment in the “project Ukraine,” Britain has sustained high indirect costs as a consequence of sanctions imposed on Russia. Today, large segments of British society are slumping into Dickensian era poverty.

According to last year’s figures from Trussell Trust, the number of people in the UK who needed emergency food supplies from food banks more than doubled in the last five years, to 3 million. One in five households have trouble paying their water bills, and many more are struggling to keep up with their energy bills. Electricity bills in the UK are over five times higher than the European average and will substantially increase this winter again, as the suppliers’ wholesale costs increased by 20% over the last few months! It’s little wonder that as many as 48% of Britons said that they would have to turn down the heat, or switch it off completely to survive the winter financially.

In February this year, The Guardian published an article titled, "Gordon Brown slams 'obscene' levels of destitution in the UK." Its opening paragraph states that, "Britain is in the throes of a hidden poverty epidemic, with the worst-affected households living in squalor and going without food, heating and everyday basics such as clean clothes and toothpaste..." The Guardian also published a column written by Brown himself titled, "Tables without food, bedrooms without beds. Grinding child poverty in Britain calls for anger - and a plan."

Brown lamented that in some neighbourhoods of his own home town of Kirkcaldy, 70% of children were in poverty which is the worst he had seen in his lifetime. He described Britain as being "haunted by poverty we thought had been consigned to history." Indeed, as The Guardian put it last year:

“Everything points… to a horrific cliff-edge looming… and an avalanche of debts, defaults, evictions and unpaid bills to follow. ... Put simply, frighteningly large numbers of people just don’t have enough money to absorb the shocks that are coming. Wages are too low, benefits too mean, and the cost of living too high for them to afford even the basics. ... The CEO of one British retailer complained that his stores were losing customers to food banks or simply “to hunger.”

The parasite is killing the host

When businesses are losing sales to poverty, rather than competition, we know that the parasite is killing the host. The parasite, of course, is the banking cartel and it doesn’t care about the plight of the ordinary British people. In an interview last year, Bank of England's top economist, Huw Pill, thought that the best advice he could offer to his fellow Britons was to just accept being worse off.

He literally said that, "Somehow in the UK, someone needs to accept that they're worse off and stop trying to maintain their real spending power by bidding up prices..." Parroting the same mindset, the Bank's Governor, Andrew Bailey admonished British workers not to demand pay raises in order to do their part in the fight against inflation.

None of this is accidental; it’s not like Britain has been cursed with the bad luck of having consistently incapable or uncaring governments. Rather, the policy of immiserating the British people has been sustained and deliberate. According to a report written in 2018 by Prof. Phillip Alston, UN Special Rapporteur on extreme poverty and human rights, a "systematic, willful, concerted, and brutal economic war" was being waged against the poor and vulnerable sections of British society. Since then, things have only gotten a whole lot worse: for British families, “2024 was shaping up to be, financially, the worst year in living memory.”

Now, if these policies were deliberate, then what is their objective? Well, Gordon Brown did spell it out in his February op-ed: he called on the chancellor Jeremy Hunt (who had then replaced Kwarteng) to "undertake a root-and-branch review of universal credit." But the “universal credit” Brown was mentioning is merely the lure. The actual bill of goods that Brown was selling as he feigned outrage over poverty he himself helped create, was forcing a neo-feudal subjugation on British citizens by making them dependent on the nanny state for handouts.

This is why his partner in crime, Tony Blair has been pushing so hard to introduce a digital ID in the UK. It will be needed to police British people’s obedience and compliance with whatever rules, norms or restrictions that the ruling establishment might demand. It could be vaccinations, confinement to 15-minute cities, carbon quotas, death panels, insect protein fodder, love for the big brother, military conscription, forever wars, etc. Now that their ship has sunk in Ukraine (and in the Middle East), they need these measures in place, yesterday!

This is not progress toward greater prosperity and freedom but rather a future that George Orwell described as, “a boot stamping on the human face, forever.” Britain’s not so excellent misadventure in Ukraine tore the last shiny fragment from her democratic façade, revealing her feudalistic, authoritarian rule by an unelected, unaccountable and depraved oligarchy.

History suggests that such regimes ossify and have a certain tendency to drag their host nations into dark ages where they may remain mired in backwardness for generations. It remains to be seen whether the British people will find the strength and determination to fight back and win a better future for the coming generations.

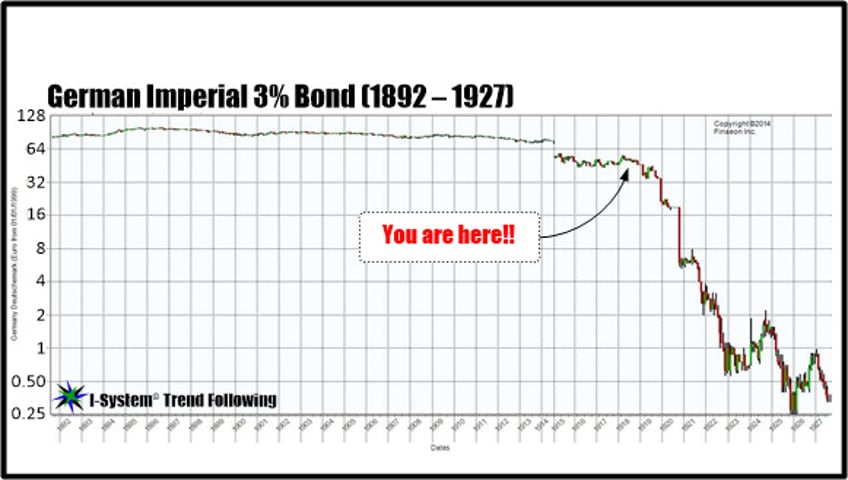

I sincerely hope that they will fight back. The same fight is gathering for all of us in the Western world. In my next report I’ll address the changes that will likely impact the financial markets in Britain and her dependencies like Australia and Canada. As the empire unravels – good riddance – it will create opportunities for major windfalls, possibly one of those rare occasions worth paying attention to. In concluding, I’ll only foreshadow what I believe is possible by presenting the chart of the German Imperial Bond at the turn of the 19th century.

Current British circumstances are in many ways similar to those faced by the Weimar republic a century ago, suggesting that it might travel along a similar trajectory to a similar end.

Alex Krainer – @NakedHedgie is the creator of I-System Trend Following and publisher of daily TrendCompass investor reports which cover over 200 financial and commodities markets. One-month test drive is always free of charge, no jumping through hoops to cancel. To start your trial subscription, drop us an email at

For US investors, we propose a trend-driven inflation/recession resilient portfolio covering a basket of 30+ financial and commodities markets. Further information is at link.