“The Intrinsic Value Of Bitcoin And Gold, Finally Explained”

“Andrew Bailey, Donald Trump and Charlie Munger are wrong. Bitcoin does have intrinsic value.”-

Background

Authored by GoldFix ZH Edit

A relatively unknown (in the mainstream) but well respected research firm at GoldFix and other reputable places1 released a controversial report recently comparing Gold’s utility to Bitcoin’s. We were lucky enough to see some of it. That report is the topic for discussion in this piece. First a sample of their previous work

From the excellent Decoupling from Gold Killed the USD in the '70s.:

The real culprit of the 1970s stagflation was not the oil shock, but the shock that came from the August 1971 collapse of the Bretton Woods monetary order – the dismantling of the peg between money and gold, and the massive inflationary impulse that it unleashed.

In the above analysis BCA debunks the ‘energy crisis’ as reason for 1970’s inflation and offers Gold standard abandonment as the true culprit then.

Here is an excerpt of their current report broken into three main sections using their subtitles:

- The Intrinsic Value Of Bitcoin Is That It Cannot Be Confiscated

- Gold’s Value Also Comes From Its ‘Non-Confiscatability’

- Bitcoin Will Displace Gold In The $15 Trillion Non-Confiscatability Market

Those sections will be excerpted in 3 or 4 parts. No opinions or meta-analysis will be given on these next few posts. Please read this footnote3. Here is section 1 excerpted.

Part 1: The Intrinsic Value Of Bitcoin Is That It Cannot Be Confiscated

Excerpted from BCA Research Special Report [All Emphasis ours]

Executive Summary [Section]

The intrinsic value of bitcoin is that it cannot be confiscated by the state, either through monetary inflation, or through bank failure, or through outright expropriation.

Introduction

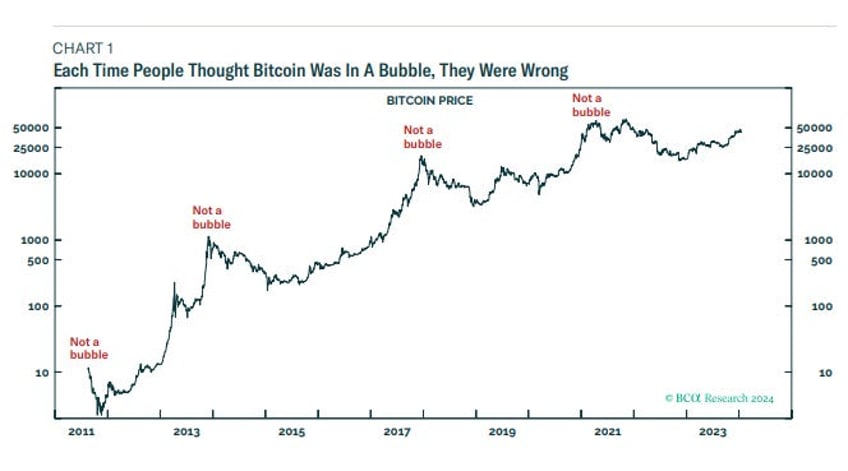

The US Securities and Exchange Commission approval last week for bitcoin spot ETFs marked an important milestone for the cryptocurrency asset-class. Albeit, after bitcoin’s spectacular recent rally, the widely-anticipated ‘news’ was the trigger for some healthy profit-taking, which could run further. Even so, bitcoin is up by 160 percent since the start of last year, unwinding most of the losses through 2022, and making cryptocurrencies by far the best performing asset-class of 2023 (Chart 1).

Yet for anybody who is considering buying bitcoin or a bitcoin ETF, an over-arching worry lingers. Does bitcoin have intrinsic value? Many senior economists, politicians, and investors have answered with an emphatic ‘no’. Bank of England governor Andrew Bailey has warned:

“If you want to buy bitcoin, fine, but understand it has no intrinsic value. It may have extrinsic value, but there is no intrinsic value.”

Donald Trump has said:

“I am not a fan of bitcoin and other cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air.”

The unlikely paring of Andrew Bailey and Donald Trump are warning that if bitcoin has no intrinsic value, then it is really nothing more than an elaborate Ponzi scheme. Its value relies entirely on finding somebody else to sell to at a higher price. Or, as the late Charlie Munger put it:

“Bitcoin reminds me of Oscar Wilde’s definition of fox hunting: ‘The pursuit of the uneatable by the unspeakable.’”

Andrew Bailey, Donald Trump and Charlie Munger are wrong. Bitcoin does have intrinsic value. The important insight is that something’s intrinsic value comes not only from what you can do with it, but also from what you cannot do with it.

What you cannot do with bitcoin is confiscate it.

This is significant because throughout history, the state and institutions have confiscated our wealth. They have done so in three ways:

Through monetary inflation, which confiscates the real value of our wealth by stealth.

Through the failure of banks and other financial institutions that have custody of our wealth.

Through the outright expropriation of our wealth as, for example, was suffered by European Jews in the 1930s

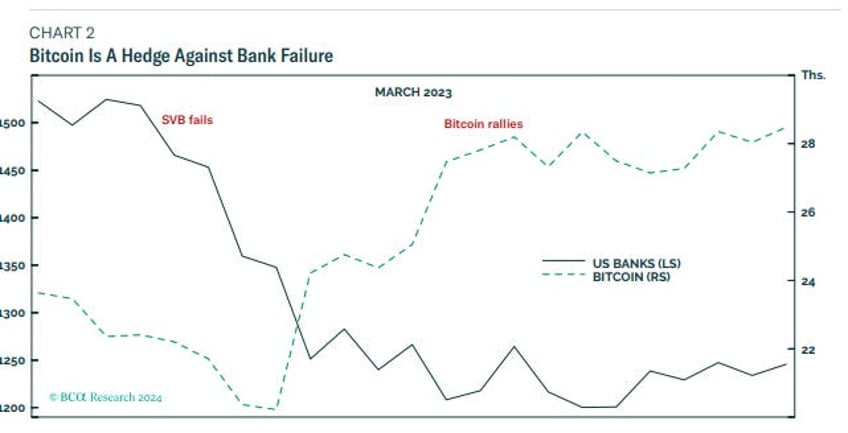

Crucially, bitcoin cannot be confiscated in any of these ways (Chart 2).

This is not to say that bitcoin cannot be stolen. If someone forces you, at gunpoint, to give them the keychain to your bitcoin wallet, they can steal your bitcoin. But it would be almost impossible for the state or institutions to confiscate everyone’s bitcoin in this way.

The state could ban bitcoin...

Continues here

Free Posts To Your Mailbox