Experience tells us that once a theme gets elevated to a condition of “magnificent,” then the best gains are well behind you. Certainly the valuations make blood shoot from my eyeballs (NVIDIA trades at a PE of 83x!!), but perhaps we can be accused of looking for things that support our assertion. Remember the “Nifty Fifty” of the late 1960s/early 1970s. Or the Japanese “economic miracle” of the 1980s. Or what about the “Asian Tigers” of the mid /late 1990s, the “New Economy/dot-com” boom of late 1990s, and so on and so forth. But sure, this time is different. Riiiiight!

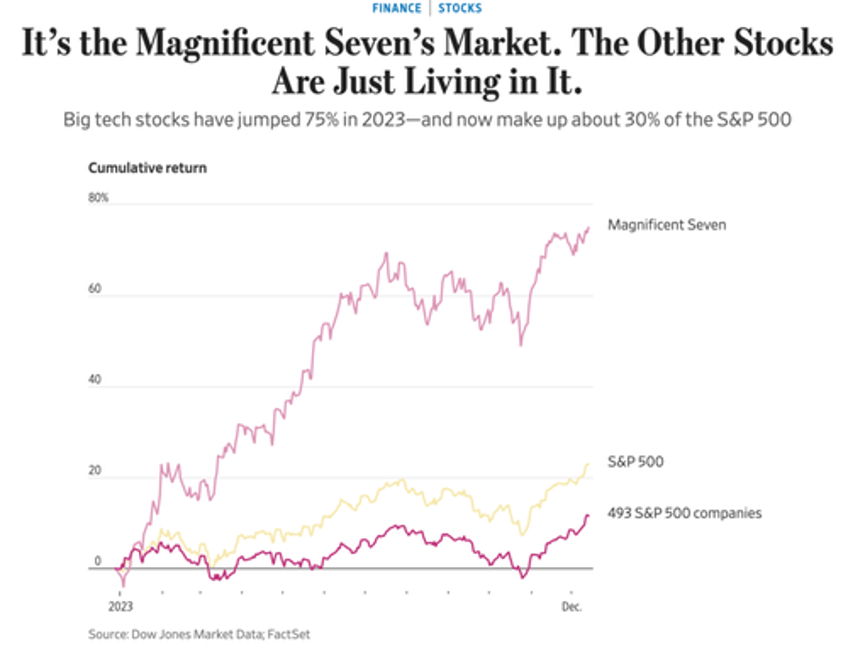

So if our experience is anything to go by, 10 years from now, the Magnificent 7 and their groupie mates will have been amongst the worst investments within the S&P 500 as violent sector rotation does its thing.

So you might ask, what is going to cause the Magnificent 7 to severely underperform the S&P 500 over the next 10 years? Heck if I know, but there are many candidates. The bursting of the bond bubble, the incoming civil war mentioned above, literally anything at this point. Inflated balloons don’t need much of a reason to burst. I just don’t want to be caught in the collapse.

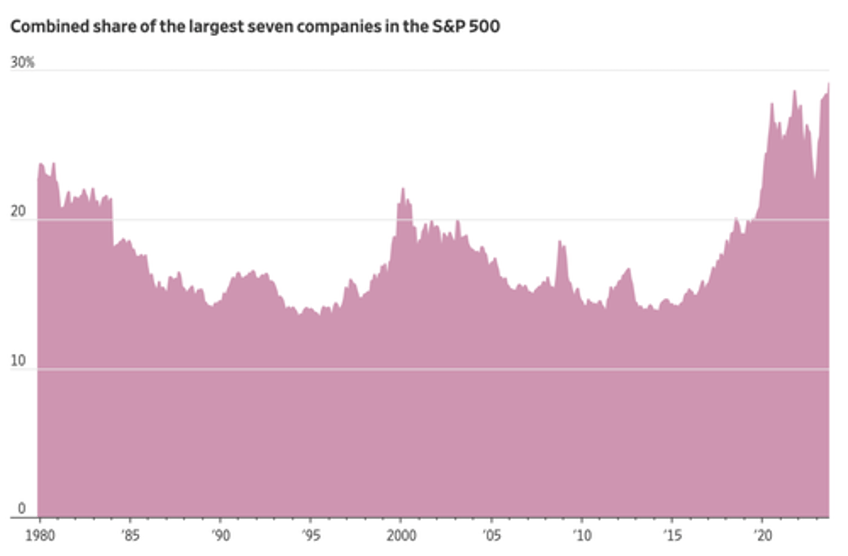

Never before (at least in a generation or two) has so few stocks had such a large weighting in the S&P 500 — and we thought we had seen it all come March 2000.

We wonder where the marginal buyer is going to come from to push this weighting higher?

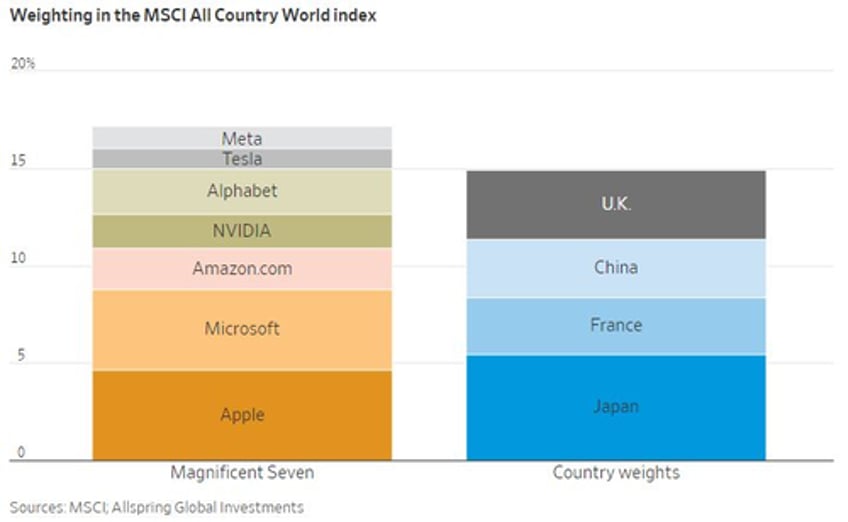

There are two things that come to mind when looking at the chart below. First, this is clinical insanity. Secondly, it does remind us of the Japanese stock market in 1989 when it accounted for 40% of the market cap of the world stock market, but its share of GDP was some 15%.

From a contrarian perspective, we don’t know what boxes have not been ticked.

Here’s an interesting discussion on the Nifty Fifty craze of the early 1970s. Those who understand history are unlikely to repeat it… or so the saying goes.