The New Trump-Powell Accord

Picture if you will two conversations that occurred sometime after Trump’s inauguration.

- Trump to Powell: Lower rates and inflation wont be a problem, I’ll get oil prices lower

- Trump to OPEC+: Lower oil prices and I’ll weaken the dollar helping your EM economies

We believe that is what is going on behind the scenes right now. The Bottom Line is: Tariffs, and tax cuts are the sizzle here. Cheaper energy and a weaker dollar are the steak. Just as Bessent advised: and Trump needs Powell on board to do this.

From January 24ths Trump is Horse-Trading Again

Powell’s Fed and the Trump Accord:

Yesterday’s rate decision was no surprise to Fed watchers. However, the Fed’s decision to aggressively reduce the amount of bonds it would sell into the market as part of its quantitative tightening (QT) program was more unexpected. Taken together, these moves signaled a dovish stance, with Powell acknowledging stagflationary pressures and financial tightness as justification for the action.

But that’s not the headline.

Powell’s Press Conference Pushback

The key takeaway from Powell’s press conference was his strong pushback against the media’s alarmist tone regarding a potential recession and the resurgence of inflation risks. Powell’s tone and responses aligned with the administration’s policies, signaling that the Fed and the White House—meaning Powell and Trump—are now on the same page.

There may not be direct coordination, at least not visibly. That would likely fall under Scott Bessent’s arena. However, based on Powell’s responses to key economic concerns, it’s evident that there is now a working alignment between Trump and Powell.

Evidence of the Powell-Trump Accord

Powell’s responses on three major topics indicate this shift:

1. Tariffs and Inflation

• Powell acknowledged that tariffs have an inflationary effect on the economy.

• He also noted that the Fed already accounts for the risk of reciprocal tariffs from other countries.

• His message was clear: The Fed sees the tariffs, understands their impact, and is not reacting with alarm.

• The subtext of Powell’s response? We have the data. We’re monitoring it. No need for panic.

2. Recession Risk

• Powell dismissed the press’s increasing concerns about recession as overblown.

• He stated that the workforce is stable and the economy is on a better track—not necessarily great, but improving.

• He called out the excess of Cassandra-like warnings about a looming downturn.

A historical note: When stocks crashed in 2022, the media ignored recession risks and instead dismissed concerns with the narrative that “talking about a recession creates one.” This peaked with the infamous “vibecession” concept—a claim that negative sentiment, not economic fundamentals, defined recessions. That argument, while interesting, was clearly partisan. fittingly, the left leaning press is now talking about a recession with no qualms about creating one.. and gone are the calls for calm and labels such as vibe-cession.

The hypocrisy and water-carrying behavior among these types was so thick that you can only surmise their brain cavities have far more space than the gray matter occupying it.

3. Inflation Expectations and Market Stability

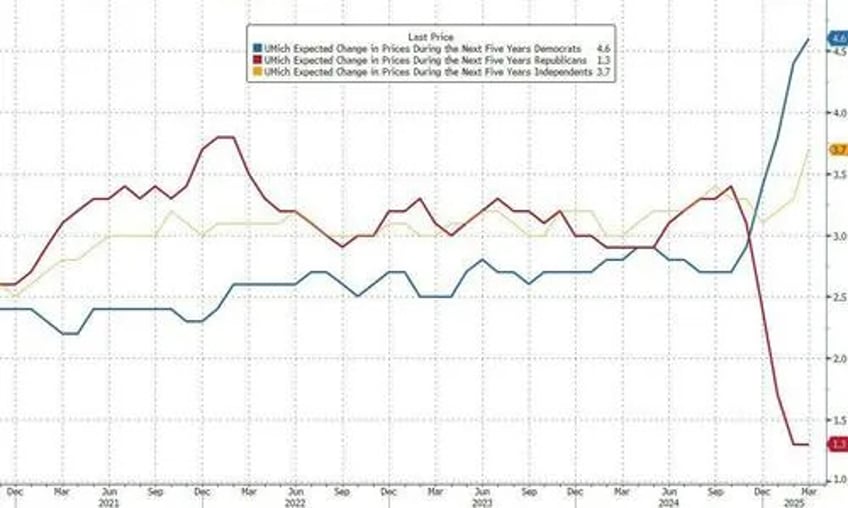

• Powell downplayed the University of Michigan inflation survey, calling it an outlier and unreliable.

• The subtext here is important: Powell was saying the UMich survey has become more politically biased over the years.

• The data shows that inflation concerns in the survey tend to rise when a Republican is in office and decline under a Democrat, even if economic conditions are the same.

• This aligns with Powell’s broader message: Inflation risks are real, but not out of control. The economy is not on the brink of crisis.

The Fed’s Tone: Mixed but Strategic

• The dot plots from the meeting were hawkish, signaling that the Fed remains aware of inflation risks.

• However, the QT reduction was very dovish, signaling an easing of financial conditions.

The press conference itself was neutral to stable, but Powell’s firm pushback against media alarmism suggested that:

1. Powell believes he has the situation under control (whether that’s true remains to be seen).

2. QT reduction is effectively a form of QE, a slowing/tapering of previous tightening.

3. Powell and Trump are in agreement—implicitly or explicitly—on the broader economic strategy.

Powell and Trump: A Working Relationship?

This emerging alignment between Powell and Trump echoes concerns Powell voiced in the previous administration. Back then, Powell occasionally pushed back against Janet Yellen on fiscal policy, noting, “Our fiscal path is unsustainable. We’re spending too much, but there’s nothing I can do about that.”

Now, Powell is signaling something different:

• “I’m not going to lower rates more than necessary.”

• “For those worried about rate hikes, that’s not happening.”

• “I will ease financial conditions without cutting rates.”

• “I see the risks of tariffs, I see the risks of Trump, and I am aligned with the bigger picture.”

This is a shift in tone. Powell is essentially saying: I’ll give Trump a shot.

What This Means for Trump’s Economic Strategy

For Trump, this is a significant policy win. Why? Because Trump’s economic strategy requires three key things:

- A weaker dollar.

- Lower oil prices.

- Fiscal space for economic stimulus.

If Powell is holding steady on rates while loosening QT, and if Trump is working Middle East and Russia deals to keep oil prices in check, then Powell won’t tighten aggressively. That opens the door for Trump’s broader economic goals—specifically, spending initiatives and tax cuts.

And if Trump can secure tax cuts, he locks in Senate support for the midterms, which extends his influence well beyond the critical first 100 days of a new term.

The Big Question: Is Powell Right?

We don’t know yet.

We’re not canonizing Powell just because he’s aligned with Trump. We’re simply noting the reality: The Fed, the White House, and the Treasury are not at odds with each other right now.

This is a major milestone in Trump’s effort to realign the economic engine of the U.S. Whether it works or not will depend on inflation, growth, market reactions, and global conditions. But for now, Powell and Trump are rowing in the same direction—a sharp contrast to the dynamics of previous years.

Continues here