Submitted by QTR's Fringe Finance

I was looking at charts of uranium stocks and Bitcoin last night—both of which have performed extraordinarily over the last year—and was thinking to myself that I could easily remember a time in the not-so-distant past where both of these asset classes were completely unloved.

Which reminds me of another asset class that right now is in the midst of waves of hatred and disapproval from the market, but I think similarly could wind up outperforming in the coming years.

It isn’t going to surprise anybody that I’m talking about precious metal miners — gold miners specifically. (And you’ll have to bear with me, I wrote most of this over the weekend before gold and the GDX’s rip on Monday — but, long term, that shouldn’t make a difference).

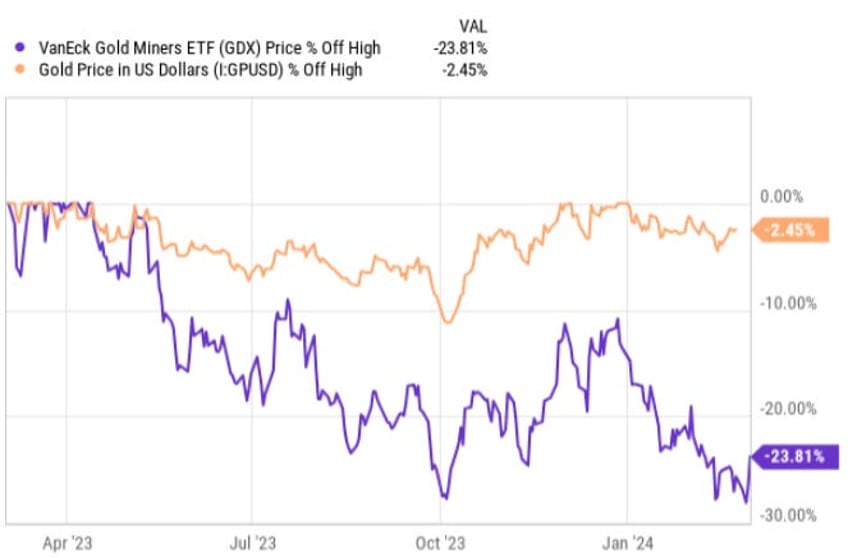

Anyway, as has been harped on by people like Peter Schiff and Larry Lepard, gold miners have been taken out back and shot, especially when compared to the price of spot gold, which sits near all-time highs. The VanEck Gold Miners ETF (GDX), for example, is 23.8% off its 1 year high while gold is just 2.45% off its 1 year high.

This move lower in miners is despite the fact that the underlying spot price of gold is near all-time highs and—if you’re a believer in technical analysis, which I consider nonsense—looks as though it is getting ready to rip even higher.

Lepard and Schiff will tell you that the reason miners are trading at such a low multiple is because the models used to predict their future cash flows are still using a predictive gold price in the future of less than $2000 per ounce. I’ve heard Larry Lepard say some models, when you look on a Bloomberg terminal, are still predicting that the price of gold will be $1800 an ounce in a couple of years. You and I, and even the Bitcoin community, know that this isn’t going to be the case. At some point, these models will update—or the market will force them to—and it'll become extraordinarily evident that gold miners represent some of the only value stocks left in the entire stock market, which, as a whole, is grossly overinflated and overvalued.

Miners are also getting a lot of hatred nowadays because of how well Bitcoin is doing. I hear Peter Schiff talk a lot about how people are pulling their money out of gold miners and putting it into Bitcoin. At first, it sounds like he’s just...(READ THIS FULL REPORT HERE).