Subscribe on our website www.gmgresearch.com

EQUITIES: Equities are cooling off after more than 80% of constituents traded above their 200-day moving averages.

VIX is slowly ticking higher

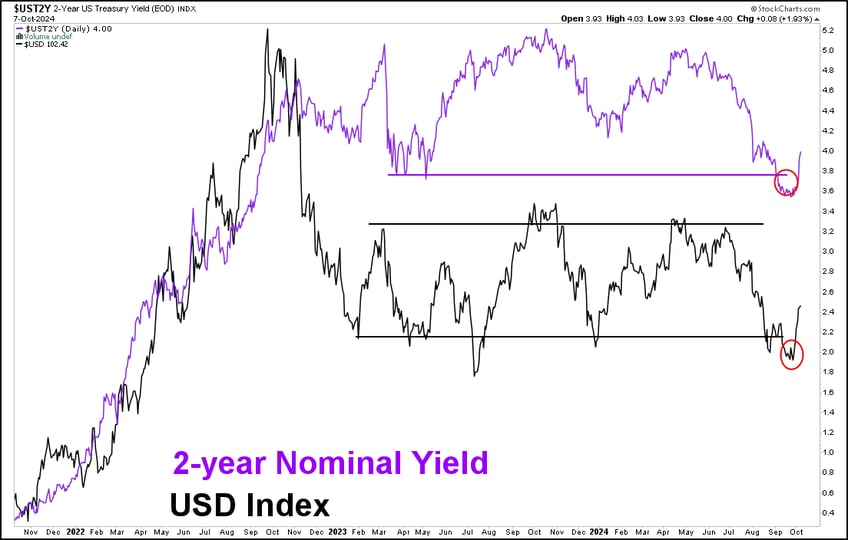

YIELDS: Interest rates have been trading higher since the recent Fed meeting. The 2s/10s yield curve is starting to invert again.

OIL: A knee-jerk reaction, enough to keep the Fed more incrementally hawkish.

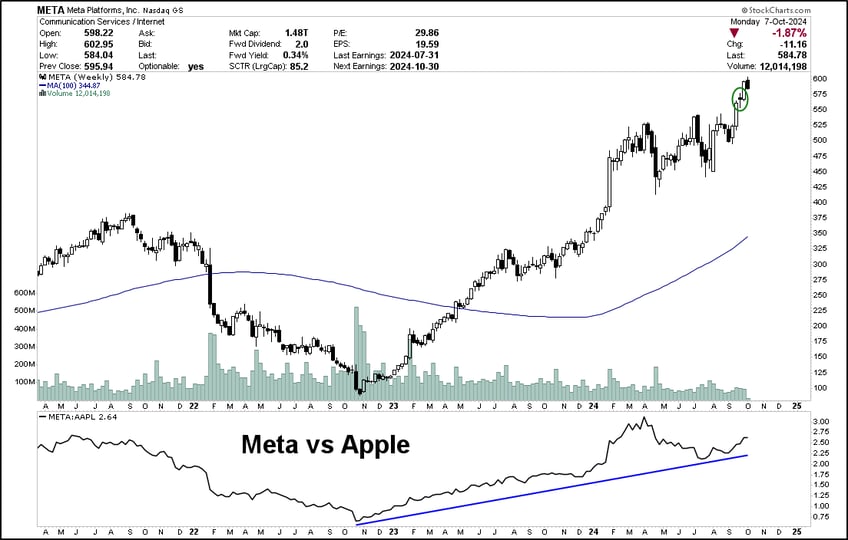

META: Reaching new highs and leading.

AMD is a relative outperformer; investors are picking this up.

BABA needs a break.

MACRO: From a macro perspective, equities likely have more near-term upside than bonds and precious metals. We still expect consolidation in DXY, bonds, and precious metals before a continuation of the prevailing trend.

CHINA: Currently overextended, but the stimulus in China is real this time. Top leadership in Beijing has introduced a number of significant stimulus measures in an unusually coordinated way and vowed to keep the support in place to shore up the struggling economy and rebuild market confidence.

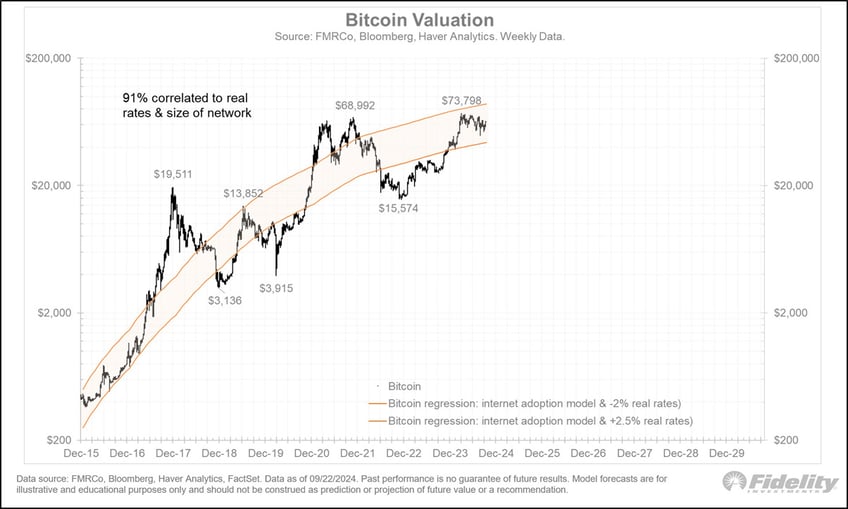

CRYPTO: Bitcoin is moving higher.

Everyone is underestimating AI and its power. Nvidia is still a buy on dips.

S&P cooling off after more than 80% of constituents traded above their 200ma

Important chart on rates and the Dollar index.

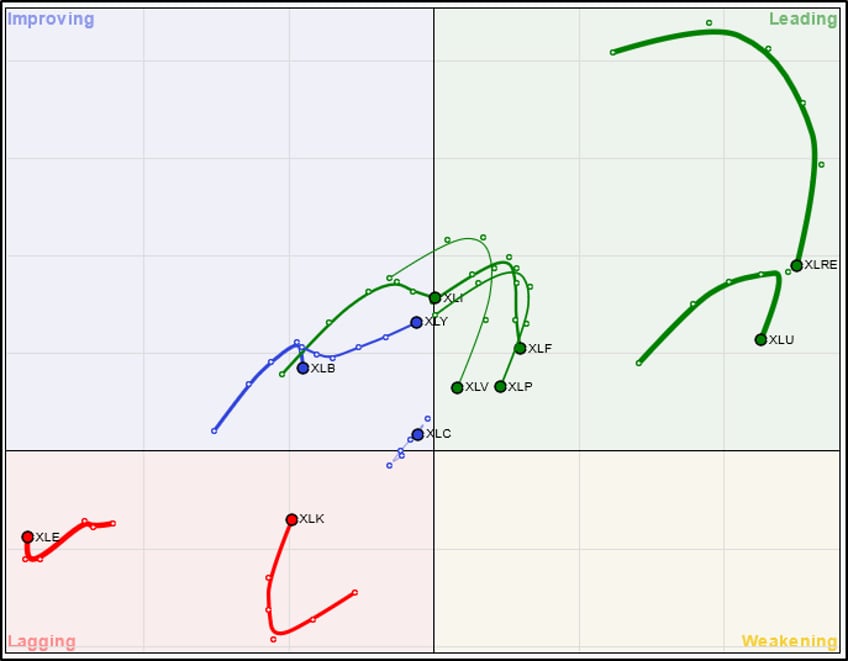

This relative rotation graph shows sector performance.

Coupang! We’ve been pounding the table since $14. Distinct breakout here.

Bitcoin: 91% correlated to real rates & network size. Going higher.

Meta: This will be better and bigger than Apple in 5 years. LONGTERM

Coherent up over 30% since the relative breakout.

AMD has been outperforming the semi index since August

Return always wants its risk payment.

Most “investors” regurgitate the news like birds.

NOT INVESTMENT ADVICE. Only for entertainment.