I warned time and again that the Fed was making a massive policy mistake that would unleash another round of inflation.

By quick way of review, the Fed stopped raising interest rates in July 2023. It then started talking about cutting interest rates in November. This was a MASSIVE mistake as inflation has NOT been defeated.

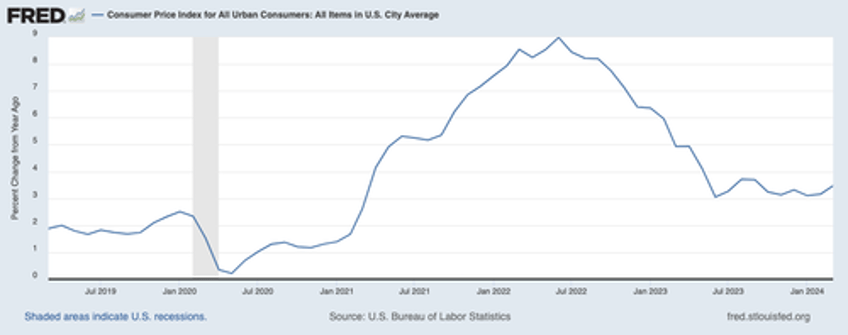

Indeed, ever since the Fed started talking about cutting rates, the official inflation measure, the Consumer Price Index (CPI) has bottomed and is now turning back up.

This trend continues. Yesterday, the Bureau of Labor Statistics (BLS) revealed that CPI rose 0.4% Month-over-Month (MoM) and 3.5% Year-over-Year (YoY) in March 2024.

This represents the FOURTH straight month of CPI coming in hotter than expected. The fact it surprised Wall Street and most investment strategists confirms that NONE of these people are paying attention to the data.

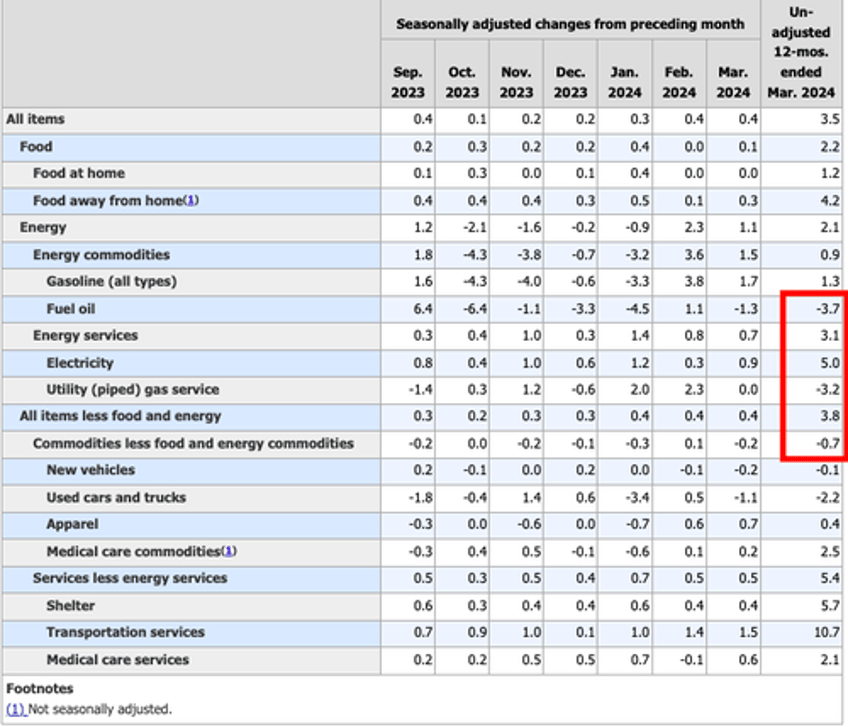

The only part of the inflation data that is down is energy prices (and used cars which receives almost no weight). Every other segment of the CPI continues to rise.

See for yourself:

However, even Energy prices will begin turning up again… as are commodities in general. Both gasoline prices and copper prices are on the rise and about to break out of multi-year consolidation periods.

This is going to catch most investors offsides… but the good news is that with the right investments, you could see EXTRAORDINARY returns from what’s coming.

On that note, we recently published a Special Investment Report detailing three investments that will profit from this rampant government spending. Normally this report would cost $499, but we are giving copies FREE to anyone who joins our daily market commentary.

To pick up your copy, go to:

Graham Summers

Chief Market Strategist

Phoenix Capital Research, MBA