The Silver Squeeze Is Real And It’s Spectacular!

[EDIT- no changes or additions were made to the text. Subtitles in ALL CAPS were added for ZH readers]

BACKGROUND: FROM STONKS TO SILVER AT WALLSTREETBETS

Some of you may remember a little thing called “Gamestop” a while back.

A bunch of retail “apes” all bought the heavily shorted video-game stonk and drove the price from $17 to $400 which arguably would have gone even higher but for shady malfeasance by Vlad “Dracula” Tenev of Robinhood.

For the apes, it wasn’t about money, it was about sending a message.

On the heels of that glorious “David and Goliath” victory, the plebs began brainstorming for their next target. “Silver $25 to $1000” read one post, by u/RocketBoomGo, alias of Jim Lewis.

It got enough traction that WallStreetBets, and its 12 million users, were earnestly squeezing silver.

Lots of interesting things happened right away.

Yes, the price quickly made new highs and bumped against the upper bound of $30.

In response, an elite team of industry shills went on TV to try and defuse the bomb, delivering some pretty eyebrow-raising whoppers along the way.

Jeff Currie, Goldman’s commodity expert par excellence, made the comment which still whiffs of foul play:

“The shorts are the ETFs. The ETFs buy the physical, they turn around and they sell on the COMEX…”

He also claimed that silver is a 25 billion ounce market.

(Spoiler, it’s literally 1000 times smaller than that now).

He also tried to dispel the “myth” that the ETFs were controlling spot price, or that the ETF flows were not that big (FTX issuing fake bitcoin, anyone?)

We know from Chris Marcus of Arcadia Economics that actually, when the SLV was seeing its biggest inflows ever, in February 2021, the spot price of silver dropped by 10%.

SLV also infamously changed its prospectus in the middle of the night, to protect the custodians, in the event that the fund “couldn’t track” the silver price.

Which is why it’s particularly interesting that on Wednesday 3 February, right after claiming to add 3416 tonnes of silver to SLV by frantically tapping the LBMA vaults in London, the iShares Silver Trust prospectus was changed, and the following wording added https://www.bullionstar.com/blogs/ronan-manly/silversqueeze-hits-london-as-slv-warns-of-limited-available-silver-supply/

WALLSTREETSILVER IS BORN

In a great due diligence piece, user u/HappyHawaiian laid out various reasons why SLV was inimical to silverbugs. He instead favored PSLV, the closed-end fund by mining magnate, Eric Sprott, whose interests are aligned with true price discovery, as they purchase and bid up unencumbered bars on the open market to correspond with inflows. shorturl.at/hjAP5

But just as the squeeze was reaching a fever pitch, a troll army infiltrated WallStreetBets claiming that there had been a mistake, and squeezing silver should be avoided, because Citadel was long silver or some such nonsense.

Jim Lewis and his buddy Ivan Bayoukhi were forced to splinter off from WallStreetBets to form WallStreetSilver, with their humble legion of 40,000 squeeze loyalists, a mere 1/300th of the buying pressure of the original 12-million-strong WSB coalition.

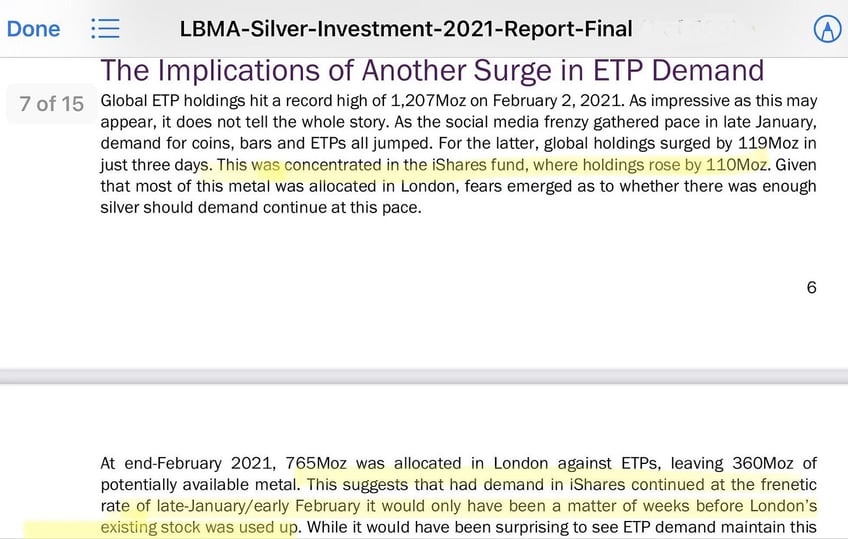

The LBMA said the quiet part out loud, that they’d have been wiped out in a matter of weeks had the “frenetic” retail pace continued..

As a side note, the just-in-time “110 million ounce” [rise in iShares holdings] mentioned above that materialized out of thin air (150 trucks’ worth), later turned out to be an accounting error https://m.investing.com/analysis/accounting-error-shines-light-on-silver-200580605

So you could say our stackers are a bit receptive to the “conspiracy theories” about price suppression, and weren’t giving up without a fight.

But why silver, over gold, anyway?

WHY SILVER OVER GOLD ANYWAY?

Historically silver has been “retail gold”, simply a store of value by which gold is readily divisible, and more appropriate than gold, for the everyman, to barter smaller items.

And if it comes out of the ground at a 7:1 ratio with gold, but half of it gets used up in industry, shouldn’t the price ratio be 4:1, or 7:1, rather than a ridiculous 80:1?

Could it be that by keeping its price lackluster, making it a clunky store of value, (basically the only thing on earth at half its 1980-high), that people are disincentivized from hoarding it as an inflation hedge against the very same bankster conjurists’ fiat-printer-go-brrr bonanza?

And if that’s the case, how can you continue to keep something completely detached from true market price discovery indefinitely?

This is the bet which the now 230,000-strong and growing WallStreetSilver ape army is making. Sooner or later, the dam will break.

While on the surface (spot price), the insiders and WallStreetBets have long dismissed the Silver Squeeze as a failure, we’re fortunate enough to have a privileged look under the hood by one of our own silverbacks, which tells a different story.

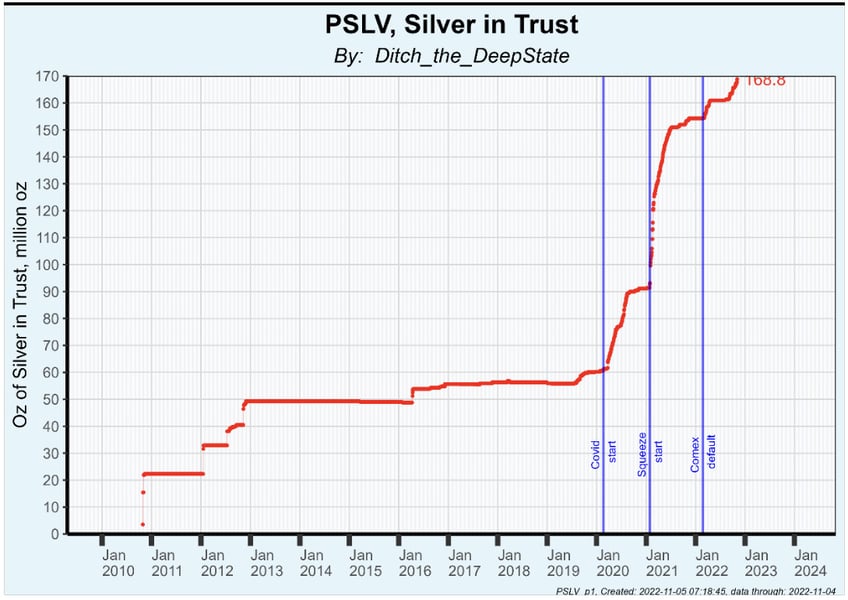

u/ditch_the_deepstate, alias of Michael Lynch, who was actually banned on Twitter for speaking poorly about JPMorgan, is a talented analyst who deciphers not just the action in the banks’ vaults, but also the implications for tightness in their supply.

Since our silver squeeze began, the Comex Registered category, which supposedly stands ready to backstop physical deliveries, has plunged from 170 million ounces to a paltry 35 million, a 5-year low.

At $23 spot, a measly $800 million could squeeze the silver market!

Back in March, 2022, Ditch went on Palisades Gold Radio to describe how the Comex effectively defaulted.

But the game putters on, for now.

So long as the banks have metal to cast off as “ballast”, the idea of a true squeeze is unlikely, and brief spurts of enthusiasm wane.

When they run out of silver, it may trigger the cataclysmic event which could well correspond to the end of fiat itself: a FOMO rush into a minuscule market driving silver price up a wall, sending a rather ominous signal to the market about the dollar’s strength, with a gold rally likely not far behind, let alone the scandal that the Comex makes SBF look like Mother Teresa.

REUTERS REPORTS MASSIVE SILVER DEFICIT

The irony that crypto bugs may end up clamoring for regulation from the CFTC’s Rostin Benham, the very man who admitted he was able to “tamp down what could have been a much worse situation in the silver market” should not be lost on readers here.

And this is precisely the corruption that we seek to expose.

And whereas most of WallStreetBets’ plays revolve around squeezing cringeworthy dinosaurs en route to extinction like Revlon or Bed Bath and Beyond (So what if the CFO jumped out of a window, shorts haven’t covered!), WallStreetSilver is making a much more stable and strategic play with huge industrial tailwinds on top of everything we’ve discussed. There’s solar panel, chips and battery demand, all set to explode. And history tells us that the Fed’s monetary tightrope will end in either hyperinflation or massive credit collapse, both of which, silver is an excellent shield for.

It was only recently that Reuters randomly announced the biggest deficit in decades.

and metals shill/bankster apologist Jeff Christian stupefyingly suggested his viewers diversify into PHYSICAL silver, while having spent the better part of 40 years doing the exact opposite.

A CYA for the storm that’s coming?

They blame Indian demand for the supply deficit, but that can’t be the whole picture, because PSLV’s vault holdings have risen from 90 to 168M since the squeeze started:

So this is where we stand.

WHERE WALLSTREETSILVER STANDS NOW

Jim Lewis’ twitter account (WallStreetSilver) has grown to over 500k followers, one of the fastest growing accounts on Twitter.

We’ve helped silver outperform gold, the S&P, Dow and Nasdaq year-to-date. We’ve drained the vaults to a historic low.

Now we just need you to FOMO in somewhere between $25 and $1000.

Creflo Silver is a member of Wall Street Silver’s meme team and on Twitter (@CrefloSilver)

- Site: WallStreetSilver.com

- Reddit: r/wallstreetsilver

- Twitter: @WallStreetSilver