Submitted by QTR's Fringe Finance

In my view, the most undervalued segment of the market remains gold and silver miners. Here is my full recent writeup on why I want to own miners, which I’ll talk about a little here. Remember — now you have to throw in the mix even more geopolitical unrest — something that was not on the radar screen as of last week when I wrote this. I believe the outlook for miners remains extremely attractive.

As I discussed in a recent podcast with Mark Spiegel, I said I was anticipating further declines in the price of the metals as (1) a broader deleveraging process sweeps through the market due to rising rates and a contracting economy and (2) people continue to believe the Fed is winning some type of war against inflation.

If, like me, you regard the soft landing narrative as a mere charade, it becomes imperative to note that the “deleveraging” could be imminent. Much like the Covid crash of March 2020, we can anticipate a wholesale sell-off of nearly everything not firmly anchored. This will encompass precious metals.

As I have emphasized multiple times on this blog, this moment will prompt a significant increase in my allocation to mining companies and gold. I believe this will serve as the launchpad for a more extensive supercycle in gold, fueled by the inevitable surge in central bank stimulus aimed at rescuing the entire system. But I have already been continuing to buy the GDX, SIL, PAAS, NEM, AEM and several others. But most of my firepower just goes right into the VanEck Gold Miners ETF (GDX) for now.

As I wrote last week (forgive some redundancy here), when the mix of gold sellers transitions more toward people who are deleveraging, and less from those selling gold due to a hawkish Fed policy, I predict the selloff in the precious metal will accelerate. As always happens with markets, commodities, or anything freely traded, there will eventually be a point of peak capitulation in the precious metals. They may crash to levels 20% or 30% lower than they are right now. In fact, I could see gold potentially dropping to $1,500 per ounce very temporarily, depending on how quickly and aggressively deleveraging occurs.

At this point, I think the pendulum will shift from complete and total unadulterated capitulation and fear to a rapidly emerging realization that gold is one of the only assets that can hedge against virtually everything—not just inflation but also the growing geopolitical and macroeconomic risk. This scramble will come on quickly and will accelerate just as fast to the upside. From there, $3,000 per ounce will likely be only 12 to 18 months away, I believe. But it isn't just gold that I'm looking at at that point; it will also be the miners.

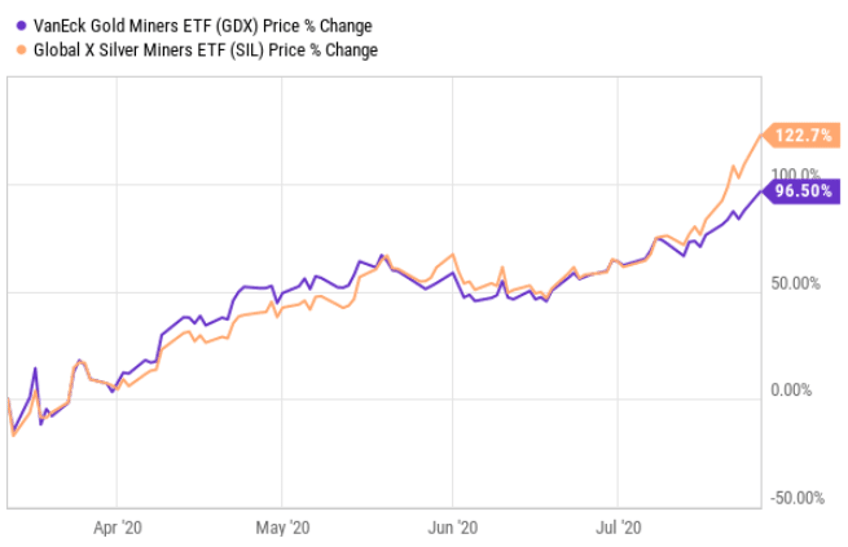

Miners after the 2020 crash:

They will sell off disproportionately to gold and may potentially rise 5X or 6X from their capitulation lows, due to the fact that they can offer leverage on the price of the commodity. It wouldn't surprise me to see the GDX move to between $15 and $18 during a capitulation move lower. From there, I would expect it to rise above $50 in very short order as the scramble back to the precious metal occurs twice as quickly as people sold it off. From 2020 lows, miners rose about 100% in five months.

I think this next move could be even more pronounced.

I'm not ready to make the massive move with "big bazookas" yet, but I have noticed that gold prices are starting to move aggressively lower as the broader market does. I'm biding my time and will make sure that I have ample cash reserves on the sideline for when I believe a generational opportunity in the precious metals will strike.

My full thoughts on miners are here. Just remember that when I wrote this, the Israel/Hamas risk wasn’t even on the table yet, and that this adds a whole new (bullish) dimension to my miners thesis.

My full portfolio review, including names I am watching as longs and shorts, updated just days ago, can be read here.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.