Submitted by QTR's Fringe Finance

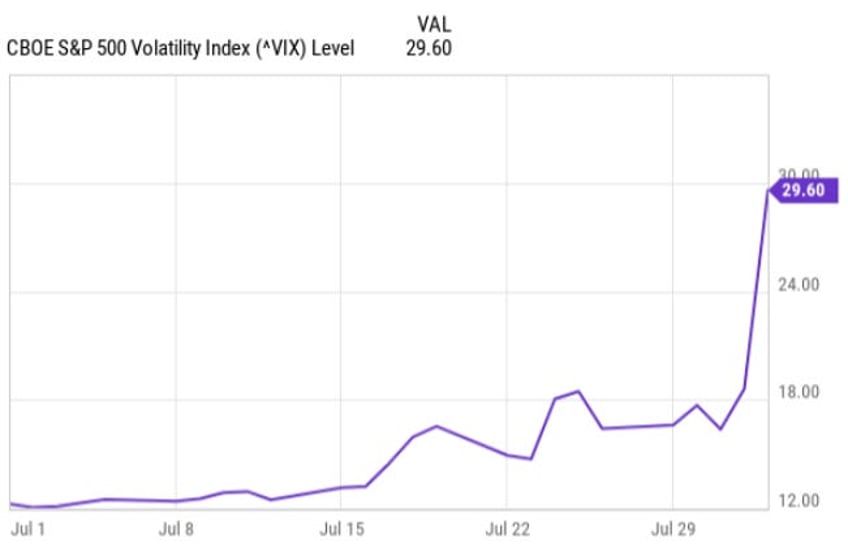

Just about two weeks after I wrote an article called “We Are On The Edge”, discussing how, if I had to pick only one trade to put on at the time, it would have been getting long volatility, we saw a massive spike in the VIX to end the week on Friday. Here’s how things looked early afternoon on Friday.

In my opinion, Friday’s trading session marks the beginning of a scenario that I have been predicting would unfold for the better part of the last two years. Here’s what I think is playing out.

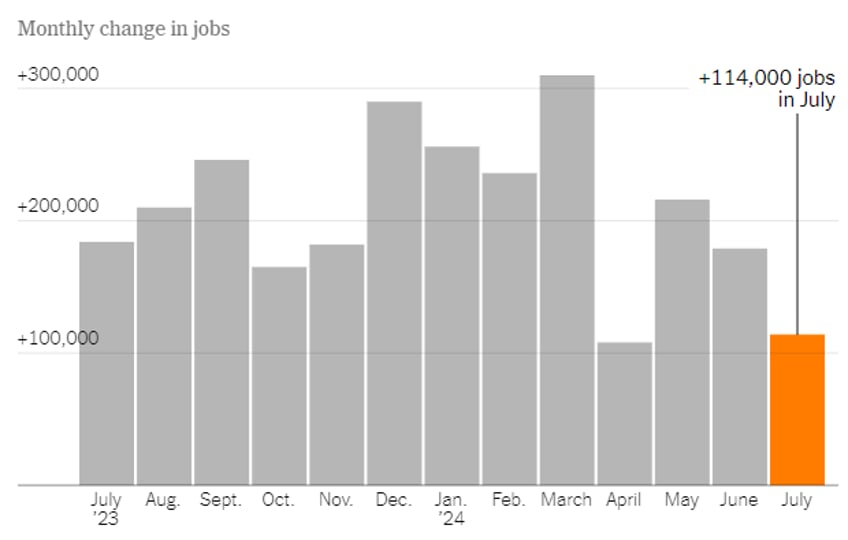

Friday, we finally saw serious signs of an economy deep in recession emerge in the macroeconomic data, as hiring slowed significantly and the unemployment rate jumped to 4.3%.

Chart: New York Times

Normally over the last two years, this would have been shrugged off by the market.

However, the tech and AI bubble had already started to burst about three weeks ago, and momentum into the numbers today was bearish instead of bullish.

The news also came after a horrific overnight session in Japan, where stocks plummeted 6% on the back of the BOJ raising rates. Ken Cheung, director of foreign exchange strategy at Mizuho Securities, told CNN:

“The BOJ made a hawkish shift after its surprising 15 (basis point) rate hike. Importantly, the BOJ flagged the inflation upside risks … and left the door open for further rate hikes. ”

And both the jobs number and Japan’s market taking a shit came after a week of escalating tensions in the Middle East, with a direct conflict between Israel and Iran looking more likely.

But the biggest deal about Friday’s trading wasn’t the volatility in stocks; it was that, for the first time in the last two years...(READ THIS FULL ARTICLE HERE).